One Metal

The One Metal Everyone Needs to Own Today

I admit that I’m deep in the weeds with the energy revolution going on right now. I’ve put a few friends to sleep, talking about it in social situations (don’t you hate that guy?).

But I am still shocked when I get push back from someone who should know better.

Back in February, I sat in my friend’s living room, talking with him about commodities. I mentioned the looming copper shortage, but he thought the supply shortage was overblown. He cited the recent decline in copper price as evidence:

But prices can be deceiving.

You see, copper isn’t easy to substitute. For example, aluminum can substitute for copper. BUT…

According to The Air Conditioning/Heating/Refrigeration News:

It must be pointed out that motor efficiency is much more complicated than the great copper vs. aluminum debate. It is possible to match the power performance of a motor wound with aluminum to a motor wound with copper.

But since aluminum requires more turns and/or a larger diameter wire, this may not always be economically feasible in some applications.

That means we need copper for motors. And to be clear, every electric vehicle uses four electric motors – one for each wheel.

And EVs are selling like crazy in China. According to the Wall Street Journal, 5.7 million EVs sold in 2022. That’s equal to about 42% of all the cars sold in the U.S. last year.

And China’s EV market forecasts predict it will reach 7.5 million vehicles in 2027.

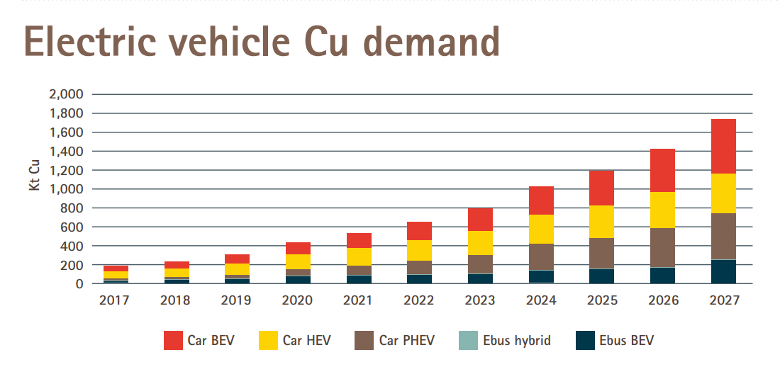

According to the Copper Alliance, EVs alone added 600,000 metric tons of new copper demand in 2022. To put that in perspective, that equals roughly half of the production of the world’s largest copper mine. And the demand is only getting larger.

Here’s the whole forecast:

The looming copper demand isn’t just an electric vehicle story. It’s tied to the global push towards electrifying everything. And that’s happening in nearly every country around the world. And that adds up to massive demand growth.

The other key point to note is that there aren’t any copper demand segments going away. We still need copper for air conditioners, refrigerators, and motors. But batteries are more important than ever. And as we add demand for community scale batteries, to store solar and wind power, demand will continue to grow.

My favorite quote, which I now use to refute that 2022 price decline, comes from John LaForge, head of real asset strategy for Wells Fargo bank:

“We’ll look back at 2022 and think, Oops. The market is just reflecting the immediate concerns. But if you really thought about the future, you can see the world is clearly changing. It’s going to be electrified, and it’s going to need a lot of copper.”

That’s why copper is a major focus for our portfolio in 2023. And that’s why we published a series of videos about copper, on our YouTube channel. You can see them here: Intro, Part 2, and Part 3.

Check those out and see what you think. If you like them, let us know. Leave us a comment either way, we’d love to hear from you.

Sincerely,

Matt Badiali

Numbers to Know

1.4 Billion

There are 1.4 billion internal combustion engine vehicles worldwide today. Even the staunchest hater of these engines concedes there will still be 1.4 billion vehicles in 2050. And demand is growing as the world’s population rises. (The Western Producer)

11.9 Percent

Percent of the total greenhouse gas emissions by the transport sector. This includes a small amount of electricity (indirect emissions) as well as all direct emissions from burning fossil fuels to power transport activities. (Our World in Data)

2.5 Percent

The copper penny really is not that much copper. The penny is 97.5 percent zinc and 2.5 percent copper (National Science Foundation)

What’s New in Sustainable Investing

Florida Governor DeSantis signs anti ESG investing bill

The law, which will take effect July 1, doesn’t stop fund managers from investing in companies that use such standards. But fund managers won’t be able to base investment decisions on issues such as climate change and social diversity. (Action News JAX)

Investors argue ESG investing is about investing risk not politics

According to the investment team at Calvert Research and Management, when ESG investing works, and translates into investment returns, it shows that there is a clear business case for ESG. (WBUR)

Video Of The Week

Not all car manufactures are on the EV bandwagon

Why is Toyota sticking to this diversified approach, and how will it affect its position in the global market?