Portfolio Review Issue

This One Simple DIY Tool to Manage Your Portfolio Works Every Time

Don’t run with scissors. Look both ways before you cross the road. Don’t sleep on train tracks. Don’t pet a growling dog…

These are all easy decisions, right? And they all have to do with one thing: risk management.

If you fall, while running with scissors, you will get cut. If you pet a growling dog, you will get bitten.

It’s the “will probably” part that we need to understand. We don’t do those things because of potentially bad outcomes. Here’s how that applies to our investments…

When I began my career in finance, I was far from expert. I came from a stable isotope research laboratory at the University of North Carolina. I was brand new to finance, and my mentor had to start from zero.

He gave me a million finance books to read. But the most valuable information about investing came from our discussions about human nature and risk. And those were areas that I understood well.

The financial stuff is cumbersome, but human nature is understandable.

He showed me how investors tend to work against their own success. The tendency was to sell stocks that did well (winners) and to hold on to losers.

Investors hate to take a loss, so if they never sell, they can always “hope” that the stock will recover.

He compared that to growing a garden, where you picked all the flowers and let the weeds grow. Ugly image, right?

What we know is that a stock’s performance tomorrow is likely to repeat what it did today. So, a falling stock tends to keep falling. And that’s where risk management comes in. Instead of selling our winners, we need to sell our losers and let our winners run.

That’s where the “will probably” part of investing comes in.

Holding a stock that’s falling is like running with scissors. It may work out okay. But it also could end up in an emergency room visit. And in investing, an emergency room trip is expensive.

My mentor showed me a trick to avoid running with scissors in our investments.

His solution to human nature was a simple formula in an excel spread sheet. He showed me how he used it to determine when to sell stocks. And I’ve used it ever since. In fact, it saved my readers in 2008 when the market crashed.

We call this tool a trailing stop.

I wrote about it here:

“The #1 Key to Making Money in the Stock Market is Simpler Than You Think”

OR you can watch my explainer video about it here:

Grove Pod Episode 10 – When to sell a stock?

A trailing stop is adult supervision for our portfolio.

It’s a simple formula that kicks in when you’ve gone far enough. And because it’s a formula, it works every time…on any stock.

Trailing stops were some of the first tools I learned about, when I began working with stocks. I built a simple spreadsheet to track the current price of the stock versus its trailing stop. It’s actually easy. You only need to update the sheet when the stock makes a new high. Otherwise, you just watch to see if you hit your stop price. And as soon as that happens, you sell. Not hard. Not time consuming. And it can save you a fortune.

In this month’s issue, we’ll do the heavy lifting for you.

We’ll revisit each current portfolio position. We’ll touch on the investment outlook for each one. And we’ll give you the current trailing stop values for each one. We’ll organize them by the date we published our research – oldest first.

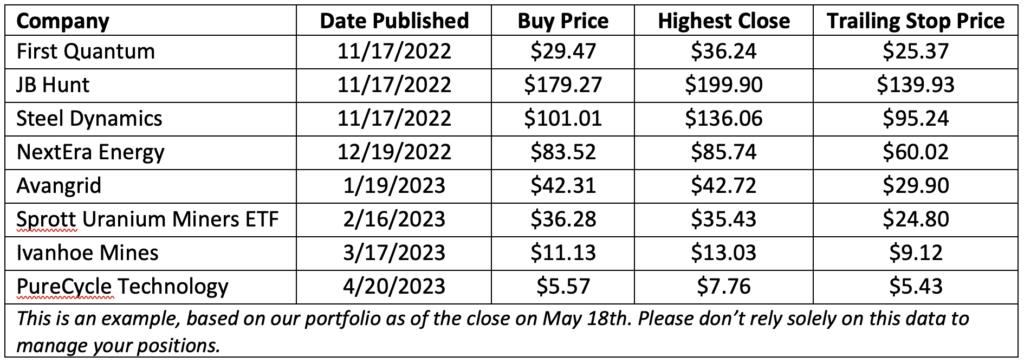

But first, here’s my version of the trailing stop table. We used a 30% stop on each position. That means we multiply the recent high price by 70% (100% – 30% = 70%). That tells us the price we need to sell our positions if they don’t make new high prices.

Now let’s review all our positions.

