How to Capitalize on the Sustainability Movement

The first steps in investing in a world focused on reducing carbon

We know that sustainability is a huge force in global markets, because the people with the money told us.

That information is out there, for anyone to see…

BlackRock, the giant $115 billion financial services company surveyed its investors in 2020.

These aren’t your average mom-and-pop investors. These individuals manage $25 trillion in assets.

BlackRock asked them about the future. The survey results shocked the financial industry…

These investors planned to double their current investments in sustainable products over the next five years. That would jump from 18% of their assets under management to 37% by 2025.

The Chief Client Officer at BlackRock, Mark McCombe said:

The tectonic shift we identified earlier this year has really taken hold, [it]… pushed sustainability into the mainstream of investing. The results of our survey show this sustainable transition is occurring all around the world.

There simply is no way to deny this trend. The players are too prominent. The dollar amounts are too large to ignore.

This move to sustainability will change the way we invest. It will change the future of many companies and by default change the fortunes of many, many investors too.

Over $51 billion of investors’ money moved into sustainably-focused companies in 2020. Today 1/3rd of all the money under management in the U.S. is flowing into these companies.

From 2018 to 2020, assets invested in these companies grew from $12 trillion to more than $17 trillion.

That’s a huge amount of money and it will send shares of these companies soaring higher.

The good news is that we have plenty of time to position ourselves before the big move. Because, as we discussed before, potentially trillions of dollars are going to move into sustainable companies.

We just have to get there first, and we’ll see our wealth grow. That’s what this report is about. It’s our best ideas for playing the move into an electric world.

That’s because billions of dollars are going into alternative energy, electric vehicles (EVs), and batteries.

According to Statista, investors put nearly $250 billion into renewable energy projects from 2015 to 2019 (the latest data available). And the new infrastructure bill just signed into law allocates $73 billion for the electric power grid.

According to Bloomberg, car makers Volkswagen, Mercedes-Benz, Stellantis, GM, and Ford committed more than $228 billion in investments in electric vehicles.

In 2020 alone, battery companies raised $5 billion in deals. That’s up from $1.1 billion in 2019, according to Forbes.

That’s a lot of near-term investment in new energy supply, transportation, and storage. And all those things have one thing in common: copper.

If You Like Sustainability, Then You Are a Copper Bull

Maybe you’re a fan of the electric economy for environmental reasons.

Or perhaps it’s financial – you plan to buy a Tesla because you put a lot of miles on your car.

It’s possible that you don’t have much interest in owning an electric vehicle. But still, based on the Biden administration’s commitment to green energy, the growing popularity of electric vehicles (which I discuss in more detail below) and the growing interest of millennials and Generation Z, you know the industry will grow in the coming years.

Regardless of your reasons, you’re here to learn about how to invest in the electric economy.

And I have news for you.

Whether you know it or not, you’re a copper bull.

You’re not alone. Copper is my favorite natural resource right now.

So if you’re looking to add some mining companies to your portfolio, it needs to be copper.

I talked to my friend Valerie recently about how, when you buy a new car, you see that make and model everywhere.

She drives a Toyota Prius – a hybrid – and she used to notice Priuses everywhere in her South Florida community. But now, she told me, she sees more Teslas on the road than ever before.

Tesla sold cars in 22 states in 2020. A lot of cars. About 35% of those cars are in California. But Texans bought a lot of the electric vehicles too.

General Motors announced in November 2020 that it would sell 30 different EV models by 2025.

From its website:

Between 2020 and 2025, GM will invest more than $27 billion in EV and AV product development spending, exceeding GM’s gas and diesel investment. The investments will create thousands of new, good-paying U.S. jobs. This includes plans to make our Factory ZERO and Spring Hill, Tennessee assembly plants dedicated to electric vehicle production.

GM is just one automaker that’s investing billions in new electric vehicle designs. That’s the trend.

