Investors Beware – The Lithium Sector is a Mine Field

In January 2024, we had a Mangrove Investor staffer in Vancouver for a short course titled “Capital Markets for Geoscientists and Engineers.”

It was all about how public mining companies behave (both good and bad). One interesting chart came from Dr. Nikki Adshead Bell’s presentation. She was a CEO, sits on multiple boards, and raised millions of dollars for mining companies. She’s incredibly influential and well connected.

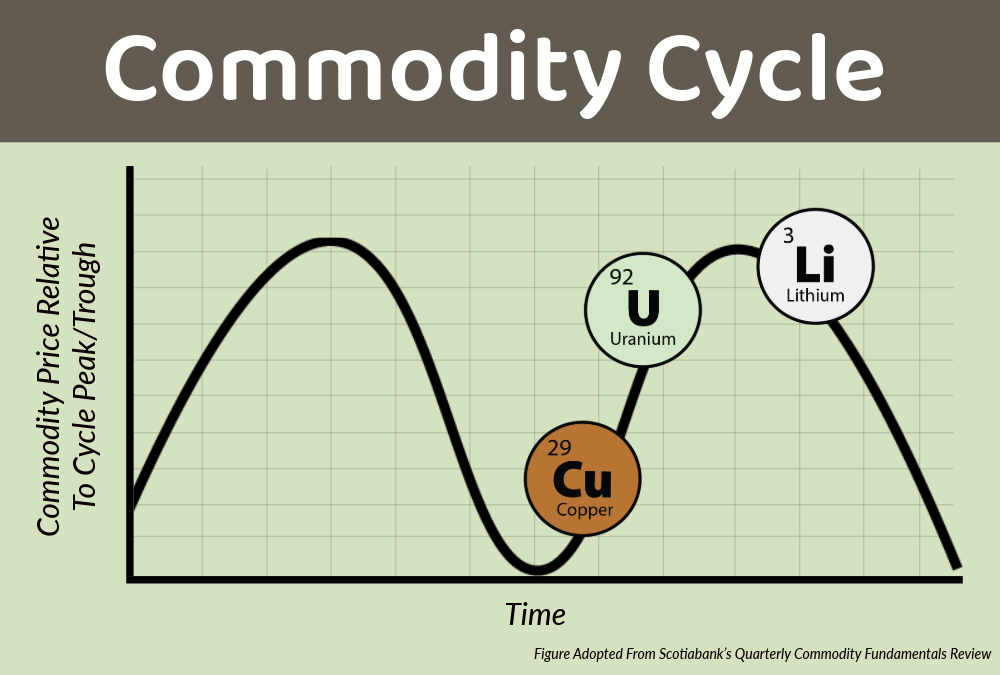

During her presentation, she quizzed the audience. She asked us to predict how the prices of commodities like uranium, lithium, and copper would perform this year.

A shocking number of people were bullish on lithium.

But then she showed us her forecast. You could feel the air go out of the room.

Here’s what she thinks:

This chart shows us three predictions, but the big takeaway is that the lithium price is on the way down.

That’s really important, because lithium companies were everywhere. The major lithium company, Sociedad Quimica y Minera (NYSE: SQM) is in more than forty exchange traded funds. And it was a drag, as you can see here:

What this shows is that even the largest producers respond to falling commodity prices. SQM is down 60% from its high in November 2022. And as you’ll see, that’s the way all commodity producers respond. When the price declines, the whole sector does too.

We need to understand where we are in the lithium cycle. Right now its down and we don’t believe it bottomed yet.

These big secular trends in commodities can last months or decades. Lithium will find a bottom, we just don’t know when. And to start 2024, the news is full of lithium producers laying off workers and new companies entering the space.

Production is ramping up and as you’ll see, that could push the price down further.

Lithium was a hot commodity for the past few years. We saw a slew of companies either add lithium projects to their portfolios or go public around lithium.

Today there are 75 lithium companies on the TSX Venture Exchange and more than a dozen on the TSX Exchange. That gives you some insight into the space. The TSX Venture is for early-stage companies, while the TSX is for the more senior companies. The fact than there are six times as many juniors means that there was a lot of investor interest (and money) in this commodity.

That means you should avoid lithium explorers, developers, and probably producers too.

Or, if you are aggressive, this sector still has some opportunities to short stocks. Some are well down, but some are ready to fall.

