Why Lithium Is Old News

Last week at this time, I was on stage at the Rule Symposium on Natural Resource Investing. It was a great conference.

As the MC, I had the pleasure of introducing many of the biggest names in mining.

I noticed two common themes during the presentations. First – the entire commodity complex is in an unexpected bear market.

And second – global demand for electricity and storage is changing the demand outlook for metals like copper, nickel, cobalt, and silver.

Related to that last idea, Rick Rule was asked about lithium. It is, after all, the metal the batteries are named after. And many attendees owned lithium stocks. But there is no lack of supply of lithium. There’s plenty of it around.

That means the lithium price is constrained. But that’s not the case for the other primary battery metals. That’s why he’s focused on things like copper today.

That’s the same outlook that we have at New Energy.

We see an inevitable wave of demand coming for battery metals as we transition even partially to electric vehicles.

That’s not to say that we won’t ever buy a great lithium miner… the copper opportunity is simply bigger right now.

But my favorite takeaway from the week’s presentation is that the mining companies building new mines are focused on community, environment, and process. In the past, it was all about being in the lowest cost quartile or the highest profit quartile. Now, it’s about stewardship and creating partnerships with the local communities.

It’s a trend I call “new mining.” Leading the pack are companies like Ivanhoe Mines (TSX: IVN) and Seabridge Gold (NYSE: SA). Our latest recommendation, Capstone Copper (TSX: CS) falls into that category too. We talked about the company’s commitment to mining best practices in our New Energy issue this month.

But these miners aren’t immune to the current bear market.

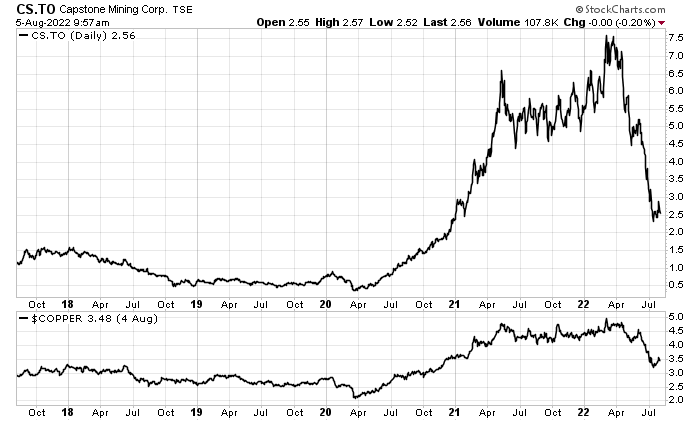

Capstone’s share price tracks the copper price closely right now, as you can see below:

The top line is Capstone’s share price. The lower line is the price of copper per pound. As you can see from the chart, Capstone’s price tracks copper, with a lot more volatility.

The recent drawdown shows that clearly.

The copper price fell 35% from its high in March to its low in July. Capstone’s share price fell 70%. That’s extreme. And it illustrates the fear and uncertainty of the overall bear market right now.

But the smartest money in mining knows that the copper price can’t stay low for long. And if you play a longer game – 18 to 36 months, this will be a sector that makes us a lot of money.

We just need to wait out the fear of this bear market and allow the fundamentals to reassert themselves. When the reality of demand outstripping copper supply hits, this trend will reverse. And when we have to limit battery production due to the short supply, copper prices are going to soar.

Have a good week!

Matt Badiali