Nuclear is the Simple Solution to the Global Demand for Fossil Free Electricity

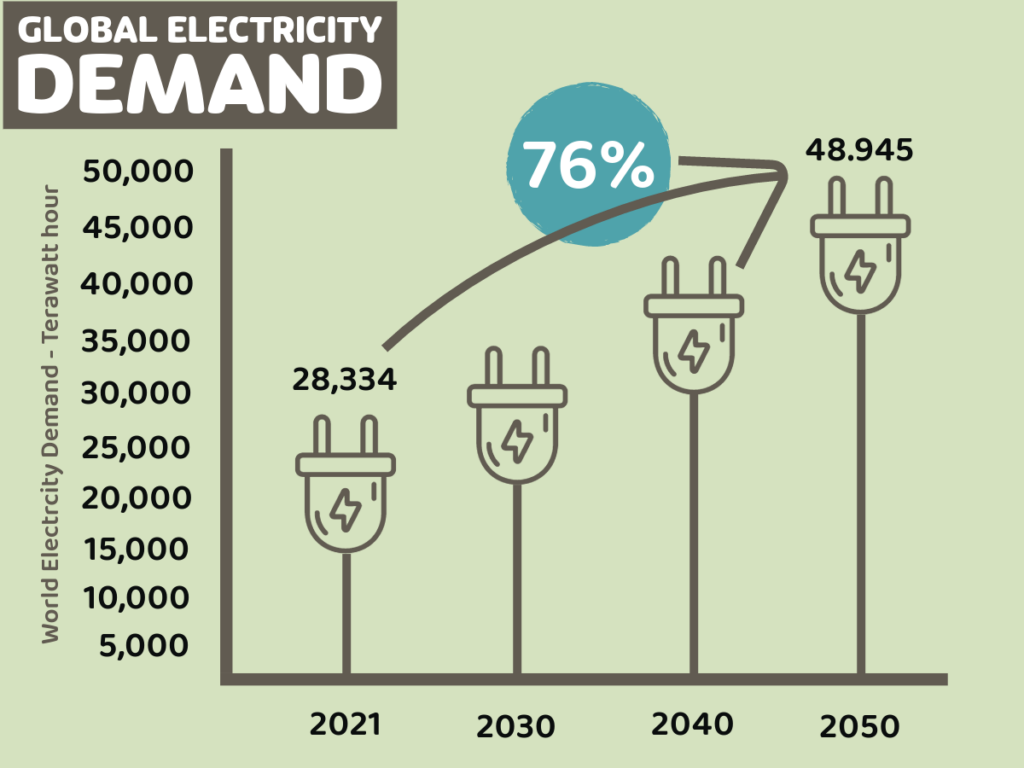

According to the Energy Information Administration (EIA), global electricity demand will grow 76% by 2050

That’s important because electricity has specific fuel needs.