This report is all about why the lithium sector is risky today. We will show why the commodity price is falling. We will also dive into what to look for when we review lithium projects. Finally, we will look at exploration and development companies in the sector that we believe are most at risk.

The lithium price crash is underway

We recently wrote about ExxonMobil, the giant oil company, taking a step into lithium.

They claim that direct lithium extraction (DLE) of oilfield brine is possible. And they put their money where their mouth was…they leased 120,000 acres of land. That’s 187.5 square miles, larger than 8 Manhattan Islands worth of land. They also created a whole new division, called Mobil Lithium.

They didn’t do this out of generosity of spirit. ExxonMobil thinks it can produce a lot of lithium. Their marketing claims that by 2030, they will produce enough lithium for over 1 million electric vehicles.

Here’s the thing, if ExxonMobil is doing it, you better believe that Shell, British Petroleum, and Chevron are right on their heels. That means we could see a glut of lithium hit the market. And that will be exactly what we need to spur adoption of electric vehicles.

Here’s what I mean.

According to a recent Goldman Sachs report on DLE, it can produce lithium faster, cheaper, and more efficiently than brine ponds or hard rock mining. It has a much smaller footprint and is far greener than the other techniques. The Goldman report compared the disruption coming to lithium to the impact fracking had on the oil industry.

If you recall, the oil produced from shale crushed the oil price, as massive amounts of oil came to market. Interestingly, we are seeing similar price action from lithium already.

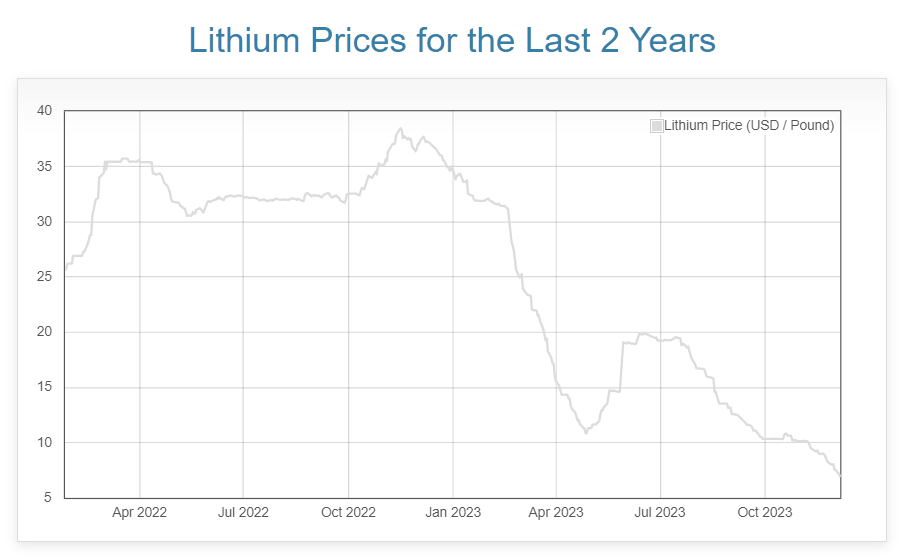

Here’s the chart:

My suspicion is that the price of lithium reflected the emergence of DLE and the participation of the major oil companies in the space. More lithium is coming. Apparently, a lot more.

The New York Times caught on to this trend back in March 2023. At that point, the metal price was down just 20%. Today it’s down 80% from its recent high price. The essay remarked that the drop in price defied analysis:

The sharp moves have confounded many analysts who predicted that prices would stay high, or even climb, slowing the transition to cleaner forms of transportation, an essential component of efforts to limit climate change.

Instead, the drop in commodity prices has made it easier for carmakers to cut prices for electric vehicles. This month, Tesla lowered the prices of its two most expensive cars, the Model S sedan, and Model X sport utility vehicle, by thousands of dollars.

The authors were early but correct about the price cuts. According to Money.com, a personal finance news site, the average electric car price is down 22% from last October. And much of that is on the lithium price decline.

A Tesla Model S battery holds around 138 pounds of lithium. In January 2023, the raw lithium metal in the battery cost about $2,195. Today, it costs about $1,035.

Cheaper cars will spur faster and broader adoption of electric vehicles. That will, in turn, require more battery metals. I suspect that we will see lithium prices settle significantly lower, despite that rise in demand.

