The Great Electrification

It’s time. Uranium is about to repeat its historic bull market.

The last time the uranium price soared, it sent uranium explorers soaring. But it started with a historic bottom. On January 1, 2004, an Australian uranium exploration company, Paladin Energy (OTC: PALAF), traded for 5 cents per share.

Uranium miners lost money doing business. It cost the industry $15 to produce a pound of the stuff… that meant they still lost $4 on every pound they sold. That was unsustainable… and a few expert resource investors figured it out early.

Uranium prices were already in an uptrend. They rose from $7 per pound in 2001 to over $11 per pound. By 2005, the uranium price had jumped to $20 per pound and then climbed 75% to $35 per pound by the end of the year.

Investors got excited about uranium too. They piled into anything related to uranium.

By January 2005, Paladin Energy was up to 47 cents. That’s a 460% climb. But by the end of 2006, it had hit $6.85 per share. That’s a 1,357% gain in just two years… but it was a 2,000% gain in just 36 months.

Giant uranium producer Cameco (NYSE: CCJ) had a similar run.

From $3.20 in early 2003 to over $45 per share in 2007 – that’s a 1,300% gain in just over four years.

Those are just two examples of what the industry did the last time we saw a bull market. And it’s what we could see in the next three to four years.

That’s because we are on the cusp of a brand-new bull market. There is a strong global move back into nuclear energy right now. Plants that were slated for shutdown are staying open. And money is pouring into new reactors and innovative technologies.

The Great Energy De-Globalization

The single-biggest trend in energy today is “de-globalization.”

For more than a century, the world has relied on oil and coal exports. These critical fuels have historically come from a handful of countries. However, every country in the world needs them for transportation and electricity.

But as the supplies of those fuels dwindle, the remaining supply has found itself in the hands of bad-actor nations. And now, the world understands Russia’s willingness (specifically) to weaponize its oil and gas exports.

The country’s recent invasion of Ukraine demonstrated how much power these petroleum suppliers have today. Russia used its natural gas supplies as leverage over Europe. It wanted to keep the west out of its conflict with Ukraine. Europe and its allies then boycotted Russian gas and oil, which caused energy prices to spike.

And that reality scared a lot of powerful people.

It’s caused a global re-alignment of energy suppliers and consumers. Many countries in Europe began looking for alternatives to buying fuel from Russia. This will be a difficult period for consumers as the supply lines change. But there is a big winner emerging from this geopolitical fallout: nuclear power.

Geopolitics + Reducing Emissions

For the world to make strides in reducing CO2 emissions, nuclear power must expand. To meet its stated goals, the world needs about 10 gigawatts per year of carbon-free power through 2030. That’s an enormous number. And a year ago, there wasn’t much political will to get it done. But today, it’s much more likely to happen.

Mainly due to Russia’s weaponization of its energy supply, every country in the world wants more autonomy in its energy supply.

Even the U.S. has made huge strides in modernizing its nuclear power fleet over the past 12 months. We currently produce nearly 30% of the world’s total nuclear energy.

Nuclear energy also appears in a large slice of the Bipartisan Infrastructure Law passed in 2022. This law allots more than $62 billion for the Department of Energy (DOE). Part of that funding goes towards modernizing nuclear power by demonstrating advanced reactors, preserving the existing fleet of nuclear power plants, and using nuclear energy to produce hydrogen fuel.

The DOE provided more than $12 billion in loan guarantees to help utility companies complete the Plant Vogtle nuclear reactors in Georgia. Once online, this will be the nation’s largest clean-energy power plant.

Another key to moving forward in the U.S. is reusing old coal power plant sites for new nuclear power plants. A 2022 Department of Energy report examined the efficiency of replacing old coal plants with new nuclear power. The results showed that it can cut between 15% and 35% off the construction costs. According to Reuters, nuclear engineering companies TerraPower and X-energy received $160 million to build two advanced nuclear power plants by 2028. Both could use existing coal power infrastructure.