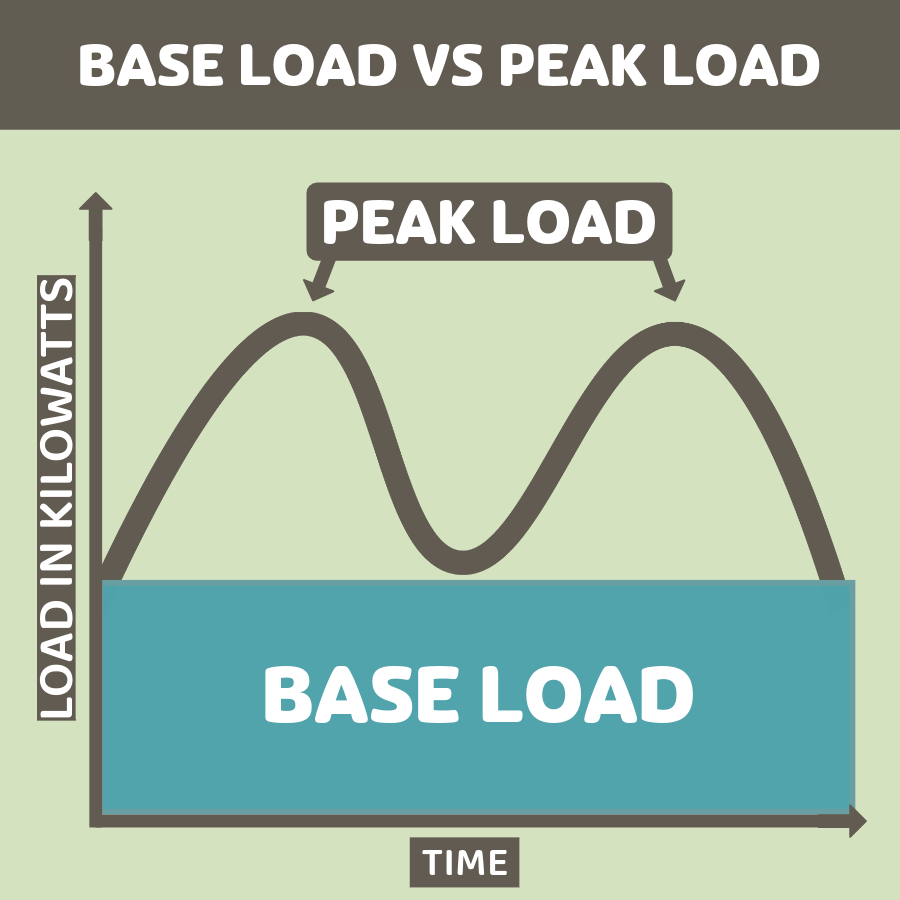

Electricity has two “modes” – base load and peak load. Base load is the supply that’s always on. It’s the supply we rely on to make the lights go on, no matter what time we use them.

That supply comes from two main fuels – coal or nuclear.

Peak load is the extra supply we use at certain times. If we have a heat wave and everyone uses their air conditioning at full blast for a week. That adds extra load to the system. Sometimes it’s as simple as adding electricity in the afternoon, when people come home from work at the same time. We all cook, turn on the television, and turn on the lights together – it adds a lot of extra electrical demand.

Peak load is mainly supplied by natural gas, because it’s easy to turn on and turn off quickly.

The new electricity will include both base load and peak load power. And while renewables can provide electricity, they don’t fall into either of the existing categories.

Wind only works when its windy and solar only works in daytime.

Without batteries to store and distribute that power, renewables are frustratingly inconsistent.

That leaves countries with a choice between coal and nuclear power to supply new demand. And this month, we’re going to look at why many countries will choose nuclear power. And we’ll have a new recommendation on how to own a basket of uranium companies to profit from that trend.

The World Considers Nuclear as Green Power (Again!)

We recently wrote in a Grove essay:

“Nuclear power is the single best source of base-load electric power that doesn’t produce carbon dioxide, or other gaseous pollution.”

We believe nuclear power will be one of the big winners of the Great Electrification. Nuclear power can replace coal as the primary source of baseload power.

In this month’s New Energy, we’ll go over nuclear power and its beneficiaries.

We see the emerging global demand for new nuclear power as a major catalyst for a uranium renaissance.

Nuclear Power Fundamentals

In its simplest form, nuclear power uses the heat generated from the fission of uranium fuel. The heat turns water to steam, which powers a turbine.

The process is simple and straightforward.

However, the lack of understanding led to fear after plant issues at Three Mile Island, Chernobyl, and Fukushima Daiichi.

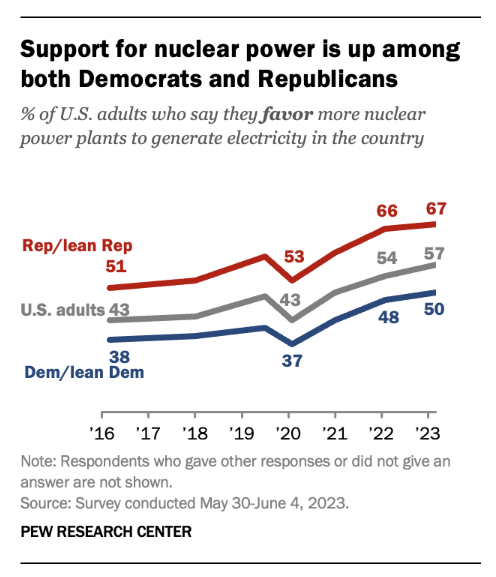

Public attitudes towards nuclear power waxed and waned over the years. For example, a 2005 poll in the European Union showed just 37% of people for more nuclear power and 55% against it.