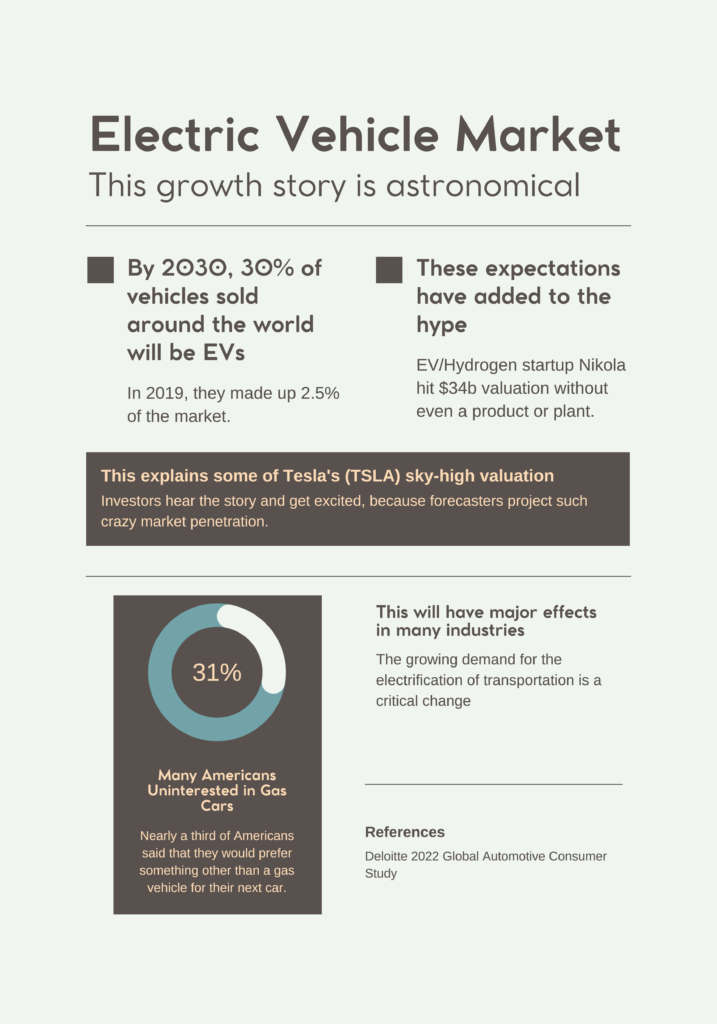

EVs: The Numbers

In a recent study, Deloitte, the big bank, laid out the numbers to support this massive growth potential:

But there is one story that is just emerging. It is a huge downstream impact story that hasn’t made it to the mainstream yet.

But it should be part of your portfolio… because if you believe in the electric vehicle story, you are bullish on copper.

Why Copper – Not Lithium – Is the Real Hero of the Green Energy Revolution

The story of electric vehicles overshadows the copper story. Lithium for batteries and some of these other natural resources get more play. But the big story within the electrification of cars is copper.

Longtime readers know I wrote about copper for years because it’s so important. This is an inevitable bull market. And here’s why…

In a regular car with an internal combustion engine, it needs about 50 pounds of copper. It needs the copper in the wiring and motor. But an EV needs a whole lot more.

Take the new Teslas, for example. It takes about 183 pounds of copper per car. That’s because each wheel has a motor that needs the windings. Then you have all the wiring in it. And it has a giant battery.

The battery story is one reason why copper demand didn’t break out yet. Most people think of lithium when they think about vehicle batteries, or chargeable batteries in general. It’s in the name: lithium-ion batteries.

So of course, we think that these batteries are giant blocks of lithium… but that’s not the case at all. Lithium only makes up about 2% of these batteries.

Copper makes up 8% of EV batteries.

That means there is four times as much copper in one of these batteries as lithium, but lithium gets the press.

The lithium story blew up because there was a brief supply shortage. Demand skyrocketed so fast, producers couldn’t meet demand in the short term. That has to do with the history of the metal…

Let me share a little story about lithium. For years, nobody knew what to do with this stuff.

It was produced as a by-product of fertilizer production. You can recover it from geothermal power stations. And you can mine it from hard rocks. There are lots of sources for lithium.

And historically, they used it to make grease. They used it in paint. But there wasn’t a giant industrial demand for it. That is, until they started using it in rechargeable batteries.

When they were making rechargeable AA batteries, there’s plenty of lithium supply. And there was plenty for cell phone batteries and laptop batteries. But when they started making these giant car batteries, supply got tight.

