Mangrove Investor’s Bear Market Playbook

As I write this, over 1.7 million people in Florida have no power thanks to Hurricane Ian.

Millions more are cleaning up today. The giant storm hit the most populous counties in the state.

My family and I are among them.

We experienced high winds for a couple days as the storm crossed the state. But we were spared the main force of the storm as it went out to sea.

The wind was loud. We are surrounded by oak trees, and the branches clashing and the wind whipping through became a backdrop to everything.

The difficult thing for me was the variation. I don’t mind a constant drone. But changes in volume and tempo get my attention. Gusts rolled through and increased the noise. Branches, palm fronds, and hickory nuts rained down on the roof.

It was hard to ignore. I found it the single hardest thing to get through. It increased my stress level. And 36 hours of it, as I know the main part of the storm is approaching, was tough.

But this isn’t the first hurricane we’ve endured.

And we’ve seen so many storms through the years that we have a standard storm tradition.

During the storm, we put on our raincoats and go for walks. We bake goodies for ourselves and our neighbors. And we play games to pass the time.

After the storm, we go to work. We clean up our yard and then help the neighbors. We put away all our supplies (flashlights, generator, etc.). And then we relax.

We take a walk on the beach to see what washed up. We cook dinner on the grill (because we often lose power and have to cook whatever thawed). And then we light a fire in the firepit and break out the smores.

I like that tradition because it puts a positive ending on a stressful and possibly perilous situation. I believe that example will help my children as they mature. The storms we endure teach them to be confident in the face of adversity.

If you’ve been watching the headlines, you know that communities are assessing the damage from Hurricane Ian today. But it’s not the only headline we’re seeing. As interest rates and inflation rise, the market is being clobbered, too. We’ve been in this situation before, though, so we know what to expect. Let me show you our stock market storm tradition…

Looking Back at 2008 for Insight Into the Current Market

As I wrote in the September 30 Weekly Update, I had a front-row seat for the 2008 crash. I was relatively new to investment research back then. But I had a mentor and friend with a ton of experience…and he was troubled. At first.

Then, as the market began to recover, he took a second mortgage out on his house to buy stocks.

I’m not kidding.

He saw the recovery as a moment when there was literally a pile of money waiting to be picked up. So that is what he did.

In the Weekly Update, I told another story about betting on that recovery: My speculation in a tiny mining company. I knew the management team well and I knew that it wasn’t going out of business. And I laid out three critical attributes for stocks to buy in a bear market:

- Great management

- Solid cash position

- Zero risk of bankruptcy

These are important because access to capital was tough at the time. If companies didn’t have the cash that they need, it would’ve been trouble as the bear market drew out.

Today, we’re seeing the same thing.

As you can see in the chart of the S&P 500 Index below, this bear market is about nine months old:

The bear market that started in 2000 lasted about 25 months. The one that started in 2007 lasted for 17 months.

As this bear market plays out, we want to be safe. That’s why we need to highlight which companies in our portfolio meet our crash-proof criteria and which do not. There are a couple companies that we should avoid until the market bottoms.

That doesn’t make them bad companies. It just means that they are higher risk, and vulnerable to falling further than they already have.

So, this month, we will review our current portfolio. We’ll sort our positions by what we want to own now and what we want to wait to own.

And next month, we’ll have a brand-new recommendation.

Breaking Down the Portfolio into What to Buy and What to Watch

We currently have nine positions in our portfolio that go back to June 2022.

We have one company that is a bullet-proof winner. Jade Power Trust (TSX V: JPWR.UN) is a renewable energy provider in Canada, Netherlands, and Romania.

As we showed you in our September 12 Weekly Update, Jade Power is being acquired by Enery Power Holding, a renewable energy company from Austria.

Enery Power Holding will be buying the trust’s renewable power assets for C$93.7 million or C$3.40 per unit. The cash will be paid out to unitholders in two distributions which will be set by the board of directors once the transaction closes. The first distribution is worth more than the current share price:

The Trust is pleased to announce that it now expects the initial Special Distribution amount to be approximately CDN$3.16 per Unit, as compared to the CDN$3.03 per Unit previously announced on September 1, 2022.

Jade Power’s units currently trade for C$3.04 each. Current shareholders should hold on for the distributions. If you haven’t already bought, you can still get the distribution if you buy now. This is easy money. If you buy at the current price, you’ll make almost 12%.

After Jade Power, we have to look at the risks for each position.

We are going to focus on the companies that we can buy today, plus one company that we believe is too risky to continue to hold. The stocks that we don’t discuss here are still worth holding, but they all have risk exposure that could bring shares down (which we’ll touch on).

Lower-Risk Companies You Can Buy Today

We don’t know just how bad the bear market could get. And doing nothing right now to conserve cash is a sensible choice. However, some of our readers would like to know what they could be doing today.

We can point to three companies in our model portfolio that meet our criteria for surviving a bear market and thriving during the recovery.

Brookfield Renewable Partners (NYSE: BEP), Altius Renewable Royalties (TSX: ARR), and Li-Cycle (Nasdaq: LICY) all generate revenue today. They are all well-run companies with strong businesses.