First Quantum Minerals Ltd. (TSX: FM)

First Quantum is a giant copper miner. We bought First Quantum as part of our special report How to Capitalize on the Sustainability Movement. It was one of the first three companies we researched for Spotlight.

First Quantum had a rough first quarter of 2023. Here’s what CEO Tristan Pascall had to say:

“The first quarter was difficult with production impacted at our three largest operations. At Cobre Panamá, production was interrupted by a temporary suspension of exports but returned to full production rates once the suspension was lifted. Our Zambian operations experienced a seasonal impact, however, the rainy season is nearing an end. We are focused on improving operational performance and expect production to recover over the course of the year and, as such, we remain committed to our guidance for 2023.”

The takeaway is that First Quantum should still produce the amount of copper that it projected for this year. And that’s great news. In addition to its struggles in production, the company made some important moves in the last three months. One of the biggest was its partnership with mining giant Rio Tinto. The two companies teamed up to advance the La Granja Copper Project in Peru.

La Granja is one of the largest undeveloped copper resources in the world. First Quantum paid $105 million to become the operator and own 55% of the project. It holds an inferred resource of 4.3 billion metric tons of rock with a copper grade of 0.51%. That works out to over 48 billion pounds of copper. But an inferred resource is the highest risk category (because it is based on the least amount of data).

That means the companies must do a lot of work to refine their understanding of the deposit and outline an economic volume of copper to mine. First Quantum will raise $546 million to complete a feasibility study of the project.

Shares are moving higher, and we are up 8% in the six months since we bought.

Recommendation: We’ll continue to hold this stock and put a 30% trailing stop on our position from here. That means, if shares close below $25.37, as it shows in the table above, we will sell our position. But remember, the trailing stop moves with the high prices. So, as First Quantum’s share price climbs, so will our stop price.

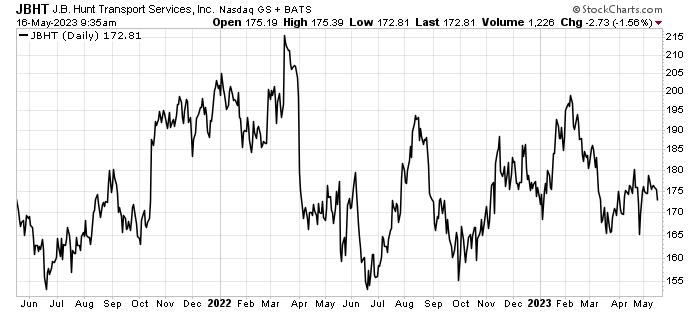

J.B. Hunt Transport Services (JBHT)

J.B. Hunt is a giant freight trucking company. We bought J.B. Hunt as part of our special report How to Capitalize on the Sustainability Movement. It was one of the first three companies we researched for Spotlight.

Like First Quantum, the giant trucking company had a rough first quarter of 2023. Revenue and Operating income fell 7.4% and 17.0% respectively, from the first quarter 2022 to this year. Management called it the result of a “freight recession.” The cost truckers charge to move freight fell 31% from last year to this year. And that hit the whole trucking sector hard.

That said, J.B. Hunt’s business is still excellent. We can tell by its credit rating. On May 12, credit rating company Moody’s confirmed J.B. Hunt’s credit rating as Baa1. That has not changed in a decade. It’s remarkable. And it is well into “investment-grade” territory. That’s unusual for a logistics/shipping company.

The reason for its rock-solid credit rating is its franchise agreements with railroads. According to Moody’s, J.B. Hunt’s “intermodal franchise arrangements” with most major North American railroads “positions it to benefit from growth in intermodal freight.” And that credit rating underlies its strong business.

That strong business, combined with the recent weakness in shares, led to a rerating by some important investment firms. In May 2023, investment bank JP Morgan’s analysts recommended its investors to be “overweight” J.B. Hunt stock. That’s an upgrade from its previous “neutral” rating.

Shares are flat from when we bought. We are down 1.6% in the six months since we bought.

Recommendation: Our outlook is cautiously optimistic, so we’ll continue to hold J.B. Hunt. As with all our positions, we’ll use a 30% trailing stop. That means, if J.B. Hunt shares close below $139.93, we’ll sell.

Steel Dynamics (STLD)

We recommended the company for Copperworks, its copper recycling partnership with Spanish giant La Farga. On April 19th, Steel Dynamics published its first quarter results.

