I’m not going back to Papua New Guinea

I spent the week of May 22nd, in Vancouver British Columbia

The weather was a slice of heaven. Like a stolen week from some future July, brought back for my enjoyment.

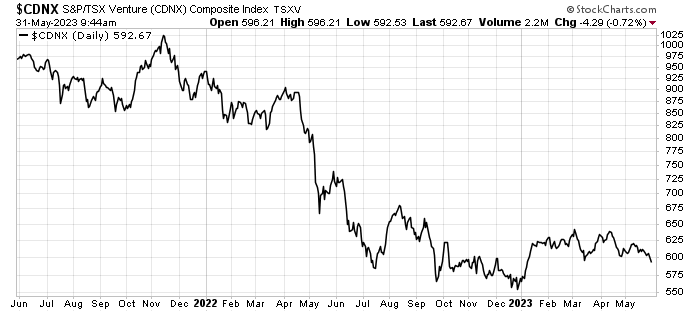

However, unlike the weather, the money folks in Vancouver are unhappy. Most lost a lot of money on mining companies over the last few years. They are gun shy about investing right now. Money is sitting on the sidelines. It’s hard to find folks who are excited about most metals.

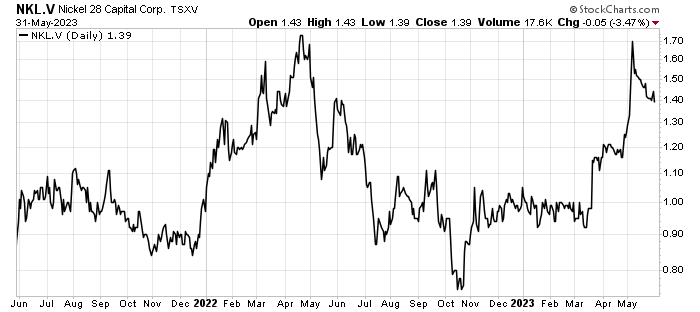

This chart tells the story:

The exception to that was battery metals.

Everyone wanted to tell me about the latest lithium deals. And with giant car-maker Ford making its huge announcement that week, those junior lithium stocks were up.

This month, we’re going to review one of the best battery metal companies in the sector. It’s not a mining company or an exploration company…it’s a royalty company.

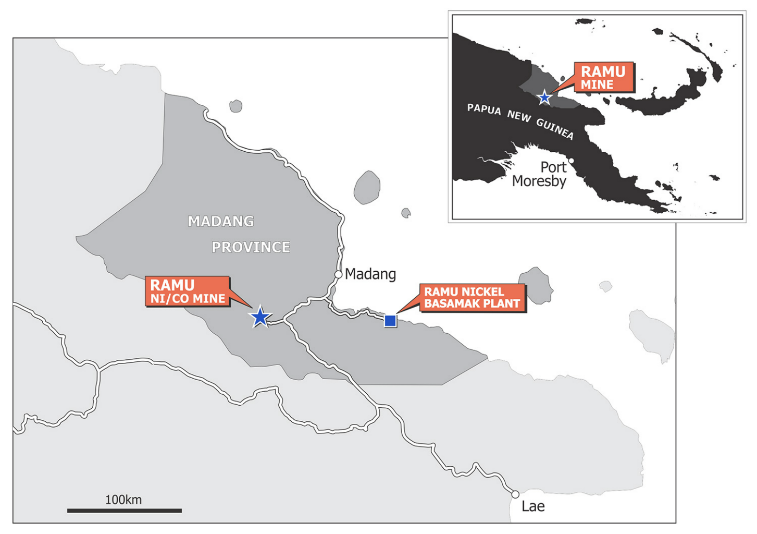

And it has a royalty on a nickel-cobalt mine in Papua New Guinea (PNG).

And no…I’m not going back to PNG. Once was enough.

This is me in PNG in 2009.

A well-known former Wall Street broker turned newsletter writer believed it was a fraud.

It wasn’t.

It took 42 hours to travel from my house to Port Moresby. And another couple of hours to fly into the jungle, hop into a helicopter, and head out to see this well. It was Interoil’s big discovery, which ExxonMobil now owns.

The country is incredibly well endowed with mineral wealth. It has petroleum, metals, timber, etc.

And it’s a hub of interest from every developed country in the world, particularly in that region.

So, this month, we’ll dig into that mine and this little Canadian royalty company that owns a slice of it…along with a bunch of other projects in North America.

Nickel and Cobalt Royalties – How to Get Paid by the EV Boom

Let me introduce Nickel 28 Capital Corp. (TSX V: NKL).

Nickel 28 Capital Corp. (TSX V: NKL) is a C$120 million nickel/cobalt royalty company.

Nickel 28’s current value is based on its 8.56% interest in the producing Ramu nickel, cobalt mine in Papua New Guinea.

Ramu’s cash flow to Nickel 28 is about $30 million per year. Out of that money, $20 million goes to debt repayment and interest expense. The other $10 million turns into cash to Nickel 28.

The company has about $40 million of long-term construction debt left.

Once they repay the debt, the royalty share increases to 11.3%.

At current production, Nickel 28’s share of the production is 2,900 metric tons of nickel and more than 600,000 pounds of cobalt per year.

However, that share will increase to 3,800 metric tons of nickel and over 800,000 pounds of cobalt.

That’s a huge increase in expected revenue within the next six months.

Ramu is one of the best performing nickel mines in the world. The resource covers less than 15% of the exploration license. The current location has total reserves of fifty-four million metric tons at 0.88% nickel and 0.09% cobalt.

