New Energy Weekly – Six Months Today

We officially hit the “six months of business” milestone today.

That sound is the round of back-patting going on here at Mangrove HQ.

And as we look back on those six months, we see quite a few successful positions. We hope you are making money from our research. If so, congratulations. We have a new pick coming up on Monday. And we couldn’t be more excited.

For now, let’s look at our current positions. Our model portfolio average return is +12.9% as of the close of the market today. For comparison, the S&P 500 is down 0.9% over that period the Nasdaq is down 4.6%, and the TSX Venture Index is down 16.8%.

Four of our positions are up double digits:

- Ivanhoe Electric (NYSE: IE) at 17.0%

- Canadian Premier Sand (TSX V: CPS) at 43.8%

- Jade Power Trust (TSX V: JPWR.UN) at 45.3%

- Capstone Copper (TSX: CS) at 70.2%

The other companies are down but should rally in the next few months. The stocks I’m watching closely are Brookfield Renewable Partners and Li-Cycle. Here’s why I like them.

Brookfield is a power company. They generate clean electricity in North America, South America, Europe, and Asia. They had an excellent quarter, with funds from operations (basically revenue) up 15% over the same time period last year. They invested about $1.5 billion in new deals. And added 2,600 gigawatt hours of annual clean energy generation capacity.

The company issued C$400 million in “green bonds” to raise capital. The bonds, due in 2032, yield 5.88% per year.

Brookfield is growing its portfolio every quarter. And we know demand for clean power is growing. Barring any unforeseen complications, it’s inevitable that Brookfield’s value will grow over the next few years.

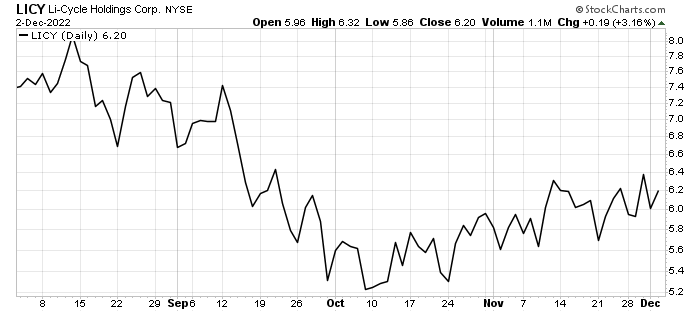

We have a similar view of Li-Cycle Holdings. We are down 20.1% on our position since August 2022. The stock took a hit almost immediately after we bought it, dropping to a $5.23 per share low in October.

However, the company’s value defies its share price.

Even as its shares bottomed, the company opened its fourth Spoke recycling facility in Alabama. And the company was named to Fortune’s Change the World List for 2022. In November, the company announced a global recycling partnership with Vines Energy Solutions. Vines specializes in research, development, and manufacturing of batteries for mobility and energy storage.

Vines views its partnership with Li-Cycle as a key part of its ESG strategy of sustainable and closed-loop battery production. This is exactly what we thought would happen with Li-Cycle. It’s unique business model makes it ideal as a partner for battery makers.

I’m a huge fan of the spoke and hub buildout. Spokes take raw batteries and break them down to “black mass” – basically mixed recyclable metals. That gets shipped to the hub, where it can be refined into specialty materials. They are mining waste and we are fans.

This is another company whose stock price belies its corporate success. However, since its bottom in October, shares are up 18.5% – nearly $1.00 per share. That means the trend is with us now.

We have lofty expectations for Li-Cycle over the next couple of years.

If you have any questions or comments about the companies and their performance, please feel free to drop us a line at wecare@mangroveinvestor.com. We’d love to hear from you.

For the Good,

Matt Badiali