I’m a little upset this month

I saw something that really irritated me

It was a trusted source of financial information bending facts to meet his political narrative.

The problem that I have with it is that it could (probably did) cost his audience money. And he knows better.

I attended the Orlando Money Show a couple of weeks ago. Fox’s Making Money host Charles Payne was a featured speaker. He filmed a segment from the floor of the show that was a diatribe against electrification.

According to Charles, this is an agenda that the people don’t want. He said:

“They are forcing Americans to drive cars they don’t want to drive… They are forcing automakers to make cars that they don’t want to make. We don’t have free choices…”

He believes EVs are a fad and everything to do with this sector will be crushed in the market. But the facts don’t back him up.

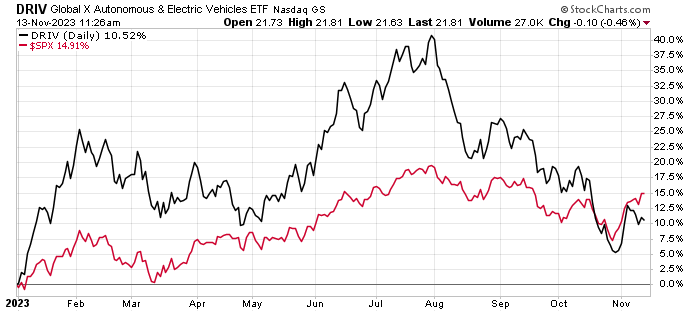

The Global X Autonomous & Electric Vehicles ETF (Nasdaq: DRIV) is a fund of electric vehicle companies. It underperformed the S&P 500 by 25% over the last two years. That chart looks a lot different over the past year.

As you can see, DRIV is up 10% on the year and about 5% below the performance of the S&P 500 over that same period. DRIV outperformed the S&P 500 for most of the year. It doubled the performance of the S&P 500 through August. But its fall was steeper than the S&P 500 since then.

If you only got your information from Charles Payne, you’d think these stocks performed horribly. That’s what happens when you put politics ahead of financial research. While I have no problem avoiding certain companies’ stocks. I do not fabricate data to match my worldview.

And that’s an important point to make. You should always do some research on your own. And you should never take “facts” at face value. Not from Charles Payne, not from me…not from anyone.

This month, we are going to take a break from company research. The market conditions aren’t right for adding a stock right now. And there is a bit of a conversation about where and how you get your investment information. And what you should do with it.

Do Your Own Research (A Little Bit, Anyway)

I know, I know – you subscribe to Mangrove so that you get research. But remember, not every idea we discuss will be right for you. We should all do a little digging on our own before we buy.

At Mangrove, we try to cover all the potential issues – size, liquidity, risk, reward, etc. But we publish our material on a regular basis. That means timing is always an issue. We don’t have the luxury of buying over time to get the best price…but you do!

And you don’t need to pay up for basic financial information. There are several places to get it for free:

These are free sites that can show you charts, financials, and metrics for companies and funds. They are useful to fact check the talking heads you see on television and social media.

The important thing to know about financials is that they are the “rear view mirror”. They look backward at what happened in the past. Investments are all about projecting into the future.

That’s why digging into the big stories is so important. Charles Payne’s rant is a great example. He mischaracterized the situation. And his fans will pay for it.

When we analyze a sector for potential investment, we want to see indications of health. For example, the Associated Press reported:

A nonpartisan business group that advocates for clean energy estimates that 403,000 jobs will be created by the 210 major energy projects announced since the Inflation Reduction Act took effect in mid-2022.

At least $86 billion in investments have been announced, with the biggest job gains expected in the electric vehicles, battery storage, and solar energy sectors.

The amount of the investment tells us that this is much more than a fad being foisted on Americans. It shows us that the industries believe that these technologies are the future. They aren’t putting $86 billion to work for free. These companies think the investments will generate significant returns.

That’s how we “see the future”. And it is why we are so interested in investing in electrification.

Sorting the Long-Term Trend from Short-Term Noise

To sort out our long-term investment strategy, we want to see those kinds of investments outlining the future.

This is the kind of information that you don’t find on Yahoo Finance. This is the kind of research that you get from one of the major investment research firms like Bloomberg…or from doing a lot of sleuthing on your own.

We built Mangrove Investor around the long-term implications of the mass electrification movement. We began to see massive investments in this sector a couple of years ago. And we know that money will drive demand and growth in electrification.

Our job, as investors, is to find the best companies in that space. The ones that will grow and benefit from those $86 billion.

Unfortunately, short-term issues will disrupt these long-term trends. That’s what we’re seeing right now.

Today, we need confidence in our long-term trends. We are still recovering from the Covid-19 disruption to the markets and economies around the world. Inflation caused by disrupted transportation is now mostly companies holding on to higher prices for as long as they can.

We can see that from the recent spate of high quarterly earnings data. If inflation were real, most companies would see flat earnings. That’s because their costs would be higher, matching the higher prices they charge consumers.

However, according to LSEG data, 81.3% of the S&P 500 quarterly earnings surpassed expectations. That’s the highest number since 2021.

The Federal Reserve Bank’s response to inflation was to raise the Federal Funds rate. That’s the cost banks charge to borrow money. And it impacts every loan made – cars, homes, credit cards, etc. As the cost of those loans soared, it reduced spending. The goal was to force prices to fall.

We saw that happen with fundamentals like commodities and agriculture. What we need now for the price of staples like food, soaps, cleaners, clothing, etc. to fall as well. That’s typically how things work. The savings get passed on to consumers.

But they haven’t yet. Companies are in the sweet spot of lower input costs and higher sales prices. That’s why companies are making so much money right now.

Taking a Break This Month

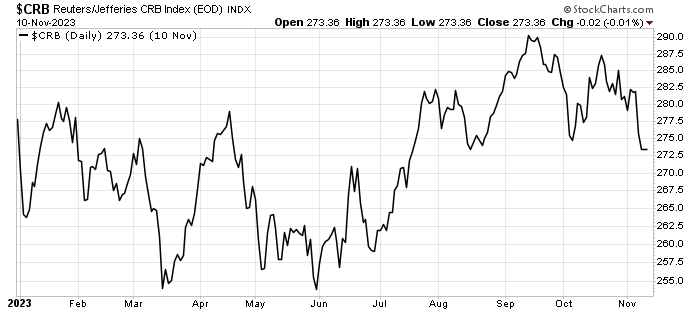

This was a rough couple of months for the Spotlight portfolio. Few natural resource commodities performed well. You can see what I mean from this chart of the Commodity Research Bureau’s index (CRB Index):

The CRB Index tracks a basket of energy, agricultural, and metal commodity prices. The value today is as low as it was back in mid-July. That’s because, as bond prices rise, commodity prices fall. The strong U.S. dollar, weak economic data, and uncertainty in Chinese demand all pushed the prices lower.

And when the war in Israel kicked off, it sent a ripple of panic through the market. Investors sold riskier stocks across nearly every asset class. Most stocks in both energy transition and natural resources fell in price. It was brutal.

It’s with that backdrop that we decided not to recommend a stock or fund this month. Now we are heading into the holidays. The market is a mess. There is no urgency to add new positions to our portfolio.

Good Investing,

The Mangrove Investor Team