The company’s overall first quarter performance fell in line with our other companies. But while the bottom-line profit fell slightly, Steel Dynamics’ recycling arm did very well.

And the company executed its plan to get into low-CO2 aluminum production as well. CEO Mark Millet said:

We are quickly progressing on our aluminum flat rolled products mill and are incredibly excited about this meaningful growth opportunity, which is aligned with our existing business and operational expertise. The team has placed orders for critical equipment, and the rolling mill site location in Columbus, Mississippi is exceptional. We have intentionally grown with our customers’ needs, providing efficient sustainable supply-chain solutions for the highest quality products…

…We are pleased to further diversify our end markets with plans to supply aluminum flat rolled products with high recycled content to the countercyclical sustainable beverage can industry, in addition to the automotive and industrial sectors…

…Our commitment is to the health and safety of our teams, families, and communities, while meeting the current and future needs of our customers. Our culture and business model continue to positively differentiate our performance from the rest of the industry. We are competitively positioned and focused to generate long-term sustainable value.

This take on metal production is unique. Smelting is traditionally a dirty, dangerous industry. Steel Dynamics turned that paradigm on its head by putting safety and community first. That commitment, alongside excellent financial performance led us to recommend them in the first place.

Steel Dynamics shares are down 3.6% since we published our research in November 2022. However, I share their outlook on the auto industry. As manufacturing moves back into the U.S., Steel Dynamics’ products will increase in demand.

Recommendation: We remain optimistic about the automobile industry in North America. The growth in manufacturing here will drive demand for recycled metal. As with all our recommendations, we will use a 30% trailing stop for Steel Dynamics. That means if shares fall below $95.24, we’ll sell.

NextEra Energy (NEE)

NextEra Energy is our giant low-carbon power generator. They rank in the Top 20 in the world by Fortune’s Innovation rankings. They are one of the largest investors in U.S. infrastructure with more than $50 billion spent through 2022. And they returned 945% to investors over the last 15 years.

Those are head-turning statistics.

The latest news from NextEra that grabbed my attention is a green hydrogen project in Oklahoma. They plan to partner with CF Industries (the world’s largest ammonia producer and a major nitrogen fertilizer producer). The two companies, in partnership with the U.S. Department of Energy proposed to develop a zero-carbon-intensity hydrogen project.

However, the deal hinges on funding from the DOE. If they get a grant, it should progress. But there hasn’t been a final investment decision yet.

This is the kind of deal I’d love to see by these two industry giants. The plan includes a 100-megawatt hydrolysis plant to split water into hydrogen and oxygen. NextEra would supply a 450-megawatt renewable energy plant. That would make zero-carbon hydrogen, which would then combine with nitrogen to become zero-carbon fertilizer.

This would be a huge leap forward in agriculture. The critical component will be cost. Today, natural gas prices are cheap, so the bar for entry is high. But when natural gas prices soar again (which they always do), the bar to entry goes much lower.

That’s a huge leap in agricultural technology. The U.S. corn crop consumes 65% of all the nitrogen (ammonia fertilizer) used by farmers. That was over 5.6 million tons in 2022. And all that fertilizer comes from natural gas today. If they can replace the hydrogen from natural gas with green hydrogen from hydrolysis, it would be a game changer for reducing the fertilizer industry’s massive carbon footprint.

It’s so exciting that if we didn’t already own this company, we’d be doing the research on it right now!

NextEra Energy shares are down 9.2% since we published our research in November 2022. However, they continue to innovate, with deals like zero-carbon fertilizer.

Recommendation: As with our other energy recommendation, we continue to be positive on the sector. We like NextEra’s approach to business and its innovative partnerships. However, we will use a 30% trailing stop on our position. We’ll hold this stock and keep an eye on our trailing stop. If shares close below $60.02, we’ll sell our position.

Avangrid Inc. (AGR)

Avangrid is another clean energy producer. It’s a subsidiary of the European giant renewable power company Iberdrola. We recommended them in January 2023.

The company aspires to be the leading sustainable energy company in the U.S. It has about $40 billion in assets. It operates in twenty-four states, mostly in the northeast.

