How to Take On China’s Lithium Monopoly

North America’s First Refinery of Its Kind

The lithium batteries in your everyday life – like your car’s battery, your laptop’s battery, and some of the small rechargeable batteries in your junk drawer – are mostly coming from China.

In 2021, China held 79% of the global lithium-ion battery manufacturing capacity (in terms of gigawatt hours).

That’s according to Statista’s data. In addition, China owns 80% of the world’s battery metal refining capacity.

Those are incredibly scary statistics when we know that the world’s energy demands are moving towards electricity.

I say “scary” because we just saw how Russia used its choke hold on natural gas supplies to influence Europe’s response to its invasion of Ukraine.

The ability to control your rival’s energy supply gives you a material advantage on the world stage. Energy is power.

The geopolitical implications of the battery economy will be as important in the next 50 years as oil’s were in the last 100.

That’s why this period of energy transition is so important. The world is changing under our feet. We will see new powers and new economies emerge quickly.

Our focus in New Energy is to bring you those trends and to figure out the opportunities that result.

Used Battery Supply Will Soar

It makes sense that as electric vehicle popularity grows, so will the volume of used batteries.

Trading in your used battery for a new one will be much more common as batteries get bigger and more expensive.

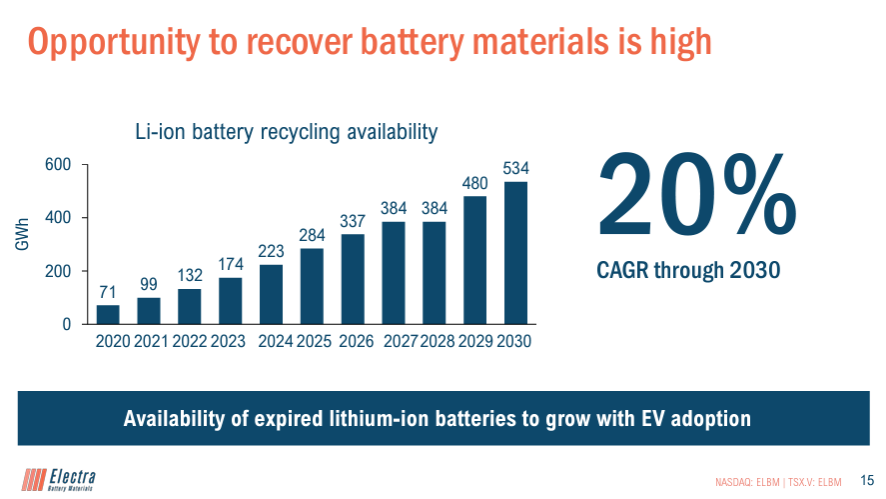

According to this company’s data, the recyclable lithium battery supply will grow by 20% compounded annually through the next seven years.

We’re going to see an surge of batteries that can get recycled.

S&P Global, a widely respected energy industry research firm, forecasts that electric vehicle sales could reach 40% of total passenger car sales by 2030. Rival industry research by BloombergNEF suggests that over 50% of passenger car sales will be electric by 2030. The Bloomberg analysts point out that consumer incentives in the $374 billion Inflation Reduction Act (passed by the U.S. in 2022) will help speed this up.

The fact that every major car brand has rolled out new electric models in the past few years supports that prediction.

And this month, I want to tell you about company that will profit on these moves. It is building the first fully integrated battery materials “park” in North America.

The park will include cobalt and nickel refining capacity as well as a large-scale lithium-ion battery recycling facility.

As you know, I have a soft spot for recycling. The looming demand for batteries means that we need to consider all ways of getting critical metals. Instead of relying on China for all our lithium, we can easily rely on the metals already sitting in our homes. Recycling will play a critical role.

And this company not only has the recycling and refining park, but it also owns a cobalt-copper deposit in Idaho.

Let’s jump into the research.

Electra Battery Materials (Nasdaq: ELBM; TSXV: ELBM)

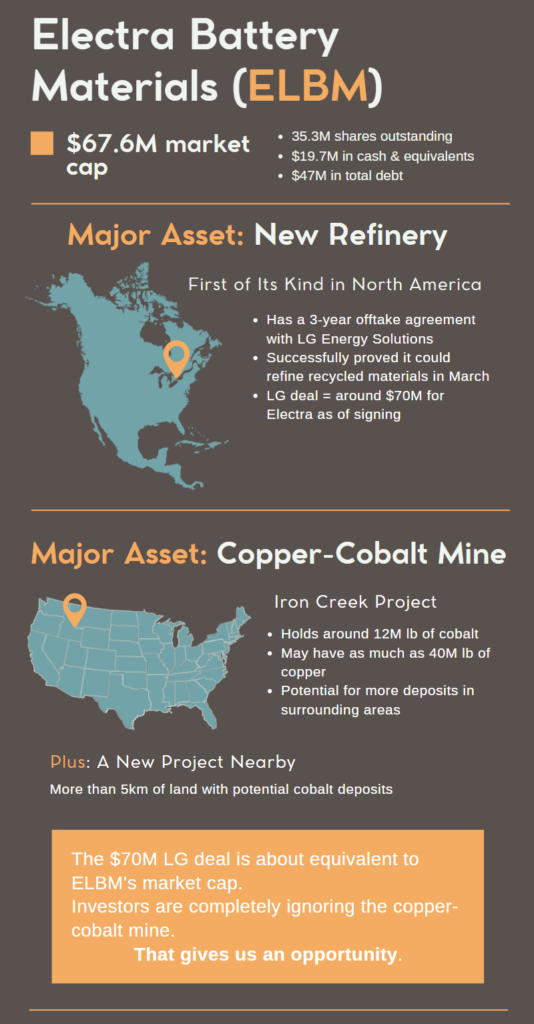

Electra Battery Materials is an $67.6 million company with two main assets.