Bill Gates, co-founder of Microsoft, is the founder and chair of TerraPower. And the company is pushing hard to use existing infrastructure and workforce from a retired coal power plant in Kemmerer, Wyoming.

The takeaway is simple. The world’s energy supply is going through a massive change. And it will take time. But I do know one thing…

It’s Inevitable

We are moving from a world dominated by liquid fuel to one with a solid-state energy regime.

Make no mistake, this won’t be an instantaneous change. We won’t wake up tomorrow or next week or even next year to see portable nuclear power plants on every corner.

But in less than 10 years, there will be a profound change in our energy production.

I ought to know. I’ve studied this sector for years.

I was one of the first analysts to recognize the impact that shale drilling would have on the oil and gas industry.

And now I’m telling you that this change in energy will have a massive, transformative impact on a few areas of the stock market. It’s inevitable because the driver for this transition isn’t climate change… it’s national security.

As I mentioned above, Russia’s invasion of Ukraine sparked a global conversation about energy.

The result has been a deep revision of national energy policies around the world. Today, energy security dominates the conversation. That means countries want to generate electricity within their own borders, without the need for international, unreliable fuel supplies.

As a result, we’ve seen a surge in demand for solar, wind, and nuclear power plants. As noted in energy research firm Sprott’s January 2023 monthly update to clients, since the start of the Russian invasion of Ukraine, nearly every country with a nuclear power fleet is working to keep it open. Those countries have either delayed shutdowns, announced expansions, or made nuclear a principal source of electric power in the past year.

That’s because nuclear power can take the place of coal and natural gas for “baseload” power generation. Baseload power is the energy supply that’s always running – unlike solar and wind power, which only run under certain conditions.

We believe the global clean-energy transition will grow more urgent as energy security becomes synonymous with national security. The signposts point to a commodity-intensive, inflationary, and capital-intensive decade ahead. Energy-transition materials and precious metals will become far more valued than in prior years.