The company had several positive milestones in the first quarter of 2023. And as these projects move forward, they will have a positive impact on its share price. Here are the bullets from its press release:

- Received a key, positive court ruling in Maine for the New England Clean Energy Connect transmission project

- Extended PNM Resources merger agreement through July 20, 2023

- Received approval for NY CLCPA Phase 2 transmission investments of $2.25 billion, bringing the total transmission opportunities in NY beyond 2025 to over $3 billion

- Executed 524 MW of solar PPAs

- Signed MoU with Navajo Tribal Utility Authority to develop up to 1 GW of green energy projects

- Progressing on settlement negotiations in New York and Maine rate cases

That said, the company’s first quarter was well below last year. That’s due to accounting. In the first quarter of 2022, they counted a $181 million bump from restructuring an offshore wind lease partnership. That’s a “one-off” bump.

The company currently has 524 megawatts of solar proposed projects, 205 megawatts of solar commissioned and about a gigawatt of solar under construction. That’s a huge amount of power coming.

And it expects to begin work on the 806-megawatt Vineyard Wind offshore project in the next three months.

In 2022, the company had 8.4 gigawatts of wind and solar power capacity. Year to date that’s up to 9.0 gigawatts. Which should drive the forecast increase in net income in 2023 of $850 million.

Avangrid shares are down 7.3% since we published our research in January 2023. However, the company continues to invest in projects that will contribute to their earnings over the long term. This is a slow growth play and it continues to pay us dividends while we wait.

Recommendation: As with our other energy recommendation, we continue to be positive on the sector. We like Avangrid’s growth plan. We expect that to have a positive impact on earnings which should lead to a higher share price. As with the rest of the portfolio, we will use a 30% trailing stop on our position. That means if shares close below $29.90, we’ll sell our position.

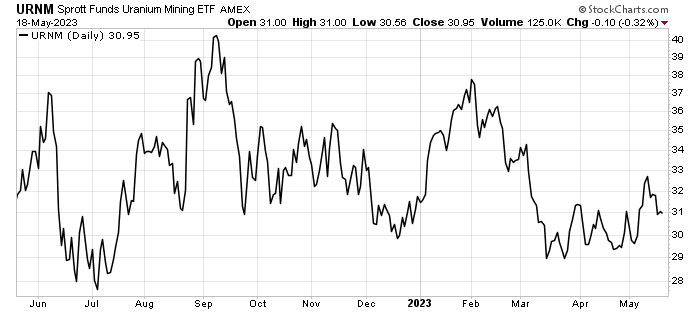

Sprott Uranium Miners ETF (URNM)

We bought the Sprott Uranium Miners Exchange Traded Fund (ETF) in February 2023, to capture the upside of the uranium boom. The ETF holds a basket of uranium miners.

We don’t expect this to be a short-term trade. But instead, should grow with uranium demand. And it takes a long time to build new nuclear power plants.

As you can see from the chart below, the stocks fell out of favor as economic worries became front of mind for most investors:

Investors don’t want to speculate on mining companies when they are worried about bank failures and recession. That’s why we use a trailing stop. We own the position and expect it to work out in our favor. But if the economic worries get too strong, we’ll exit and look to get back in at a later time.

Uranium is a “when” not an “if” situation. We can always step out and wait for a better entry point if things get ugly in the next couple of months.

We are currently down 14% on our position and our buy price was the highest price we’ve seen. We’ll keep a close eye on this position. The stock price appears to be recovering, but we need to watch it.

Recommendation: As with the rest of the portfolio, we will use a 30% trailing stop on our position. That means if shares close below $24.80, we’ll sell our position.

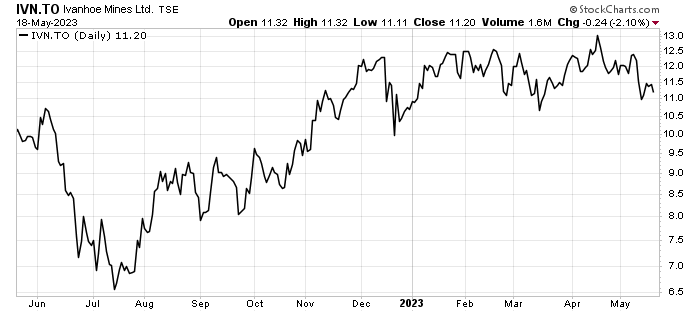

Ivanhoe Mines Ltd. (TSX: IVN)

