The Best Idea From the Giant PDAC Conference

I just spent five days in scenic, chilly downtown Toronto for the Prospectors and Developers Association of Canada (PDAC) mining conference.

It’s one of the world’s largest mining conferences.

I really enjoy it because it’s a chance to reconnect with friends and colleagues. This one was particularly informative because I haven’t attended since 2019, so I was seeing many people that I haven’t seen in years.

And I came away with a new favorite company. Before I jump into that, let me take you on a virtual tour of my trip.

The Metro Toronto Convention Centre hosts the PDAC. It’s gigantic, with over 700,000 square feet of floor space. That’s about 16 acres of conference space under a roof.

In 2010, the convention center hosted the G20 summit, the premier forum for international economic cooperation.

Since the building opened in 1996, it has added more than C$6.3 billion in direct spending to the Toronto metro area. I certainly added my share this trip – the price of hotel rooms is up more than 50% since I last attended.

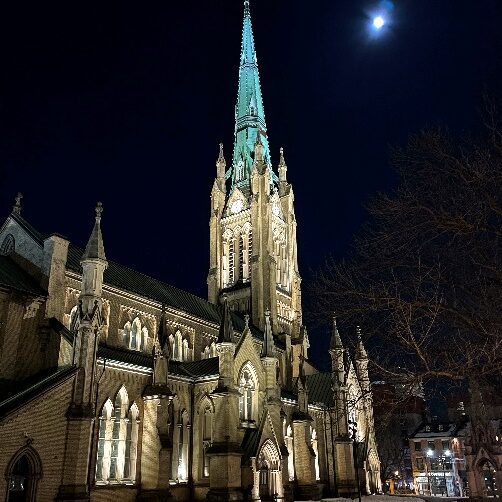

But the downtown area around PDAC is beautiful:

I didn’t spend a lot of time out in the air, because the temps were below freezing.

And the wind smacked you in the face. The good news is Toronto takes that into account.

There’s a whole series of walking tunnels, called “the PATH,” that let me walk to PDAC from my hotel under cover.

This is a picture of part of my walk every day. Bright, open, and warm. In the distance is the train station where you catch the commuter rail to the airport. I’m a fan.

It isn’t just about being at the conference.

A lot of business gets done outside of the PDAC. I had several important meetings here:

This is the Clockwork bar in the Fairmont Royal York hotel.

It’s a beautiful bar (try the french fries).

After the conference closes for the day, the meetings continue. I spoke to a series of companies, fund managers, and bankers in venues just like this.

But I was working for you, too.

I learned a lot at the conference itself, and I came away as a copper evangelist.

We’ve talked about copper in Spotlight before.

I told you it was the backbone of the sustainability movement in our very first report: “How to Capitalize on the Sustainability Movement.”

As I said then, if you’re sold on the energy revolution, you’re a copper evangelist, too.

See, the copper market is huge.

But it needs to get much larger to meet the looming demand from the green energy transition.

Here’s what I said in that report:

Billions of dollars are going into alternative energy, electric vehicles (EVs), and batteries.

According to Statista, investors put nearly $250 billion into renewable energy projects from 2015 to 2019 (the latest data available). And the new infrastructure bill just signed into law allocates $73 billion for the electric power grid. […]

But the big story within the electrification of cars is copper. […]

In a regular car with an internal combustion engine, it needs about 50 pounds of copper. It needs the copper in the wiring and motor. But an EV needs a whole lot more.

Take the new Teslas, for example. It takes about 183 pounds of copper per car. That’s because each wheel has a motor that needs the wirings. Then you have all the wiring in it. And it has a giant battery.

But today, we don’t have enough copper.

There is no way that we can meet global government mandates for sustainable electricity, batteries, and cars without massive increases in the copper supply. I just don’t see copper production keeping up. And short of a global recession, it can’t.

And when supply can’t keep up with demand, prices go up.

I don’t see any way around that scenario for copper.

And following that logic, I made another discovery: My new absolute favorite natural resource company. It’s not oil or gas, not uranium or fertilizer.

It is hands down the best natural resource company on the market today. If you made me choose one natural resource stock to hold for the next decade, gun to my head, this is it.

And that’s because it owns three of the world’s best copper deposits. It owns one of the largest copper complexes in the world, which also happens to be Africa’s largest high-grade copper discovery. In addition, it has a high-grade zinc-copper-silver-germanium mine and a platinum-copper-nickel-gold mine under development.

It’s everything to everyone. And as long as the global economy continues to tick along, this stock will make a lot of money.

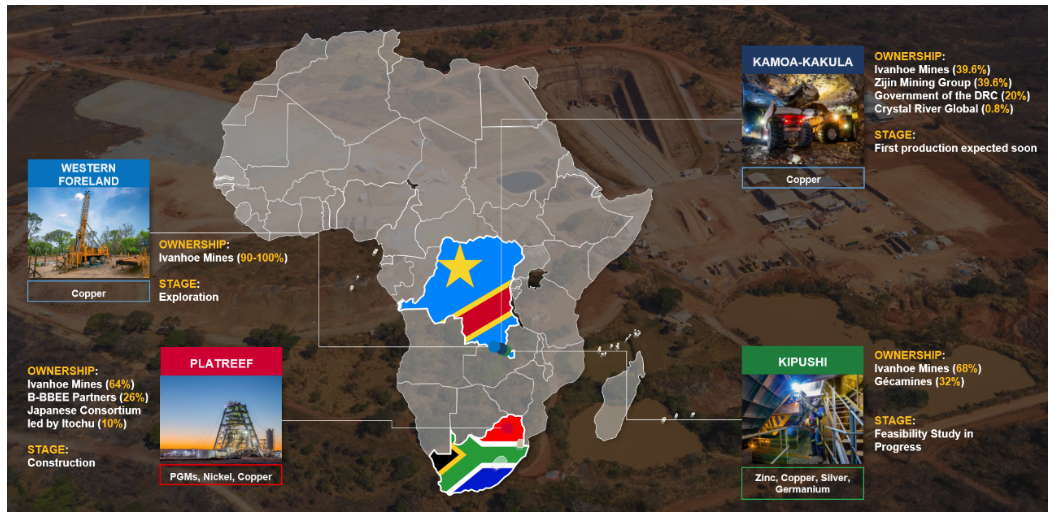

Introducing the leader of the New Mining Movement: Ivanhoe Mines (TSX: IVN)

Ivanhoe Mines is a $13.5 billion Canadian mining company.