It owns the Iron Creek cobalt project in Idaho and a fully permitted battery recycling refinery with a three-year offtake agreement with LG Energy Solution.

The refinery sits just north of Toronto. On March 13, 2023, Electra announced that it had successfully recovered lithium from its “black mass” recycling trial.

Black mass is the industry term for used battery materials.

It’s a major milestone that validates Electra’s proprietary process.

This business will generate revenue in the short term.

According to the company’s investor presentation, the LG Energy Solution deal will generate $70 million in revenue, based on current cobalt sulfate prices.

Given that the company’s market cap is also around $70 million, it seems the market only values that deal.

But Electra has an exploration project that’s worth a lot more than zero!

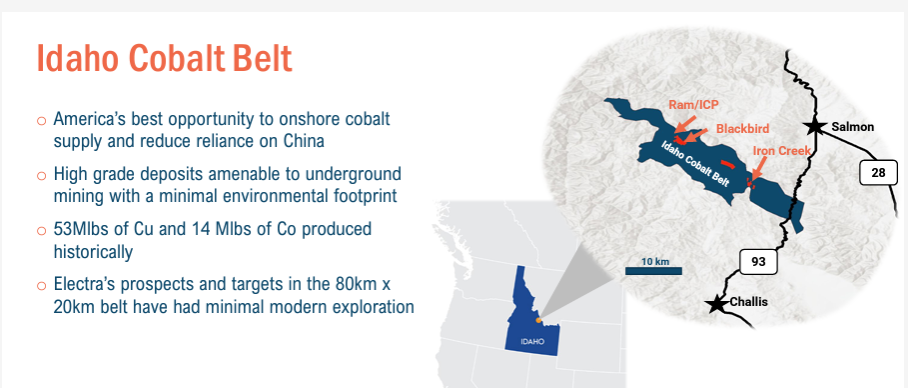

The Iron Creek project is on the Idaho cobalt belt:

Iron Creek contains both copper and cobalt. In 2019, the company completed a resource estimate on the project. It holds an indicated resource of 12.3 million pounds of cobalt and 29.1 million pounds of cobalt resource. It also holds another 12.7 million pounds of cobalt and 39.9 million pounds of copper in the inferred category (which is a much lower confidence).

The project is a high-grade deposit and it’s open in all directions. That means the company could find more material.

It’s worth much more than zero.

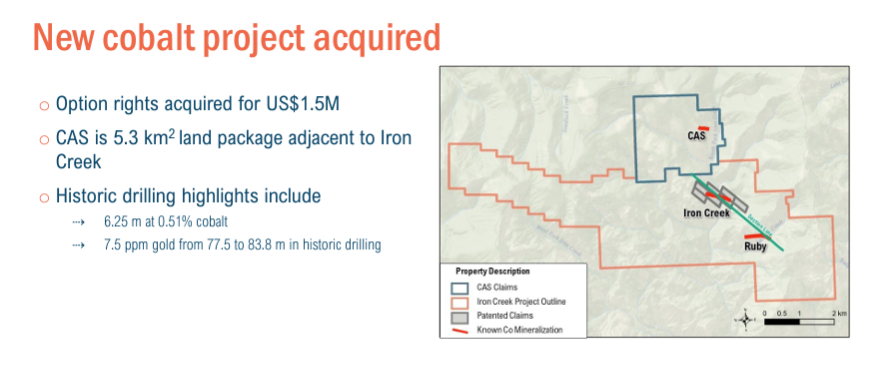

And now, the company has a new project adjacent to Iron Creek:

This is an ideal business model to own to take advantage of the rise in electric vehicles. It owns both a new and important recycling center and a domestic copper-cobalt deposit.

The fundamentals look great too:

- 35.3 million shares outstanding

- $19.7 million in cash and equivalents

- $47 million in total debt

We do have some real risks with this company, however.

Iron Creek is still an exploration-stage project. And Electra doesn’t plan to be a mining company. It plans to get capital and a real partner to put it into production. If it can’t find a partner, the only way to unlock the value of Iron Creek will be to spin it out.

The good news is that Iron Creek is the largest unmined cobalt resource in the U.S. That should attract partners.

The market is going to value this company on its recycling business going forward.

Action to Take: Buy Electra Battery Materials (Nasdaq: ELBM) and use a 30% trailing stop. That means if we pay $2.05 per share for Electra and the shares fall to $1.44, we will sell. That’s how we limit our downside risk.

I’m a fan of this company. It’s exactly the kind of stock we want to own to take advantage of the Inflation Reduction Act.

And while today’s battery production is concentrated on China, Electra is part of the charge to bring sustainable production to the U.S.

For The Good,

Matt Badiali