A Great Way to Play the IRA

The Massive Success of the Inflation Reduction Act of 2022 Creates a Huge Investment Opportunity

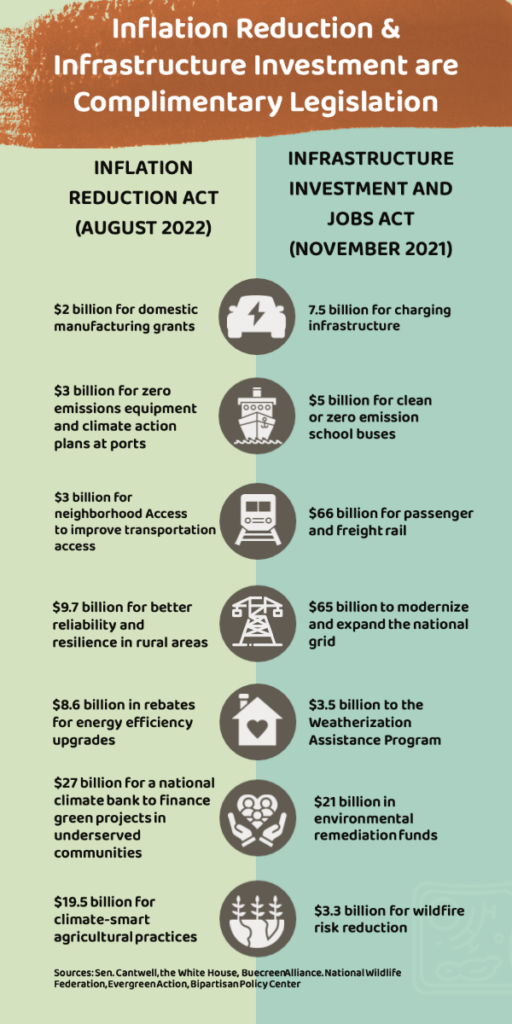

The Inflation Reduction Act of 2022 took a page out of oil and gas law to create a wave of investment into clean energy.

What caught everyone by surprise was the overwhelming success of the program.

As I wrote in a recent Grove essay:

There’s no getting around it, the Inflation Reduction Act of 2022 (IRA) is an unqualified success. In just one year, the law’s tax incentives are working as planned. They spurred massive investments in clean energy – far more than anyone expected.

The IRA is Congress’ largest ever investment in combating climate change. More important, it uses market forces to stimulate growth in the direction they want it to go. That’s stealing a page from support for energy sources like nuclear and oil & gas.

During the first fifteen years of development, nuclear power received about $3.3 billion per year, according to a 2011 research paper by DBL Investors, a venture capital firm. That same report showed that oil and gas received $1.8 billion annually over its first fifteen years.

And that support didn’t stop. Nuclear power receives heavy subsidies from the Price-Anderson Act of 1957(!). That requires the federal government to indemnify utilities in the case of a nuclear disaster. Without that backstop, no one would insure nuclear power, effectively eliminating the entire industry.

Oil and gas’ historic intangible drilling and development tax credit (IDC) goes all the way back to 1913. Designed to attract capital to the high-risk business of oil drilling by allowing businesses to write off:

“…any cost that has no salvage value and is necessary for the drilling of wells or the preparation of wells for production.”

In addition, all minerals are eligible for a depletion income tax deduction. As finite resources, companies can write off the some of the revenue as depletion. This became tax law in 1926 and continues today (with modifications).

Then there are the geological and geophysical expenditures tax credit, the enhanced oil recovery tax credit, the marginal well tax credit, and the passive loss exclusion for working interests tax credit. These are all designed to encourage investment in domestic oil and gas.

These are the precedents that built the foundation for the IRA’s support for clean energy. And no one can argue that the IRA is an unprecedented government handout. We have more than a century of the government lending a helping hand to domestic energy programs.

And like all those programs before it, the IRA is massively popular.

How the IRA Works

According to Aaron Brickman, Senior Principal at the Rocky Mountain Institute:

“The United States is effectively now the most attractive destination for global capital in clean energy and cleantech.”

