The Great Electrification is Here

Lars Rebien Sorensen is the chair of the world’s third largest fund

And he’s trying to bring nuclear power back to Denmark. Sorensen runs the Novo Nordisk Foundation.

He told Danish financial publisher Finans:

“The more I dive into it, the more components I see as being potentially relevant for the foundation and, down the line, our investment company.”

Denmark famously embraced the “Nuclear Power? No Thanks” slogan after the Russia’s Chernobyl nuclear power plant disaster:

Sorensen’s interest in nuclear power shows how far the world came on nuclear energy and uranium..

This is a massive shift in sentiment, from even a few years ago. The International Atomic Energy Agency (IAEA) used the global rise in interest in nuclear power to revise its long-term outlook.

IAEA General Director Rafael Mariano Grossi spoke at the group’s general conference in Vienna in September 2022. He summarized the state of nuclear power around the world:

Sorensen’s interest in nuclear power shows how far the world came on nuclear energy and uranium..

This is a massive shift in sentiment, from even a few years ago. The International Atomic Energy Agency (IAEA) used the global rise in interest in nuclear power to revise its long-term outlook.

IAEA General Director Rafael Mariano Grossi spoke at the group’s general conference in Vienna in September 2022. He summarized the state of nuclear power around the world:

Today the 430 nuclear power reactors operating in 32 countries provide approximately 386 gigawatts of installed capacity, supplying some 10% of the world’s electricity and around a quarter of all low-carbon electricity. There are 57 reactors under construction in 18 countries; these are expected to provide about 59 gigawatts of additional capacity.

The Agency believes nuclear power may double the global capacity to 873 gigawatts at the high end.

The main driver for this change in outlook is national security.

However, the secondary driver is wealth.

Many developing countries still rely on fossil fuels for electricity. They are hurt more by soaring prices than richer countries. And they struggle to supply electricity to their people.

According to the International Energy Agency, 1.3 billion people lack “modern energy access.” To put it in context, 21% of the population of India can’t charge a cell phone or power a light bulb. Nearly half the residents of Nigeria lack any electricity. And 73% of the people in Ethiopia and 84% of the population of Tanzania have no electricity at all.Bangladesh is one of the poorest countries in the world. It generates less than $5,000 in gross domestic product per capita. That’s less than 10% of the U.S. It has two new nuclear power plants under construction today.

That’s why seeing some turn to nuclear is a huge deal. The changes we see happening in nuclear power construction, particularly smaller, less expensive designs – in 2020, the U.S. Nuclear Regulatory Commission approved the design of small modular reactors. These are less expensive, create less waste, and can fit in smaller footprints.

Today, 30 countries are planning or building their first nuclear power plants.

More nuclear power creates both a problem and an opportunity. Because even if we follow one of the IAEA’s low-ball cases for nuclear power growth, the world will need a lot more uranium than it has right now.

And that’s why we want to own uranium companies today.

We began positioning our portfolio in this sector with NexGen Energy (NYSE: NXE) and the Sprott Physical Uranium Trust (TSX: U-UN). With those two holdings, we own near-term development – with NXE’s Rook 1 project – and physical uranium with the trust.

However, our next recommendation is a uranium exploration play. This adds more risk to the portfolio because it doesn’t own uranium. Instead, it holds a portfolio of exploration targets. The company and its partners spend money exploring these targets, looking for the next Rook 1.

They may not find it. But if they do, these stocks can go up hundreds of percent. And the risk-to-reward ratio with this company looks great.

That said, don’t risk the rent payment on exploration stocks. These are speculations. They are high-risk, high-reward companies.

And here’s why we want to own them…

Fission 3.0 (TSXV: FUU) recently announced a discovery at its Patterson Lake North property. The company drilled a continuous 15.0-meter interval of rock that ran 6.97% uranium. That’s a fantastic hit. Here’s what the stock did on the news:

It went from 8¢ to 40¢ in 2 months. That’s a 400% gain from a single drill hole.

That’s what we want to own.

Canada’s “Saudi Arabia” of Uranium

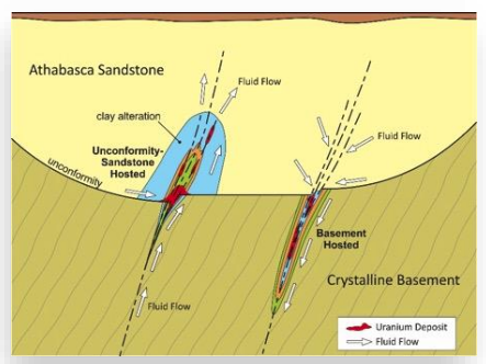

Uranium rich fluids travel up from deep in the ground.

