High Energy Prices Will Accelerate Adoption of New Energy

Dear Friends,

I’m excited to write my first weekly update ever, for Mangrove Investor’s New Energy. Welcome and thank you for subscribing!

My thoughts this week focus mainly on inflation, and energy inflation specifically.

There is no doubt in my mind that refiners – from giant integrated companies like ExxonMobil to independent refiners like Valero – are scalping U.S. consumers right now.

A quick check of independent refiners Valero, Phillips 66, and Marathon show all three had record revenue in the first quarter of 2022. And I’ll bet you dollars to donuts that Q2 will be even better.

And that’s weird because these independent refiners have to buy oil to make refined products. As oil prices rise, it costs the refiners more. Imagine a baker who has to pay a whole lot more for flour. It should squeeze the profit margins of these companies.

In normal times, refiners get a modest sliver of the price of refined products. But it appears that they are taking a bigger bite today, to make up for lost profits during the lockdown.

And while that sucks for us, it will definitely fuel demand destruction. Recall that period of high oil prices after 2008. It led to the flood of hybrid cars into the market. By 2013, hybrid vehicles accounted for 3.2% of new vehicles sold in the U.S.

I believe these soaring fuel prices will renew the interest in high-gas mileage and straight up electric vehicles. The timing of astronomically high prices couldn’t be worse for the oil industry. But it will be a boon to car makers’ plans for electric vehicle sales.

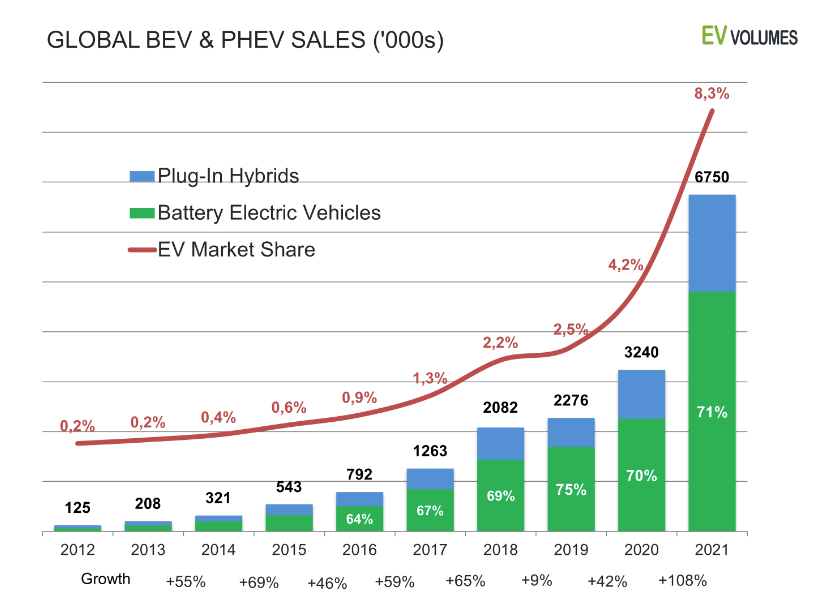

Figure : Source – https://www.ev-volumes.com/

According to the Electric Vehicle World Sales Database, 2021 saw electric vehicle sales double from 2020. And they now make up 8.3% of global sales. In North America, market share jumped from 2.3% in 2020 to 4.4% in 2021.

This is a tailwind for electric vehicle sales and the associated industries. We’ll keep an eye on it, but with the general market down-turn, we could find some bargains out there right now.

I’ll keep you posted on what I find.

Good Investing,

Matt Badiali