New Energy Weekly – My friends are all having fun

I’m convalescing from eye surgery at the moment. Turns out, I got cataracts at a young age.

Not sure why I’m lucky, I just am. The good news is that eye number one went well. I’ll get the next one done next week. Fingers crossed.

But as luck would have it, my surgery coincided with some of the prettiest weather and waves that I can ever remember in December. Air temperature in the mid-seventies. Water temperature in the mid-sixties. Big, clean waves…and I’m stuck at home healing.

Oh well, my friends are all having fun.

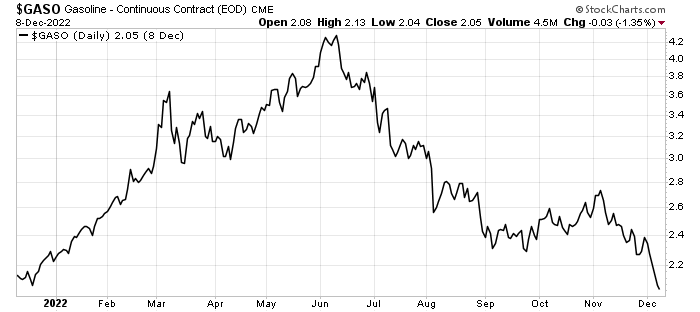

I wanted to revisit my gasoline price tantrum from a few weeks ago.

It looks like the oil sector is about to hit the skids in 2023.

This is a warning if you own oil stocks

Back on November 18th, I wrote to tell you that I’d lost my temper…in the produce aisle of the grocery store.

And in that update, I showed you a bunch of nerdy graphs that showed that refiners were charging a lot more for gasoline than usual. And I warned everyone that oil was a bad investment right now. But not all of you listened…

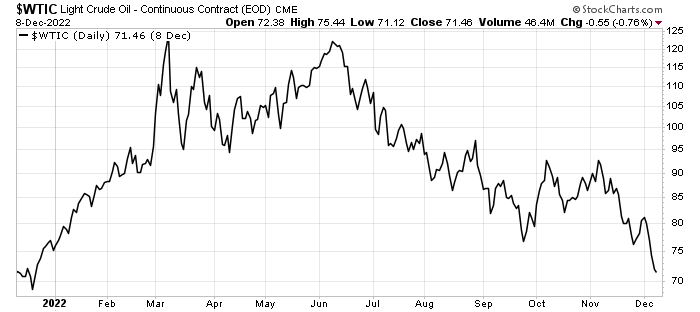

You see, many folks looked at the profits and thought, “Oil is a great place to be invested right now.” And it was, if you bought it a year or two ago. But buying in November was a bad plan. And as you can see from this chart, it’s getting worse:

This is a chart that foreshadows the fourth quarter of 2022 for oil companies. Here’s what I see, Q4 2022 will be the worst all year. And are going to get clobbered, as you can see here:

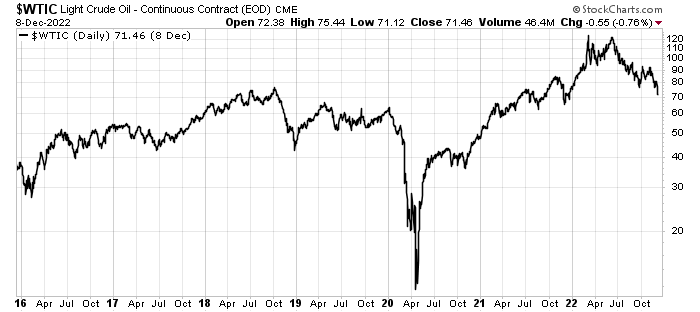

Now some of you may look at this chart and say, “I thought we wanted to buy low? Doesn’t that mean we should buy now?”

And the answer is no. We DO NOT want to buy oil companies. My suspicion is that the oil price will continue to decline in 2023. I wouldn’t be surprised if it hit $60 per barrel next year. That’s because the current price is well above the five-year average price, as you can see here:

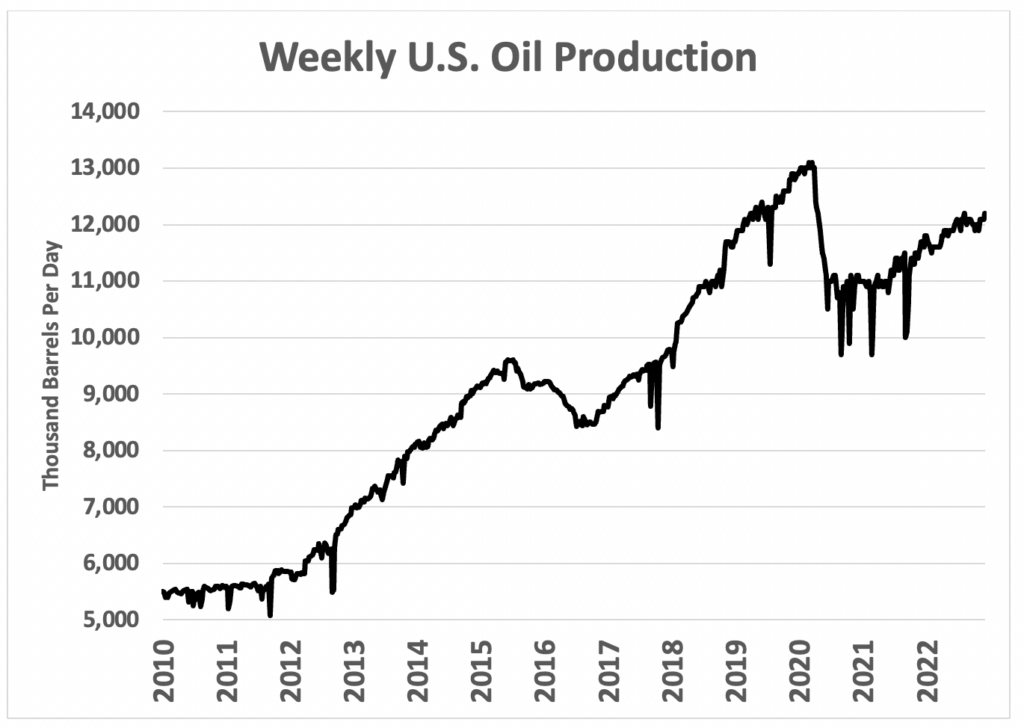

The last years’ worth of soaring prices kick-started U.S. oil production again. Companies are drilling and producing oil in the U.S. again. You can see it in the data:

These data comes from the U.S. Energy Information Administration website. They are the real figures from the U.S. oil industry. And they tell us the story.

We currently produce 12.1 million barrels per day. That’s just one million barrels per day below the all-time high of 13.1 million barrels per day set in March 2020. So, just to be clear, we are producing a lot of oil. And that production rate is climbing.

I take two things from these data. First, gas prices should be coming down hard in early 2023. And oil companies’ stock prices are heading lower.

So, if you own big oil, here’s your warning. Get clear of those companies now. Tough times are coming.

Have a great weekend!

Matt Badiali