Copper Will Underpin the New Energy Future

“Electrifying our homes, commercial buildings, and vehicles is one of the most practical actions we can take to address the climate crisis… Using electricity for household needs like heating and cooking will help lower energy bills and insulate American families from volatile fuel prices. Electrifying our lives and our economy will also create jobs in local communities and improve the air we breathe in our homes and workplaces…

“Fortunately, key technologies to electrify our homes, commercial buildings, and vehicles are already widely available in the market.”

– Representative Kathy Castor from Florida, Representative Paul Tonko from New York, Senator Martin Heinrich from New Mexico, and Senator Tina Smith from Minnesota in a statement establishing the first Electrification Caucus in both the House and the Senate.

The new energy of the world is electricity.

Today, everything is electric – cars, watches, games, you name it. And thanks to its ability to move electricity, copper will be the single most important commodity for the near future.

It takes about one metric ton of copper to make 40 electric vehicles (EVs)… or 100,000 mobile phones… or 400 computers… or to wire and plumb five single-family homes… or to transport electricity to 30 homes.

Depending on the type of EV you have, it can take about 40-kilowatt hours (kWh) of electricity to recharge an electric car. To put that in perspective, an average U.S. home consumes about 30 kWh per day. So, an electric car more than doubles the electricity demand of a household.

In the U.S., we use about 337 million gallons of gasoline per day. At 20 gallons per tank, that’s 16.9 million fill-ups every day.

That works out to drivers needing 676-gigawatt hours (GWh) of extra electricity per day just for their EVs.

After going through the numbers over and over, I can tell you the math doesn’t work.

We aren’t producing enough copper to meet the demand that the extra 674 GWh would need – in the cars, the transmission lines, or the motors.

But new electric cars aren’t the only things using copper for an electric future. As more smart devices come online, more computer chips will be manufactured using copper, too.

As investors, that’s a huge opportunity for us. We want to own copper miners… but only the ones that are committed to the greenest possible practices. It’s a hard choice to make. But since we all consume copper every day, we should put our money behind the best copper miners.

We need to reward them for mining the right way.

This month, we take a deep dive into a relatively new copper company. It is the product of a recent merger, has several excellent projects, and focuses on best practices (which we’ll talk about shortly).

While this may not be for everyone, we believe it’s one of the best-run companies in mining. Let me show you why…

Copper Mining Done Right

On March 3, 2022, Capstone Mining and Mantos Copper received approval from the Supreme Court of British Columbia to combine. It was the final government rubber stamp on a four-month process that combined two lower-tier mining companies into a new mid-sized company.

The combined Capstone Copper (TSX: CS) is a C$3.4 billion miner that embraces modern and sustainable mining practices. It is committed to safe operations with small footprints.

In order to reduce carbon emissions, the world needs to mine copper. And as responsible investors, we need to own the copper miners that commit to best practices. That’s what Capstone Copper brings.

In 2021, Capstone Copper (under its pre-combination name, Capstone Mining) produced around 85,000 metric tons of copper at two mines, Pinto Valley and Cozamin. That worked out to 187.1 million pounds at a cost of $1.81 per pound of copper produced.

Those are excellent economics in today’s copper market.

The copper price averaged $3.14 per pound over the past five years. That puts Capstone’s mines firmly in the “business” category, as opposed to “science project”… don’t laugh, we see that a lot in mining.

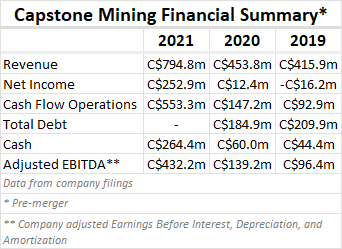

With copper prices so high, Capstone brought in a personal-best $252.9 million in net income in 2021. The company now has no debt and $264.4 million in cash.

The company has a powerful base to execute its goals, as you can see in the table below:

From a valuation standpoint, the combined Mantos/Capstone company looks excellent. The shares cost about equal to eight times the adjusted EBITDA. That’s cheap compared with many other mining companies. And it’s especially attractive for a company growing as quickly as Capstone is. And the copper price should remain stable or higher over the next three to five years.

Now, let’s take a quick look at Capstone’s mines, which will drive the growth of the company, and the value of its stock.

Capstone’s three mining projects are all copper-focused, with some extra goodies thrown in. Its Mantos acquisition adds two new mines – Mantos Blancos and Mantoverde.

Our investment thesis is simple. This company produces a lot of copper and byproduct metals that we need. And it’s going to produce a lot more of it in the near future. Its portfolio will grow by 49% in two years and 125% shortly after.

Capstone’s Commitment to Key Best Practices

One of the reasons we like Capstone is its commitment to using advanced processes to improve its mining techniques. Many mining companies explore these options, but they don’t implement them due to higher costs.