The rules for getting the tax break ramp up over time. Right now, just 50% of battery components must be made in the U.S. But by 2029, 100% must be made here.

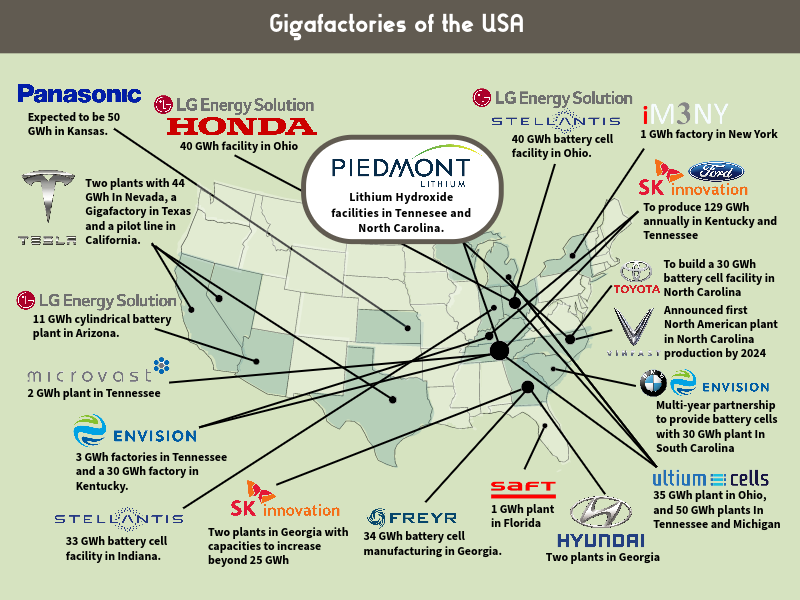

Nearly 100 new clean energy manufacturing facilities or factory expansion were announced in the past year. That’s almost $80 billion in new investments directly attributable to the IRA.

According to the New York Times, the IRA enticed companies to announce 31 new battery manufacturing projects in the U.S. And the math gets crazier. The battery plants will produce 1,000 gigawatt-hours per year by 2030. That’s enough to support 10 million to 13 million electric vehicles per year.

That’s well over the original estimates when the IRA was just a bill. The Congressional Budget Office expected the electric vehicle (EV) tax breaks in the law to generate $14 billion in tax savings for consumers over a decade. With a year’s worth of data, Goldman Sachs just upped that estimate to $393 billion.

And it attracted some major international businesses. According to Reuters, car makers Audi and Tesla, power generation firm Drax Group, and battery maker Northvolt AB all have plans to build manufactories in the U.S., thanks to the IRA.

And it’s not just electric vehicles. Goldman Sachs updated another CBO estimate, this time in wind and solar manufacturing. The CBO projected $37 billion in tax savings over a decade. The latest data from Goldman Sachs is already up to $190 billion.

This is a massive windfall that only just hitting investors. Remember, the IRA is only a year old. And few investors are interested in clean energy.

The key provision of the IRA is that the batteries must be manufactured or assembled in North America. And that will put a premium on battery metals sourced in North America…particularly lithium.

This month, we’re going to evaluate a new lithium producer here in the U.S. – Piedmont Lithium

