Nuclear Power Is Popular Again

In 2011, the unthinkable occurred

A magnitude 9.0 earthquake struck the seafloor 45 miles east of the Oshika Peninsula in Japan.

It was the most powerful earthquake ever recorded in Japan and the fourth largest in the world.

The earthquake damaged the Fukushima Daiichi nuclear power plant. However, it was the giant tsunami that led to meltdowns in three of the reactors at the plant.

The disaster shook the world.

Japan shut down all of its nuclear power plants. Its prime minister at the time, Naoto Kan, did a 180-degree turn on nuclear power.

He went from building more reactors to being overtly anti-nuclear. Japan turned to natural gas and fossil fuels.

Eventually the country refocused its energy plans around renewables and energy efficiency.

But that wasn’t enough. And on Aug. 23, the Japanese government officially reversed course on nuclear power.

Prime Minister Fumio Kishida said the country will restart its idled nuclear reactors and develop next-generation power plants.

This is a huge leap forward for both the nuclear power industry and uranium mining companies.

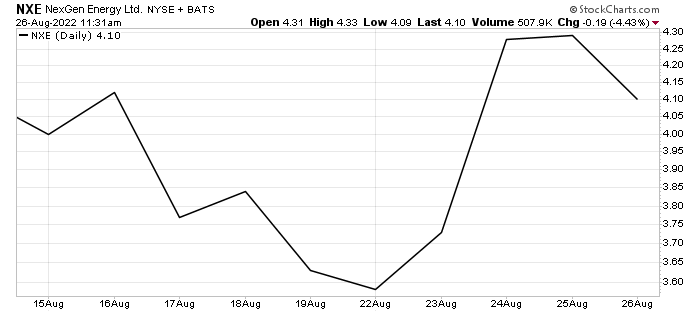

Our uranium miner, NexGen Energy (NYSE: NXE), saw its shares leap higher on the news:

Going forward,uclear power will be a major player in the energy mix around the world.

Renewables are great, but they’re intermittent and require storage systems. Nuclear is the only carbon-free source of consistent baseload power.

And with Japan’s about-face on nuclear power, this trend will take off.

The news from Japan is the catalyst we needed. You can expect to see more uranium and nuclear companies in the New Energy portfolio over the next 12 months.

The Federal Reserve Extends the Bear Market

Federal Reserve Chairman Jerome Powell gave a speech at the Kansas City Fed’s annual policy forum in Jackson Hole, Wyo.

He hinted that we’ll see more rate hikes in the future. Here’s one of his most salient comments, as reported by Bloomberg:

“Restoring price stability will likely require maintaining a restrictive policy stance for some time. The historical record cautions strongly against prematurely loosening policy.”

The markets reacted poorly to those comments. By midday the Nasdaq Composite Index fell 2.5%, and the S&P 500 Index fell 2.2%.

This could mean the bear market we’ve seen in 2022 has further to go.

The summer rally from June to August already peaked, as you can see in the chart below:

I use charts for trends.

And you can clearly see two different trends in the S&P 500 from 2021 to 2022.

While the bull market in 2021 didn’t go straight up, it did follow a pattern.

It made higher highs and higher lows. That’s a hallmark of a bull market.

That changed in January 2022.

The bear market in 2022 looks totally different.

The S&P 500 has lower lows and lower highs. That’s the hallmark of a bear market.

That may seem simple, but it’s important. Especially now.

In August, the trend broke out of that pattern. And now we need to watch and see. The next few weeks are critical.

If the S&P 500 breaks below 3,665 (the red line), the bear market is still on.

If it rallies through 4,305 (the green line), we may be past the worst of it. And that’s great news for our portfolio!

Have a great weekend.

Matt Badiali