By investing in Capstone, we are supporting the use of modern mining techniques. We believe that every dollar we invest is a vote. By supporting a company like Capstone, we vote for improving mining practices.

Mining has come a long way in the last 100 years. It can be safer, cleaner, and less environmentally destructive today… when it’s done right.

As a graduate student back in 1999, I visited the Ducktown Basin in Tennessee. It was an active Superfund site at the time – the Environmental Protection Agency was on the ground cleaning up toxic materials – because of the mining waste.

This region produced copper from the late 1800s to the late 1980s. Mine waste from that period included sulfuric acid, lead, mercury, PCBs, and other contaminants. The companies disposed of those wastes in and around Davis Mill Creek and North Potato Creek.

When I visited, the acid mine drainage had killed off most of the forests. I saw the faint green of sapling pine trees in the bright orange landscape. Researchers had seeded the huge area with acid-tolerant pines by helicopter.

Even today, 23 years later, the area is still damaged:

It was… instructional. Mining done wrong can do this to communities and environments. Thankfully, many new mining companies learned from these lessons. And the good ones use new techniques to reduce or eliminate these problems.

While you don’t need to memorize these steps, they’re important for our research. Here are a few of the practices that Capstone implemented at its mines to improve health and safety:

Pyrite Agglomeration – Sulfide minerals (like pyrite and chalcopyrite) are the chief source of a mine’s acid drainage. Capstone created a process to divert acid-generating minerals from the waste tailings, back into the leach dump. That’s the area where the natural acids can help recover copper from the ore.

Paste Backfill and Dry Stack Tailings – Modern miners understand the need to conserve water and prevent landslide disasters. The old method of moving tailings (mine waste) used a “slurry” of water and waste. The slurry ran through pipes to special reservoirs where it could be dealt with (or, sometimes, not dealt with). It was a cheap, convenient, and wasteful method of disposal.

Today, companies remove the water from the tailings. They may recycle the tailings into a paste to fill in the mined areas. That makes the mined areas safer and reduces above-ground waste. In other cases, the companies remove 80% of the water or more. The resulting waste forms cakes that can be “dry stacked” away from water sources.

Recycling Mine Waste – At Pinto Valley, Capstone successfully showed economic copper recovery from mine waste using a patented catalytic technology. The company plans to increase copper production to 300 million-350 million pounds per year by treating mining waste. The site holds more than 450 million metric tons of historic mine waste.

And we want to buy into this sustainability directly, instead of putting our money into a mining fund. We want to actively avoid bad actors like giant miner Vale (NYSE: VALE). But few (if any) funds will make that distinction.

And make no mistake, Vale is one of the worst villains in mining. The company willfully ignored warnings about the structural integrity of the Brumadinho tailings dam in Minas Gerais, Brazil. The subsequent dam collapse killed 270 people.

It was Brazil’s worst industrial accident. Millions of tons of mining waste poured out when the dam collapsed. It completely destroyed the village of Córrego do Feijão. And it cost the lives of many workers.

The settlements alone cost Vale $7 billion. The final cost will be around $10 billion. The worst part is that the company chose to cut corners on safety as an acceptable business cost.

We believe that should matter when it comes to investments.

BUT… the world still needs mined materials. We can’t ignore the mining sector in our investments because it would hurt our commitment to make money and to do good. And it would allow the status quo to continue. So, we must find the right companies. The ones that are committed to safety and best practices.

There are many companies like Capstone out there, we just don’t hear about them. We started New Energy for exactly that reason. There are many great companies doing business the right way that we wouldn’t ever hear about from The Wall Street Journal or Bloomberg or Fast Money.

There is no way to avoid mining and still achieve a low-carbon future. That leaves us with two choices: bury our heads in the sand and ignore where the metal comes from… or be proactive investors and put our money to work with companies that embrace our values.

The good news is that there are many mining companies that take sustainability seriously. There is no harm in digging holes in the ground. The harm comes from mishandling that process due to greed, ignorance, or indifference.

We can use financial leverage to persuade companies to embrace modern mining techniques and rehabilitation practices. Because financial pressure is something all these companies understand.

Action to Take: Buy Capstone Copper (TSX: CS) up to C$7.50 per share. We may need to be patient with this one. The current war in Ukraine made all the commodity prices soar. However, we believe the stock will range between C$6.00 and C$7.00 per share for a while due to the market volatility. Our patience will be rewarded if we use a limit order and give ourselves time to get in.

For the good,

Matt Badiali

Bonus Idea: Jade Power Trust (TSXV: JPWR-UN)

I sat off to the side of the stage and watched Jim Rickards deliver a terrifying “what’s next” for German power. Jim is a lawyer, author, and economic analyst. He held senior positions at giant firms like the notorious Long-Term Capital Management, Citibank, and Caxton Associates. I know him from his frequent guest appearances on television and financial conferences.

