Urban Mining Is the New Frontier for Battery Metals

I hated mowing the lawn … until last year.

While I never really loved it, my complete loathing ramped up in the late 2000s. That’s when the U.S. phased out methyl tert-butyl ether as a fuel additive. The authorities replaced it with ethanol. That was really when my strong dislike of lawn care exploded.

And to be fair, it wasn’t just my lawn mower. It was my trimmer, my chain saw, and my pressure washer too. Because those small engines can’t handle the ethanol gasoline.

I spent more time caring for the motors of those beasts than I did actually using them. I bought fancy fuel stabilizer. I purged the motors before I put them away. (And the one time I didn’t, I had to have my lawn mower motor completely rebuilt.)

That’s because ethanol is a terrible fuel additive. And the scientists knew it was bad.

Back in 2013, Marv Klowak, global vice president of research and development for Briggs & Stratton, the largest manufacturer of small engines, told Consumer Reports:

“Ethanol has inherent properties that can cause corrosion of metal parts, including carburetors, degradation of plastic and rubber components, harder starting, and reduced engine life… The higher the ethanol content, the more acute the effects.”

Since then, the data has piled up. Ethanol kills small engines. Classic car and boat owners, in particular, hate the stuff.

According to Junkyard Mob, an “uncensored vehicle news” website, ethanol can destroy gas tanks, fuel pumps, and gaskets. In addition, it attracts moisture into the fuel.

Ethanol gasoline single-handedly ruined my relationship with my power tools.

There was another choice. I could seek out one of the two gas stations in my town that sold ethanol-free gasoline. That’s not ethanol-free gasoline at every pump, that’s a single pump at two different gas stations. And that’s a five-mile area around me.

Those pumps get used primarily for boats. And nothing makes me happier (sarcasm) than waiting to fill up a two-gallon container in line behind a 30-foot boat.

Not to mention, non-ethanol gasoline is expensive. It can cost up to 15% to 20% more per gallon than regular gasoline.

I bumbled along for years, treating my tools carefully and changing the gasoline in the cans every few weeks. It got to be a sore point, as you can imagine.

But then, last Father’s Day, my wife bought me a new lawn mower. I immediately got rid of all my gear and put my old self-propelled mower on the curb.

The new mower is as light as a feather. It’s quiet. And it cuts like a dream. It’s electric but cordless. It takes a battery about the size of my two fists … and I can cut the whole lawn.

The clouds parted, and the sun is shining on my lawn once again.

They finally made battery-powered tools that aren’t toys.

It’s just the next big step forward for electrification.

Up until this purchase, I wasn’t a fan of battery-powered stuff other than my laptop and a cordless drill. That was about it. The electric bikes, scooters, and skateboards seemed like a fad.

But they haven’t gone away. And now the battery technology is moving into real utility (for me). I’m going to sell my weed eater next.

According to The Washington Post, I’m part of a “revolution” in electric lawn care. The paper cites the public works department of the city of Mountain Brook, Alabama: It switched from gas to battery power for its mowers, weed eaters, blowers, and even chain saws. According to the article, Mountain Brook spent $18,000 to move to electric lawn equipment. Mayor Stewart Welch aims to be 90% electric within five years.

That trend mirrors the overall movement in North America. According to Stanley Black & Decker:

“The volume of electric-powered lawn equipment that North American manufacturers shipped jumped from about 9 million units in 2015 to over 16 million in 2020.”

The U.S. Environmental Protection Agency estimates that, in the U.S. alone, we consume over 3 billion batteries every year. And that volume will only increase with all the new battery-powered tools and cars coming on the market today.

According to MarketResearch.com, battery-powered lawn equipment demand is growing three times as fast as gas.

According to tractor manufacturer John Deere’s mass channel business sales manager Sean Sundberg, battery-powered riding lawn mowers are the next big thing. He cites the ease of use as a major reason for adoption – all the same reasons I love my mower.

But it isn’t all sunshine and roses with batteries.

The shift to battery power creates a whole new set of problems. These batteries need totally different materials from gas-powered motors. First, they need a lot more metals like lithium and copper. The demand has already sent the price of both metals soaring.

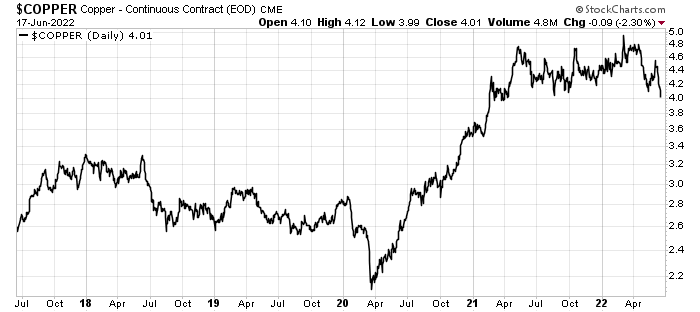

The copper price has risen 49% since 2019. That’s due in part to flat production growth during the pandemic and the snarl of global trade preventing the metal from getting where it needed to go. At the same time, global copper consumption grew from 23.6 million metric tons in 2019 to a forecasted 25.1 million metric tons in 2022. That’s a modest 6.4% growth. But tight supply caused the copper price to soar.

