How an Exchange Traded Fund Shocked the Mining Market

An Exchange Traded Fund Shocked the Mining Market in January and Gave Us a Copper Opportunity

A manmade earthquake swept through the junior mining market in January 2024. It was a heck of a way to start the year.

It was an unnecessary disruption that sent some stocks plummeting and others soaring. The companies’ movements had nothing to do with their fundamentals. It wasn’t because some made discoveries or had setbacks.

Instead, it was about a fund moving its money around.

Let me take a step back.

Investors want baskets of stocks. It’s a great way to play a trend in a sector, without digging into every company in that sector. A basket smooths out the risks of individual stocks. It’s a way to capture the trend of a sector. And it smooths out the company-specific volatility. That’s where exchange traded funds (ETF) come in.

There are a zillion different ETFs to reflect any investor’s interest. I’m convinced that some are just created to see if anyone will buy them.

One of my favorites is the Inverse Cramer ETF (NYSE: SJIM). It does the opposite of whatever CNBC personality Jim Cramer does in the market.

The problem with ETFs comes with the number of shares that need to trade in every company that they own – known as liquidity. It’s a common problem.

Here’s what I mean:

Let’s say you had $50,000 to invest in a stock. And the stock only traded $5,000 per day. We would say that the stock is “thinly traded”. And with that low volume, it means it would take 10 days of trading to accommodate your order…if you bought every share traded every day.

You can see the problem. If you are buying everything, then the rest of the market would be shut out. You created more demand than the supply of shares can manage. That pushes the price up. Sometimes way up.

The same thing happens in reverse when you want to sell. Every trade needs two sides – a seller and a buyer. If there are no buyers, you have to lower your selling price. And with thinly traded stocks, that can cause a meltdown in the share price.

That’s where our opportunity comes from this month.

A junior mining ETF changed its asset allocation model. It went from one group of stocks to another (based on two different indices). So, it had to buy and sell a bunch of companies. It dumped about seventy-four silver and copper juniors.

That’s a problem because this market is tight. Investors aren’t gobbling up extra shares. So, when the ETF sold its holdings, those stocks’ price collapsed.

We’ll get into that further, in a little bit.

But that’s where our opportunity comes from. One of the affected stocks is a copper developer with a great asset. Its going to be a mine and could easily be a takeover target.

The sell off gave us a window to buy the stock at a discount.

The Great Silver Junior Rebalance of 2024

On January 29th, we saw huge volatility among many junior mining companies in the silver, gold, and base metals. Social media blew up, as a fund moved from the Prime Juniors Silver Miners and Explorers Index to the Nasdaq Metals Focus Silver Miners Index.

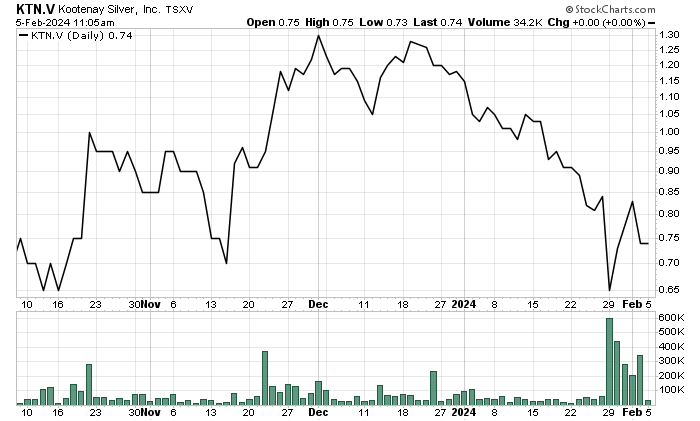

The ETF, called the Prime Junior Silver Miners ETF (NYSE: SILJ), did a lot of damage. It held large positions in some small companies. And when they sold, they disrupted the market. Kootenay Silver (TSXV: KTN) had to file a press release stating:

…its board and management are not aware of any corporate development or undisclosed material change relating to the Company or its operations that would account for the recent trading activity and decrease in its share price.

The ETF owned 910,000 shares of Kootenay, as of December 23, 2023. This is what happens when an ETF dumps the shares of a thinly traded stock:

The upper graph is the stock price. The lower graph shows how many shares traded per day.

As you can see, prior to January 28th, Kootenay rarely traded more than 50,000 to 75,000 shares in a day. And then SILJ started dumping shares in its rebalancing.