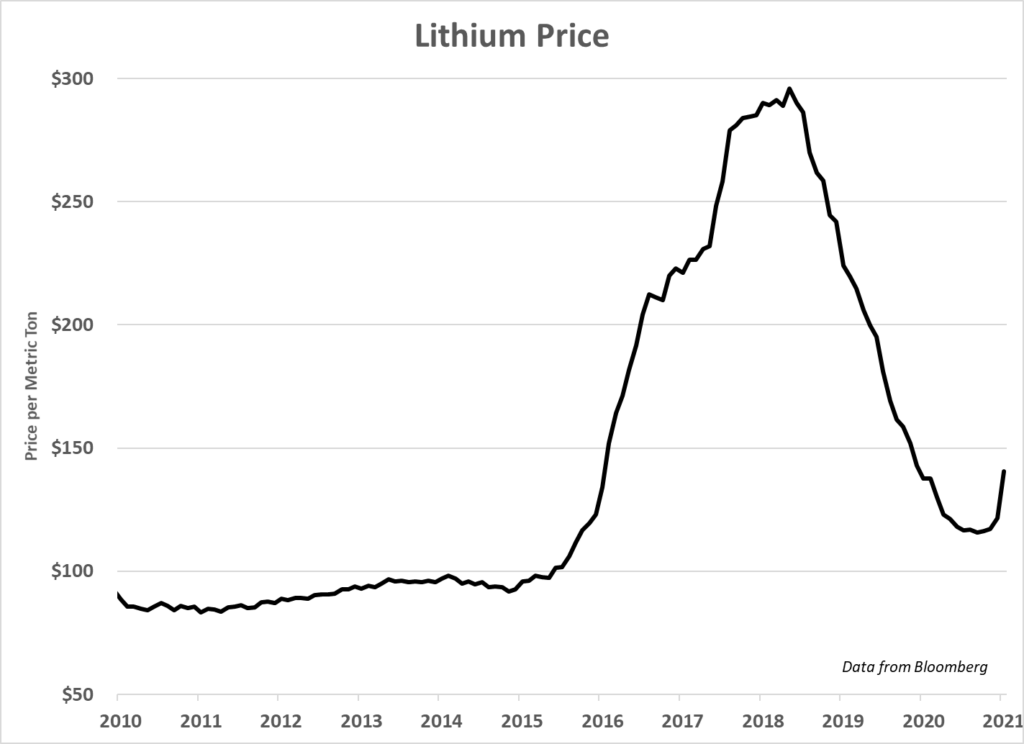

As demand for this specialty metal grew, the supply didn’t match it. That’s why the price of lithium skyrocketed in 2016-2018, as you can see from the chart:

As demand outstripped supply, the price roared higher. It soared over 200% in just two years, an astronomical move for a commodity price.

As you can imagine, lithium producers got a huge windfall. That fantastic jump in price sowed the seeds of the collapse that came next.

The lithium producers looked around and thought, well, geez. I mean, if you really want this, we can make more of it. Remember, lithium is far from scarce. It’s produced from brine – salt water found in basins that don’t have outlets to the ocean. Think the Great Salt Lake in Utah.

In most places, when rain falls on the mountains, the water runs into streams, the streams into rivers, and the rivers end up in the ocean. But in some valleys, the water comes down from the mountains and it has no outlet. It can’t go anywhere. So, it just evaporates off. And it leaves behind all the minerals that it dissolved and carried from the mountains.

Salts are one of the most soluble of these minerals. When we hear the word “salt,” we think of table salt, which is sodium chloride. That’s just one of many. Calcium chloride is a common salt that we use in sheet rock. Potassium salt, or potash, is an important fertilizer. And as we produce those salts, we get lithium chloride.

In other words, lithium is not rare. And it’s easy to mine. Many of these salts come from solution mines. They drill down into the brine and pump water down. That dissolves the salt and pushes it toward a production well. Then it gets pumped into ponds, where it evaporates in the sunshine. The miners sort the brines by density and produce lithium.

You can’t do that with copper. And that’s a looming problem.

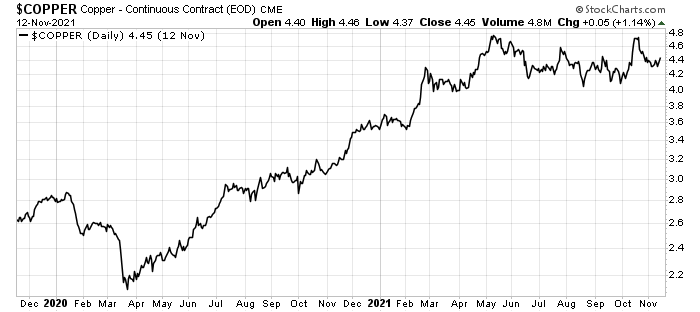

The Copper Price Could Climb 600% by 2027

We’re going to see demand for copper spike exactly the way it did for lithium. The problem is, we’re already maxed out on production of copper. So when you have a situation where demand is rising and supply can’t catch up, prices go up. We are already seeing copper prices creep higher, as you can see in the chart:

By 2027, copper demand from electric vehicles will go up by 1.7 million metric tons. As they roll out all these new vehicles, each one needs wiring. They need motors. They need batteries. All that adds up to 1.7 million metric tons. But that’s more copper than the world’s third largest copper producing country produced in 2019. China produced 1.6 million metric tons. So, by 2027, we need to add the equivalent of another China to copper production.

That’s impossible.

