This Metal’s 3,100% Rally Shows What’s Coming Next

Your money in a savings account today is like an ice cube on the sidewalk: It’s getting smaller.

Bankrate.com says the best savings account pays about 2.2%. But the U.S. has 8.5% inflation, according to the Labor Department.

That means every dollar you have in a savings account earns 2.2 cents in interest but loses 8.5 cents to inflation.

So your net return is a 6.3 cents loss for every dollar you have in the bank.

That’s terrible. It’s why so many people turn to the stock market.

But the stock market is tough. I know firsthand because I went from academics to finance in 2005. You can read about my learning curve here.

It’s important to understand why you want to own a stock. That’s what drew me to this career in the first place.

I love research and numbers. And teasing out trends in data is like an Easter egg hunt. When you get it right, the reward is a bonus in your trading account.

And that feels really good.

As I told my New Energy readers on Friday, there’s a big trend right now.

But it’s a long-term trend. And it’s not as popular as the “get rich quick” schemes that dominate the news.

The thing is, this trend will make investors a lot of money if they prepare.

To understand what’s coming, you have to understand the evolution of palladium.

Palladium was always the “little brother” of platinum. Where platinum jewelry blew up, palladium never did.

Instead, it became the substitute for platinum in technology. And it has a lot of uses.

The metal acts as a catalyst, which means it makes chemical reactions more efficient. That’s why palladium is the critical part of cars’ catalytic converter.

In technology, they use it to coat electrodes of capacitors in laptops and cellphones.

It also combines with hydrogen to form a stable palladium hydride. That allows hydrogen storage without the risk of explosions.

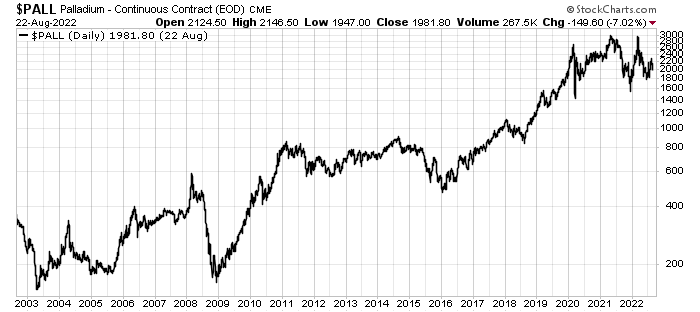

This incredibly useful metal was as cheap as $90 per ounce in 2003. It exceeded $2,900 per ounce in early 2022:

That’s more than a 3,100% increase in price. Every $1,000 worth of palladium was worth $31,200!

It’s an incredible move in the price of a metal. It happened because the world needed palladium, and there wasn’t enough supply to go around.

Yet the price of things like laptops and cars didn’t flinch. That’s because the amount of palladium was minor compared to the price of the rest of the components.

That’s about to happen to another metal – copper.

There’s no way we can meet the demands for electrification without the price of copper going much higher.

All we have to do is look at palladium to see the road map for what’s coming.

The good news is that there are many copper producers with strong business models. We recommend several in our New Energy newsletter.

And our September issue will feature a company that combines copper exploration with a forward-looking, sustainable corporate culture.

The newsletter isn’t open to the public just yet. But stay tuned for more info about New Energy and how you can become a subscriber.

Anyway, here’s this week’s latest news…

Numbers to Know

2

Number of additional shares Tesla investors will receive for each one they already owned as of Aug. 17. Shareholders approved the 3-for-1 stock split a few weeks ago. The last time Tesla’s stock split was in Aug. 2020 – afterward the stock rallied over 130% in just five months. (CNBC)

$10,000

Amount of student loan debt the federal government will forgive. The Biden administration said the debt relief will apply to individuals who make $125,000 or less and for households that earn $250,000 or less. Borrowers who received Pell Grants could be eligible for an additional $10,000 in debt forgiveness. (Yahoo Finance)

9 million

Number of jobs that Congress’ $369 billion climate and clean energy bill will create over the next decade. The Political Economy Research Institute estimates the bill will fund 5 million jobs in clean energy, 900,000 in clean manufacturing, 900,000 in efficient building, and over 2 million in other types of work. (Corporate Knights)

What’s New in Sustainable Investing

Ford signs record-breaking renewable energy deal

The Detroit-based auto giant announced an agreement with energy provider DTE Energy to add 650 MW of solar energy by 2025. The deal marks the largest-ever renewable energy purchase from a U.S. utility. It will let Ford run its entire Michigan operations on 100% clean energy, eliminating as much as 600,000 tons of CO2 emissions. (ESGToday)

Rivian posts $1.7 billion loss in electric vehicle flop

The electric vehicle startup has struggled with supply issues since the beginning of the year. It said “unprecedented levels of inflation” and “increased costs” have affected production of the California-based company. However, Rivian confirmed that it’s still on target to produce 25,000 vehicles by the end of 2022. (LinkedIn)

Links We Like

“Research suggests that more than 40% of the world’s fleet of containerships could be electrified ‘cost-effectively and with current technology’ by the end of this decade.” (pv magazine)

“When it’s time to replace the huge turbine blades that convert wind into electricity, disposal is a problem. Now, scientists report a new composite resin suitable for making these behemoths that could later be recycled into new turbine blades or a variety of other products, including countertops, car taillights, diapers, and even gummy bears.” (ACS)

“A new study shows that the average American dramatically underestimates how much their fellow citizens support substantive climate policy. While 66% to 80% of Americans support climate actions, the average American believes that number is 37% to 43%, the study found.” (Princeton University)