New Energy Weekly – Insurance Coffin

Hurricane Idalia Another Nail in Florida’s Insurance Coffin

In 24 hours, Hurricane Idalia grew from a Category 1 storm to a Category 4 storm. These categories are “Saffir-Simpson Hurricane Wind Scale” numbers. They describe hurricane wind intensity and the damage it can produce.

- A Category One Hurricane has winds from 74 – 95 miles per hour.

- A Category Two Hurricane has winds from 96 – 110 miles per hour.

- A Category Three Hurricane has winds from 111 – 129 miles per hour.

- A Category Four Hurricane has winds from 130 – 156 miles per hour.

- A Category Five Hurricane has winds over 156 miles per hour.

That means the wind speed in Idalia went from 74 miles per hour to more than 130 miles per hour in just one day. A Category Four hurricane can destroy homes. Debris carried by the wind will break windows. Older steel frame buildings collapse as will unreinforced masonry buildings.

Insurers understand this in a fundamental way – in their profit margins. And that’s in part why they are evacuating Florida.

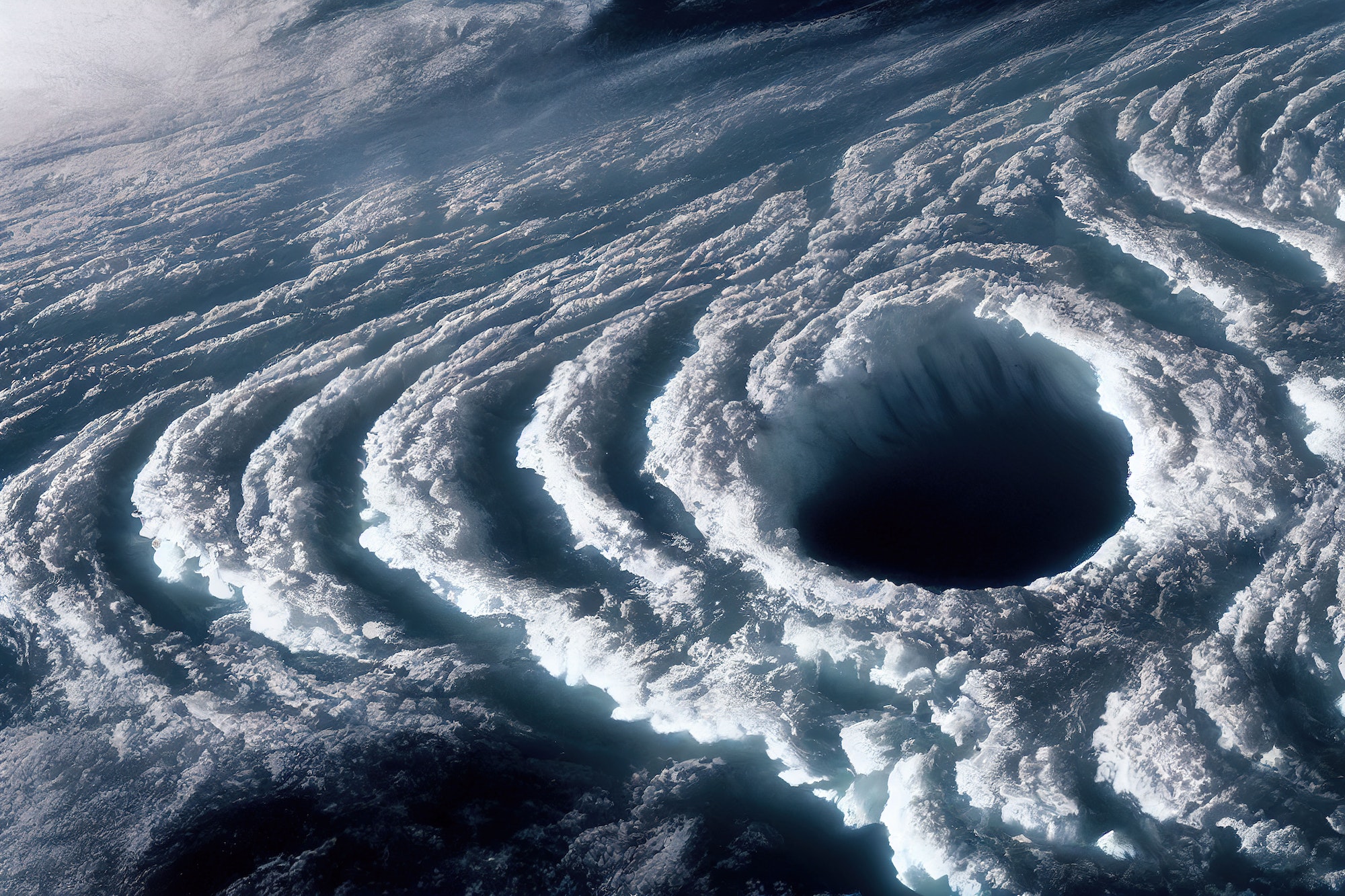

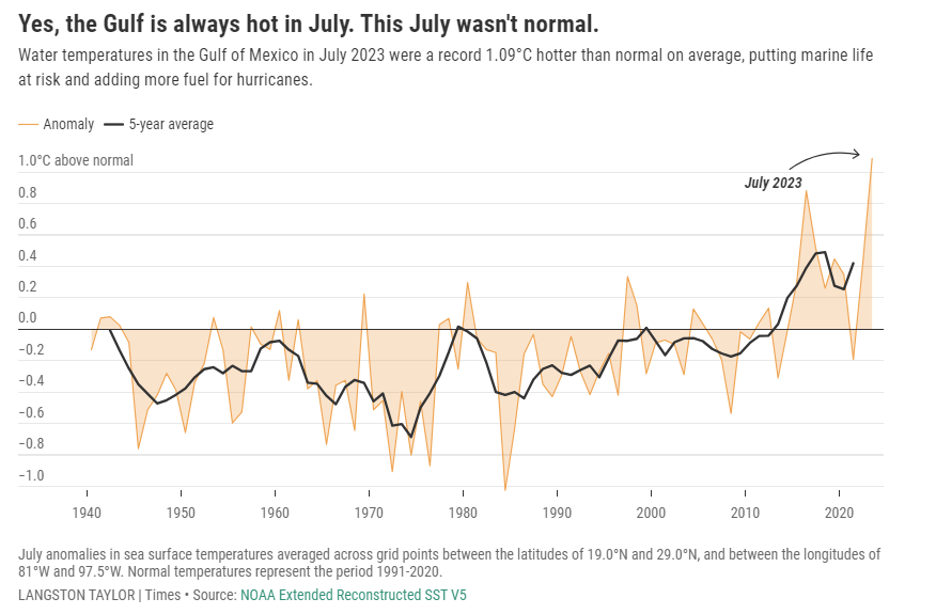

Idalia went through incredibly rapid intensification. That was due in part to the deep, hot water in the Gulf of Mexico. In July 2023, the average surface waters were more than two degrees above normal. That’s the highest on record.

And heat equals strength in hurricanes.

A hurricane is a lot like a pot of boiling water. The more heat you add to the pot, the harder the water boils. In a hurricane, it’s the wind speed. The more energy you add to the storm, the faster it rotates. And much of the energy comes from the heat of the water.