It holds three major copper projects in southern Africa: the Kamoa-Kakula copper mine, the historic Kipushi zinc-copper mine, and the Platreef platinum-nickel-copper-gold project.

I spent a lot of time at the Ivanhoe Mines booth.

I’m going to link to a series of brilliant videos on the company’s website. I watched them all. I highly recommend that you watch them too. They show the future of mining.

Kamoa-Kakula and Western Foreland

The Kamoa-Kakula mine in the Democratic Republic of the Congo (DRC) went into production in 2021. It holds 83.7 billion pounds of copper in indicated resource category and another 12.5 billion pounds in the inferred resource category.

It was the first major copper deposit found in the past 50 years.

The indicated resource means they have more drill holes into the resource, so they are more confident that it exists as a body. Inferred resource means that they have a few drill holes into it. That means it could change in size and shape, which would alter the volume of copper.

That’s a massive amount of copper. And it’s now in production. The mines produced 200,000 metric tons of copper per year. Phase 2 will double that production to 400,000 metric tons per year.

Next to the Kamoa-Kakula complex are the Western Foreland exploration licenses. They hold Ivanhoe’s latest discovery, the Makoko deposit. It’s an exciting new discovery of high-grade copper, and it appears to be massive. Drill holes intersected high-grade copper over an area measuring 4.5 kilometers by 1.5 kilometers… and they haven’t found the edges yet.

Kipushi Mine

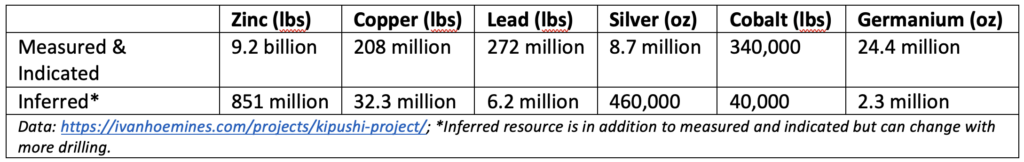

The Kipushi mine is a tremendous project as well. The mine has the highest grades of the world’s 20 largest zinc deposits (it ranks seventh in overall metal as well). Ivanhoe owns 68% and its partner Gécamines owns 32%.

Here’s a breakdown of Kipushi’s resources:

Again, this is a massive amount of metal. It would be a company maker by itself. Alongside Kamoa-Kakula, it’s an embarrassment of riches.

This is a massive mine. To put it into perspective, it would take four and a half Eiffel Towers to reach the surface from the deposit. But it’s a world class resource, so the economics work.

And it gets better…

Platreef

Ivanhoe Mines owns 64% of the Platreef project and is directing the development of the mine. This is a major platinum-group metals discovery on the northern limb of the Bushveld Igneous Complex. That’s the world’s premier platinum producing district.

The mine should go into production in 2024, with a second shaft online in 2027. In addition, the project economics get a solid boost from significant nickel and copper production.

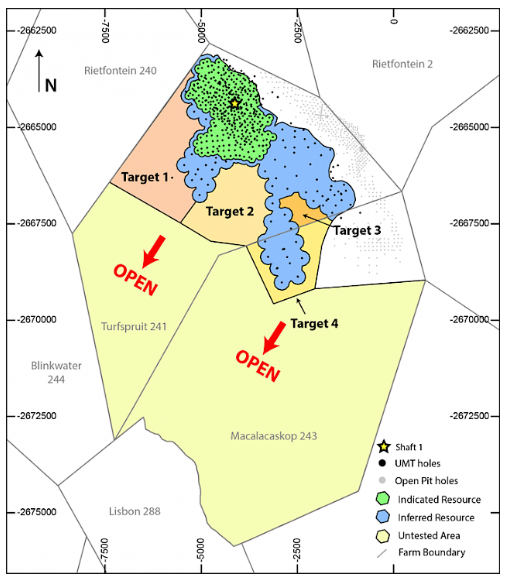

The interesting thing about Platreef is that the excavation hasn’t found the extent of the potential deposit yet. The project continues to the south and west, as you can see in the map below:

I’ll be watching Ivanhoe’s drill programs closely because these deposits just keep getting more exciting.

The truth is, any one of these projects would make a multi-billion-dollar company. But Ivanhoe has all three.

Action to Take: Buy Ivanhoe Mines (TSX: IVN; OTC: IVPAF) below $13 per share

Our risk with this position is a global recession, which would reduce metal demand significantly. That would cause metal prices to retreat and take Ivanhoe’s shares down too.

But our upside here is significant. As these mines go into production, Ivanhoe will go from zero revenue (today) to billions in revenue and earnings. That will earn it a significant increase in market value.

To wrap this up, you should watch Ivanhoe’s founder Robert Friedland summarize the role of copper in the world going forward.

This is my favorite natural resource company today. If I could only own one company for the next decade. This would be the one.

Sincerely,

Matt Badiali