ExxonMobil and DLE

As we mentioned, the U.S.’ largest publicly traded oil company is about to disrupt lithium production in a huge way.

The lure that brought the giant into the lithium industry is profits. Analysts forecast global demand for lithium to quadruple by 2030. And the U.S. needs domestic lithium

ExxonMobil (NYSE: XOM), the $416 Billion granddaddy of the oil industry, announced that it leased 120,000 acres of the Smackover Formation in Arkansas. This is a rock formation rich in saltwater brine.

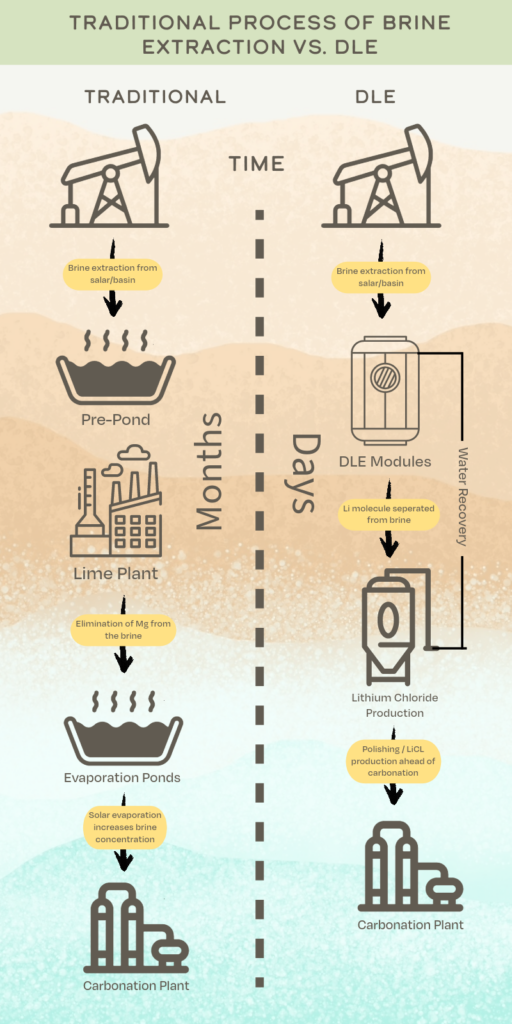

ExxonMobil is a world leader in extracting fluid from underground. Their geologists know how to drill wells. The real breakthrough is in the extraction technique. Called Direct Lithium Extraction (DLE), the process is a radical departure from the old technique.

DLE radically reduces the footprint of the brine plant because it does not use separating ponds. You can see a summary of the process in the image from a Goldman Sachs report below:

ExxonMobil’s new division, called Mobil Lithium, plans to be in production by 2027. It targets lithium production equal to the needs of 1 million electric vehicles per year by 2030.

DLE allows the company to pull brine from deep in the earth, separate just the lithium chloride, and reinject the rest of the water back into the ground. It’s an excellent example of a company using old technology to meet a new demand.

DLE will improve lithium production by:

- Doubling the brine yield per volume

- Increase recovery from 40%-60% to 70% to 90%

- Improve brine economics.

- Eliminating the need for huge brine ponds

- Eliminating waste by reinjecting unused brine liquid

DLE comes with massive promise. And it isn’t just ExxonMobil marketing its new division. Here’s what Goldman Sachs says:

“The implementation of Direct Lithium Extraction (DLE) technologies has the potential to significantly increase the supply of lithium from brine projects (much like shale did for oil), nearly doubling lithium production on higher recoveries and improving project returns, though with the added bonus of offering ESG/sustainability benefits, while also widening rather than steepening the lithium cost curve.”

This could be a revolution in lithium production. And its epicenter is in southern Arkansas. This is another solid industry moving to the U.S. thanks to electric vehicles (EVs). The initiatives spurring the move to EVs is an echo of the move to personal automobiles from mass transit.

DLE has the potential to significantly change the lithium market. And Exxon isn’t alone – Equinor, Occidental Petroleum, and Schlumberger are reportedly looking at options for lithium production. Both Equinor and Occidental invested in lithium companies already. Equinor owns a stake of Lithium de France and Occidental is a co-owner of TerraLithium.

