New Energy Weekly Update – July 1, 2022

Happy Independence Day!

I’m a huge fan of this holiday. Years ago, I was a sailboat captain in the Florida Keys. We anchored a raft of boats together on the bay side of the islands near Islamorada. There was a big resort on the island that shot off fireworks.

As the fireworks show kicked off, we could see a thunderstorm began to pass bye. And just as the grand finale wrapped up, a bolt of lightning dropped out of the cloud. Over and over again, thunder boomed, and clouds glowed from the electricity. It was as if nature decided to give us its own light show.

When it stopped, a voice carried over the water: “God wins.”

That was one of my more memorable fourth of July holiday weekends. And back then, if you’d asked me the meaning of independence, I would’ve pointed to my boat. I would’ve said something about leaving Pennsylvania and my family to follow my dream.

But today, I have a new view of independence.

I watched the price of oil soar. I watched as my newly minted 17-year-old driver learned a lesson in economics thanks to painfully high gasoline prices. And I watched as Russia used oil and gas exports to garner support for its invasion of Ukraine.

And I realized that any country that uses more oil and gas than it produces, is a client state.

Oil underpins so much of our global society. And the countries that have the oil, have the power. And unfortunately, many of those countries are bad actors – Russia, Iran, Saudi Arabia, Venezuela, Libya, etc.

As we saw with Russia, we can’t simply embargo oil exports. As the west cut its oil imports from Russia, China and India ramped up. It effectively neutralized the economic sanctions. That’s because cheap oil is cheap oil…and China doesn’t give a fig about European conflicts.

That’s an ugly truth about oil. We are dependent on it. And when it becomes scarce, we must pay the price.

Fortunately, we are developing technologies to become independent (see what I did there?) from oil.

And one of those technologies that I’m really excited about is hydrogen. Particularly, being able to make hydrogen fuel from just water and solar power. If you can create fuel anywhere with sunlight and water, you liberate the world from the tyranny of oil.

It’s a tremendous leap for the energy industry. The problem is, there are so many entrenched interests in oil that it will take some time to adopt.

There is reason for optimism, because when the price of a commodity soars, consumers begin to look for substitutes. And an excellent substitute for oil in transportation is hydrogen. And the success of electric vehicles will blaze a trail for the adoption of hydrogen.

That’s why we like Fusion Fuel (NYSE: HTOO). Its technology is simple, scalable, and competitively priced. That means this is a viable business…eventually.

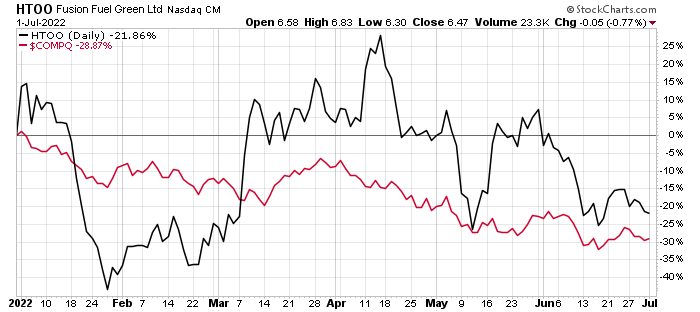

However, right now, the stock is part of a huge selloff:

This chart shows the 2022 performance of HTOO (black line) and the Nasdaq composite index (red line). The Nasdaq is primarily a technology index and it’s down 29% in 2022. Fusion Fuel did slightly better, down 22% so far this year.

But that’s okay. The future of hydrogen is years, not weeks away. And this collapse in the share price doesn’t invalidate Fusion Fuel’s technology. This is a bear market. Investors are afraid. And that means they sell everything…even promising hydrogen technology companies.

This market is making all the stocks we like, cheaper. And that’s great. Because we’re making a list of companies like Fusion Fuel. Companies that offer us energy supplies outside of the tradition oil industry. And with that, we gain independence from the influence of those bad actors who want to use oil supplies as a weapon.

Have a great holiday weekend.

Good Investing,

Matt Badiali