Spotlight Weekly – I saw this cartoon in 1982

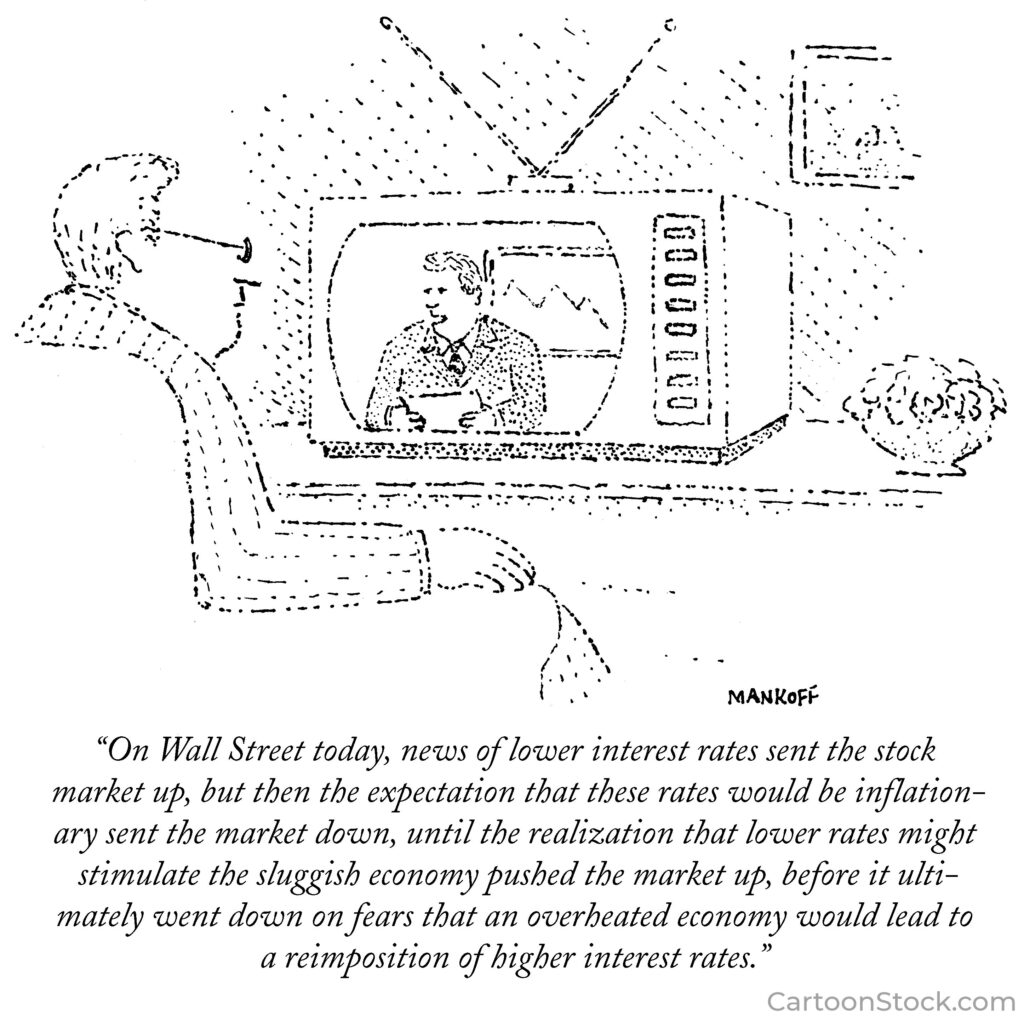

I saw this cartoon from 1982 and found it all too relatable today…

We are in a complex economic situation… The tail end of the pandemic, war in Europe, and a global energy supply crunch. Add to that a massive retooling of global supply chains and a lot of moving parts.

That’s a lot for the stock market to price in.

When faced with this kind of situation, I like to turn to the long-term trend for a clearer picture. And as we discussed last week, the trend is bearish. By that, I mean that we see lower lows and lower highs. We can expect that to continue for a little while.

The good news is that it lets us take our time and build our portfolio.

Bear markets end.

There have been 26 bear markets since 1929 (Hat tip to Kimberlee Leonard’s essay on Seeking Alpha). And they lasted, on average, 289 days. That’s less than 10 months. And the average decline was about 36%.

The longest bear market lasted 21 months from January 1973 to October 1974. Interestingly, it wasn’t the worst, in terms of performance. In 1931, the market crashed 62% in just over six months.

The shortest bear market lasted just a month. That was the COVID-19 crash in February 2020. The market fell 34% in 33 days.

The current bear market is already in its twelfth month and has fallen as deep as 25%. But it’s currently down just 18% from its peak.

It may fall further, but I think we are well past the halfway point. That’s great news. As I said before, we can use this time to build positions. And we can expect some lower prices in the future. It’s almost like cheating.

We can’t know the future, but we can use the past to give us some insight. And if the past data repeats, we will have time to buy the companies we like at better prices in the near future.

That’s perfect. We are buying low so that we can sell high down the road.

Good Investing,

Matt B.

P.S. We just launched a new YouTube channel. It’s free and we’d love it if you’d subscribe. If you like the videos, let us know! And feel free to leave us comments as well.