There is a New Energy Revolution Happening Right Now

There is a New Energy Revolution Happening Right Now – We Need to Invest in It.

I hope you had an enjoyable Thanksgiving, however you chose to spend it. We hosted three families this year. It was high-spirited, fun, and exactly what we needed to close out 2022.

And after the holiday, I got to do one of my favorite things… binge-watch college football.

I admit, college football is my favorite sport. It doesn’t get a long season compared with the ones in sports like baseball or basketball. So, this weekend, I camped out.

I’m not a big TV guy – I have too many other interests – except during college football season. (My wife and kids are always watching some new series. Lately, Derry Girls and The Great British Baking Show seem to be playing constantly. I rarely make it through an episode.)

College football is played for a short stretch of time – from September to the end of November. And this was the last weekend of regular season games. So, like many of us, I warmed up a plate of leftovers and got to it.

As I watched the parade of commercials that go along with any sporting event these days, I picked up an interesting trend. About every third commercial was a car ad. And all the cars advertised were electric vehicles (EVs). All of them.

This trend isn’t exactly new. GMC ran an ad for its “Quiet Revolution’ 2022 electric hummer” during the Super Bowl in February 2022. But it was the saturation of EV commercials this season that blew me away.

The new commercial for Chevrolet’s EVs seems to be everywhere right now. It features a song by Fleetwood Mac and shows a fleet of new cars. The company offers its Bolt, Blazer, Equinox, and Silverado models in electric. Some of these versions just launched, and Chevy is advertising them heavily.

I found that interesting – the car makers are selling electric vehicles to football audiences. According to marketing experts at Colormatics, American football fans meet the following criteria:

- 59% male

- 70% between the ages of 18-49

- 68% college educated

- 54% make over $75,000 per year

- 47% Republican

This is the oldest fanbase of any major sport – 55% of viewers are over 35 years old. It also has the highest income of all the sports demographics.

That’s what the car makers decided to target for EV ads. And it’s working. Through the first three quarters of 2022, electric car sales are up 38% over last year – roughly 577,584 sold according to Electrek’s industry data.

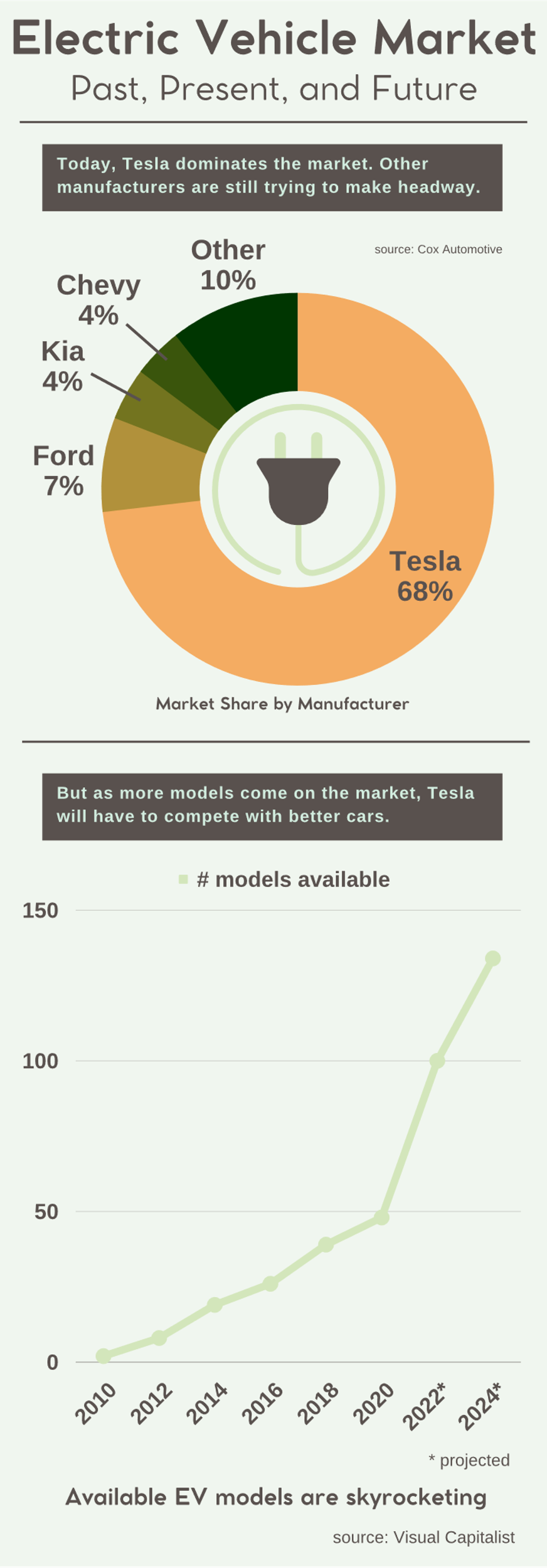

According to Cox Automotive, publisher of AutoTrader:

Electric vehicles continue to be the hot segment in the U.S. market, far outpacing the rest of the industry in terms of sales and share growth and consumer interest. A record number of EVs were sold in Q3 – more than 200,000 sold in a three-month span, a first – and new entries continue to gobble up share. Tesla is still the lead brand when it comes to EV sales, but strong growth from the Hyundai Motor Group, Ford and others continues to diversify the growing EV market.

The EV revolution is here.

And it will continue as more options come to market. It’s amazing to think that in 2010, there were just two models available. By 2015, there were 21 electric models. And by 2024, there will be as many as 134 models on the market.

But as with any industry, it isn’t without growing pains. You can read about my colleague Mike’s experience at charging stations at The Grove.

But we aren’t investing in carmakers right now. Instead, we are going to look up the chain for better options.

New Federal Incentives Juice EV Supply and Demand

There is little argument that the current administration wants EVs to succeed. The Biden Administration’s federal agencies have bought five times as many EVs this year as they did in 2021.

The administration set a goal of 100% of all new light-duty federal vehicles being zero emission by 2027. And Bloomberg recently reported that it expects 50% of all new car sales to be zero-emission vehicles by 2030.

In order to meet that goal, the administration passed legislation providing tax breaks for electric vehicles that meet certain criteria.

While this assistance isn’t the reason electric vehicle sales are rolling, it is driving manufacturing growth in the U.S. But the tax breaks require the vehicle manufacturers to meet some difficult criteria, including assembly in North America.

Half the tax credit also comes with a “critical minerals requirement.” That means companies need to source battery metals either from the U.S. or from a country that has a free-trade agreement with the U.S.

There are 20 countries that currently have those free-trade agreements in place. The ones below produce critical battery metals:

- Australia (Ni, Cu, Li, Rare Earths)

- Canada (Ni, Cu, Pb, Zn)

- Chile (Cu, Li, Pb, Zn)

- Columbia (Ni, Cu)

- Guatemala (Ni)

- Mexico (Cu, Pb, Zn)

- Morocco (Cu)

- Nicaragua (Cu, Pb, Zn)

- Oman (Ni, Cu, Pb, Zn)

- Panama (Cu)

- Peru (Cu, Pb, Zn)

That’s an interesting twist on sourcing material for EVs and batteries. It means that companies operating in these countries will get preferential treatment by EV makers working in the U.S.

We already own copper in the U.S. through our position in Ivanhoe Electric (NYSE: IE). And Capstone Copper (TSX: CS) has projects in the U.S., Mexico, and Chile. So, we are well positioned to take advantage of that focus.

However, the copper market is global. And increased U.S. demand on the metal from these countries will only make the rest of the world turn to other countries. That means we can target the best copper deposits in the world and do well.

What the EV Revolution Means for Basic Materials

All these new cars need batteries. And that will put a massive strain on the supply chain.

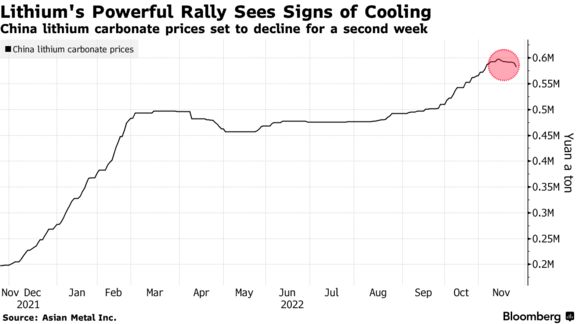

The most illustrative data point is the lithium price. According to Bloomberg, the price of lithium in China tripled over the past year:

And while the price took a break recently, this trend will develop in all the raw materials needed to build these batteries.

To get part of the tax break, the batteries also need to be made in the U.S. And manufacturers are looking to supply these batteries. Honda and giant electronics maker LG plan to invest $4.4 billion to make EV batteries in Ohio.

According to Bloomberg, the new plant will begin construction next year in southwestern Ohio. It will create 2,200 new jobs and begin production in 2025. And that’s just one of many.