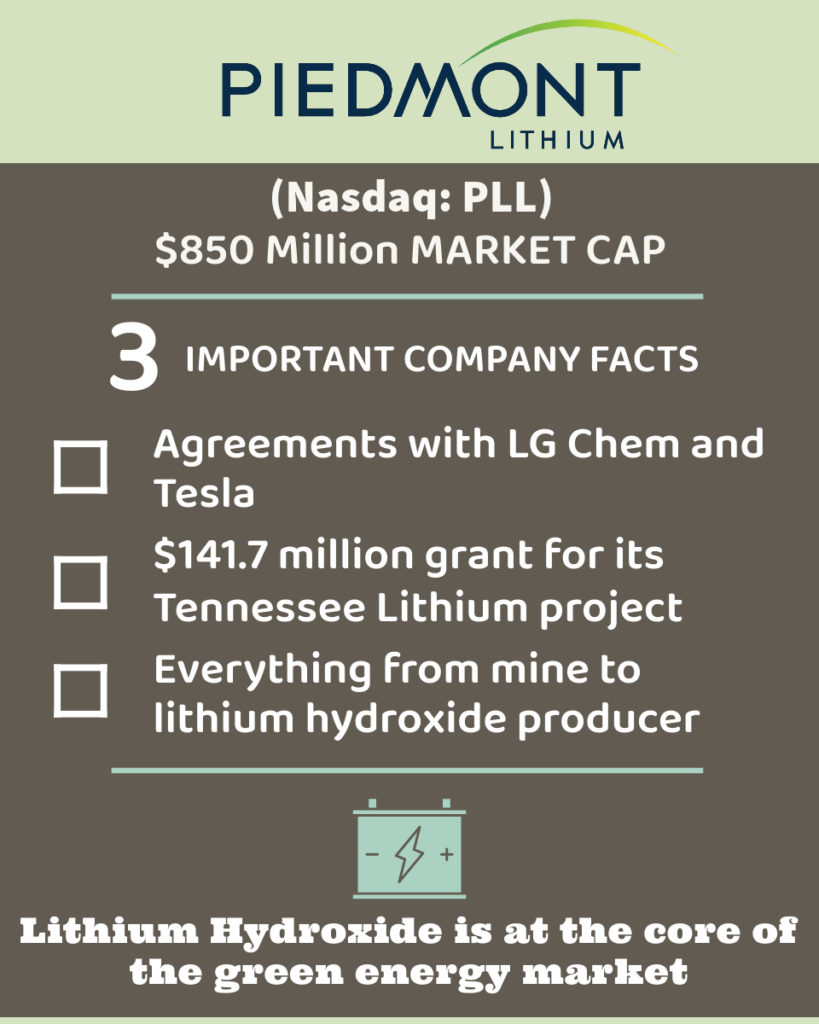

Piedmont Lithium (Nasdaq: PLL) – A Great Way to Play the IRA

Piedmont Lithium (Nasdaq: PLL) has an interesting take on the lithium mining business.

The company plans to be an integrated lithium company – from mine to finished lithium hydroxide producer. The company currently has two offtake agreements in hand, with LG Chem and Tesla.

This is exactly the kind of company that can take advantage of the economic momentum generated by the IRA. As we discussed, the investments in battery plants are far above anyone’s expectations. And those plants need lithium to make the batteries.

That’s where Piedmont can excel.

Lithium sells in three primary forms:

- Mineral concentrates (from hard rock)

- Mineral compounds (from brines)

- Refined metal (lithium hydroxide)

Piedmont plans to both produce and sell concentrate of spodumene (a type of granite with large crystals of lithium). It also plans to build two refineries to sell finished lithium to battery makers.

