Four ESG Funds to Buy for Security and Opportunity

Before 2020, hedge fund managers mocked specialized funds targeting companies that supported environmental, social, and governance (ESG) practices.

Most fund managers and investors avoided the segment, calling it unprofitable.

However, sentiment shifted dramatically as tens of billions of dollars flowed into these funds.

Though some parts of ESG are difficult to measure directly, we realize how important they are. That’s where ESG scores can give us an edge.

And the exchange-traded funds (ETFs) that track those high-ranked ESG companies are doing well today.

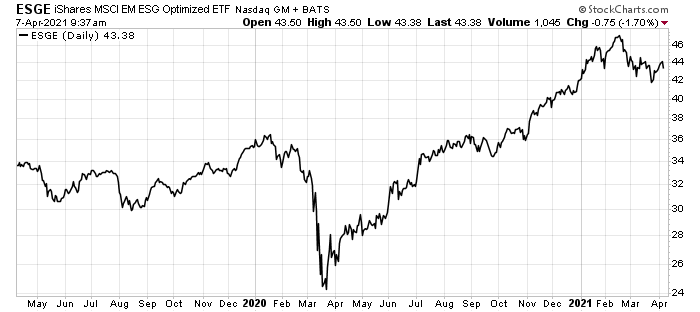

For example, the iShares ESG Aware MSCI EM ETF (ESGE) tracks an index of large to mid-cap emerging market stocks with positive environmental, social, and governance characteristics. The share price soared in 2020.

These funds have access to companies that we can’t buy in our typical online brokerage accounts. But we can get access to these alternative investments through these specialized ETFs.

And with over $6.4 billion in net assets, ESGE is a large ETF in the space. And remember, the bigger the fund, the lower our risk of one poor investment pulling the whole ETF down. That’s a positive in my book.

ESG Funds’ Strong Uptrend

As you can see in the chart below, shares of ESGE fell during the start of lockdown in March 2020, but rose 82% after:

ESGE: Up 82% From COVID Lows

The ETF has an excellent track record. It’s up 75% since its inception in 2016.

iShares’ 4 ESG Funds

iShares products are part of MSCI, a global investment research firm. These funds can be purchased on the market in any brokerage account. It has specific criteria for its indices (which iShares tracks in its ESG funds). It provides ESG ratings across nearly all stocks listed in the U.S.

MSCI believes that poor ESG practices could be major financial risks. Today, sustainable companies are a preferred investment for private equity, hedge funds, and institutions. I recommend watching the video on its ratings page here.

MSCI rates ESG risks similarly to bonds. The ratings range from “CCC” on the low end to “AAA” on the high end. Higher ratings are given to companies with strong ESG profiles positioned for future challenges.

Different ESG risks affect industries in different ways. However, good corporate governance is critical for every investor, not just for those looking to make a social impact with their investments.

The good news is that iShares offers four “ESG Aware” ETFs for investors.

I discussed the iShares ESG Aware MSCI EM ETF (ESGE) above.

The others are:

- The iShares ESG Aware MSCI USA ETF (ESGU), which tracks an index of U.S. companies.

- The iShares ESG Aware MSCI EAFE ETF (ESGD), which tracks an index of large and mid-sized companies in the U.S. and Canada.

- And finally, the iShares ESG Aware MSCI USA Small-Cap ETF (ESML), which tracks small U.S. companies.

Each ETF offers a different potential for risks and rewards. However, they all benefit from reduced risk, based on the MSCI ESG ratings.

Each fund tracks only companies with positive MSCI ESG Scores. So you can invest safely and responsibly.

These kinds of funds (and the stocks they hold) are critical to a safe and successful investment portfolio.

For the good,

Matt Badiali