Sentiment got worse after the Fukushima Daiichi disaster in Japan.

There were global calls to phase out nuclear power altogether. Some countries, like Germany, even began to dismantle their plants in favor of coal.

However, the awareness of climate change has elevated the understanding of nuclear energy’s benefits. Since 2016, support for new nuclear power plants grew from 43% to 57% of U.S. adults polled.

Today, nuclear power has bipartisan support in the U.S. According to the Pew Research Center, 50% of Democrats and 67% of Republicans support new nuclear power.

This is a massive improvement. For more than 35 years, the U.S. held a negative sentiment towards nuclear power. And so did the world.

Sweden is a good example of the changing attitudes towards nuclear power. In 1980, the government decided to phase out nuclear power. In 2010, they repealed the policy. In 2015, the government decided to close four older reactors by 2020.

Today, Sweden plans to build new nuclear reactors.

The simple reason is that the country cannot be carbon-neutral without it. And in order to achieve that goal, the government changed its commitment from 100% renewable electricity by 2040 to 100% fossil fuel-free electricity by 2040.

That’s a small, but critical distinction because it allows nuclear energy to be part of the mix.

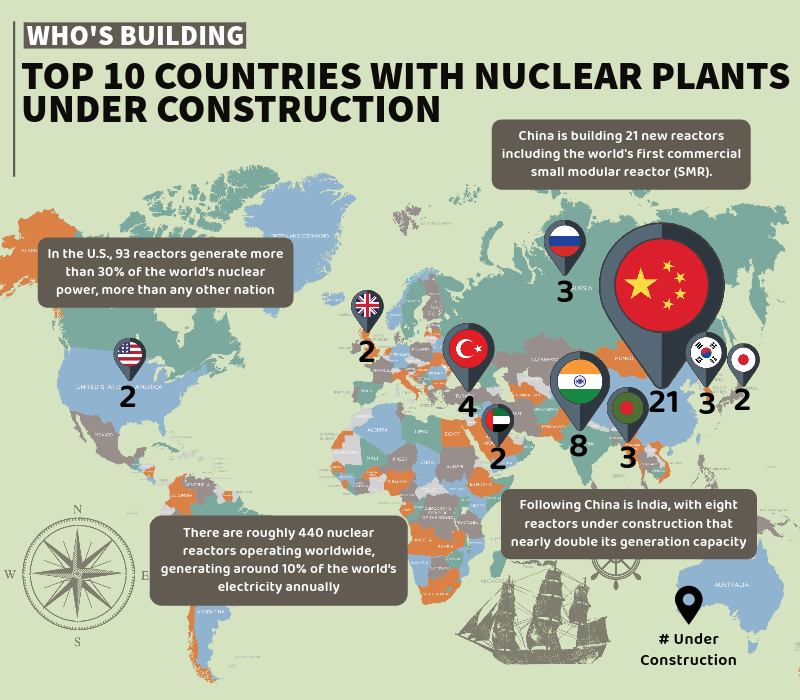

And that’s a popular attitude today. According to the World Nuclear Organization, there are sixty new nuclear reactors currently under construction.

That will increase the total number of power plants worldwide by 14%.

In addition, there are another 100 nuclear power plants on order or planned. And there are 300 more proposed power plants. That would effectively double the current number of power plants.

And that’s why we see the bull market in uranium as a long-term investment play.

Nuclear Power Packs More Energy Production into a Smaller Space

While the industry focuses on solar and wind, renewable energy isn’t adequate to meeting the needs of the world’s electricity.