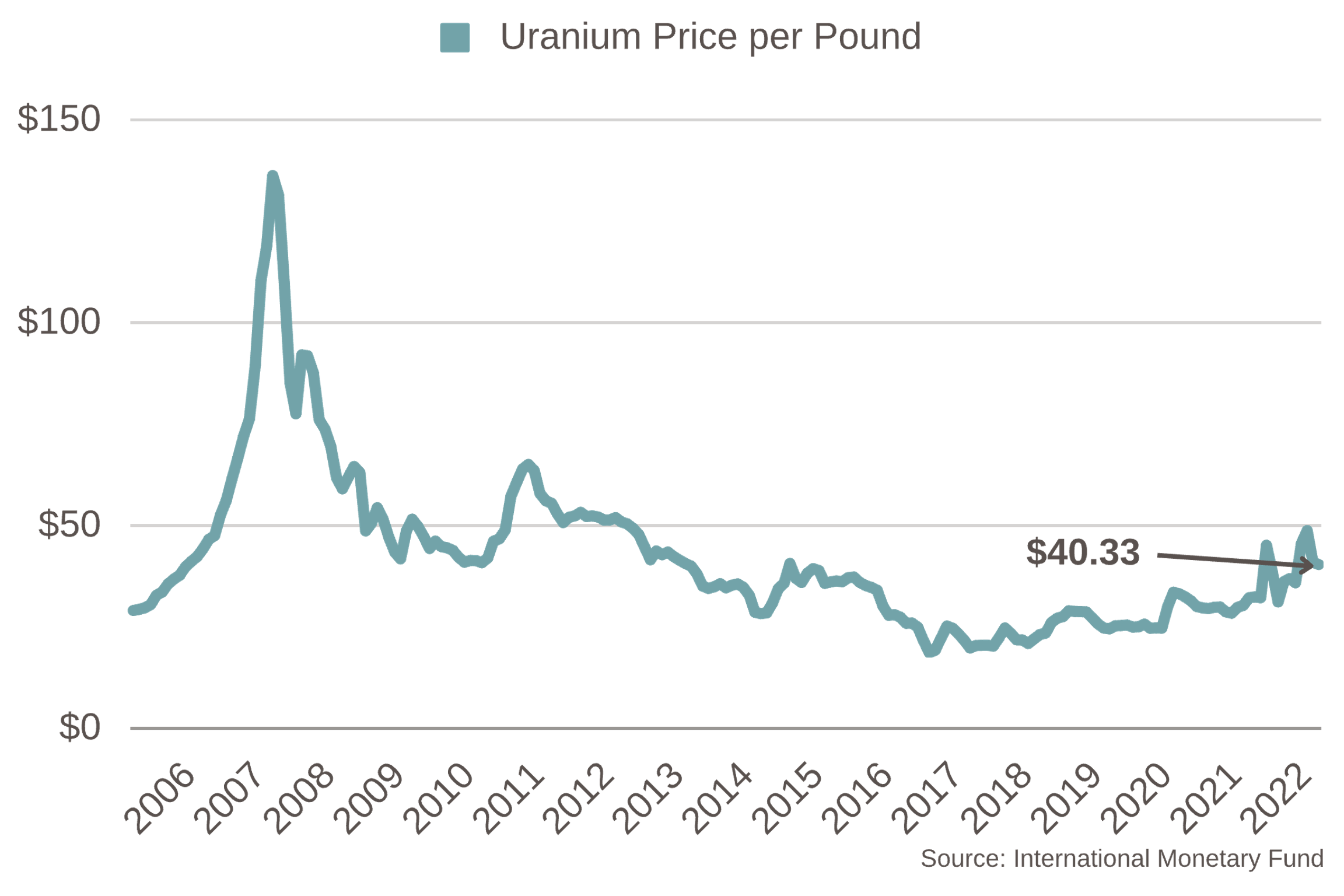

This information isn’t mainstream yet. In fact, uranium prices are just $40 per pound today. They’ve doubled since their bottom in 2020, but they’re still $100 below their high price from 2007, as you can see in the chart below.

This isn’t some short-term fad. New nuclear power plants take years to plan, permit, and build.

An 11-Year Bear Market is Ending

Uranium is a critical fuel for nuclear power plants.

But the latest bust has taken a toll on the market.

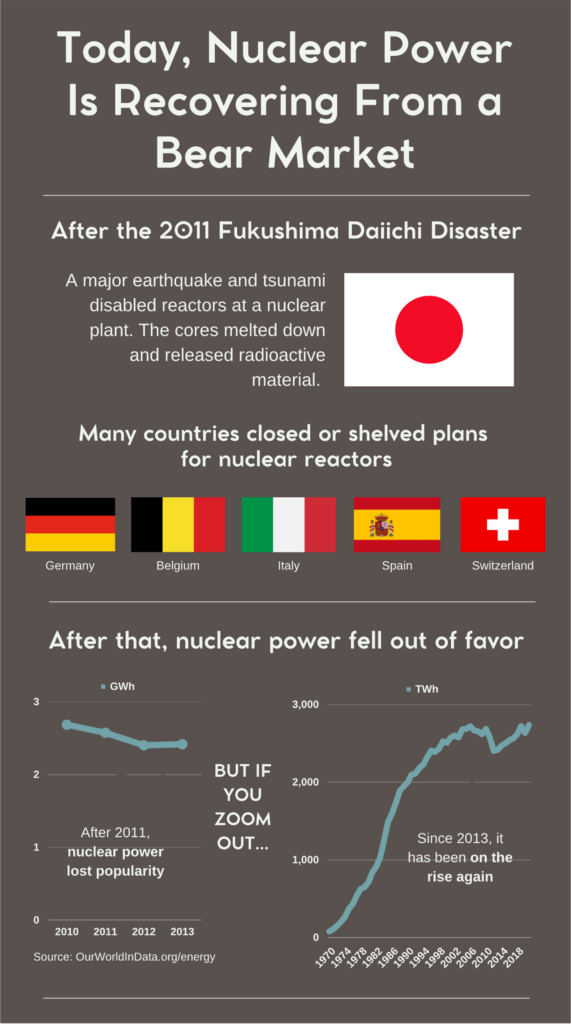

As we said above, in 2011, an earthquake struck the Fukushima Daiichi nuclear power plant in Japan.