The subsidies laid out in the Inflation Reduction Act make these investments attractive to big oil. These companies already know how to do all the critical work. They can drill wells and extract liquids. The hurdle remains the DLE technology.

All these new suppliers implies that the market will get a big glut of supply in the next couple of years. ExxonMobil says it will be in production by 2027. And it claims it will be able to supply enough lithium for over 1 million electric vehicles by 2030.

Lithium supply isn’t the only issue. Competition is ramping up.

Look Out Lithium – A New Battery is Attracting Investors and EV Makers

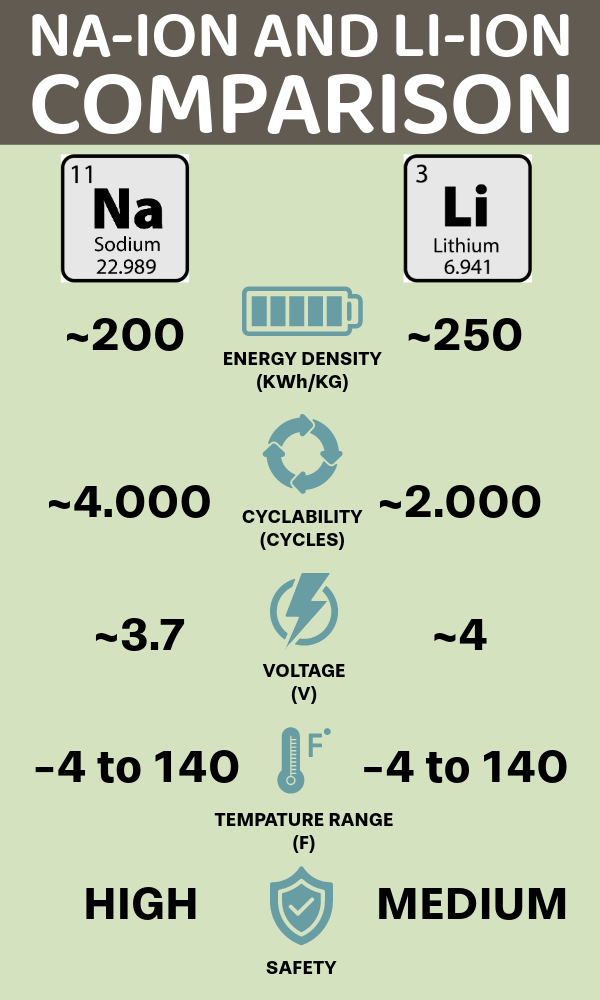

Lithium is number three element on the periodic table. It’s the most popular battery material on the planet today…but its neighbor is on the rise.

Sodium sits directly below lithium in the list of alkali metals. It’s the sixth most abundant element on earth and makes up 2.6% of the crust.

To put that in perspective, lithium makes up just 0.0007% of the earth’s crust.

The reason lithium is so popular in batteries, according to the MIT Technology Review, is its size.

Lithium is the third-lightest element after just hydrogen and helium. With weight being a critical part of battery efficiency in cars, lighter is better.

However, sodium is only slightly heavier than lithium. And the key to building a better battery is energy density. And Sweden’s Northvolt AB made a competitive sodium battery.

Northvolt said it made a breakthrough in sodium battery technology. Northvolt’s battery doesn’t use lithium, nickel, cobalt, or graphite. It’s a sodium-ion battery.

The company states that it has a validated best in class energy density of 160 watt-hours per kilogram according to the company.

Chief Executive Officer Peter Carlsson said in a press release:

“Our sodium-ion technology delivers the performance required to enable energy storage with longer duration than alternative battery chemistries, at a lower cost.”

Northvolt is an established battery maker, founded in 2016 in Stockholm, Sweden. Clients such as BMW, Fluence, Scania, Volvo, and Volkswagen have ordered $55 billion worth of its batteries. It claims that the sodium batteries are more cost effective and safer at high temperatures than lithium-ion.

Sodium batteries are also being built in China. Electric vehicle maker BYD Co. signed a deal to build a $1.4 billion sodium-ion battery plant. And China’s CATL is using sodium-ion batteries in EVs sold in 2023.