Mark Nelson, environmentalist and managing director of Radiant Energy Fund explains it like this:

Imagine you are standing in Manhattan and need to get to London in the most cost-effective way. We would find that swimming is the cheapest! By the cost per mile of swimming, it is far cheaper than building a boat, and the infrastructure needed to use a plane would be very expensive; swimming is clearly the cheapest way to get to London. Furthermore, you can have a reasoned debate with the top experts in ocean-crossing and you can all agree that you’re using the same metric. Of course, none of you have any plans on swimming there. After all, it’s not physically possible. That doesn’t stop the experts from advocating that other people be required by government mandate to swim because it’s cheap.

Another critical point in advocating nuclear energy is that it’s far less intensive than renewable energy. For example, a wind facility would require more than 140,000 acres. That’s about 170 times the land needed to generate the same amount of electricity as a 1,000-megawatt reactor, according to the Nuclear Energy Institute.

A quick rule of thumb on scales is that nuclear requires 103 acres per million megawatt-hours, solar needs 3,200 acres, and wind uses up 17,800 acres.

In other words, the investment in land is much smaller for nuclear power than for comparable renewables.

The next step is to compare the cost of power from various sources.

The Uranium Price Can Rise Because Nuclear Power is Cheap

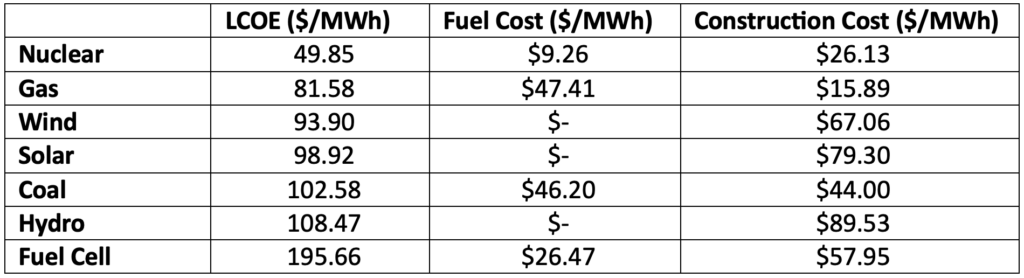

The Levelized Cost of Electricity (LCOE) is a calculation that compares construction costs, discount rates, heat price, etc.

The Nuclear Energy Agency compiled this data for 238 electric power plants around the world.

As you can see in the table below, the LCOE of nuclear power is a fraction of the cost of the next lowest – natural gas. And the fuel cost per megawatt hour is just $9.26.

Nuclear’s cost per megawatt hour is a fraction of natural gas, coal or fuel cells.

These are average prices over many different plants all over the world. Individual plant costs will vary. But the economics of nuclear power are indisputable.

The only problem was political will to build new plants. And that’s changing. Which means we need to invest in uranium.

