New Energy Weekly – Internet Full Of Economist

Another Rate Hike is in the Offing

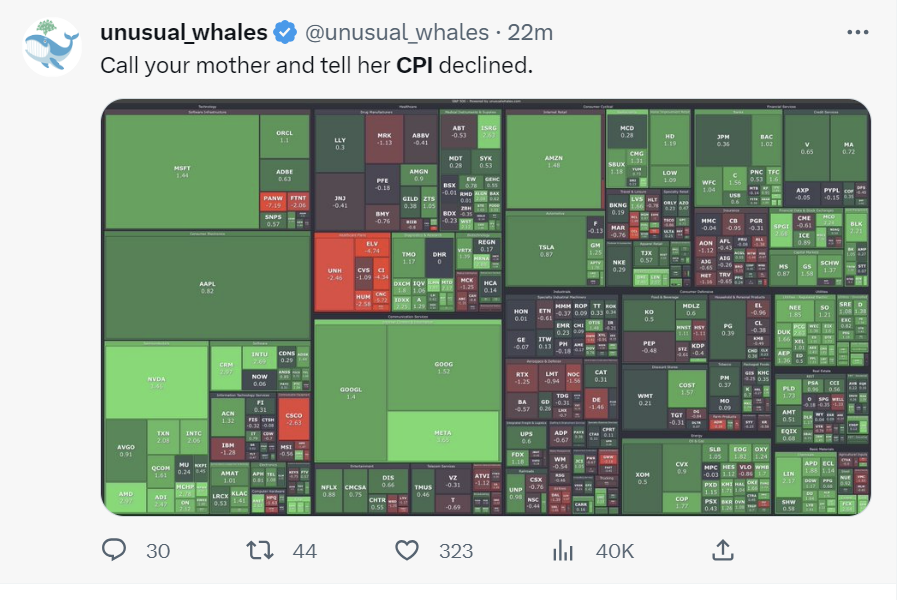

The Consumer Price Index (CPI) for June 2023 just came out. As you would expect, the internet was suddenly filled with economists. It was a good day for the stock market, as this Tweet shows.

But the truth is, there was good news and bad news. The takeaway is that the market expects the Federal Reserve to raise rates again at its meeting later this month.

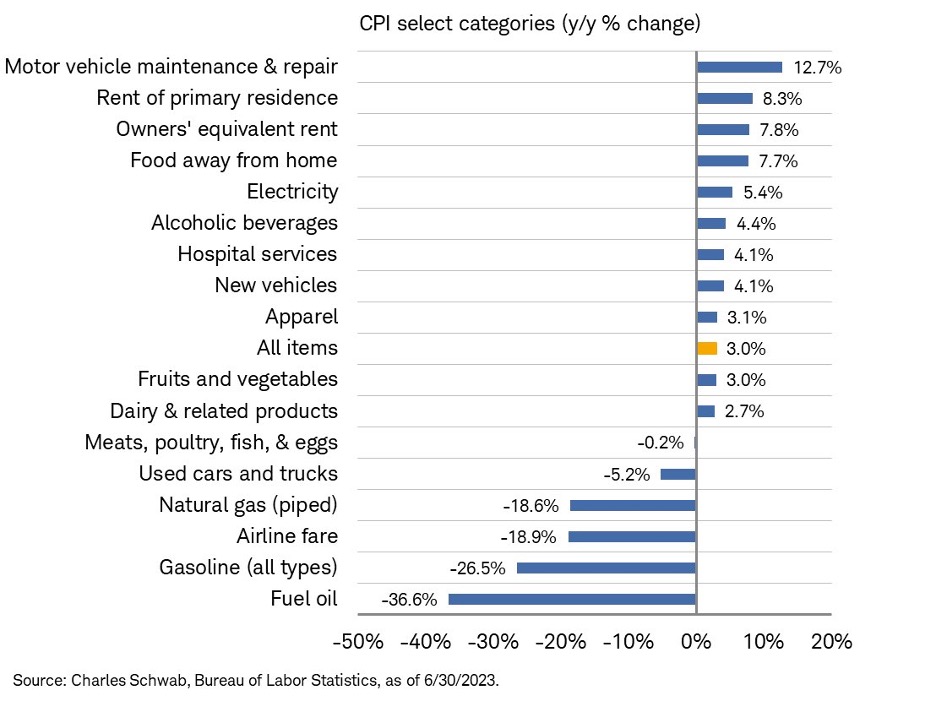

The good news first…natural gas, gasoline and fuel oil are the big declines from last year – down 18.6%, 26.5% and 36.6%, respectively. Those have a direct impact on most of us. So, to see them fall that much is excellent.

Now for the not so good news…food, electricity, restaurants, rent, and clothes are all up. The average CPI is up 3% for the year. That means, in general, everything that cost us $1 last year costs $1.03 this year. That’s not outrageous, but it means the high prices did not go down.

The average American can still feel the affect of inflation. Every time we go to buy milk, bread and eggs. Food inflation is up 26% since the end of 2019. That hits home every time we go to the grocery store. It’s bad enough that I’m tempted to get a fake ID to get a senior citizen discount. It’s bad enough that the local grocer raised the qualifying age from 60 to 65 years old.

That’s the kind of inflation that the Federal Reserve Board wants to curb. And so, we probably should expect another rate hike. If not in July, then definitely before 2024.

Another hike means a stronger dollar. A stronger dollar means lower commodity prices. We can expect our mining companies to struggle in the wake of another hike. Although the market may have priced in another hike.

If that’s the case, we could see little or no change to our portfolio. For now, we watch and wait.

For the Good,

The Mangrove Investor Team