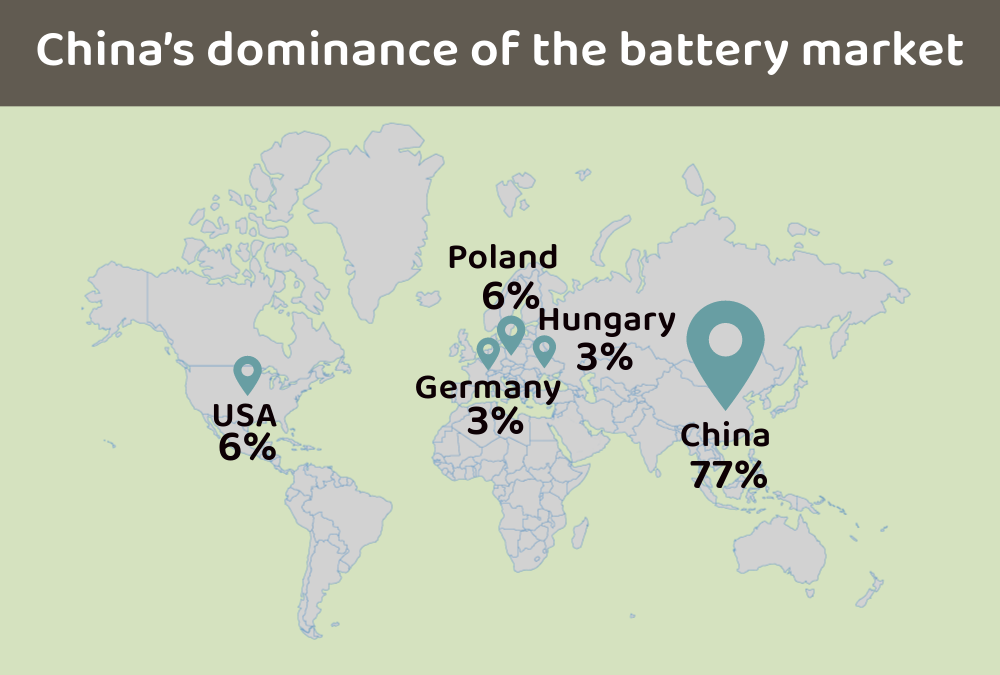

Interestingly, these batteries could reduce China’s dominance of the battery market.

China produces about 60% of the refined metals used in lithium-ion batteries. This came about because China was an early adopter of EVs and batteries. However, sodium-ion batteries are so new, there will be a more even start for developing the necessary infrastructure. And it could shift to Europe, with Northvolt’s emergence.

The emergence of sodium-ion batteries should be good for the EV market. It offers competition to the existing battery model. As long as it can produce competitive power, its lower cost will be attractive. And that will draw some demand away from lithium-ion batteries, lowering their cost as well.

The team at Mangrove Investor are working hard to understand the vulnerability of lithium mining companies to lower lithium prices. And so far, the data says these companies are massively overvalued.

The current lithium price is around $13,600 per metric ton according to the Daily Metals Price website. Yet a recent preliminary economic analysis (PEA) report on a popular Nevada project used $13,400 per metric ton as their base case in the economic model.

In other words, they didn’t show us the value of the project at the 10-year average price (which is around $12,800 per metric ton). The reason is that this project’s value collapses quickly with lower lithium prices.

And here’s the thing, lithium prices spent the first half of the last decade below $10,000 per metric ton. The metal averaged $8,400 per metric ton as recently as 2020. Lower lithium prices are not only possible, but they are also likely.

That should terrify investors, because the lithium price in China fell 69% over the past 12 months. And there are rumblings that sodium batteries offer similar performance, with significantly lower cost. Multiple electric vehicle (EV) makers now offer sodium batteries. That means lithium lost its moat as the only battery metal available for EVs.

And ExxonMobil recently announced a new business division to produce lithium from oilfield brine. They have an innovative technology that allows them to produce lithium cheaper and faster than existing techniques. They pull the lithium out of the brine and put the brine back into the ground – no evaporation ponds and no mining necessary.