According to the International Atomic Energy Agency, from 2011 to 2020, 65 reactors were either shut down or allowed to age out. And about 48 gigawatts of nuclear power capacity went offline around the world.

Not only did that take demand away, it added supply. All the remaining fuel from those plants flooded the market – most plants had 10 years of supply built up.

It takes a long time to work through a decade of uranium stock when plants are closing around the world.

A new uranium bust took hold. By 2016, the price had fallen all the way back to $18 per pound.

But the bust looks like it’s finally over.

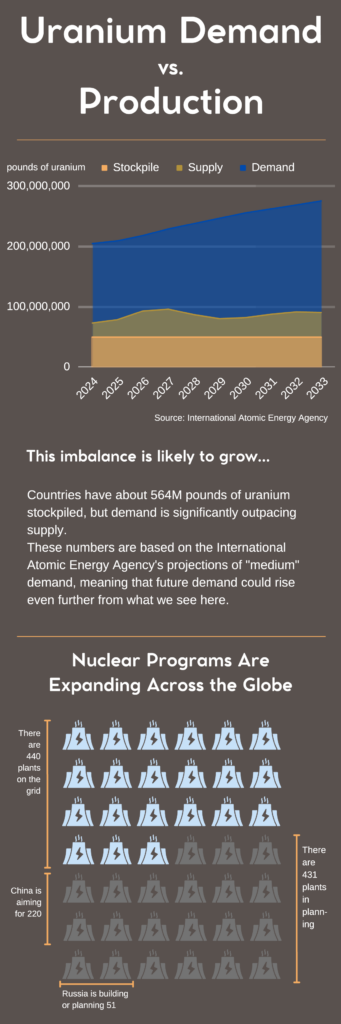

As you can see in the graphic, there are 431 nuclear plants proposed, planned, or under construction today.

This will do two things for the uranium market.

- First, it will quickly use up any excess supply from formerly closed plants.

- And second, it will bring in new demand as Japan restarts its mothballed plants.

The uranium price has already more than doubled since its 2016 low.

But we believe that the price will go higher. Nuclear power is the best source of baseload, carbon-free electricity available today.

And the nuclear power industry has new plant designs that are like comparing iPhones to old wall-mounted telephones.

That includes portable nuclear power plants for off-grid use.

The New Power Paradigm is Nuclear

One amazing thing about our political rhetoric of the past few years is we don’t hear enough about nuclear power.

It’s available, it’s reliable, and it’s local. And even more importantly, it’s energy dense.

