El Niño Provided Us With a Fantastic Turn Around Opportunity

El Niño Provided Us With a Fantastic Turn Around Opportunity

I love finding a great investment idea and then finding out the company is fantastic too.

That’s not always the case. I think giant mining company Vale might be a good investment today. But I would never own it because the company took terrible risks.

In January 2019, the dam holding back millions of tons of waste from a giant iron mine burst . It flooded the area below, killing over 259 people.

It stands as Brazil’s worst industrial accident.

The mine, owned by giant mining company Vale, wasn’t the first to have this issue. In 2015, another dam burst, flooding the town of Mariana and killing 19 people.

Brazilian prosecutors charged 16 people, including Vale’s former president, with intentional homicide .

The dams were poorly constructed earthworks. They were the cheapest waste management choice available to Vale. That’s an ugly reminder that companies don’t always choose the best path.

And that puts our investments at risk.

They put profit before safety, and it eventually caught up with them. This sort of behavior is indicative of a cultural issue. And I have zero confidence that they changed in the last five years.

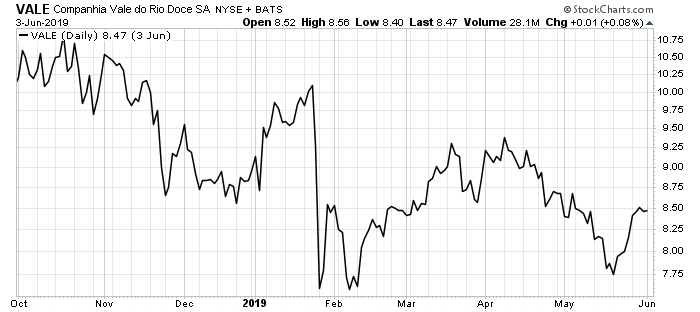

Here’s what happened to Vale’s stock when the dam burst:

That’s a 25% decline in a day. And it demonstrates something we at Mangrove Investor believe firmly, that companies who cut corners for short term profits expose themselves to massive risks.

However, the company we’re reviewing this month is the opposite of Vale.

The Human Rights Campaign Foundation named them one of the top 100 companies in Workplace Inclusion. And the global environmental non-profit CDP put the company on its A-List in water security.

FMC Corporation – Agricultural Chemicals Done Right.

FMC Corporation (NYSE: FMC) is a 130-year-old agricultural sciences company. They currently have a $6.5 billion market value. They work to advance farming through innovative and sustainable technologies.

The company has a global workforce:

- Asia: 39%

- North America: 25%

- Europe, Middle East, Africa: 23%

- Latin America: 13%

The company focuses on “precision agriculture”. The idea is to use technology to apply products at a much lower rate but get the same or better results. Their products are designed to go exactly where and when they are needed. This saves the farmer money and reduces excess products in the environment.

A good example of this is its 3RIVE 3D application technology. It’s a smart delivery system that creates a foam from specific amounts of product and water. The unit looks like a traditional planter but has a unique delivery system. The unit measures the mixture, delivers pre-measured volumes to multiple nozzles, and self-monitors for blockages.

Rather than a liquid, it creates a stable foam, which can be delivered at nearly any ground speed. One application can cover 480 acres and uses 90% less water than traditional liquid systems.

The system saves time, water, and fuel for the farmers.

FMC’s CEO Mark Douglas told CropLife International:

“We consider it a challenge to educate the channel and the grower about whatever it is we’re bringing to market, because at the end of the day the grower has to use it the right way. If we want to do all the things we just talked about, whether its biodiversity, whether its environmental impact all those things need to be taken into account. It’s education above all.”

The problem is that agriculture, like most commodities, is cyclical.

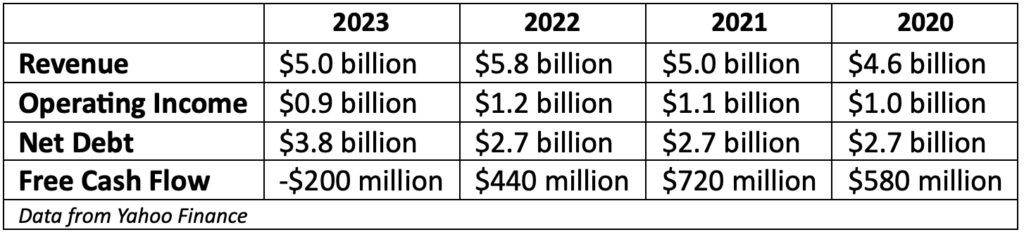

And 2023 was a cyclical down year for FMC. The company’s revenue fell 14%, its operating income fell 25%, and it issued $1.5 billion in new debt. You can see the details in the table below:

The company attributed the 2023 decline in revenue to two main factors: bad weather in Brazil and falling prices.

We see the weather-related decline as a temporary issue. Here’s why.

In 2023, a massive drought gripped Brazil. The Rio Negro, a major branch of the Amazon River, set a new low water mark of 12.7 meters. That’s the lowest water level since they began keeping record in 1903.

