The Real Driver of Tesla’s 58% Decline

By Matt Badiali

Electric carmaker Tesla (Nasdaq: TSLA) is in trouble. Shareholders are taking a beating right now.

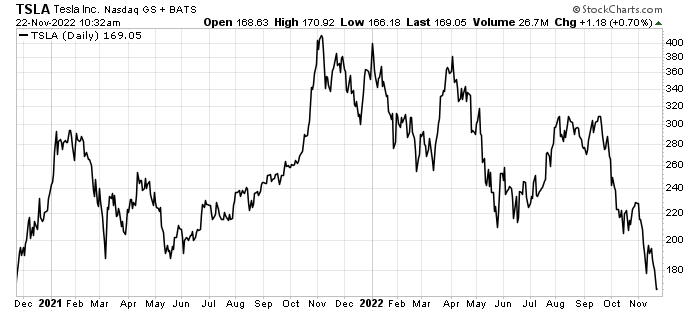

The stock is in free fall. As you can see in the chart below, Tesla shares topped out last year at over $400. They’re now worth less than $170 – a 58% decline.

That’s even lower than two years ago.

The analysts got it wrong. According to Bloomberg, Tesla shares need to rally a whopping 80% to hit the median analyst target price.

That’s due in part to supply chain issues, the rising cost of materials like lithium, and sales declines in the face of rising inflation.

But rising metal prices and logistical snafus aren’t the real driver of Tesla’s decline.

It’s a human factor: CEO Elon Musk.

His well-publicized takeover of social media giant Twitter has put him on the front page. The difficulties (and outright failures) he’s suffering at Twitter have gotten projected onto Tesla.

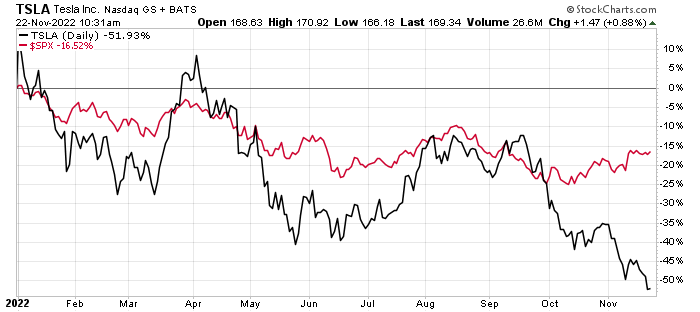

As you can see in this chart, Tesla shares underperformed the S&P 500 Index, the standard measure for the stock market, by 35% since the beginning of the year:

That’s terrible. And it highlights the problem of evaluating risk.

We couldn’t know that the CEO of an exciting electric car company would go rogue.

We also couldn’t know that his ham-fisted attempts to manage Twitter would have such negative effects on Tesla.

That’s why we recommend trailing stops on our positions. A 30% trailing stop would have saved investors from a big loss on Tesla.

This story illustrates just how frustrating investing can be.

Tesla, on its own merits, is an exciting company. Its technology changed the way we think about cars and energy.

It should be a fantastic investment. And it likely will be.

But as long as the CEO acts like a buffoon in public, it has substantial risk associated with it.

The positive thing about this decline is that the risk will probably fade quickly.

Musk will go quiet, and Tesla shares will move on their own merit again.

At that point, Tesla will look like a great investment again.

Good Investing,

Matt Badiali

Numbers to Know

40%

The reduction in labor for building an electric vehicle (EV) compared to a gas-powered car, according to Ford CEO Jim Farley. Ford aims to reach 50% EV sales by 2030. “If Henry Ford came back to life, he would have thought the last 60 years weren’t that exciting. But he would love it right now because we’re totally reinventing the company,” Farley said. (CleanTechnica)

87,560%

How much shares of energy drink company Monster Beverage (MNST) increased in value from 2000 to 2020. MNST is the top-performing stock of the 21st century so far, even beating tech superstars like Apple and Tesla. (Benzinga)

$1.6 billion

The amount EV manufacturer Polestar received to fund the production of its electric SUV, the Polestar 3. Volvo is providing an $800 million loan, while another $800 million is coming from PSD Investment. Polestar CEO Thomas Ingenlath says the company now has sufficient funds until 2023. (electrive.com)

What’s New in Sustainable Investing

VW’s plans to catch Tesla fading with key $2B Trinity EV facility up in the air

Volkswagen’s strategy to accelerate EV production close to what Tesla is achieving has hit a roadblock. The company announced in March that it would build a $2.2 billion manufacturing facility for its Trinity EV, but according to new reports, CEO Oliver Blume wants to scrap the new facility. The Trinity EV will now likely launch closer to the end of the decade rather than 2026 as originally planned. (electrek)

See the electric Lucid Gravity SUV, a Tesla rival that will have seven seats and more range than any competitor

Lucid Motors gave the world its best glimpse yet at the Gravity, a luxurious electric SUV coming soon that takes aim at the Tesla Model X and BMW iX. The Gravity will have a spacious interior and options for five, six, or seven seats. Lucid also promises that the SUV will have more range than any other EV except its Air model, which has an astonishing 520 miles of range. (Business Insider)

Links We Like

“A U.S. agency seeking to restore habitat for endangered fish gave final approval on Thursday to decommission four dams straddling the California-Oregon border, the largest dam removal undertaking in U.S. history.” (The Guardian)

“This year is shaping up to be the worst time for white-collar tech workers since the dot-com bubble burst. [But] the green-tech sector, which is riding a high of increased demand and government funding, is particularly eager to recruit some of these laid-off and highly skilled workers.” (Slate)

“After days of intense negotiations […] countries at the latest UN Climate Change Conference, COP27, reached agreement on an outcome that established a funding mechanism to compensate vulnerable nations for ‘loss and damage’ from climate-induced disasters.” (UN News)