Let’s take a quick look at the first two…

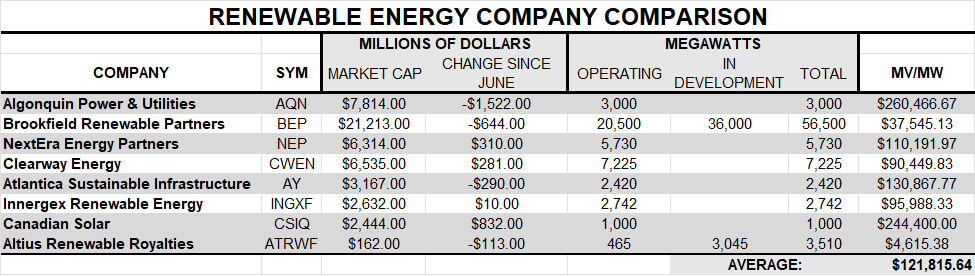

In the report “The Best New Energy Companies in the World,” we broke down renewable energy companies by market cap and megawatts.

Here’s an updated version of that table:

What we can see is that only four companies have fallen in value since June: Algonquin Power, Brookfield Renewable Partners, Atlantica Sustainable Infrastructure, and Altius Renewable Royalties.

The common thread in these companies seems to be either acquisition or development of new power. The market that hates risk right now, and that’s why these companies are down.

However, we see that as an opportunity to buy both Brookfield and Altius at a lower price than in June. And we were happy to own those stocks at higher prices.

We see all power companies as solid investments right now. We believe a rush to divest from natural gas could bring higher prices to these stocks. And we believe these higher prices could extend to Canada as well as the U.S.

We see both Brookfield Renewable Partners (NYSE: BEP) and Altius Renewable Royalties (TSX: ARR) as sensible investments today. The current market downturn has made shares cheaper but shouldn’t materially affect their businesses.

Action to Take: Buy shares of Brookfield Renewable Partners (NYSE: BEP) and Altius Renewable Royalties (TSX: ARR)

Our third company, Li-Cycle (NYSE: LICY) is building a business that will thrive in the next decade. U.S. Senate Majority Leader Chuck Schumer visited the Rochester Hub in September.

Schumer’s visit came after the passage of the Inflation Reduction Act, which allocates more than $300 billion in funding towards energy security and climate change. The Act includes provisions to support domestic manufacturing of critical materials for electric vehicles.

Schumer and Li-Cycle’s CEO Ajay Kochhar joined the Li-Cycle team to recognize the positive impacts that the facility will bring to local communities and to the lithium-ion battery supply chain in North America. That’s a strong tailwind for the recycler.

In its recent press release, the company said:

Li-Cycle’s patented, commercial lithium-ion battery recycling technologies play a key role in supporting localized supply chains of critical battery grade materials. The Rochester Hub is expected to be the first commercial hydrometallurgical battery resource recovery facility as well as the first new significant source of battery-grade lithium carbonate production in North America. The facility is expected to process battery material that is equivalent to approximately 225,000 electric vehicles per year, which will position the Company as a leading domestic supplier of critical battery-grade materials.

The Rochester Hub is on track to commission in 2023.

Li-Cycle’s quarterly update looked solid as well:

- The company has $649 million in cash (as of July 2022).

- The Arizona facility is on track to hit its target output.

- The Alabama facility should begin production by the end of 2022.

- And Li-Cycle is expanding into Europe. It secured locations in Norway and Germany for recycling centers.

We added Li-Cycle shares to our model portfolio for $7.76 each, in August 2022. Today, they trade for around $5.88 each. However, the company continues to advance its projects.

The decline in the share price centers on the risk these development projects pose. Even though the company is producing and selling recycled material (called “black mass”), the company is plowing more money into construction than it brings in. That is riskier than if the company had fully built infrastructure.

But with that risk comes potential reward. We still see Li-Cycle as a first mover in lithium-battery recycling. If you don’t have a position in Li-Cycle yet, this is a great point to begin buying shares.

These are the companies that we believe are the lowest risk options in our portfolio today. If you are looking to add positions, please consider these first.

Action to Take: Buy shares of Li-Cycle (NYSE: LICY)

However, we also have a stock that we see as too risky to hold in this bear market.

It’s the first sell of our brief history. And this is a market force-driven sell and has nothing to do with the company.

Sadly, Fusion Fuel Green (Nasdaq: HTOO) violates all of my criteria for a safe stock to hold as the markets correct.

This company uses solar power to create green hydrogen. It has an innovative technology that solves a fuel problem for millions of people – BUT there isn’t much demand for green hydrogen yet. The market needs to develop before this company can really take off.

And that risk sent shares of Fusion Fuel Green down 35% since we bought it in June 2022. That’s enough of a loss, combined with its risky future, to sell.

We’ll record a modest 35% loss on the position in our model portfolio and revisit the company when the market situation improves.

Action to Take: Sell Shares of Fusion Fuel Green (Nasdaq: HTOO)

Summary

I encourage everyone to review all their positions, whether they were from Mangrove Investor research or somewhere else. This is the right time to trim the riskier positions and build up some cash.

As we said earlier, the stocks that we didn’t discuss are the ones we believe are still worth holding. But they all have risk exposure that could bring shares down further. Canadian Premium Sand (TSX V: CPS) should have the capital it needs to build its new glass plant. But there is a lot of “should” built into that stock price. If something goes wrong, the shares could fall.

The same goes for Capstone Copper (TSX: CS) (the company changed its name from “Capstone Mining” in March) and Ivanhoe Electric (NYSE: IE). They both have plenty of money to get the job done. They both have great management. BUT… if something goes wrong, shares could fall.

For those of you looking to add positions, this is what we would call a “nibble market.”

Buy a few shares of stocks you like, but don’t build huge positions. You can buy a little now, and then wait to see what happens. That way, you limit your risk of taking big losses if the market takes another turn down.

The good news is that bear markets sow the seeds of bull markets. And if we navigate this market correctly, we will prosper when it turns.

Good Investing,

Matt Badiali