That’s over a billion pounds of nickel and over 106 million pounds of cobalt. So, there is plenty of metal in the ground to support this royalty for many years.

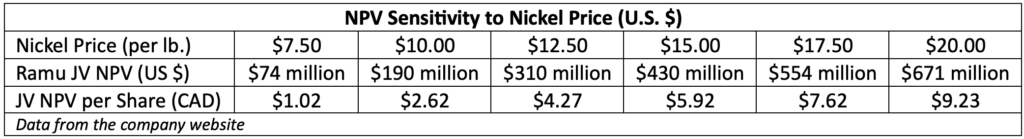

As we know, the price of nickel and cobalt change through time. The net-present value (NPV) of the royalty is sensitive to changes in price. Particularly to the price of nickel. The table below shows the details:

And as you can see, the nickel price fell over the past few months.

The price of nickel ranged from under $9.00 to more than $14.00 per pound. That means the value of Nickel 28’s value fluctuated as well. And the market doesn’t care (much) about the NPV of this stream…even though it reflects the amount of cash flow we’ll get.

You can see the effect on the price of the stock below:

The current price of nickel is around $9.25 per pound. That puts value of the Ramu JV around $2.00 per share. The current price of a share of Nickel 28 is about C$1.35 each. That means the share price today sells at a significant discount to the value of the royalty.

And that’s just the value of Ramu. The rest of the royalty portfolio gets zero value by the market.

It’s important to understand that royalty companies don’t mine.

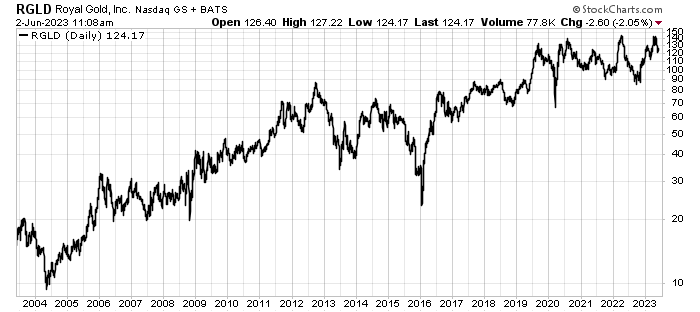

They buy the royalty for a lump sum and then collect the payments. Giant royalty companies like Royal Gold (NYSE: RGLD) and Franco Nevada (NYSE: FNV) started with cash flowing royalties.

They grew steadily, as you can see in the chart below:

Royal Gold’s shares dramatically outperformed the S&P 500 in the period above.

The key is the cash flow. The key is that these companies collect royalty payments with little cost to themselves. And they can turn around and invest in more royalties to grow that cash flow.

That’s what Nickel 28 will do at Ramu. Today, they have 8.6%. Next year, when they settle the debt, they will own 11.3%. And they have the option to buy another 9.25% at fair market value. That would bring Nickel 28’s ownership to 20.5%. Each incremental increase adds significant cash flow.

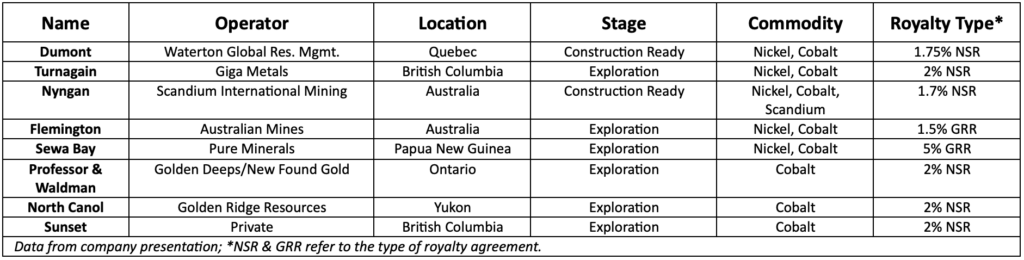

As we said above, the value of the Ramu joint venture more than covers the current market cap of Nickel 28. That means we get an entire portfolio of non-cash flowing royalties for free:

This portfolio is valuable. As these projects move towards development, they will become even more valuable.

We can think of this like a farm – we planted a valuable crop. Not all of them will grow, but some will. And we’ll cash in at harvest time.

The two construction ready projects, Turnagain and Dumont will add cash flow in the future.

In 2022, Mitsubishi signed on as a development partner with Gigametals Corp. at Turnagain. The project timeline shows first production in 2027 and going through 2055. The mine plan calls for annual production of 33,000 metric tons of nickel and 1,800 metric tons of cobalt.

Dumont is a giant nickel project about 300 miles north of Ottawa, Canada, now held by a private equity group Waterton Global Resource Management. A July 2019 study showed that the project could produce 39,000 metric tons of nickel per year for more than 30 years. In 2021, Waterton hired advisors to sell the project for more than a billion dollars. The project is “shovel ready,” but so far hasn’t found a buyer ready to build it.

We see value in Nickel 28 for its Ramu joint venture’s growth alone. Turnagain moving ahead and a potential sale at Dumont provide additional catalysts for growth in the stock.

However, the share price of Nickel 28 Capital Corp is currently falling hard.

That’s great because it’s an opportunity for investors to get in at a better price.

Action to Take: Be patient. You could put in a limit order at $1.20 per share. Or you can wait to see where the stock bottoms. We think this stock is a good buy below $1.30 per share. As it falls, that should provide a good window of opportunity to build a position below that price.

The current market isn’t great for stock owners. But it can be great for buyers. We need to be cautious about buying stocks as they fall.

But a little patience can reward us with purchase prices 10%+ below current prices.

Good Investing,

Mangrove Staff