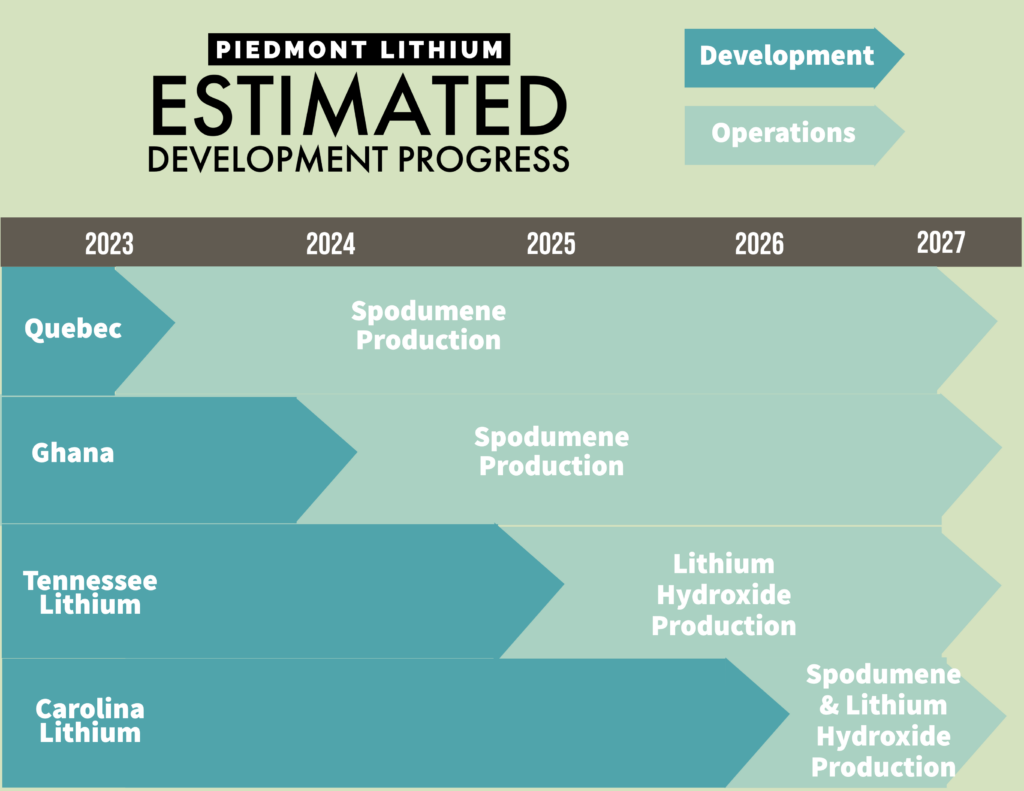

This graphic shows the timeline of Piedmont’s business.

They currently buy spodumene concentrate from Quebec to sell. The company owns 25% interest in Sayona Quebec, a joint venture between Sayona Mining (ASX: SYA) and Piedmont. The North American Lithium Project can produce 226,000 tons of concentrate per year for the first four years. Total mine life is 20 years.

In 2021, Piedmont acquired the right to earn 50% of Atlantic Lithium’s (LSE: ALL) projects in Ghana. The Ewoyaa project should be Ghana’s first producing lithium mine. In June 2023, the company produced a study (Definitive Feasibility Study) showing robust economics. It can produce 3.6 million metric tons of spodumene concentrate per year for 12 years.

Tennessee Lithium will be a world-class lithium hydroxide production facility.

Once complete, the plant will produce 30,000 metric tons of lithium hydroxide per year. That’s double the amount being produced currently in the U.S.

The plant will take spodumene concentrate from Atlantic Lithium’s Ghana mine and produce finished lithium hydroxide. Construction should begin this year.

The Carolina Lithium project will be a fully integrated site. It will include mine, concentrator, and lithium hydroxide conversion plant. It will produce 30,000 metric tons of lithium hydroxide per year once complete. Construction should begin in 2024.

