New Energy Weekly – Oil Companies are Taking a Bigger Bite Than Normal

I lost my patience in the produce section of the grocery store yesterday.

I’m a little embarrassed to even tell you about it.

I needed lettuce for salad. I went by the bin of iceberg and couldn’t believe my eyes. A head of iceberg lettuce jumped from 99¢ to $3.00 in just a couple of weeks.

I threw up my hands in disgust and walked out. No salad for us.

But it’s not just lettuce. A bottle of mayonnaise was $8. I’m not kidding! I couldn’t believe it.

Inflation is real and it’s raging.

Part of it is that manufacturers are passing along higher costs to consumers. And energy is a big part of that. It costs money to move goods from point A to point B. Whether it goes by ship, rail, plane, or truck…it needs some kind of oil product to get it there.

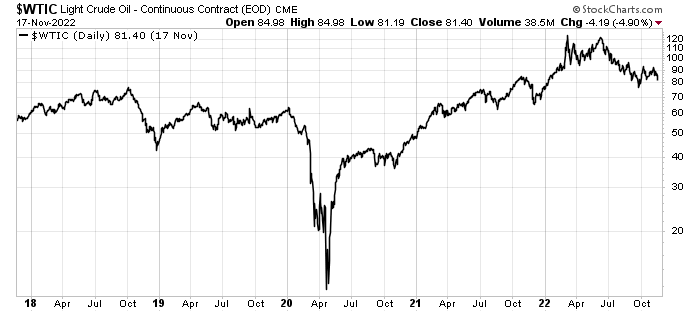

That’s why, this morning, I decided to dig in to oil prices a bit. The major oil companies like ExxonMobil, Shell, BP etc. set records for earnings last quarter. Oil prices are higher now than in the past five years. But they are coming down:

However, oil prices don’t show the whole story. Because oil derivatives (like diesel, jet fuel, and gasoline) prices are high. In fact, those prices are anomalously high today. Let me show you what I mean…

The Relationship Between Oil and Gasoline – The Crack Spread

An editor once threatened my life if I ever wrote another detailed essay on the Crack Spread. He said it was boring. He’s probably right, so I’ll just put in this link for those who are interested.

The short version is that a refinery makes money from the difference between the price of a barrel of oil and price of the derivatives. A barrel of oil is 42 gallons. From that, refiners make about 20 gallons of gasoline, 12 gallons of diesel, and assorted other stuff from the rest.

That means gasoline is the main revenue source for oil. And we can gain insight into revenue by the ratio of gas prices to oil prices. That’s a little complicated. Here’s what I mean.

If we take the price of a barrel of oil and divide it by the price of a gallon of gasoline, we get the gallons of gasoline we could make out of a barrel of oil. The gas to oil ratio.

I pulled data from the Energy Information Administration (EIA). I found that, since 1986, that ratio is around 34.6.

When the ratio is below that, gasoline is expensive relative to oil – because we get fewer gallons from a barrel. When the ratio is above that, gasoline is cheap relative to oil.

Here’s a chart of the ratio (based on weekly prices) back to 2005.

Two things jump out at me. We can see that gasoline is expensive more often than it’s cheap. Second, we are in a period of expensive gasoline prices right now.

In other words, refiners are getting more money for their oil products right now. And that’s why my lettuce went up in price by so much.

But I wanted to look at oil prices another way.

I wanted to see how broad a spread of gasoline prices we got for any given price of oil. That’s this chart:

It’s interesting to see that the spread is narrower when oil prices are lower and get wider as oil prices get higher. That makes sense because refiners can use higher oil prices as cover to eke out more profit. And that’s what we’re seeing right now.

I know that because this same chart shows us exactly that:

This shows the spread of gasoline prices vs. oil prices. And we can see that there is a range of gasoline prices that occur for a given oil price. And right now, the prices are on the expensive side.

I often defend oil companies because they are price takers. Companies like ExxonMobil don’t set the oil price. But gasoline prices have a little more flexibility. And these companies are clearly making more money today than they had at comparable prices in the past.

And that’s why our lettuce costs more right now.

For the Good,

Matt Badiali