We initiated research on Ivanhoe Mines thanks to my trip to the Prospectors and Developers Association of Canada conference in March 2023. I came away from the trip totally in love with Ivanhoe’s approach to mining, not to mention their projects. Shares climbed quickly in 2022, but flattened out in 2023, as you can see here:

Unlike other companies in our portfolio, Ivanhoe set records in the first quarter of 2023. It set a new quarterly profit record of $82 million. The Kamoa-Kakula mine set a monthly production record in March of 34,915 metric tons of copper. That was due to the completion of a “debottlenecking” program. It streamlined the production process, allowing more production.

On April 27th, the company announced an offtake and financing agreement between the Kipushi Corporation, Gecamines, and Glencore International. The three companies will take all of the Kipushi Mine’s zinc production (between 400,000 and 600,000 metric tons per year) for five years. In addition, the companies will provide a $250 million term loan.

The agreement with Gecamines will reduce Ivanhoe’s ownership in Kipushi to 62%.

I love the way this company presents their information. We all should go and review their website. This is what mining companies should look like.

We are up 2.8% on our position since March 17th. Again, this is a longer-term investment. Its growth and the tailwind for base metals put Ivanhoe Mines in a position to grow over the next couple of years.

Recommendation: We remain bullish on base metals (and precious metals, honestly). That puts Ivanhoe in exactly the right place for the next year or two. We’ll use a 30% trailing stop here as well. If shares close below $9.12, we’ll sell our position. However, we need to watch for new high prices and update the trailing stop accordingly.

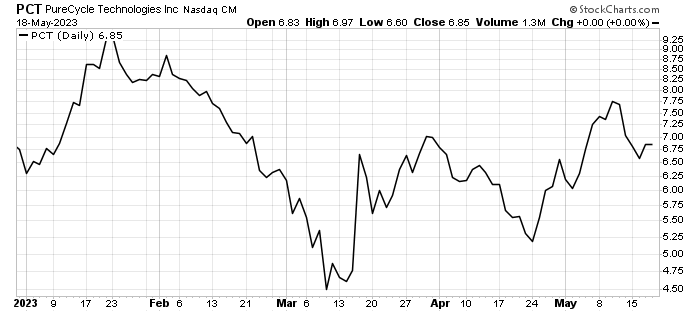

PureCycle Technologies (PCT)

PureCycle Technologies is our latest position and our best performing position by far. The company got a huge boost in early May when it announced that it had “mechanical completion” of its first polypropylene purification plant in Ironton, Ohio. This milestone de-risks the investment. That put more investors at ease, and interest picked up as you can see:

The company plans to build a second facility in Augusta, Georgia. PureCycle secured $62 million in debt and plans to issue bonds by the end of June. The debt would go towards initial construction at Augusta, while Ironton ramps up to commercial production.

At that point, the company will look to secure lower-cost, longer-term financing for Augusta.

We’ve only owned this stock for a few weeks now. There will be more difficulties as we go. But I’m thrilled with their performance in a tough market. We are currently up 23% on our position.

However, the stock high $7.76 per share in mid-May. That boosted the trailing stop. As you can see in the table above, we will close the position if it falls below $5.43 per share.

Recommendation: PureCycle’s next big event will be actual production from its Ironton location and solidifying the location for its new plant. Until then, we could see shares ease lower as some folks take profit. That’s fine, but I still expect to see it put in new highs on those events. We’ll use a 30% trailing stop here as well. We’ll close our position if shares close below $5.43 each.

The single biggest risk we face as investors isn’t bank runs, inflation, or the debt ceiling crisis.

It’s the inability to react to any stimuli that loses us money. That may be something we see. But often, it’s something that shows up in the behavior of the stocks first. They start to fall, for no real reason, and then months later we find out that there was a crisis.

It can often have nothing to do with the stocks we own. In which case, we monitor them as they fall and reenter them when they begin to move higher again.

That’s why trailing stops are so powerful. They use a simple math trick to give us a signal to sell our stocks. And if we don’t get the signal, we just keep holding. Its super easy and it can save your investments from disaster.

I hope you’ll consider using trailing stops on all your positions. And if you like this, let us know at wecare@mangroveinvestor.com.

Sincerely,

The Mangrove Team