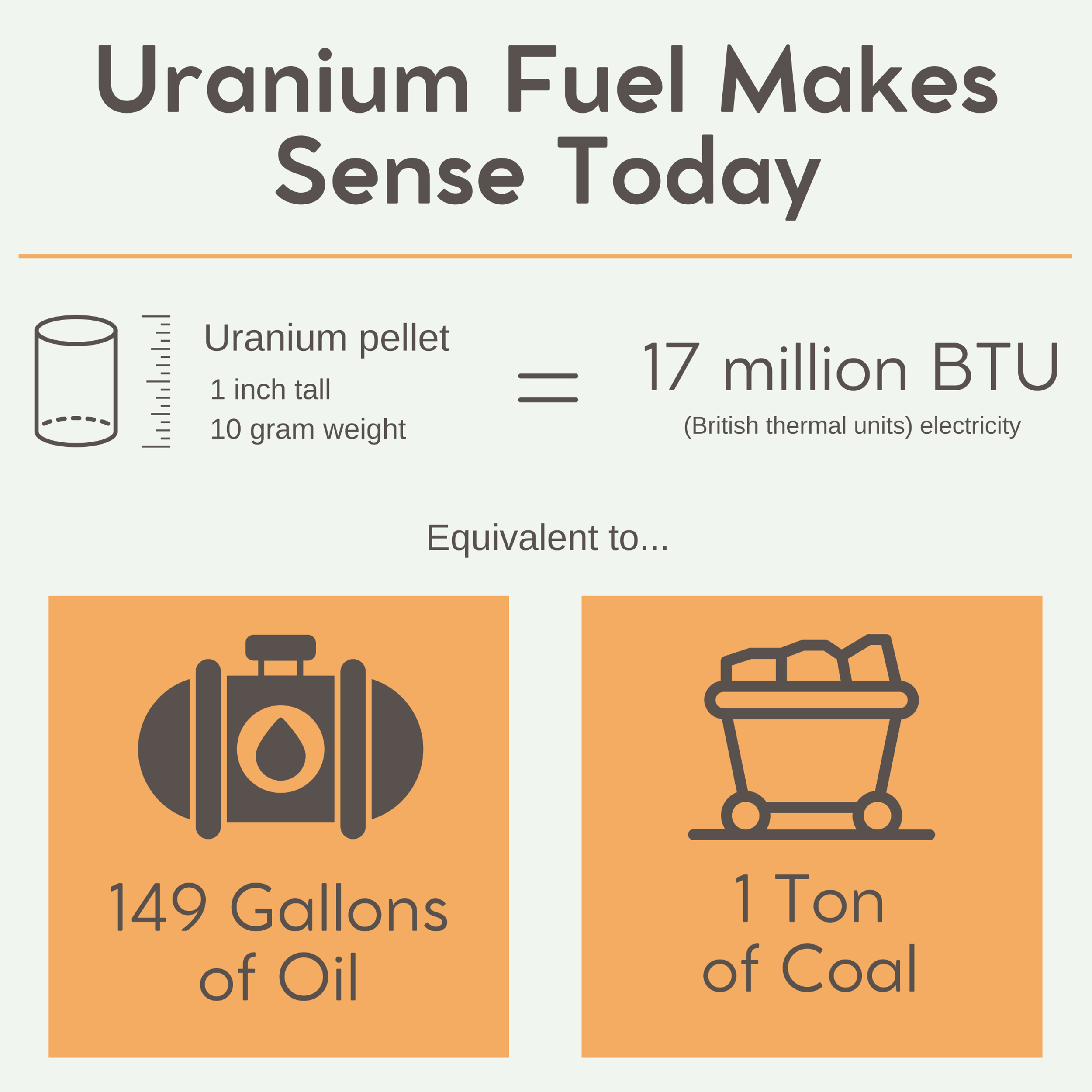

At $50 per pound of uranium, a ton of fuel costs about $100,000.

- The equivalent amount of coal (at $38 per ton) would cost $3.5 million.

- The equivalent volume of natural gas (at $5 per thousand cubic feet) would be $7.7 million.

- The cost of oil (at $80 per barrel) would be a whopping $25.8 million.

That’s why nuclear power makes so much sense today. You can tack a zero onto the current price of the fuel, and it is still far more economical than coal or oil.

The U.S. has a vast amount of uranium. That means nuclear power is a great way to secure the U.S. from imported energy supplies.

U.S. Secretary of Energy Jennifer Granholm recently appointed Kathryn Huff to her team. Huff was a professor and led the Advanced Reactors and Fuel Cycles Research Group at the University of Illinois Urbana-Champaign. She has focused on nuclear her whole career. Huff will help develop a full uranium strategy in the U.S.

And that’s important because the supply-demand ratio is rough right now. The world needs more uranium supply.