We don’t have the mines. We need the equivalent of the world’s largest copper mine, Escondida in Chile, coming online in the next five years. But Escondida is a geologic anomaly. It is a gigantic mine.

We may never find another one like it. But to meet soaring demand for copper, we need to find, develop, and build another Escondida by 2027.

That’s not going to happen.

Maybe we can build several smaller mines. The combined production from the second, third, and fourth largest copper mines in the world, barely add up to 1.8 million metric tons.

We can’t even replicate the world’s second, third, and fourth largest copper mines and get them built and permitted and in production by 2027.

It’s simply not possible.

And if the forecast for electric vehicles is correct, copper is going to be in short supply. We will be in deficit and that’s going to drive the price up.

And there isn’t any let up in the demand for copper.

All over the world. Governments legislated out combustion engines. They’re legislating in alternative energies like solar and wind power, which consume tons of copper. If you want to move an electron from point A to point B, you must have copper. So as the electrification of the world progresses, it must be built on a foundation of copper.

I’m saving my old pennies, because they will be worth a whole lot in a few years.

For investors, this means we should own copper producers, copper developers, and even exploration companies. We should own the whole sector, from top to bottom, because the copper price is going up. It wouldn’t surprise me to see the copper price respond to this demand like the oil price responded from 2000 to 2010. Oil soared 600%, from $20, a barrel to $140 a barrel. That was an extreme run, driven by demand and the fear of shortages…

Just like the copper market today.

That means I’m in the market for copper producers. Because every day, these assets get more valuable. Every single day, the closer we get to the inevitability of 30% of cars sold around the world being electric, the more valuable copper becomes.

I combed through the companies that are even partially related to copper production. I decided against many of the miners because many, like giant Freeport McMoRan (NYSE: FCX), have some serious environmental concerns.

However, we found a company that meets both criteria: to invest in the copper space and in the “do good.”

It’s not a copper miner, but it is part of “circular economy.”

The circular economy is the idea that some resources can be “infinite.” They simply need to be recycled. There are three main goals of a circular economy, according to the Ellen Macarthur Foundation:

- Design out waste and pollution.

- Keep products and materials in use.

- Regenerate natural systems.

These are values that we at Mangrove Investor also hold dear. That’s why this giant recycling company jumped off the page at me, as a copper investment. Let me show you what I mean…

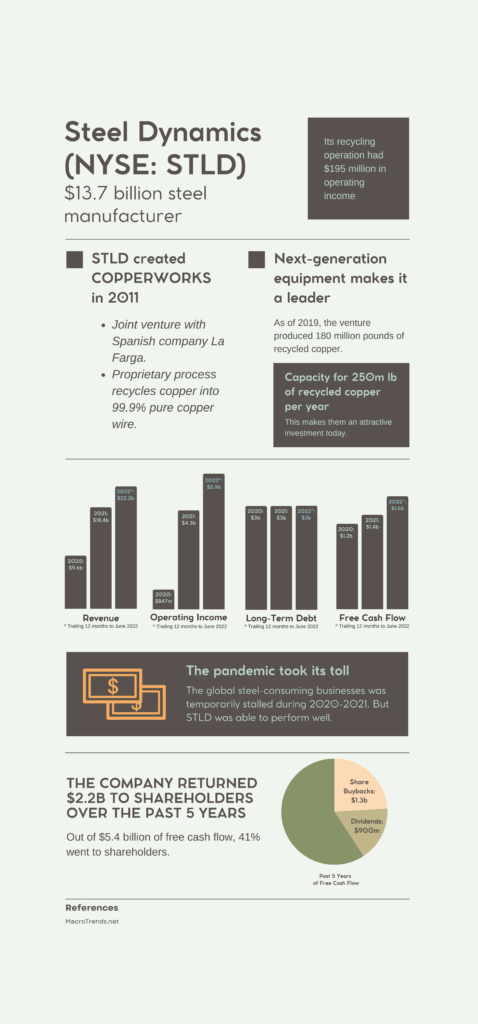

Circular Economy Copper Play: Steel Dynamics (Nasdaq: STLD)

Sustainability

Steel Dynamics’ electric arc furnace (EAF) steel mills are among the least carbon-intensive mills in the world. Recycling a ton of steel eliminates 1,400 pounds of coal consumption.

Its EAF mills produce just 0.2 metric tons of CO2 emissions per metric ton of cast steel. A typical blast furnace produces 1.62 metric tons of CO2 emissions per metric ton of cast steel. That is just 12% of the emissions per metric ton of the average U.S. blast furnace steel mills.

The reason for that is its low relative energy consumption. The EAF mills consume just 25% of the power needed by blast furnace steel mills.