This will be a dramatic escalation of copper demand. These plants will focus on buying copper from that list of countries above. But as I said, the copper market is global. If we see extra copper demand, the price will go up globally, not just from the countries that the U.S. focuses on.

Buying a High-Quality Copper Deposit in Ecuador for 36 Cents on the Dollar

When I first met Christian Kargl-Simard, the CEO of Adventus Mining (TSXV: ADZN; OTCQX: ADVZF), in 2016, I thought he was young and very smart. We traveled to Ireland together to review zinc projects with the Altius Minerals team. Altius planned to create a new base metals company. And I was invited to see its formation. At the time, I didn’t know he was going to be leading the company.

We had many hours to discuss the mining business. I quickly recognized that this young engineer-turned-banker was an expert in the base metals markets.

Altius Minerals has some of the smartest operators in the mining space and it’s the parent company of Adventus. That team hand selected Christian to run Adventus. And they made an excellent choice.

It has 166.4 million shares outstanding and C$24 million in cash on hand. There are 31.3 million warrants outstanding.

The company’s original focus was on zinc. But not long after going public, the company pivoted into copper when the opportunity came. And in the process, the team acquired an unbelievable copper-gold deposit in Ecuador called El Domo.

As I hinted at earlier, Ecuador doesn’t meet the current criteria for the EV tax credit.

That’s ok.

Copper is a global market and demand will only increase. According to Paola Rojas, CEO of Synergy Resource Capital, copper is the third largest metal market after iron and aluminum. And the rising demand we see will continue to make it more valuable.

Our expectations, as I’ve said before, are for the copper price to mimic lithium and palladium as demand continues to climb and supply lags behind. That’s why we want to own undeveloped world-class copper projects.

Adventus is also part of what we call the “New Mining” group of companies. I discussed it at length in our September issue, “The World’s Greatest Mining Entrepreneur Strikes Again.”

The company embraces best practices in the form of social engagement and sustainability. It sources all the power for El Domo from hydroelectric dams. And the project will bring $600 million in economic development to the area through taxes, investment, and royalties.

More importantly, Adventus and its partners engaged the community in a discussion of water use. This is a critical aspect of building a mine in Ecuador – how to positively impact the community’s water supply. This dialogue will reduce risks for mine construction and operation because it creates an open line of communication to the community. That’s great.

The recent share price bump came from the Ecuadoran government approval of the development of El Domo. The agreement came with a series of deal sweeteners – 5% reduction in income tax tariff, waiver of capital outflow tax, waiver of import duties, and a tax freeze for the life of the contract.

It was a major milestone and the share price reacted accordingly. But shares are still well below their 2021 high.

And even though the shares are cheap, El Domo gets more valuable as we approach production.

The team expects construction permits to come in by June 2023. Construction will begin when the company receives the permits. First concentrate production is forecast for the first quarter of 2025.

As the company completes each milestone, El Domo gets closer to production and more valuable. Today we can buy the world-class El Domo copper-gold project for 36 cents on the dollar and get the rest of Adventus for free.

Adventus would be worth owning right now if it only held El Domo and nothing else.

Action to Take: Buy Adventus Mining (TSXV: ADZN) up to C$0.75 per share. Be prepared to hold these shares up to two years. And don’t be concerned by short term movements in the stock.

Our biggest risk with a position in Adventus comes if the company doesn’t get its construction permit. If that happens, we will revisit this position. Short of that, this is a stock to buy and hold. El Domo only gets more valuable as it gets built.

This should be a boring and highly lucrative investment if it goes well.

The EV Revolution Is a Big Story in New Energy – We’ll Be Investing in it Heavily

I’m amazed at the speed that the world’s automakers have embraced EVs. Make no mistake, this will eat at the demand side of the oil-price equation.

The U.S. is the world’s largest consumer of oil. And 60%-plus of that consumption comes from personal automobiles. As more people turn to EVs, demand for gasoline will begin to erode.

This is a turning point in the history of energy use. We need to follow the story closely.

It’s not an immediate impact and it may not be inevitable… We’ll have to see how the EV market grows. But the current data indicate a strong adoption of these new vehicles. And anecdotally, the number of Teslas I see on my local roads has risen enormously over the past couple of years.

My suspicion is that the use of these vehicles will grow exponentially over the next few years. If I’m right, investments in companies like Adventus will make us a lot of money.

For the Good,

Matt Badiali