The takeaway is simple – nuclear power is on the rise. But we’re coming off a 12-plus-year cycle of low uranium prices and under-investment. Supply needs to come online yesterday. That means the price of uranium has to go up.

Investors should put together a portfolio of uranium mining stocks right now to take advantage of the rising price and emerging bull market.

For most investors, there are two simple solutions – either buy Cameco (NYSE: CCJ) or buy the Sprott Uranium Miners Fund (NYSE: URNM).

5 Ways to Invest in the Uranium Bull Market

So now you know why uranium is a sector we want to own. The next question is “how.”

There are five ways for any investor to take part. These don’t require us to put drums of radioactive materials in our garage. And they don’t need any complicated options strategy.

If you have a simple stock trading account, you can own uranium.

Uranium Investment Option No. 1 – Physical Uranium and Royalties

This option gives investors exposure to the commodity price without the risks associated with mining. The upside here is based on to the movement of the uranium price. And these companies avoid the risk of actually having to mine the metal. However, they have no leverage to the price of uranium, like a producer would.

There are two public companies that hold physical uranium for investment.

Yellow Cake (LSE: YCA; OTC: YLLXF) is a £750 million market cap, London-listed company that holds physical uranium. Yellow Cake trades on the London stock exchange and on the over-the-counter (OTC) market in the U.S.

From its website:

Yellow Cake holds physical uranium oxide (“U3O8”), has no operating assets and does not enter into hedging arrangements. The Company engages in uranium related transactional activities, such as uranium location swaps. We actively assess other operational and financial transactions on an opportunistic basis to secure exposure to uranium, including streaming and royalties and other financing opportunities.

The company has an agreement with Kazatomprom, the national uranium company of Kazakhstan, to buy uranium. The agreement allows Yellow Cake to buy up to US$170 million of uranium for $21.01 per pound through 2027. The company can buy an additional $100 million worth of uranium as well.

That’s a spectacular deal, considering the price of uranium is now near $50 per pound.

Sprott Physical Uranium Trust (TSX: U.U) is a C$3.9 billion market cap Canadian trust. According to its website, it “invests and holds all of its assets in uranium in the form of U3O8.” The goal of the trust is to:

Provide a secure, convenient and exchange-traded investment alternative for investors interested in holding uranium.

This is a closed-end trust. It holds over 60 million pounds of uranium. It’s stored in three areas: Cameco in Canada, ConverDyn in the U.S., and Orano in France. According to the website:

The Trust’s assets represent enough uranium to power France’s nuclear energy needs for over two years, based on calculations derived by WMC Energy.

Because the fund is closed-end, it can trade at a premium or a discount to the value of the uranium it owns. It tracks that on the website. In 2022, it traded at a premium on 52 days and at a discount on 198 days.

We hold Sprott Physical Uranium Trust in the New Energy portfolio.

For investors looking to invest in the commodity simply, without the risk of mining companies, these two stocks are the easiest options.

There is a third non-mining choice here – uranium royalties.

Uranium Royalties (Nasdaq: UROY; TSXV: URC) is a company that holds royalties on uranium projects – that means it owns an irrevocable percentage of each project. And it isn’t on the hook for any of the costs or risks of the mine. It owns royalties on a wide range of projects, from small exploration companies to giant mines like Cameco’s Cigar Lake and McArthur River.

In addition to royalties, URC also owns shares of other uranium companies.

For example, it owns shares of Yellow Cake for exposure to physical uranium, in addition to holding its own reserves.

This business model provides exposure to the commodity price. But it also has the potential to do well as its partners bring other deposits into production. The company doesn’t have to pay any additional money to those partners. Its royalties do not require any maintenance capital.

Uranium Investment Option No. 2: Uranium Producers

There are three different types of mining companies: producers, soon-to-be producers, and explorers.

Each offers investors a distinct set of risks and rewards.