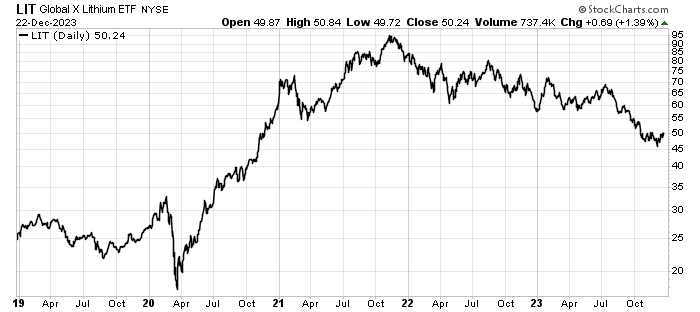

New competition in batteries and lithium supply should continue to push lithium prices lower. If you own a company developing a lithium project, it’s time to sell. But that shouldn’t be news…lithium stocks fell hard for the last two years. You can see the trend in this chart of the Global X Lithium Exchange Traded Fund:

Don’t let the recent price jump fool you, this sector is in trouble. Lithium prices could fall further. In 2023, Grandview Research put the lithium market at $8.2 billion. They projected a 12.8% annual growth rate to 2030.

However, the aggregate market value of lithium producers is over $42.6 billion. In other words, the current market value of lithium producers is more than 5 times the value of the current market.

That’s a serious valuation problem, especially with the potential price risks. Investors should beware – 2024 may not be an auspicious year for lithium.

We see development projects as the most likely sources of over-valuation. The PEA’s that use lithium prices of $30,000 per metric ton are fantasies. If a company doesn’t show a project’s value at lower prices, don’t walk away – run away.

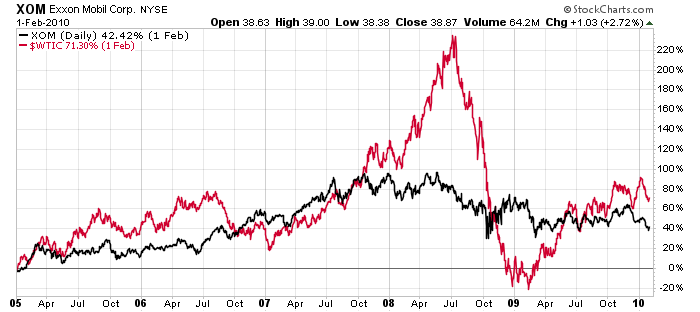

Holding (or HODLing) commodity producers is a recipe for disaster.

What I mean is that commodity prices are cyclical.

They go up…and down. When you make a lot of money on a position, you should always watch the underlying commodity price.

If the trend turns down, take profit.

It doesn’t matter how big or secure a company seems, its share price will suffer when the commodity price goes down.

Here’s a great example. This is a chart of ExxonMobil from 2005 to 2010. The oil price rose over 220% (red line). ExxonMobil’s share price doubled…and then fell. And this is arguably the best commodity producer in the world.

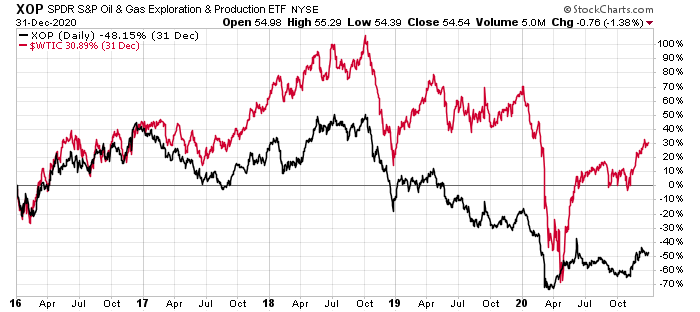

ExxonMobil outperformed the entire industry back then. During the last downturn, the oil price doubled from 2016 to 2018, and then fell by more than 60%, only to recover up 30% (red line).

The oil producers got crushed. They went up about 50% only to end up as a 50% loss (black line):

You can see how the industry tracked the commodity price. That’s a common theme among all commodity companies.

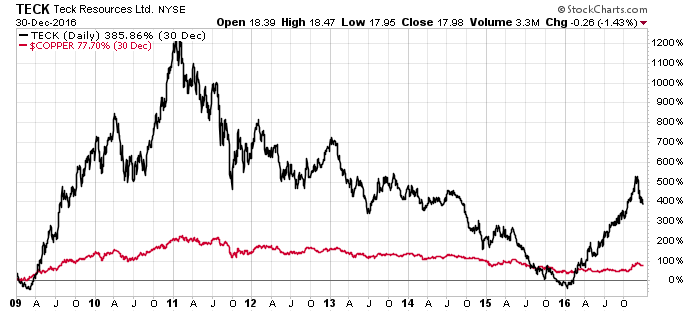

The next example is Teck Resources (NYSE: TECK) and the copper price. From 2009 to 2011, the copper price rose about 200%. Copper producers like Teck Resources exploded in price. Teck shares went up more than 1,200% in those two years.