And it’s not just copper. The lithium price has soared 517% since June 2019.

Demand will continue to grow – spurred by new battery demand. And that means we need more supply.

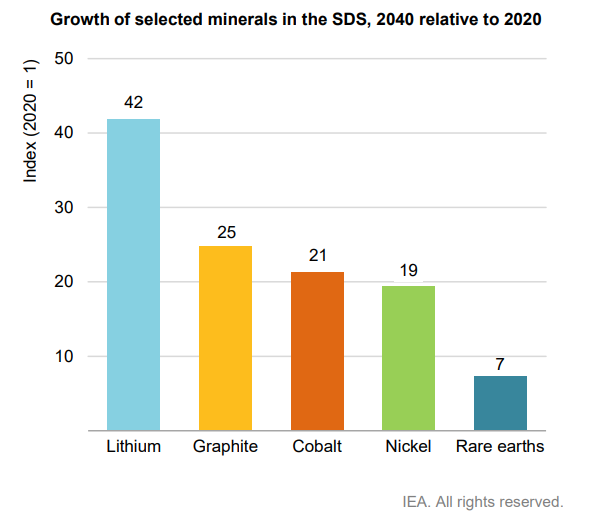

The forecast for lithium demand is borderline crazy. In the International Energy Agency (IEA) report titled “The Role of Critical Minerals in Clean Energy Transitions,” experts forecast demand for battery metals like copper, cobalt, and lithium.

In the table, you can see that the analysts forecast the demand for lithium will rise 42 times today’s amount by 2040. And it isn’t just lithium. The world needs 25 times more graphite, 21 times more cobalt, and 19 times more nickel.

It will be difficult to meet that demand through mining alone. And it will be nearly impossible to meet lithium demand. Here’s why…

In 2020, the world used about 70,000 tons of the metal. To meet the IEA’s forecast, we’d need to produce almost 3 million tons of lithium per year.

And the data supports the rapid growth in demand. In 2021, demand jumped 33% from 70,000 tons to 93,000 tons.

The problem is, we only produced 100,000 tons of lithium in 2021. That’s a skinny margin of supply over demand. And while demand jumped 33%, supply only ramped up 21% from 2020 to 2021.

According to the U.S. Geological Survey’s (USGS) “Mineral Commodity Summaries 2022”:

“Lithium supply security has become a top priority for technological companies in Asia, Europe, and the United States. Strategic Alliances and joint ventures among technology companies and exploration companies continued to be established to ensure a reliable, diversified supply of lithium for battery suppliers and vehicle manufacturers.”

The lack of supply, combined with the long-term demand for lithium, sent its price soaring. According to that same USGS report, a ton of lithium from China rose from $7,000 per ton in January 2021 to about $26,200 per ton in November 2021.

That kind of price volatility opens doors to all sorts of lithium supplies. One of those new sources of lithium is “urban mining” – otherwise known as recycling. In California, the government made it easy to recycle small rechargeable batteries. These aren’t the kind used in cars. They are like the ones in my new lawn mower or my rechargeable drills.

In 2020 alone, the state recycled more than 204 tons of lithium-ion batteries, over 126 tons of nickel-cadmium batteries, and nearly 39 tons of nickel metal hydride batteries.

That’s just in California and without electric vehicle batteries.

But not all batteries get recycled. When we add up all the battery waste around the world, the numbers get huge.

It’s called the “Global End of Life” problem. To put it simply, about 460,000 metric tons of lithium-ion batteries die annually (as of 2020). There is a huge opportunity to “mine” that waste stream.

And that’s why we love this company we are about to introduce you to. It’s the leading North American battery recycler. And it’s just building out its business now. That means we can get in early, and our investment will grow with the company.

We think this company will be a behemoth in the near future.

Let’s take a look…

Solving the Global End of Life Lithium-Ion Battery Challenge

Li-Cycle is a $1.3 billion market cap battery recycling company. This is a relatively young company (Tim Johnston and Ajay Kochhar founded it in 2016), and it listed on the NYSE in August 2021.

Recycling technology will be in huge demand in the near future. And Li-Cycle is well out ahead of the pack.