The fluid travels up through cracks in the crystalline basement rock.

It leaks out of the hard rock and pools in some areas in the Athabasca Sandstone.

That’s what everyone wants to find.

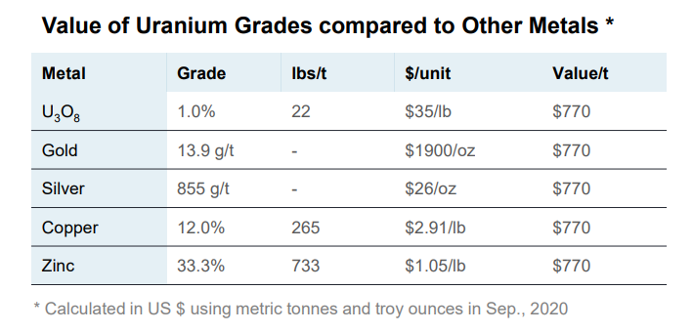

The average grade of the uranium deposits in the Athabasca basin is nearly 2%.

That’s incredibly high grade.

That makes for outstanding economics:

Why we like it:

Skyharbour Resources (TSXV: SYH)

I recently had a conversation with Skyharbour CEO Jordan Trimble about his company. I heard about the business from an investor friend of mine. Turns out, I’m glad I did. It is one of the best positioned junior uranium explorers in the market today.

Skyharbour’s flagship projects are Russell Lake and Moore.

Russel Lake Project

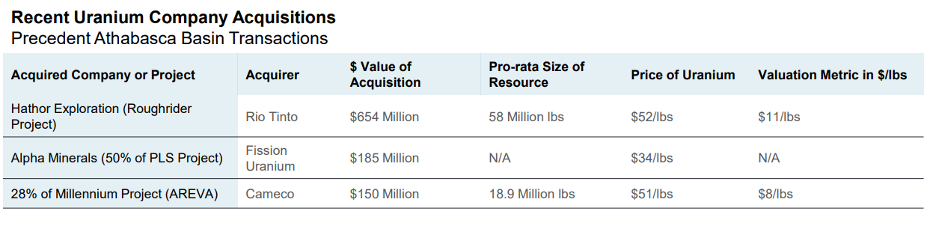

Russell Lake, a newly acquired project from Rio Tinto, sits between Cameco’s Key Lake mill and its massive McArthur River mine. Rio Tinto acquired Russell Lake when it bought another uranium explorer, Hathor Exploration in 2011. However, Rio Tinto preferred to focus on the Roughrider deposit and shelved Russell Lake.

Skyharbour negotiated a partnership with Rio Tinto for the project. Skyharbour can earn 51% of the project by paying C$508,200 in cash and issuing 3,584,014 shares. And the company will fund C$5,717,250 in exploration over three years. Skyharbour can reach 70% and then 100% ownership if it meets certain future milestones.

Russell Lake is a premier, advanced project with significant historical exploration. Skyharbour will be drilling the project from January through May. The company plans to complete 20 holes and about 10,000 meters. That means we have the potential for good news as we get the results.

Moore Project

Skyharbour’s second target is the 100% owned Moore project. It sits adjacent to Russel Lake to the south and east. The property received C$50 million in exploration – over 380 drill holes and 140,000 m of drilling. The drilling outlined the “Maverick Zone.” Several holes into that zone returned thick intervals of high-grade uranium. Drill hole ML-61 hit 10 meters of rock with 4.03% uranium. However, only about half the Maverick corridor saw drilling to date. Skyharbour continued drilling through 2022 with some limited success.

It’s clear that Skyharbour has many ways to succeed, through its various projects. With its focus moving from Moore to Russell Lake, we may see positive results this spring.

Our risks here is that the company runs out of money before it makes a discovery. But the company’s portfolio of partnerships substantially reduces that risk. In addition, there is a risk that Rio Tinto could sell the shares it got for the Russell Lake deal, pushing the share price down.I don’t see that as an imminent risk because the deal just happened

Action to Take: Buy shares of Skyharbour Resources (TSXV: SYH/US OTCQX: SYHBF)

Remember, this is a speculative stock. Think of it as a lottery ticket on a uranium bull market/discovery. Don’t take out a second mortgage to buy shares! But we like the portfolio, the team, and the business model.

If the Skyharbour team makes a discovery, this stock could easily match Fission 3.0’s chart. That’s why we speculate in these juniors.

Good Investing,

Matt Badiali