The Smart Way to Play the EV Trend

By Matt Badiali

Over the last decade, the U.S. didn’t increase its energy generation capacity.

It wasn’t necessary to add capacity. We consume about the same amount of electricity as we did in 2006.

But that’s about to change. And there are great investment opportunities in this space.

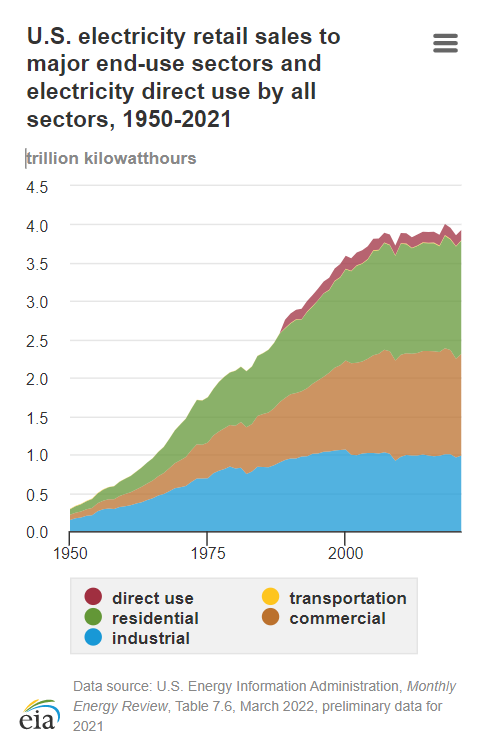

In 2021, the United States consumed 3.9 billion megawatt-hours of electricity. That’s about 13 times more electricity than we used in 1950.

The highest annual consumption occurred in 2018, at about 4 billion megawatt-hours.

As you can see in this chart, that was a small peak on an otherwise flat part of the curve:

According to the Energy Information Administration, U.S. energy use will grow by about 1% per year through 2050.

To put that in perspective, the U.S. consumes about 11.7 megawatt-hours of electricity per person annually. An individual in the U.S. uses nearly twice the electricity as a German, and five times more than a Brazilian.

A growth rate of 1% per year is equal to all the power consumption of New Zealand added every year.

By 2050, our electricity usage will grow by 33% – or 1.3 billion megawatt-hours. That’s like adding the power consumption of India to the U.S. in under 30 years.

And one tech trend will account for a large portion of that increase: electric vehicles (EVs).

The Rise of EVs Is a Huge Opportunity for Investors

According to statistics firm Statista, EV charging demand will jump from 4 million megawatt-hours in 2020 to 107 million megawatt-hours in 2035.

That means EV charging will make up 20% of the growth in power demand over the next 13 years.

That will require considerable changes to our infrastructure.

Where I live, Teslas and other EVs are common sights. But there are few public chargers.

If the estimates are accurate, the next five to 10 years should bring many new EVs, and new charging stations too.

That trend launched a handful of new exchange-traded funds (ETFs) like the:

- Fidelity Electric Vehicles and Future Transportation ETF (FDRV).

- iShares Self-Driving EV and Tech ETF (IDRV).

- Global X Autonomous & Electric Vehicles ETF (DRIV).

- Simplify Volt RoboCar Disruption and Tech ETF (VCAR).

- SPDR S&P Kensho Smart Mobility ETF (HAIL).

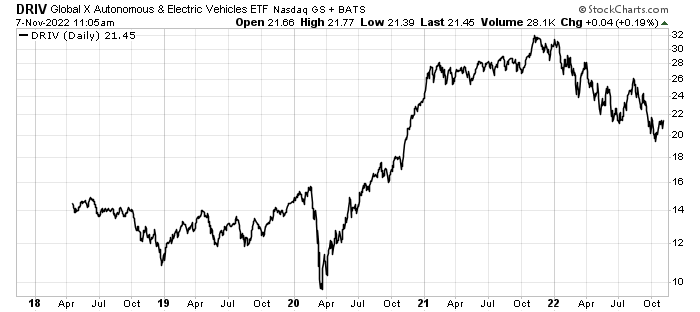

DRIV is the largest of those funds, at just over $800 million in market value. It launched in 2018.

DRIV soared higher in 2020, as you can see from this chart:

However, in 2022 DRIV has followed the market lower. Shares are now down more than 30% from their 2021 peak and continue to decline.

We aren’t adding any electric vehicle companies to our New Energy portfolio… yet.

And as we discussed earlier with the Lordstown Motors essay, this is a risky part of the market.

Today, we’re more interested in the “picks and shovels” of this trend. We know this sector of the market is growing.

We don’t want to try to pick the winners of the EV race. Instead, we want to own the companies that sell materials to those EV companies or electricity to EV owners.

That’s a great way to play this trend, and opportunities abound.

Good Investing,

Matt Badiali

Numbers to Know

$75 million

The payout won by Texas furniture store owner Jim “Mattress Mack” McIngvale. Earlier this year he bet $10 million that the Houston Astros would win the World Series – a prediction that came true as the Astros beat the Philadelphia Phillies on Saturday. According to Caesars Sportsbook, it’s the largest payout in sports betting history. (ESPN)

$2.04 billion

The size of the record-breaking Powerball lottery jackpot. A lone winning ticket was sold at a Joe’s Service Center in Altadena, Calif., lottery officials said Tuesday. The odds of matching all six winning numbers were 1 in 292.2 million, according to the Multi-State Lottery Association. (CNN)

$2.22 trillion

The total market value of Apple (AAPL) shares as of Tuesday’s close. Last week, the iPhone maker briefly had a higher valuation than Alphabet, Amazon, and Meta combined. Apple’s market cap is larger than the gross domestic product (GDP) of Italy, Brazil, and Canada. (Entrepreneur)

What’s New in Sustainable Investing

Canada kicks out Chinese companies from lithium mining

Three Chinese companies have been ordered to sell lithium mining assets in Canada after the country’s government imposed limits on foreign involvement in supplying “critical minerals” used in batteries and high-tech products. Lithium, rare earths, cadmium, and other minerals are used in emerging technologies such as mobile phones, wind turbines, solar cells, and electric cars. (Autoblog)

EU says it has serious concerns about Biden’s Inflation Reduction Act

The landmark $369 billion climate and energy bill includes tax credits for electric cars made in North America and supports U.S. battery supply chains. As a result, the European Union is worried about potential new trade barriers on European electric vehicle producers. EU officials will present a document to the U.S. listing nine tax credit provisions that it has an issue with. (CNBC)

Links We Like

“‘The warming seas are starting to swallow our lands – inch by inch. But the world’s addiction to oil, gas, and coal can’t sink our dreams under the waves,’” Tuvalu Prime Minister Kausea Natano said in a statement.” (CNBC)

“Planting milkweed in your own outdoor spaces is not only a way to help [monarch] butterflies, but it’ll also upgrade your garden or windowsill with beautiful, low-maintenance wildflowers.” (Popular Science)

“Recessions make us do dumb things with our money. Here’s how to keep a cool head and avoid the bear traps.” (Business Insider)