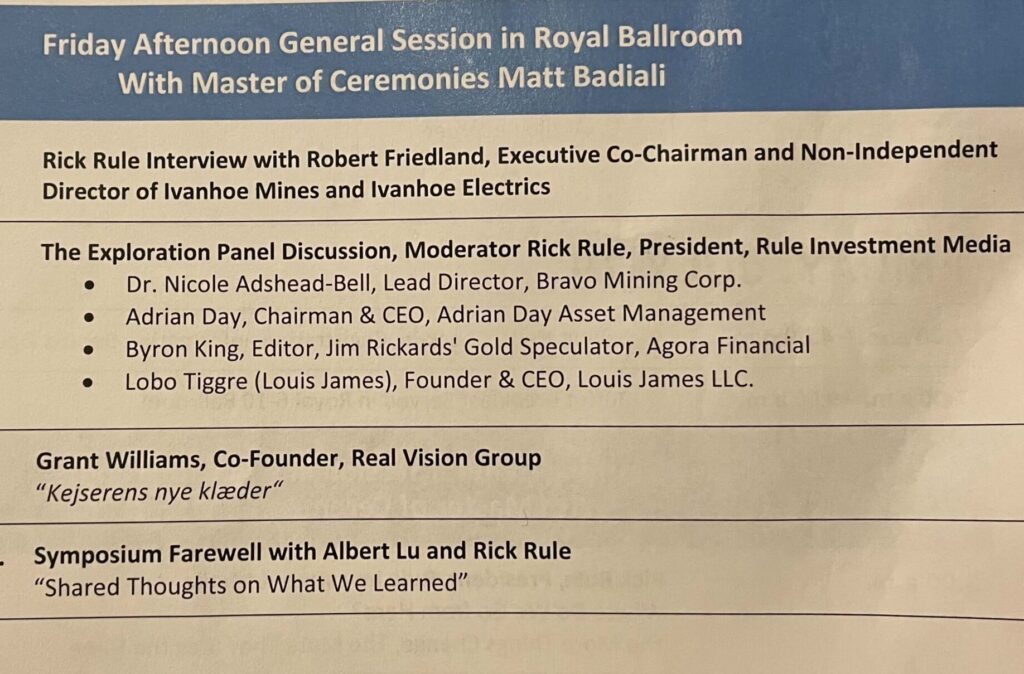

Last week, I was a master of ceremonies for two days at the Rule Symposium, one of the best natural resource investment conferences in the world. It was my job to introduce each speaker, so I saw a lot of the preeminent analysts and executives in the sector.

(You’ll hear more ideas from this conference in later issues, I promise.)

As you may know, if you are paying attention to the war in Ukraine, much of Europe’s energy comes from Russia.

Pipelines bring oil and gas from Russia’s oil fields to Western European energy markets. Germany imports and stores gas in the summer for use in the winter.

And Russian national gas company Gazprom owns about a quarter of the storage capacity in Germany.

Natural gas isn’t something you can move easily. Unlike oil, it takes specialized pipelines and ships to transport it. That means Germany can’t just start buying natural gas from the U.S. or the United Arab Emirates. They are stuck taking the gas from closer to home.

Rickards believes that Russia will bleed down Germany’s natural gas supply by limiting imports this summer. The effect will be soaring energy prices this winter when the country doesn’t have enough gas for demand.

But the truth is this war in Ukraine won’t just impact Germany. There will be a need for more electricity across the continent.

The good news is these countries can (and do) buy electric power from other European countries. And that’s where Jade Power Trust (TSXV: JPWR-UN) comes in.

This is a small, $41 million market cap green power company that generates electric power in Romania, which is 100% coupled with the German power grid.

Jade Power’s production is 77% wind, 20% solar, and 3% hydro. The company estimates that it offsets the emissions of about 22,137 cars per year.

It produces between 150,000 and 160,000 megawatt-hours per year. That generated C$18.6 million in revenue last year. And they are on track to beat that in 2022. In the first quarter, they earned C$6.7 million in revenue, a 33% increase from the first quarter of 2021.

I’m a huge fan of that kind of performance. And the outlook for the next year or two leads me to believe that Jade Power can continue that trend.

The company has an excellent balance sheet. They carry about C$10.6 million in debt, down from C$96 million in 2017. Today, the company has C$12 million in cash. More than enough to pay off all its debt and have some left over.

As I said, Germany will probably run low on natural gas this winter. That will drive the country to import more electricity. Additional power demand should send electric power rates up across Europe. That will benefit Jade Power.

The company’s stock price has lagged from a 52-week high of $3.79 in March to a recent low of $1.56. I’m happy to buy the stock at its current price – around $2.25 per share.

However, this company doesn’t trade much, so be sure to use a limit order.

Action to Take: Buy Jade Power Trust (TSXV: JPWR-UN) ahead of high electric demand in Europe this winter.