Energy Costs Make Meat More Expensive

Where Will Our Protein Come From?

This month, we’re taking a detour from our primary energy production theme to look at something a little different: Food production.

According to the consumer energy savings website Save On Energy, the U.S. consumed more energy growing, preparing, and transporting food than the United Kingdom used in total in 2018. Now, the U.S. is several orders of magnitude larger than the U.K. But the fact that we are consuming more in a single industry is still revealing.

Nearly 20% of the fossil fuels used in the U.S. go into food production – particularly meat. It takes the equivalent of about 107,482 British thermal units (Btu) to produce a pound of beef, 44,992 Btu for a pound of pork, and 15,013 Btu for a pound of chicken.

To put that in perspective, that means it takes the energy of 150 gallons of oil – three entire barrels – to sell the meat of a single beef cow in the U.S. (That’s based on a University of Nebraska estimate of the amount of beef in a beef cow.)

That is unsustainable. We can’t keep up with the energy costs of producing meat protein like that in the U.S. And that’s not even mentioning the rest of the world. A burgeoning world population can’t afford to get to these levels at all. We have to look to plant protein.

This investment idea is a little different from our usual New Energy recommendation.

Today, we’re talking about a company trying to address the issue of food security.

According to the World Resources Institute:

To adequately feed more than 9 billion people by 2050, the world must close a nearly 70 percent gap between the amount of food produced in 2006 and that needed by mid-century.

One acre of dry peas (the smooth green peas we usually see in the grocery store) creates 210,654 grams of protein. Compare that to just around 8,330 grams from an acre of cow pasture.

That means peas are 25.3 times more efficient at creating protein.

While soy led the way with tofu, we’re now moving into more novel proteins.

What are “novel proteins” and where do we find them?

Here are some popular brands and their main ingredients:

- Beyond Meat – Pea Protein

- Impossible – Heme Protein

- JUST – Mung Bean

- Trophic and Triton Algae – Red Algae

- InnovoPro – Chickpea Protein

- Plantible – Duckweed Protein

If you’ve heard anything about plant-based meat stocks lately, you’ve probably heard that they are falling.

And it’s true. Beyond Meat (BYND) stock has fallen over 88% in the past five years. That’s after signing deals to put its meat into restaurants like McDonalds, KFC, and Taco Bell. The company was overvalued and has now begun to sell its products for less than it costs to make them. That’s unsustainable. That’s not the kind of business we want to own.

And while the Impossible Burger (made by Impossible Foods) at Burger King made a lot of headlines, the luster has worn off.

Bloomberg Businessweek even called the industry a “fad.” Even worse, it said that alternative meat was a failed experiment.

So why are we talking about it now?

We’re long-term investors. At Mangrove, our main goal is using our dollars for the good – we invest in long-term trends that are good for our wallets and good for the planet.

Short-term doom and gloom from news sites like Bloomberg actually make us excited. We see people underestimating these industries and we know that means we can find stocks for cheap.

And when it comes to alternative meat products, we think that the future that sci-fi promised us is finally here.

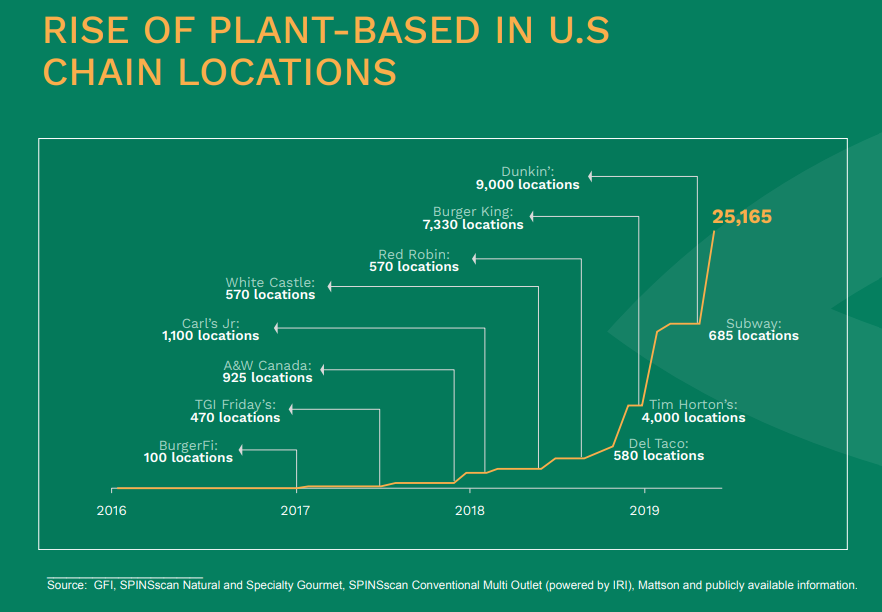

If you look past the pessimistic press, the data tells us that these products are showing up everywhere we want to see them. They are mainstream. Just look at the penetration into fast food from an alternative meat investment company’s presentation.