In addition, the company recycles 100% of the water used in its smelting process. The company recycled 1.1 billion pounds of non-ferrous metals like copper and aluminum in 2019. And it recycled 11 million tons of iron scrap in 2019.

Obviously, metal production is never going to be perfect, whether we are mining or recycling. But Steel Dynamics makes a strong case for being among the best in a bad sector. And we need metal recycling as the world transitions to electric power.

That’s why we recommend buying Steel Dynamics (Nasdaq: STLD) for the coming explosion in copper prices.

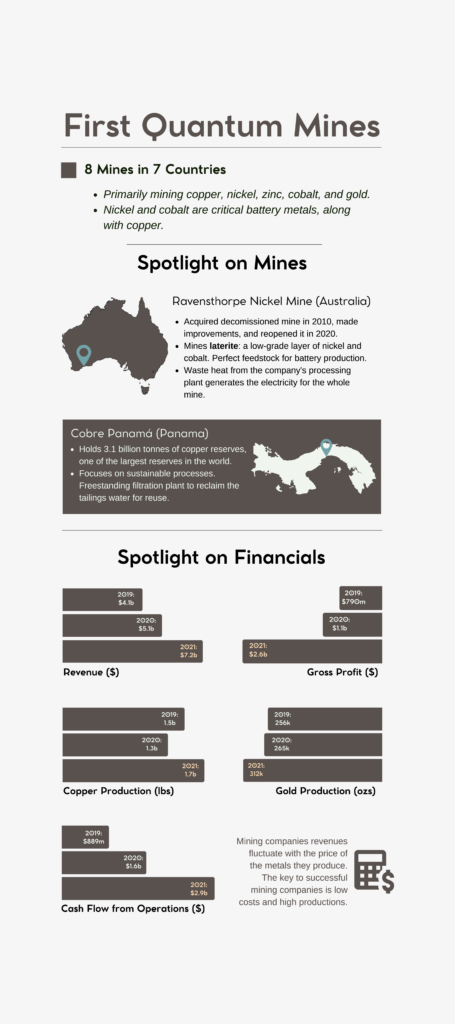

A Sustainably-Focused Copper Mining Company: First Quantum Minerals (TSX: FM)

First Quantum Minerals is a $16.2 billion copper and gold mining company.

As we discussed earlier, there simply isn’t enough copper supply to meet rising demand. That’s why mining copper will be an absolute necessity.

It’s important for us to own copper miners that embrace our values. Mining itself isn’t the problem. It’s the profit-first mentality that creates most of the problems we see from mines. First Quantum focuses on sustainable mining. It embraces the communities in the areas it mines. Management is committed to creating local jobs, supporting local communities, and using sound environmental practices in its operations.

The company understands that earning and keeping community support for mining is the only way it can succeed. You can’t just pull up a mine and move like you can with a factory. That means community support is critical.

The company has a global corporate social responsibility (CSR) program that “…balances best practice with site specific needs and the needs of our host communities.”

If we must have the copper, then we must have mining.

That means we must find and support mining companies that integrate themselves into communities well. That’s what First Quantum does well.

Sustainability

The new-style corporations need to embrace the communities where they operate. And that’s the direction First Quantum took from the start. Without the communities, mining companies cannot operate. You can’t ship a mine to another country if local opinion turns negative. That means mining companies must become good neighbors.

First Quantum leans into that sentiment. The Cobre Panama mine supports Girl Up Club: “a UN-funded movement, that provides training and support to empower young women.” The Kansanshi mine supports the Young Women’s Christian Association. The Sentinel mine supports the Start Your Business training program. And the company runs a Literacy Program in Akjoujt, Mauritania that offers women opportunities for education and independence.

There is no question that the global energy transition requires far more critical metals like copper and nickel than we currently produce. That’s why we need to own producers – they will be excellent investments over the long term.

We have the ability to choose which producers we support with our investment dollars. Choosing a company like First Quantum means that we support what it does – not only through mining, but through its community engagement.

Action to Take: We recommend First Quantum Minerals (TSX: FM)

We believe its production will continue to grow and the value of its copper and gold production will increase. We see this as a three-to-five-year opportunity. However, we will use a 25% trailing stop on our position in the portfolio to protect our capital.

Conclusion – Sustainability Is a Great Place to Be Invested

The sustainability movement isn’t a fad. The numbers are too large, and the players are too serious. And the trend is in place. As the market recovers in 2022 and into 2023, this will be one of the largest trends to emerge.

We watch the price tickers on Bloomberg. When we see lithium and cobalt prices become part of the regular rotation, you’ll know that the trend is mainstream. Until that time, we can buy into these companies and prepare.

Good Investing,

Matt Badiali