Spotlight Weekly – Federal Reserve Raised Rates

Today’s update will be brief

Yesterday, the Federal Reserve raised interest rates another half percentage point. And the comments during the meeting implied that they will continue to raise rates through 2023.

The benchmark rate (called the federal funds overnight rate), which is the baseline cost to borrow money, is now at a 15-year high. What that means for us consumers is that the prime rate now sits at 7.0%

The prime rate is the interest rate that banks use as a starting point for all loans – for cars, houses, credit cards, etc. And this current hike, plus the guidance, means that borrowing money is expensive now.

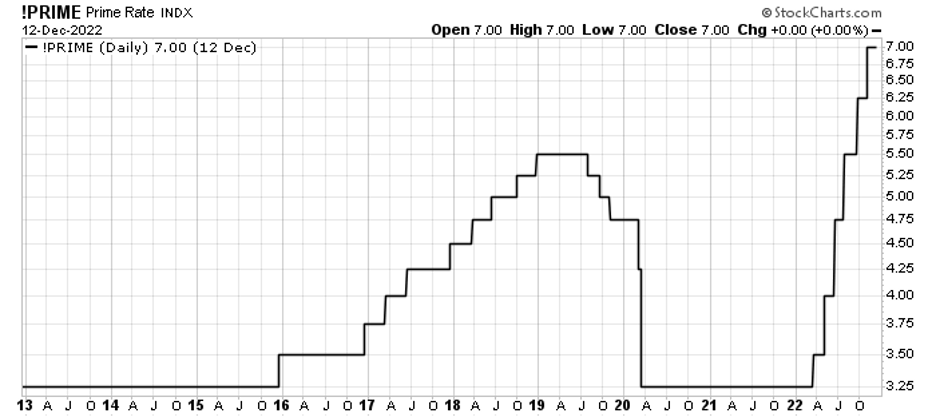

This is a ten-year chart of the prime rate:

As you can see, the past decade was a great time to use a loan to buy stuff, particularly real estate. The average home price, according to the FRED, rose from $238,000 in 2012 to $454,900 today

Let’s break that down a bit. Let’s say you bought a house in 2012. You put 20% down in 2012 (that’s $47,600) and took a 30-year loan at 3.25%. In 30-years, you paid $372,884 for the house. But in just ten years, it’s already worth $454,900.

We made 72% on our $47,600 investment. That was fantastic. And people went crazy for it. Real Estate Investment Trusts (REITS) popped up all over the place. Their entire business model was to borrow money at 3% and earn 6%+ on the properties.

BUT…that’s about to come to a screeching halt.

That math looks a lot different if your loan was for 7%. In thirty-years, you will pay $570,000 for that same house. Which means you are sitting on a net loss of $115,100. Not so great an investment.

And there’s a high likelihood that housing prices will slow or even decline. Particularly if we see a recession.

That means we need to focus on our investment portfolio. If we aren’t making money on our houses, then we need to make our investments work harder.

As I’ve said often, we are closing in on a bottom in this current market. And there are opportunities to pick off great stocks that will give us great returns. Our goals in the short term are simple:

- Do not take a big loss – use 25% trailing stops on all our Spotlight Positions

- Know why we are buying a stock and what our risks are

- Go slow – buy small positions in great companies

- Stay out of the popular sectors – no crypto, tech, or real estate

We have a terrific opportunity in the supply chain for electric vehicles, renewable energy, and infrastructure investment. Those are the sectors we will focus on for the next few months, while we watch the changes in the economy.

Good Investing,Matt Badiali

P.S. We just launched a new YouTube channel. It’s free and we’d love it if you’d subscribe. If you like the videos, let us know! And feel free to leave us comments as well.