The reason we buy mining companies is for “leverage” to the commodity price – ideally, a mining company can find and produce the metal for a lot less money than it can sell for. And a company that has the potential to find more uranium has the potential to be more valuable to shareholders.

However, these companies also come with more risk than physical uranium plays. Mining is inherently risky. Trucks break down. Equipment wears out. The cost of operations can go up. All those things can affect how much material a mine produces, which can impact the company’s share price.

However, producers are less risky – they have operating income. The rest of the companies do not have any sort of income – they’re still trying to set up their operations.

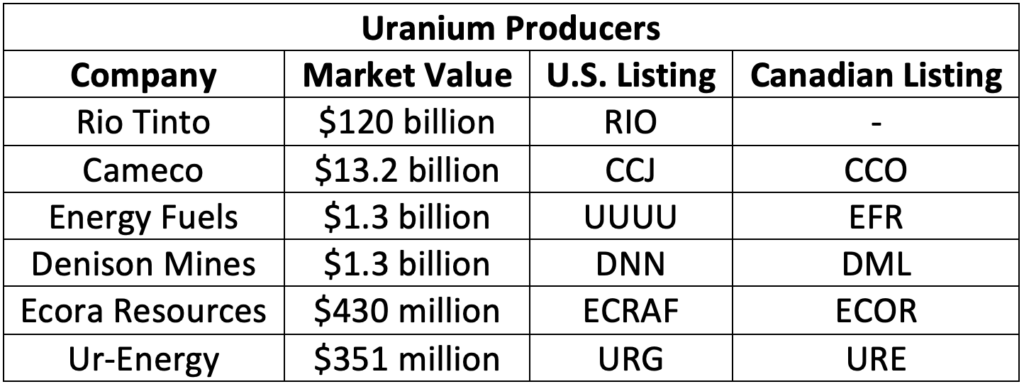

Here’s the list of North America-listed uranium producers:

The benefit of owning producers is that they trade for multiples of their earnings. In a bull market, when the price of uranium rises, these companies should make larger profits. And that should send the share prices of these producers much higher.

For investors willing to take on more risk for a bigger reward, the developers offer a good middle ground between producers and explorers.

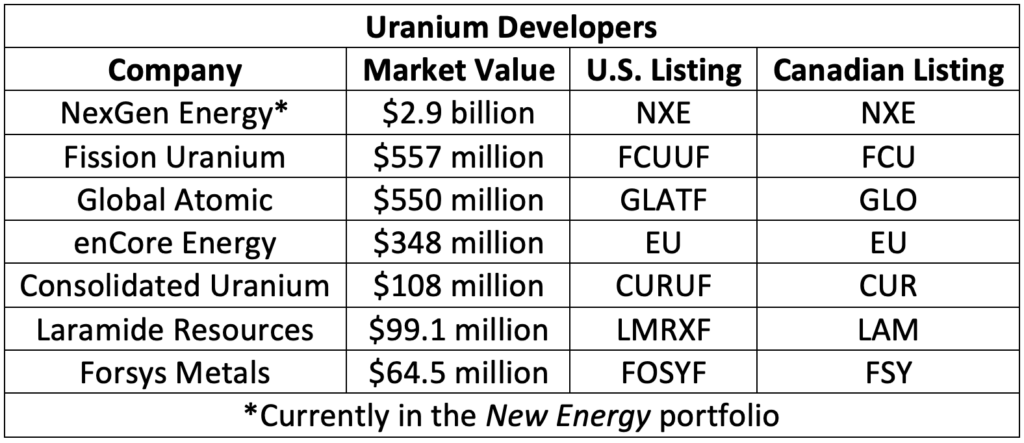

Uranium Investment Option No. 3: Uranium Developers

Uranium developers are companies that are in the process of building new uranium mines.

These companies are often ignored by investors because they have long lead times before they can actually produce material.

They have uranium assets. They should be in production within three years to five years. That means they should benefit from the rising uranium price right now. And as these companies continue to advance their projects, they will gain value as well.