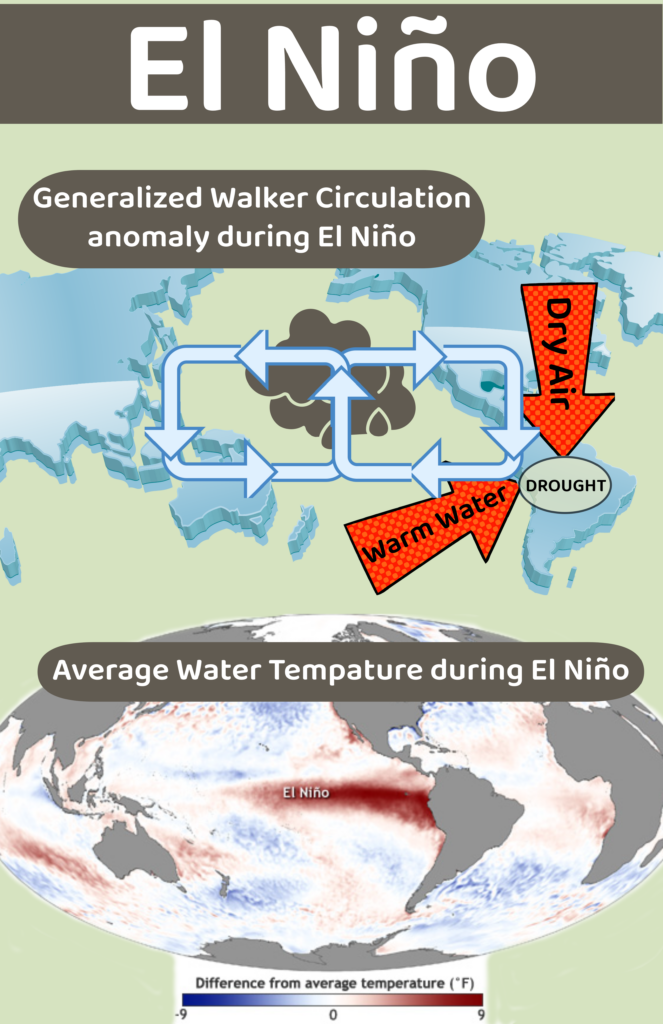

The drought is linked to the El Niño/La Niña cycles. We are currently in an El Niño, which coincides with dry conditions in Brazil. El Niño periods correspond to the two previous massive droughts in 1963 and 2010.

As you can see in the graphic, during El Niño, rising air (and rain) shifts west over the ocean. Sinking, dry air descends over the Amazon basin.

That dry air holds no moisture, so there is no rain. This year was particularly severe. That led to the decrease in agriculture and the impact on FMC’s revenues in the region.

But droughts are temporary. El Niño is just one half of what meteorologists call the El Niño Southern Oscillation (ENSO). And experts believe that the worst phase of ENSO is past.

Experts predict the wetter version, La Niña, will set in this summer.

That will bolster the agricultural industry in Brazil.

That’s a big reason why we believe FMC’s 2023 revenue troubles are isolated. However, as you can imagine, investors fled the company due to its poor performance last year.

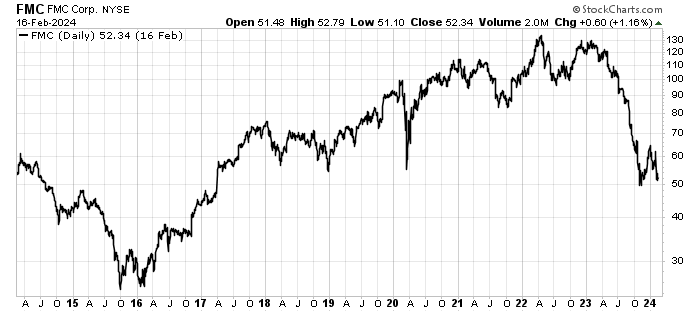

The company’s share price fell hard on the troubles in 2023. Its price is near a six-year low, as you can see in the chart below.

As you can see, from 2016 to 2023, FMC’s shares went on an absolute tear. It went up nearly 420% from its low. But it fell over 60% from its peak to today. That’s too much.

As we said, much of its trouble came from a drought in Brazil. As La Niña kicks in, that market will recover. And today, the company pays a fat dividend. That should attract investors back into the stock as well.

The company paid a quarterly $0.58 per share dividend in December 2023. Projecting forward, that’s a $2.32 per share annual dividend. At the current share price of $52.00, that’s a 4.4% yield.

The concern is that the dividend might be cut, due to poor performance. However, the company’s guidance for 2024 is solid. It will support that dividend. Here’s what they published in a recent press release:

- Revenue: $4.5 billion to $4.7 billion

- Earnings: $900 million to $1.05 billion

The company’s outlook for 2024 continues to be positive. It plans to cut between $50 million and $80 million in costs in 2024. And it expects to see the market return to a more historical rate this year.

Action to Take: Buy FMC Corporation (NYSE: FMC) up to $55 per share and use a 25% trailing stop.

That means we would sell the stock if it closed 25% below our purchase price or $41.25 per share ($55.00 per share x 0.75 = $41.25 per share).

We see FMC as a turn-around story. The company’s main losses are weather related. As we discussed earlier, ENSO is an oscillation, and it will reverse course this summer. That eliminates the primary driver of FMC’s losses in 2023.

The company has a long history of dividends, so we should be able to collect 4%+ on our investment while we wait for the company’s share price to recover.

For the Good,

The Mangrove Investor Team