New Energy Weekly – It is an emotional beast

I spent the last two days driving up the east coast of the U.S.

And if the volume of trucks on the road are any indication, our economy is still percolating along fine. However, the same can’t be said for the stock market.

It is an emotional beast that tends to stampede in one direction or another.

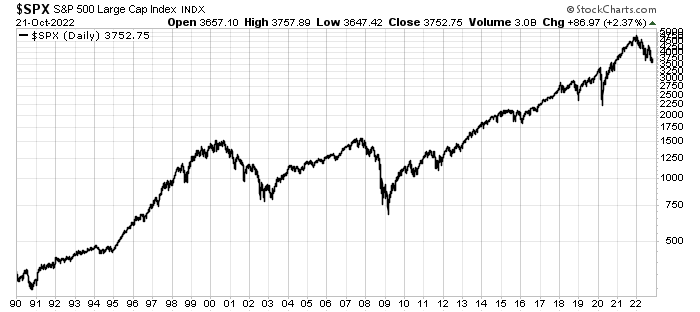

Over the long term, the stock market is the best place to grow your wealth. We know that. And a simple chart from 1990 to today bears that out:

- Every $100 you put into the market in January 1990 is worth more than $900 today.

- Every $100 you put into the market in January 2000 is worth $167 today

- Every $100 you put into the market in January 2010 is worth $222 today

That’s an excellent way to grow your wealth. You just park your retirement account in a big basket of –stocks and don’t look at it for a couple of decades.

But…

If you put money to work at the exact top in 2000, it took until 2013 for the stock market to break back above that level. So, you didn’t make any money on your investments for 13 years. That’s not great.

However, even though the broader market languished, there were stocks that did very well. For example, if you bought Starbucks Coffee (SBUX) in January 2000, your investment went up over 1,180% by the end of 2013.

The basic materials sector had a massive run during that period too. Mining stocks, oil and gas stocks, and energy in general had huge runs.

My suspicion is that we will need to do more of this kind of selective stock research for the near future. The spigot of easy money is off now. The Federal Reserve is raising interest rates come hell or high water. That change has the broader market wildly bouncing up and down daily.

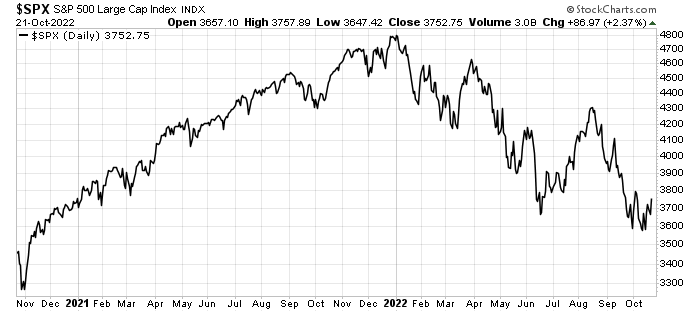

The financial term for that is “volatility.” Another way to think of it is fear. This chart shows the difference between the confident bull market (2021) and a volatile or fearful bear market (2022):

In 2021, the S&P 500 moved higher in a gentle, almost straight line. No one was betting that it would go lower.

However, in 2022, the chart line becomes jagged, like a saw blade. That’s the appearance of volatility.

It goes like this: investors sell stocks to lock in gains or avoid losses. Speculators jump in to “buy the dip.” Investors sell more shares into the rally…and stocks fall further.

For us, this is just noise. But it is the kind of market that we can expect over the next few months (or more).

What’s more important is the long-term trend, which is down. That means it is more likely that the S&P 500 will be lower a month from now than it is today.

BUT…

There are stocks defying the trend. We touched on Jade Power Trust (JPWR.UN) in the last update. Their stock isn’t going to fall because they are going to be acquired.

These bulletproof stocks are what we need to find now. The market isn’t rewarding potential, that’s why we exited our position in Fusion Green Fuel (HTOO). It has enormous potential, but it also has risk.

The market is afraid of risk now. Our task is to find bulletproof stocks that will buck the trend

. These are the companies that we can buy with confidence.

Good Investing,

Matt Badiali