On January 29th, Kootenay traded more than 600,000 shares. Its share price opened at $0.87. At the end of the day, it closed at $0.65. That’s a 25% loss in a single trading day. And that’s just one example. The fund hit about seventy-four silver and copper related juniors in its asset allocation change. Some were bought, so they went up. But many good companies got sold as well.

And that’s where our opportunity comes from.

One of the First Families of Mining has a New Copper Company

Filo Corp. (TSX: FIL) is a $2.7 billion Canadian mining company focused on the Filo del Sol copper project in South America. The project sits on the border of Argentina and Chile, about 100 km southeast of Lundin Mining’s Candelaria mine.

The company is developing a new copper deposit that fits our needs. It’s easy to see how this company could grow and has the potential as a takeout target as well.

Filo del Sol is an unusual mineral deposit. It is a cluster of several different types of mineralization in a single giant area. It is the result of several massive episodes of metal-rich fluids invading the rocks. The result is a “dumping ground” for copper, gold, and silver.

That’s why this project is so rich. It holds huge lengths of mineralized rock. For example, hole FSDH041 held 858 meters (nearly six football fields long) of rock that averaged 0.86% copper, 0.7 g/t gold, and 48.1 g/t silver. The copper or gold grades alone are exciting. But when you put them together, you get a copper equivalent grade of 1.8%.

And in that long drill hole was a zone of 83.7 meters (nearly a full football field) of rock that ran 3.13% copper, 2.4 g/t gold, and 272.2 g/t silver.

Its most recent drill hole results were 1,449 meters at 0.61% copper equivalent (that’s nearly a mile) and 1,298 meters at 1.01% copper equivalent.

This is simply a massive project and Filo doesn’t have its arms around the whole thing yet.

And while we are impressed by the project, we also like how Filo is run.

Filo follows the United Nations Sustainable Development priorities.

The Lundin Group has a multi-decade presence in this part of the world. The Lundin Foundation supports Filo’s ESG commitment in the region. A Managing Director of the Lundin Foundation sits on Filo’s board. Filo set out the following goals:

- Climate – Engage in climate and environmental stewardship that avoids, minimizes, or offsets impacts.

- Workplace – Provide a zero-harm workplace that is diverse and inclusive.

- Governance – Demonstrate accountability, integrity, and transparency in alignment with international standards.

- Community – Build trust through openness, respect, and contributing to the community resilience and prosperity.

These goals show that Filo understands how to operate as a new-style mining company. And they have to do this because the Lundin group of companies operates multiple projects in this area.

The Lundin Group is one of the best international exploration companies in the world. The patriarch, Adolf Lundin, founded the group more than fifty years ago in 1971. I had the pleasure of interviewing his son Lukas Lundin before he passed away in 2022. While his father founded the company, Lukas was the driving spirit for the last thirty years. Today, Lukas’ sons William, Adam, Jack, and Harry run the various companies. Adam Lundin is the Chairman and William is a board member of Filo.

And they are serially successful.

The Lundin Group companies generated $15.8 billion over its lifetime. Here are some incredible returns:

- Red Back Mining: 1,041%

- Argentina Gold: 1,091%

- International Musto: 1,757%

- Lundin Energy: 15,566%

Those are some impressive results. And it contributes to our confidence in Filo.

In 2023, Filo published a Prefeasibility Study (PFS), which outlines the potential mine it can build. The results of the PFS (from just part of the project) looks fantastic:

- After-Tax Net Present Value: $1.3 billion

- After-Tax Internal Rate of Return: 20%

- Payback: 3.4 years

- Annual Copper Production: 66,000 metric tons

- Annual Gold Production: 168,000 ounces

- Annual Silver Production: 9.3 million ounces

The PFS used price estimates of $3.65 per pound for copper, $1,700 per ounce for gold, and $21 per ounce for silver.