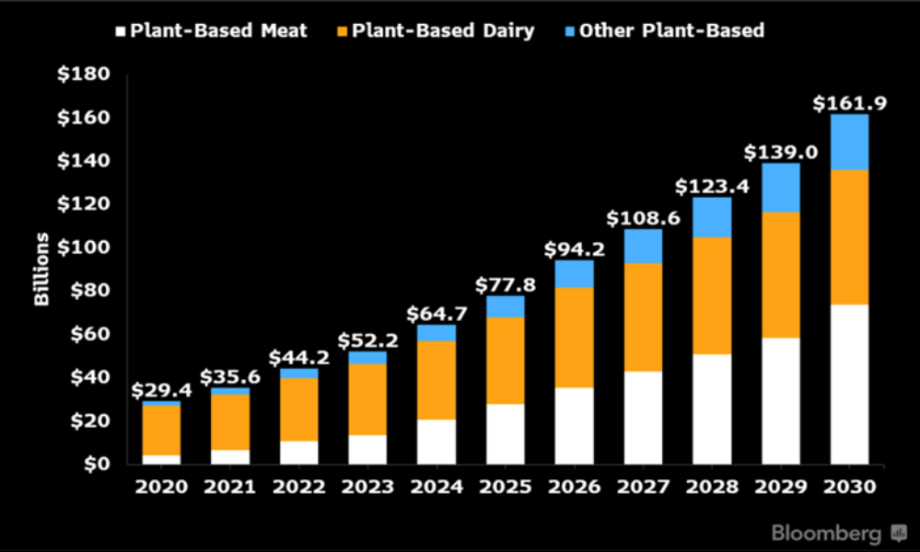

The growth is undeniable. In 2020, plant-based foods brought in roughly $29.4 billion. Bloomberg Intelligence (a different branch from the Businessweek news site) analysts project the plant-based food market will grow to more than $161 billion by 2030.

Bloomberg Intelligence isn’t the only group projecting a massive surge in the plant-based food market. Data Bridge Market Research projects a 25.5% compound annual growth from 2022–2029. And the research firm forecast it to hit $88 billion by 2029.

According to the company’s analysis, these are the key drivers:

- The rising prevalence of chronic lifestyle diseases (like obesity and diabetes)

- Widespread adoption of veganism around the world

- Rise in social media marketing

- Development of novel products like plant-based milks, egg substitutes, and meat substitutes

- Product innovation particularly in snacks and protein

The market data are compelling. I recently took a meeting with management of a small, innovative company in the plant-based food space. The team impressed me so much, I decided to feature the company this month.

I know this company isn’t our usual energy idea. But as the cost of producing meat protein rises with energy costs, plant-based protein will be more popular. And I thought this made an excellent investment opportunity.

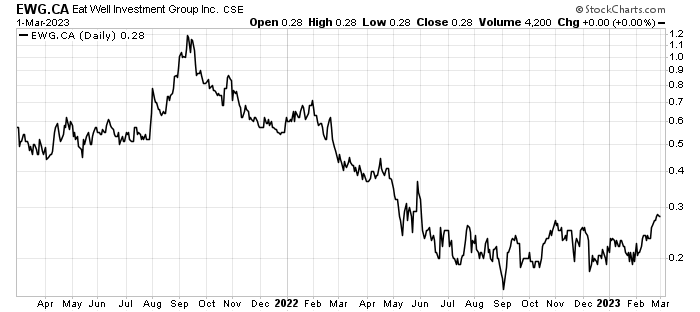

Eat Well Investment (CNX: EWG; OTC: EWGFF)

Eat Well is a $44 million-market cap food investment company. Through Eat Well, we can own several companies that are working to feed the world.

The company’s mission is:

To build a plant-based foods investment company that feeds families globally while honoring time valued health and wellness traditions, which drives the future of food security by investing in sustainable and environmentally friendly solutions and maximize shareholder value through strategic investments & acquisitions.

The compelling part of the story is that Eat Well is just getting positive revenue. At the same time, the share price has collapsed in the past year. At its current price, we’re paying about five times earnings. And that’s cheap, especially when you consider that its competition has no or negative earnings.

The risks to this company include things like product recalls and the competitive plant-based food industry. In addition, Eat Well carries debt that it used to buy the businesses. That means it has to generate enough cash flow to cover the interest payments.

However, the company just restructured its debt through the Business Development Bank of Canada. The deal cut Eat Well’s interest rate from 14% to 9.2%. The refinanced credit will free up $1.9 million in annual cash flow.

Action to Take: Buy Eat Well Investment (CNX: EWG; OTC: EWGFF) up to C$0.35 per share.

We will watch this stock carefully. We will re-evaluate our position in six months.

This is an unusual company for New Energy. Let me know what you think – do you want us to bring you opportunities outside of metals and energy?

You can always reach me at WeCare@mangroveinvestor.com. I’m always interested in your thoughts, comments, and advice. So let me know what you like and what you don’t.

For The Good,

Matt Badiali