New Energy Weekly – On the Brink of Something

The stock market can turn quickly from bull to bear in a heartbeat.

It all comes down to risk and fear.

When investors feel confident, they buy companies “down the risk chain.” In other words, they are willing to take on more risk in their investments. The ultimate top in confidence are the bubbles, like the NFT/crypto currency mania of the last few years.

When they lose confidence, they pull back. And when they start selling the major blue-chip companies, we need to take notice. And that is the case right now.

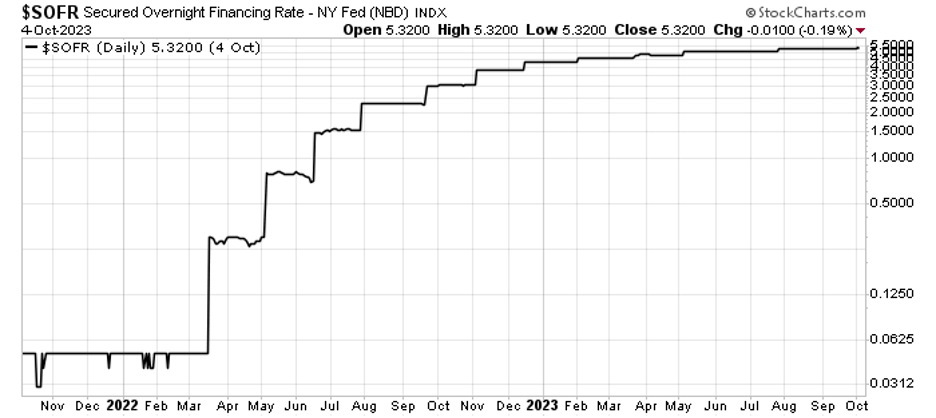

Today, we have several forces impacting investor confidence. The first is higher interest rates. The chart below shows the rates that banks pay. You can see the “stair steps” due to the Federal Reserve increasing the rates.

According to the Federal Reserve Bank of New York’s website, the Secured Overnight Financing Rate is:

… a broad measure of the cost of borrowing cash overnight collateralized by Treasury securities.

As the rate goes up, it has broad implications for the economy and the stock market. We discussed this before, in the context of housing. Higher interest rates dramatically increase the cost of buying a house. We can see that in the number of new homes being built. Short of the pandemic in 2020, the recent decline is the largest since 2009.

Even as oil prices rise, gasoline prices remain high.

In addition, the higher interest rates make the dollar more valuable. Those interest rates make the bonds more popular. And today, you can earn over 5% risk free. Those bonds drove the value of a dollar up, as you can see here:

A stronger dollar means you can buy more “stuff” per dollar, particularly commodities. That pushes down the price of everything from oil to cotton to other currencies.

There is a push to take profits now. Investors are worried that the rising interest rates will finally slow the U.S. economy. Particularly through housing, which has an enormous impact all throughout the U.S. economy.

Add to that the political mess in Congress and investors are pulling out and sitting on the sidelines for the moment. You can see that by the performance of the S&P 500 Large Cap Index below.

The bull market that was in place looks broken now. We need to watch closely for the next week or two. If the index continues to decline, the market could take a large step lower.

Investors are uncertain. They are losing confidence in the market. And that leads to lower prices.

We’ll keep you posted on what’s going on next week.

For the Good,

The Mangrove Investor Staff