If you held those shares as the copper price declined over the next few years, you gave that entire gain back:

That’s an incredible round trip. And some investors didn’t take the upward leg, they bought in late and only rode it down.

That’s the risk you take when you buy producers as the price of the underlying commodity falls.

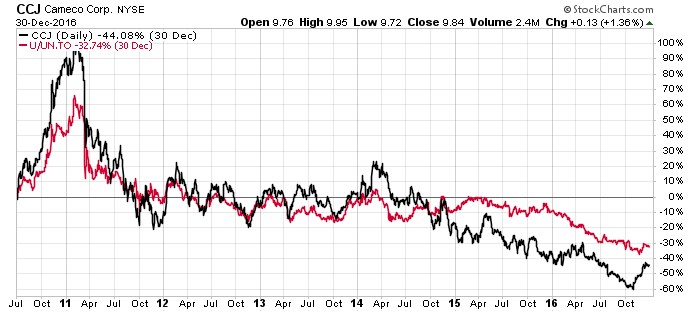

Another example is uranium from 2010 to 2016. This is the end of the peak in the uranium price. In 2011, the tsunami and earthquake struck the Fukushima Daiichi nuclear power plant in Japan. Countries around the world began to divest from nuclear energy.

The price of uranium fell and so did the price of the largest uranium producer in the stock market:

If you bought Cameco at any point from 2012 to 2016, you probably lost money.

That’s the setup we see in lithium today. Investors beware.

But don’t take my word for it. The trend is already set. Here are a couple of examples of what happened in the lithium space already.

Making Over-the-Top Promises Gets Your Stock Kicked to the Curb

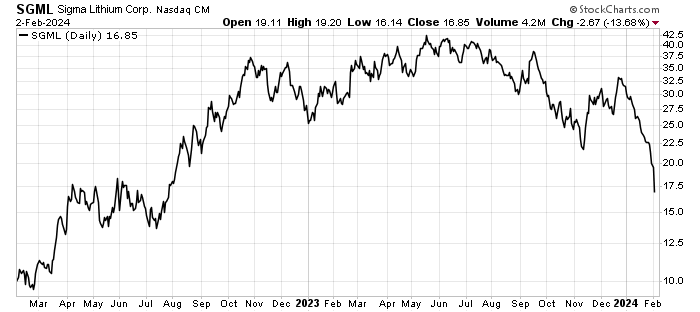

Sigma Lithium (Nasdaq: SGML) is building the hard rock (spodumene) project called Minas Gerais in Brazil. The huge project has an after-tax NPV of $15.3 billion and an IRR of 1,282%. That’s outstanding but it also got investors fired up over its potential. The project uses a base price of $25,000 per metric ton of lithium. That’s a bit high, but it’s better than other estimates, as you’ll see.

This is the chart of a lithium company getting clobbered by a short report written by Grizzly Research. Sigma Lithium Corp. is building a hard rock lithium mine in Brazil.

There were rumors that Tesla was interested in the project, which sent shares ripping higher.

But then the wheels came off.

There was no deal with Tesla. There was no takeover coming. Insiders sold as the share price peaked. Then the report from Grizzly laid out some ugly details. This share price fell 56% in eight months.

Overstating the Lithium Price Can Tank Your Project

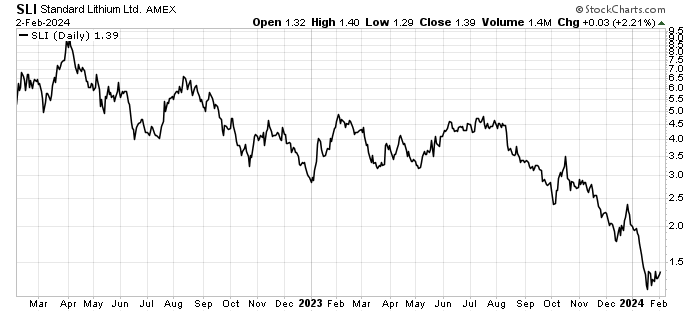

Standard Lithium (NYSE: SLI) followed a similar story. It is a $245 million mining company building the LANXESS lithium project in southern Arkansas. The company published its definitive feasibility study (DFS) in 2023. According to the DFS, the LANXESS project has a present value (NPV) of $550 million and an internal rate of return (IRR) of 24%.