This storm will cost somewhere between $12 billion and $20 billion in damage and lost economic activity. But it could have been much worse. The storm made landfall in one of the least populated areas of Florida. Taylor County, which took a direct hit, has a population of 21,815 people.

If the storm had come in further south, say Hillsborough County (1.5 million) or Pinellas County (1 million), it would have done much more damage.

A turn to the east a little earlier would have taken the storm through Tampa and then Orlando. Those cities alone hold 5.7 million people. A Category Four hurricane would devastate those areas.

This is the new reality for Florida. After Hurricane Ian in 2022, many insurance companies went bankrupt. Southern Fidelity, Weston Property & Casualty, and United Insurance Holdings Corp. all went under, forcing tens of thousands of customers to find new coverage.

And many more are leaving. In 2022, Farmers announced it was leaving. Bankers Insurance and Lexington Insurance left too. Even AAA, the venerable auto insurer is bailing out of the sunshine state.

Natural disasters aren’t just driving insurers from Florida. AIG, Allstate, and State Farm stopped taking customers in California due to massive wildfire damages.

And as the climate continues to change, we will need to adapt to the new normal. We will need to develop new policies around fires and hurricanes, so that the insurance companies can operate. And things will get more expensive, as we incorporate the cost of these disasters into our daily lives.

Sincerely,

Matt Badiali