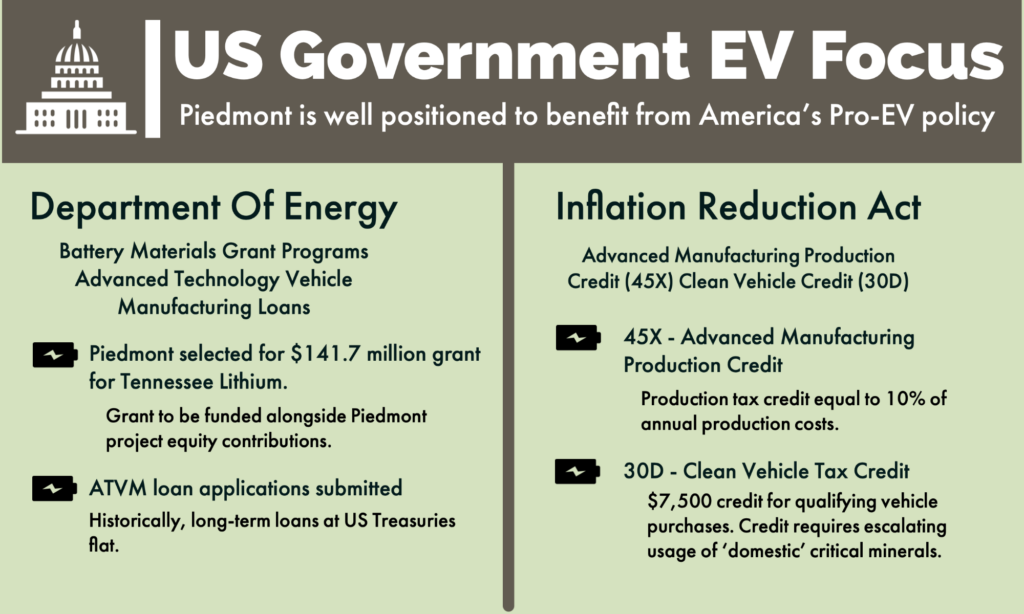

Piedmont is still in early stage today. But in time, the resulting company will be diversified across the lithium production space. They will be in the perfect position to benefit from government incentives on multiple levels.

The U.S. Department of Energy tapped Piedmont for a $141.7 million grant for its Tennessee Lithium project. This is one of the first projects funded directly by the IRA. The grant will support the construction of the $600 million refinery. The Tennessee plant will produce 30,000 metric tons of lithium hydroxide per year.

Piedmont also established a relationship with giant battery maker LG Chem. The company will invest $75 million in Piedmont lithium shares (1.09 million shares at $68.40 each).

The two companies also established a spodumene offtake agreement. Piedmont will supply 200,000 metric tons over four years.

Piedmont has a three-year agreement with Tesla to supply spodumene concentrate.

The company will deliver approximately 125,000 metric tons beginning in the second half of 2023 through the end of 2025.

The price will be determined by the average market price of lithium hydroxide.

The benefit to that business model is that they can use the cash flow generated from sales to offset development costs.

Today, the company has two partnerships with Sayona in Quebec and Atlantic Lithium in Ghana.

What we like:

- Near-term cash flow

- Established offtake agreements with LG Chem and Tesla

- Positioned to benefit directly from IRA

- Integrated lithium company – from exploration to sales

- Projects in Quebec, Ghana, Tennessee, and North Carolina

- Selling to major battery makers like LG Chem

Our risk is that the company hits a pothole during development. That’s actually a common occurrence during development. But the spodumene concentrate sales will help offset any short-term hiccups. We should use a trailing stop, as insurance against something worse.

The company doesn’t make any money yet. But that will start this year. And that will be a huge catalyst for the stock.

Financially, the company is in good shape. It has low long-term debt – just $160,000. It has about $88 million in cash. However, it does have some big bills coming. It has to invest $70 million to earn into the Ghana project. And construction costs for Tennessee and North Carolina are big tickets. However, the cash flow from the second half of 2023 will help offset those bills.

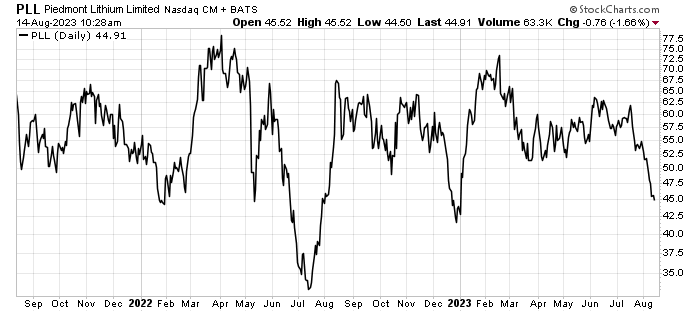

Action to Take: Buy Piedmont Lithium (Nasdaq: PLL) up to $50 per share. This is still well below its recent highs and an 37% discount to LG Chem’s investment. We will use a 30% trailing stop on this position. That means we will sell if shares fall 30% from the highest price after we buy.

Piedmont Lithium has all the hallmarks of a tremendous investment. It has robust projects. It has an economic tailwind. And it has established offtake agreements with major players in the battery markets. I don’t put a lot of stock in price targets, but the big banks think this stock will be north of $90 – $100 per share.

Frankly, I can see that happening as these projects ramp up. That’s why we want to own Piedmont Lithium now.