That seems great, right?

The project is worth twice as much as the current market cap of the company. The problem is, it’s fundamentally flawed. The DFS assumes that the lithium price will be $30,000 per metric ton over the life of the mine. And the mine’s economics are sensitive to the price.

If the lithium price falls 20% to $26,000 per metric ton, it knocks 39% off the NPV. And the IRR falls to 18.4%. It’s important to note that the average price of lithium carbonate since 2019 is $19,740. That’s also 39% below the $30,000. And it was $29,000 in 2023.

The results are as you would expect:

This stock fell from $5.00 per share last February to $1.39 today. That’s a 72% decline in 12 months. But that’s the result of the company gambling on a high lithium price. As the commodity price turned, investors realized the risk.

Short Opportunity – But First Some Words of Caution.

At Mangrove investor, we rarely recommend shorting, generally. It’s hard to do for most investors. Your potential gains are capped at 100% – and that requires the stock to actually go bankrupt! Your risk, on the other hand, is unlimited. If the stock you are shorting goes up 1000%, you are on the hook for it.

So beware before you decide to play this game. That said, sometimes the opportunities are just too obvious. And we believe this is one of those cases.

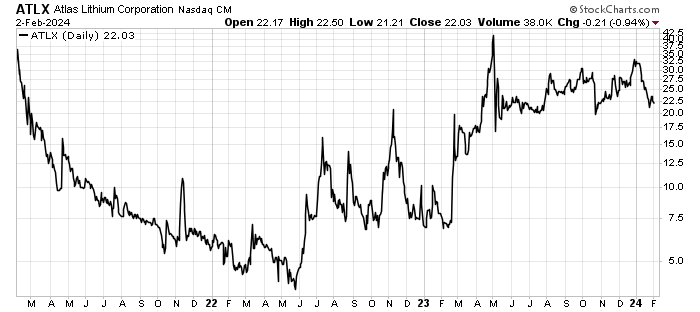

Recommendation: Short opportunity is Atlas Lithium (Nasdaq: ATLX)

According to its technical report for the Das Neves Lithium Project, the available information (as of August 2022) was “insufficient” for estimating a resource as Das Neves.

The company plans to report its Preliminary Economic Assessment (PEA) in the first quarter of 2024.

The PEA is the 20,000-foot view of the mining project. It doesn’t use granular cost information. It will produce a net present value (NPV) and an internal rate of return (IRR). Both of them should be massively discounted because they don’t use real data.

Don’t ask me why…it’s a function of the rules. And I disagree with how PEA’s work.

Here’s what’s important.

The PEA’s estimate is the best this project will ever look. It will only go down from there. And my view of the project isn’t optimistic because of the following:

- Low grade at 0.22% Li2O

- Poor recovery at 29.7% in the coarse fractions. It’s worse for the fine fractions.

- Rush to production – the company guided 150,000 tons per year by the end of 2024.

- Delays are inevitable – no project goes 100% right.

The company has a $250 million market cap and enough cash to bring the mine into production. Theoretically, they could pull off a miracle. They could build the mine within budget…but we don’t have any information on the plan yet.

The 2022 technical report didn’t have enough information to estimate a resource. That’s the volume of rock containing potentially economic lithium. The actual mined reserves are a subset of the resource. Today, the company has an enormous amount of “potential”. And we believe investors are buying the stock on the hype, not the reality.

Once they publish the PEA, reality will arrive in a big way. We believe this stock could fall 25% to 50% after that report comes out.

The period when a company switches from exploration to development is called the “orphan” stage for a reason. And in this case, Atlas is fighting price headwinds already. Anything that goes right won’t move the stock higher. And anything that goes wrong will send it lower.

While the shares aren’t at their all time high, they are still way too buoyant for this market. This company could easily fall 50%, even with all the hype surrounding them right now.

For the Good,

The Mangrove Investor Team