The Uranium Bull Market is On

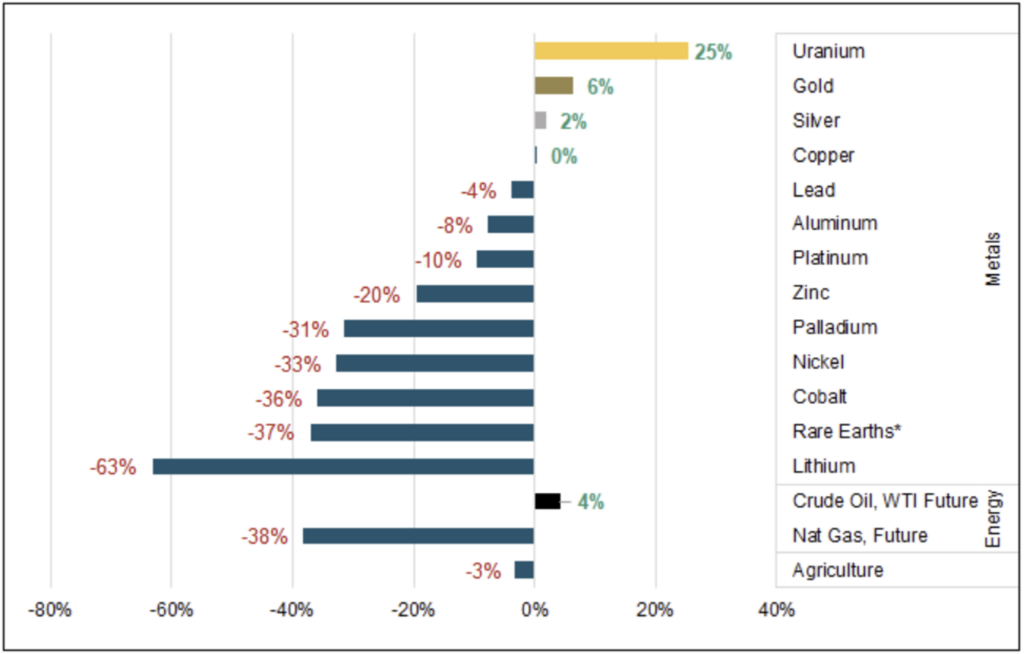

Uranium is the best performing commodity year to date in 2023.

Where most commodity demand goes through China, uranium doesn’t.

That means most commodity prices are subject to the ebbs and flows of the Chinese economy.

This year’s weakness in commodity prices can be traced directly back to the issues in China.

But uranium is independent and its performance shows.

The result of the rising uranium price is that uranium stocks outperformed other sectors over the past year.

We believe that trend will continue.

This is a Sneaky Good Fund to Play the Uranium Bull Market

The best way to play this trend is to own a basket of companies.

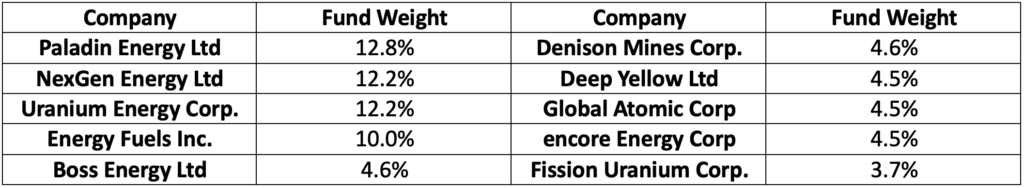

Fortunately for us, there is a pre-selected basket of uranium explorers and producers. The basket includes stocks from all over the world – London, Australia, Canada, the U.S. These are excellent uranium companies that would be difficult for us to buy and manage on our own.

The fund holds twenty-nine uranium stocks. It’s the perfect basket, but it’s too many companies for an individual investor to manage on their own. These run the gamut in size. The largest is Paladin Energy, a $3 billion Australian uranium miner with operations around the world. But it also holds several small cap Canadian exploration companies.

This is a new fund, launched in February 2023. It’s small – just $143.3 million in total net assets. It’s the perfect blend of risk and potential reward in the uranium space.

It’s the perfect vehicle for us.

It’s the Sprott Junior Uranium Miners ETF (NYSE: URNJ). The fund’s key points are simple:

- Pure Play Junior Uranium ETF – The only pure-play ETF focused on small uranium miners, selected for their potential for significant revenue and asset growth.

- Uranium Bull Market – A new uranium bull market is likely underway, incentivizing miners to explore and develop new uranium mines.

- Critical Mineral in Clean Energy Transition – Uranium and Nuclear Energy are critical to the clean energy transition.

- Supporting Energy Security – Uranium and nuclear energy provide reliable, affordable electricity that may help countries achieve energy security.

The top ten holdings of the fund are:

These are excellent companies that will respond well to the bull market in uranium.

We could own any one of these companies for exposure. However, we prefer to use a basket of stocks. That reduces our risk at the company level.

We believe Sprott is an excellent way to do that.

Action to Take: Buy the Sprott Junior Uranium Miners ETF (NYSE: URNJ) and use a 30% trailing stop on the position.

The bull market in uranium is on.

And as nuclear energy emerges as the first choice for new baseload power, this trend will increase.

In the face of climate change, there is new political will to use nuclear power. This trend could explode in the next few years.

We’ll keep you updated on the trend.

For the Good,

The Mangrove Investor Team