New Energy Weekly – U.S. Energy Mix

A Peek at the Future of the U.S. Energy Mix

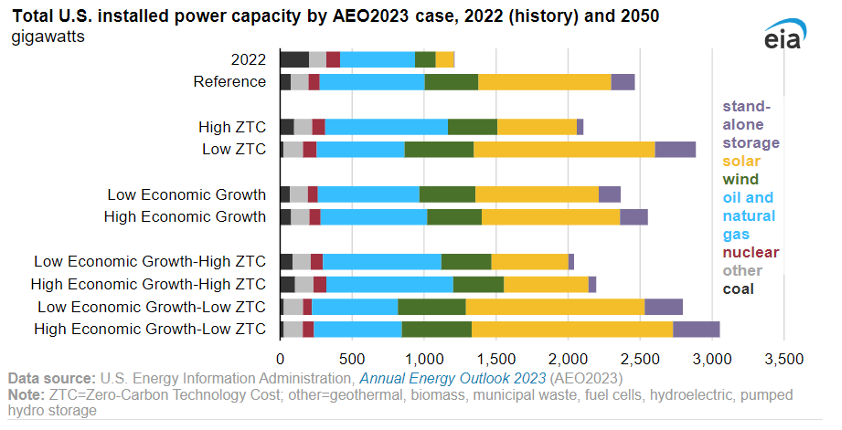

The latest edition of Today In Energy from the Energy Information Administration (EIA) forecasts the power grid capacity doubling in the next 27 years.

As you can see in the table below, there are many permutations of the forecast. However, the “Reference” case is the benchmark forecast.

The models also include economic growth and zero carbon technology costs (ZTC). The low economic growth case assumes a compound annual growth rate (CAGR) of 1.4%. To put that in perspective, the U.S. GDP grew 2.1% for the past 10 years.

It’s clear to see that solar was the huge winner in all these scenarios. The solar segment grows by more than 500 gigawatts in the most conservative estimate. In the most aggressive scenario, it grows by more than 1,000 gigawatts.

One major driver for this growth is the Inflation Reduction Act (IRA). The legislation, passed in 2022, allows qualifying clean energy projects to receive additional tax credits for meeting certain objectives. Things like labor requirements, domestic content requirements, location requirements, etc. all significantly increase the tax credits.

Those provisions act as incentives for developing wind and solar. The reference case above estimates that wind and solar will generate 56% of electricity by 2050. To be clear, this is a similar kind of incentive structure that the U.S. gives oil and gas drilling. Oil companies get to write off “intangible drilling and development costs (IDCs). It was set up in 1913, as a way to attract capital to the oil industry. And it got a revamp after the oil embargo in the 1970s.

IDCs include the cost of any drilling or development work done by contractors under any form of contract. That includes labor, fuel, repairs, hauling and supplies used in drilling and servicing oil wells. It also includes clearing the ground, road making, surveying, and geological work. It’s a huge tax break and it is one of the reasons that the U.S. oil industry is so successful. Seeing it applied to alternative energy is fantastic.

This also vindicates our position in energy metals. These forecasts all point to much higher demand for electrical metals like copper, nickel, and lithium. We’ll need more recycling and more mined material. The future looks bright for investments in New Energy.

Sincerely,

Matt B.