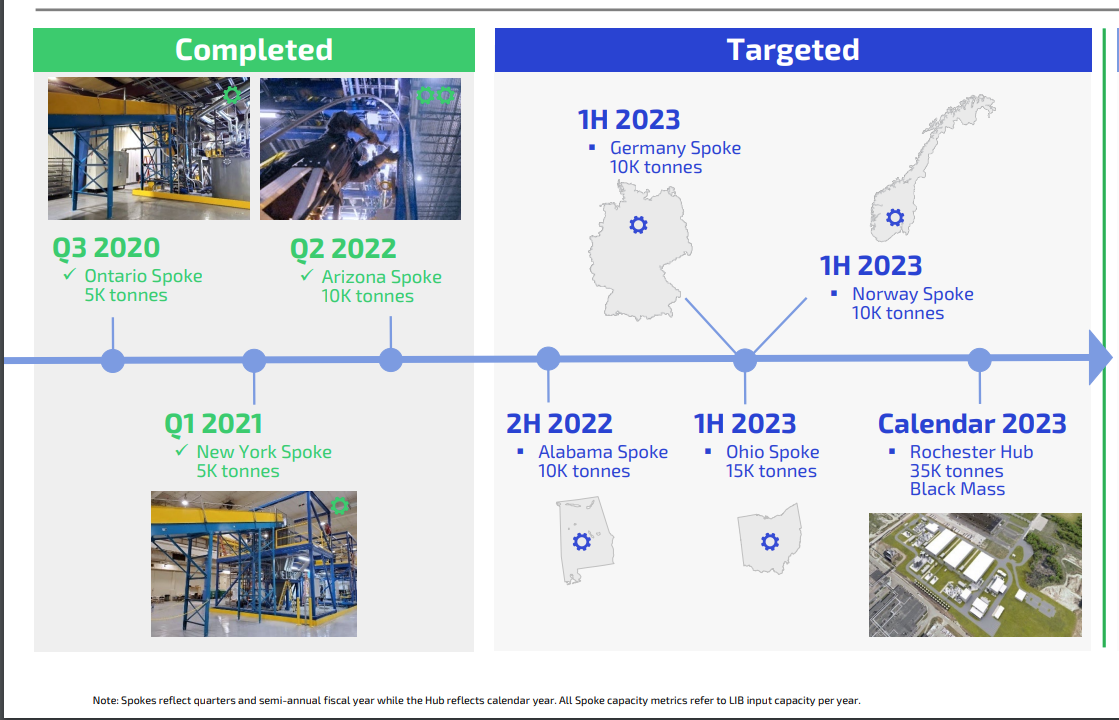

The company plans to build a series of recycling intake centers (called “spokes”) around North America. There, workers will strip out and sort batteries. The presorted material is then shipped to a hub for refining and resale.

The company’s “hub and spoke” system allows them to collect material from all over the U.S. and Canada.

Another point that increases our confidence in this investment is management’s execution of its plans. The team announced some huge advances over the second quarter of 2022:

- Long-term commercial agreements with leading battery metals companies that name Li-Cycle as the preferred recycling partner.

- Arizona Spoke is now operational, along with Ontario, and New York.

- Alabama and Ohio Spokes in development.

- Rochester Hub will commission in 2023.

- 6,500 to 7,500 metric tons of recycled metal targeted for 2022.

Four North American spokes will be in operation in 2022. That will generate three times the volume of recycled material (called “black mass”) vs. 2021. Li-Cycle also has two European spokes in development. Located in Norway and Germany, these spokes will produce 10,000 metric tons of recycled material per year, each.

Below, you can see Li-Cycle’s development timeline through 2023:

To put that in perspective, in the second quarter of 2021, the company produced about 300 metric tons of black mass from recycled batteries. In the second quarter of 2022, Li-Cycle produced over 700 metric tons of black mass.

Over that period, revenues jumped from $300,000 in 2021 to $8.7 million in 2022. As the new spokes and hub come on stream, those numbers will jump even further. That’s our opportunity, as shareholders.

In summary, the company’s financials are solid. It has enough cash to build out its current projects. And it has major partners like Glencore and LG backstopping its plans.

Our biggest risk with Li-Cycle (NYSE: LICY) is actually the market. We are in the grip of a bear market, which is clobbering the Nasdaq in particular.

As you can see in the chart below, the Nasdaq erased all of its gains back to September 2020:

And that decline will hit money managers hard. The risk is that as the market falls, investors pull their money out of funds. As the money managers get these redemptions, they must sell shares to raise capital. And when that happens, they sell everything – particularly stocks that haven’t fallen far.

That’s the risk to Li-Cycle. About 25% of its shares are held by institutions like giant banks BNP Paribas, Invesco, First Trust Advisors, and Covalis, among others. If those companies must raise cash, they could sell Li-Cycle shares. That would push down the share price.

For us, that’s both a positive and a negative. In the short term, we may see shares of LICY fall further. It currently trades around $7.50 per share. That’s about $1.60 (27%) above its 52-week low price.

That means, if we jump into this stock right now, we risk a 27% draw-down if it falls back to that low.

The opportunity is to slowly build a position in Li-Cycle, by buying on down days. That’s a great way to use the down days in the market to get better prices.

In short, the company will continue to do its work and grow. We simply need to have the long-term confidence to buy it here and hold. Li-Cycle has the potential to become a massive player as batteries take off.

Action To Take: Buy Li-Cycle (NYSE: LICY) below $7.55 per share. Our recommendation is to build your position over time. Set your limit order well below the current price and give it a few days. We will discuss the position in the weekly updates.

In conclusion, Li-Cycle is one of those companies that I believe we should hold forever (barring any scandals). We can buy this company now, and not look at it again until 2025. And the best part is, we can use the general decline in stocks today to buy this future blue-chip at a discount.

Good investing,

Matt Badiali