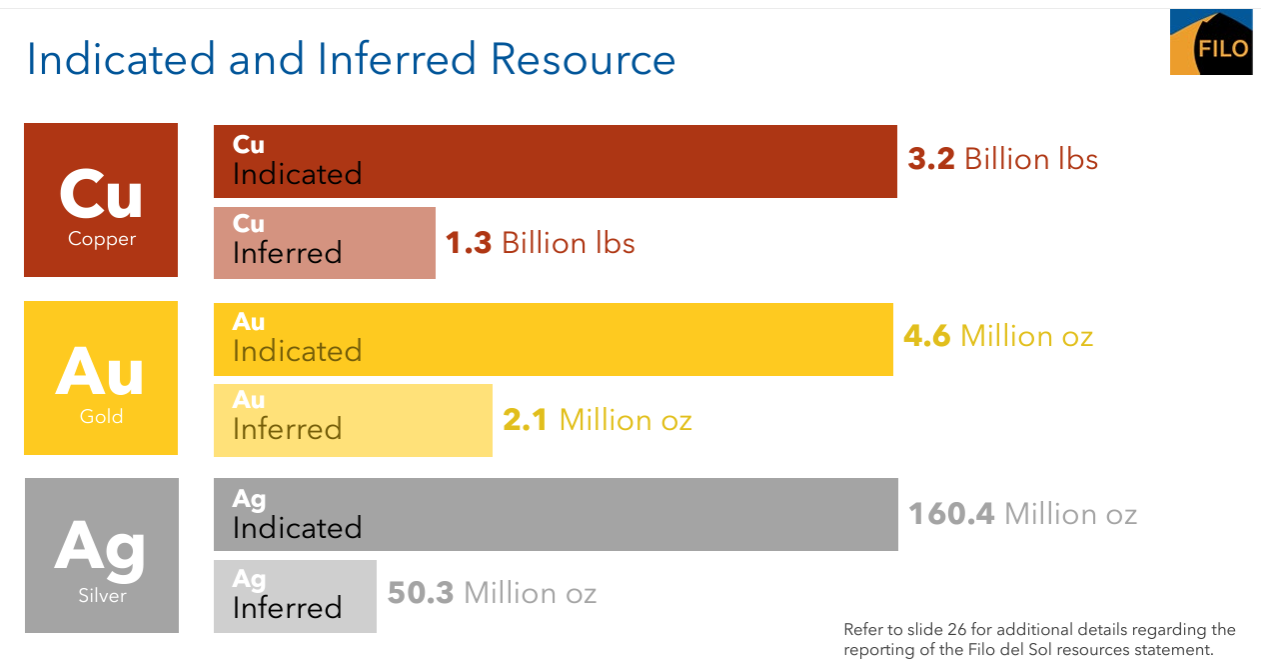

The report lays out the mineral resource, which is the global volume of mineralized rock. We can’t call it ore, until it’s put into a mine plan:

The company’s current plan is to drill 40,000 meters in 2024. They want to grow the size of the deposit and get a better understanding of the mineralization. They need to find the edges of it, to get a handle on how large it is. That’s an outstanding problem to have.

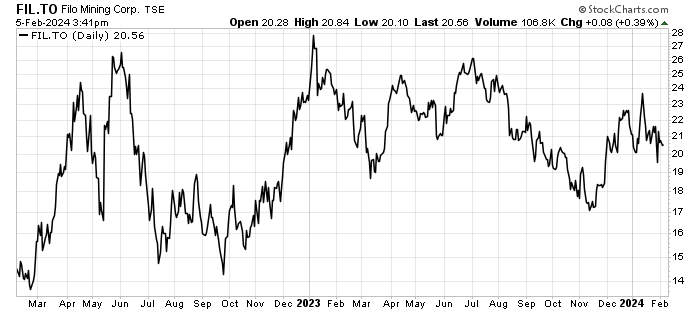

Over the past couple of years, Filo traded sideways, as you can see:

We have three catalysts for making money in Filo: rising copper price, growing the resource, and a potential acquisition.

Our risks are a declining copper price, company mismanagement, or political unrest.

Obviously, we believe copper prices are headed higher. So, if we did see the price fall, it would be more short-term and a buying opportunity.

We try to weed out troublesome management teams, by knowing who runs the companies we want to buy. In this case, the Lundin’s reduce our risk considerably. They have experience in the region and a history of success. Their history and current presence in the region mitigates the potential political risk as well.

Action to Take: Buy Filo Mining (TSX: FIL) up to $24 per share and use a 25% trailing stop. That means, if you buy it at $23 per share, you will sell the stock if it closed below $17.25 per share.

Filo is an excellent way to play the rising copper price.

The resource still has some room to grow, but the real value will be unlocked by higher copper prices.

It is a generational asset that we rarely see. It’s the kind of weird, mineralized area that will become a massive mine. Best of all, it’s in the hands of a group that understands mining and community relations. They will do a good job of moving it towards production.

Good Investing,

The Mangrove Team