Rough RIDE – Is Lordstown Motors Going Bankrupt?

By Matt Badiali

We always knew that some of the splashy entrants to the electric car market would fail.

Statistically, nine out of 10 startups fail, according to the Small Business Administration.

We expected electric truck maker Lordstown Motors (Nasdaq: RIDE) to escape that fate. It seemed to be in the top 10% of electric vehicle startups.

Founded in 2018, it bought a shuttered car manufacturing plant in Lordstown, Ohio, from General Motors (GM) in 2019.

GM loaned Lordstown $40 million. And then it enticed GM into an even bigger investment in the company – about $75 million.

The loans gave Lordstown great press and a tailwind. And it became a media darling.

Forbes, Yahoo, The Detroit News, CNBC, Cleveland.com, USA Today, CNet, and the Detroit Free Press all wrote features on the company.

It was the underdog. It promised to beat all the majors to a deliverable electric pickup truck.

The high-profile, feel-good story got the attention of a special purpose acquisition company (SPAC) that took Lordstown public.

The listing on the Nasdaq exchange even got a vanity ticker symbol – RIDE.

What Goes Up…

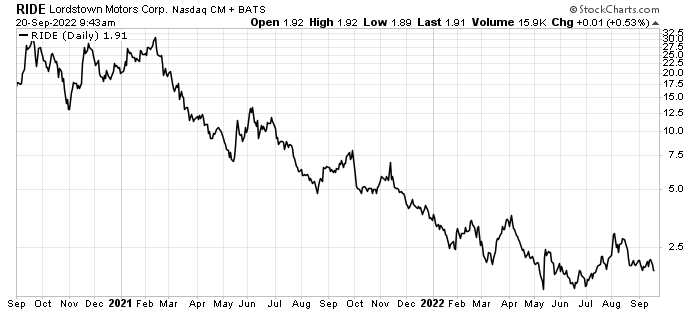

RIDE shot up from $9.90 per share in 2019 to $29 per share at the top.

But things stalled. The new automaker struggled to get its prototype trucks built.

Lordstown sold the assembly plant in Ohio to cellphone maker Foxconn for $230 million. But that’s still not enough capital.

On the August 2022 earnings call, Lordstown CEO Edward Hightower said, “Our timeline for scaling Endurance production will be tied to our strategic partnership and capital raising actions.”

In other words, no partner, no trucks. And that’s not good.

The company’s shares tanked on the cascade of bad news. They’re down nearly 95% since the 2021 high:

That’s an ugly chart. And it could get even worse.

The Vultures Are Circling

The reality of building an electric vehicle company from scratch hit shares hard.

Additionally, there were some dodgy dealings by management that were outed by a notorious short seller.

The company overstated demand and expectations, which got the attention of Hindenburg Research. It does deep research and publishes all the dirty laundry it finds.

Hindenburg’s report got Lordstown in trouble with the Securities and Exchange Commission.

That led to the departure of Lordstown’s CEO and CFO. It also ended the company’s relationship with its former guardian angel, GM.

Today, Lordstown has a deal with Foxconn to build its vehicles. And it’s trying to secure a deep-pocketed partner to help build a few thousand vehicles in 2023.

While RIDE’s price may reflect all the bad news by now, there’s still the real possibility of bankruptcy. We suggest avoiding the risk here.

Good Investing,

Matt Badiali

Numbers to Know

44

Days that U.K. Prime Minister Liz Truss was in office – the shortest term in British history. Truss resigned following a failed tax-cutting budget that led to a revolt within her own Conservative Party. Rishi Sunak became the new prime minister on Tuesday. (CNBC)

$225,000

Paid at an auction in Houston for an electric GMC Hummer that has a listing price of $112,595. Only 783 electric Hummers have been delivered so far. As of July, around 77,000 people were on GMC’s waiting list to buy one. (Business Insider)

$4.6 trillion

Tesla CEO Elon Musk’s prediction of how much his company will be worth. On an earnings call last week, Musk said Tesla will have a higher valuation than Apple ($2.4 trillion) and Saudi Aramco ($2.1 trillion) combined. If his prediction comes true, it means Tesla shares would rise over 550%. (Teslarati)

What’s New in Sustainable Investing

Biden administration awards $2.8 billion to boost EV manufacturing

The money will be doled out to 20 manufacturers across 15 states. The goal of the grants is to help develop the sourcing and refinement of battery-grade graphite, lithium, and nickel. President Joe Biden remarked, “The future of vehicles is electric, but the battery is a key part of that electric vehicle.” (CleanTechnica)

Beyond Meat introduces Beyond Steak as shares drop 80% year-to-date

Beyond Steak is now available nationwide at Walmart and Kroger, plus select Albertsons, Ahold divisions, and other U.S. retailers. The product launch comes as shares of Beyond Meat (BYND) were down 80% since the beginning of the year. BYND rallied 14% on Tuesday as investors hope for a comeback. (Yahoo Finance)

Links We Like

“At 182 GW, solar power facilities accounted for half of all global capacity additions last year, with wind additions making up a quarter of new capacity.” (Utility Dive)

“Engineers have transmitted data at a blistering rate of 1.84 petabits per second – almost twice the global internet traffic per second.” (New Atlas)

“Air Products plans to invest approximately $500 million to build, own, and operate a 35-metric-ton-per-day facility to produce green liquid hydrogen at a greenfield site in Massena, New York.” (Green Car Congress)