I Love Royalty Companies

I love royalty companies..

A royalty is the right to some fraction of the income generated by something like book sales, crops, mining, or oil production. In the natural resources market, these companies get to buy resources at a discount and then sell them to buyers, that means they offer some of the lowest risk exposure you can find.

That’s why we recommended Altius Renewable Royalties (TSX: ARR).

It offers us a way to invest in alternative energy production, with a much lower risk profile. ARR owns fractions of various wind, solar, and hydro power plants. And it adds to that portfolio all the time.

The company currently owns royalties on 3,510 megawatts of renewable power in the U.S.

Its most recent addition came in July, when it announced a deal with Hodson Energy. The deal cost Altius’ subsidiary Great Bay Renewables $40 million (spread out over three years). In return, Great Bay gets 3% gross revenue royalty on each project. The royalties last for the life of each project.

That means Great Bay will get 3¢ on every dollar paid for that electricity. And the portfolio holds 1.8 GW currently.

In discussing the deal, Great Bay CEO Frank Getman, said:

This is another example of Great Bay’s flexible, partner-like capital supporting a quality project developer as the broader renewables sector navigates the current challenges of interconnection delays, inflation, higher interest rates and supply chain issues. These challenges are creating a significant opportunity for our patient, long-term investment offering.

It’s ‘go-time’ right now for Great Bay.

ARR reported its second quarter 2022 results in August. It generated $700,000 in revenue but had a net loss of $500,000 for the quarter. That’s ok because the company is growing. And the company still expects to earn $4.5 million to $5.5 million in revenue for the full year. That means the second half of 2022 should be outstanding.

We didn’t buy ARR for a quick gain. We like royalty companies because of their ability to grow. We can see this in a company like Royal Gold (NYSE: RGLD). It buys royalties on mining projects around the world. In the fourth quarter of 2009, it generated $35 million in revenue. In its latest quarter, the company reported $146 million in revenue. As you can imagine, revenue growth boosted the stock price.

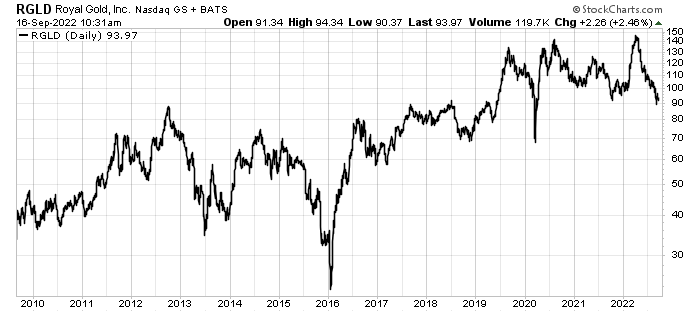

Here’s what Royal Gold’s chart looks like:

Shares soared from $40 per share in late 2009 to a recent high of $146 per share. That’s a 265% gain over 12 years. And it’s a notable example of how a royalty company can perform.

We think ARR has the same potential.

There will be many new alternative power projects coming to market in the next few years. And royalty companies offer capital at attractive terms, compared to traditional lenders.

If you haven’t put ARR in your portfolio yet, take another look. This company has a bright future.

Good Investing,

Matt Badiali

P.S.: If you have any questions or just want to say “Hi”, drop us a line at wecare@mangroveinvestor.com. I’ll respond to questions in next week’s update.