Interestingly, there are fewer developers than producers.

Here’s a list of North America-listed uranium developers:

These companies can offer good value. However, they have some risks… The construction could run long or goes over-budget. Or they could get hung up on a permit. These situations can have negative impacts on the share price. However, the uranium deposit back-stops at least some of the value of a developer.

These companies offer exposure to the uranium price throughout the construction process. They have more risks than producers, but they offer more upside in a bull market.

Uranium Investment Option No. 4: Uranium Explorers

Where producers and developers have economic uranium deposits, explorers do not. Rather, they hold prospective ground and use exploration techniques to find economic deposits.

The odds, however, are not good. These are high-risk speculations. These are not investments. That’s why these companies tend to be small. However, when they do make a discovery, their share prices tend to explode higher.

Exploration companies hold far more risk than any other class of stock. They have no assets. That means their share prices can easily go to zero. Exploration companies can often only raise money by selling more stock. That erodes the value of the existing shares (in a process called dilution).

The table below only shows North American exploration companies with more than $10 million in market value:

Investors should spend time researching these companies before investing. And they should be watched during ownership.

These are high risk-high reward speculations. However, one single drill hole can send these stocks up hundreds of percent. They can go to zero, so do not be afraid to cut your losses if things go wrong.

Uranium Investment Option No. 5: Exchange-Traded Funds (ETFs)

The easiest way to invest in uranium across the spectrum is through exchange-traded funds.

There are only three pure uranium mining ETFs. The first two are similar in construction. Either one will give you exposure to a cross section of the uranium market. The third fund is a collection of smaller exploration and development companies.

Global X Uranium Fund (NYSE: URA) is a $1.5 billion asset value fund invested across a broad range of uranium miners and producers. The fund’s largest holdings include:

- Cameco (25%)

- Sprott Physical Uranium Trust (9%)

- Kazatomprom (5.9%)

- NexGen Energy (5.2%)

- Uranium Energy (4.1%)

- Paladin Energy (4.0%)

- Energy Fuels (3.2%)

- Denison Mines (3.2%)

- Yellow Cake (2.7%)

- Hyundai Engineering & Construction (2.1%)

This ETF holds companies that may be difficult for U.S. investors to own, like Kazatomprom. It also holds more than 47% of its assets in large producers and advanced developers. That means it has less exposure to discovery risks and more exposure to the uranium price.

Sprott Uranium Miners Fund (NYSE: URNM) is a $888 million asset value fund that also holds a wide array of uranium companies. The fund’s largest holdings include:

- Cameco (16%)

- Kazatomprom (14.5%)

- Sprott Physical Uranium Trust (14%)

- Energy Fuels (5.1%)

- NexGen Energy (5.0%)

- Denison Mines (4.9%)

- CGN Mining (4.7%)

- Uranium Energy (4.6%)

- Paladin Energy (4.4%)

- Yellow Cake (4.2%)

CGN Mining is a Hong Kong-listed stock. We hold the Sprott Uranium Physical Uranium Trust in the New Energy portfolio.

Our last ETF is a much smaller fund that holds more speculative companies.

Sprott Junior Uranium Miners Fund (Nasdaq: URNJ) is a $12.3 million asset value fund that holds a group of junior uranium companies. The fund’s largest holdings include:

- Paladin Energy (12.2%)

- Uranium Energy (11.8%)

- NexGen Energy (11.2%)

- Energy Fuels (10.8%)

- Boss Energy (5.3%)

- Denison Mines (5.0%)

- Fission Uranium (4.3%)

- Deep Yellow (4.2%)

- Global Atomic (4.1%)

- CGN Mining (4.0%)

Boss Energy and Deep Yellow are Australia-listed uranium explorers.

All three of these ETFs offer exposure to the uranium sector. For most investors, either of the two large funds would be a great way to invest in the uranium bull market.