A “Picks and Shovels” Opportunity on the Next Generation of Electric Vehicles

In 1850, a Bavarian-born entrepreneur stepped off his ship onto the bustling wharf in San Francisco, California.

In 1850, a Bavarian-born entrepreneur stepped off his ship onto the bustling wharf in San Francisco, California. He brought a cargo of dry goods from his brothers’ warehouse in New York. He planned to make his fortune, selling dry goods to the miners.

You see in 1850, the California gold rush was on.

It filled the city with people seeking treasure in the mountains. He was so successful that he opened his own firm. As a good merchant, the German spoke to the miners and listened to what they needed. The most common complaint was a lack of durable work clothes.

By 1872, he and a Nevada tailor patented a process to make strong work pants. The key to their strength was to use rivets rather than thread at the points of strain on the pants. The man’s name was Levi Strauss. And when he passed away in 1902, he left $6 million to his family and charitable organizations.

That’s about $214 million in today’s dollars. That’s an incredible fortune created in just fifty years. It’s the result of supplying the materials needed by the mining boom. There are many stories about companies and industries that took off by supplying the “picks and shovels” to one boom or another.

This month, we’re going to look at that kind of opportunity in the electric vehicle (EV) sector. We are going to break down a company that makes critical supplies for EVs. And not just to the current models, but to the next generation of EV’s.

We believe demand for this technology will grow massively over the next few years.

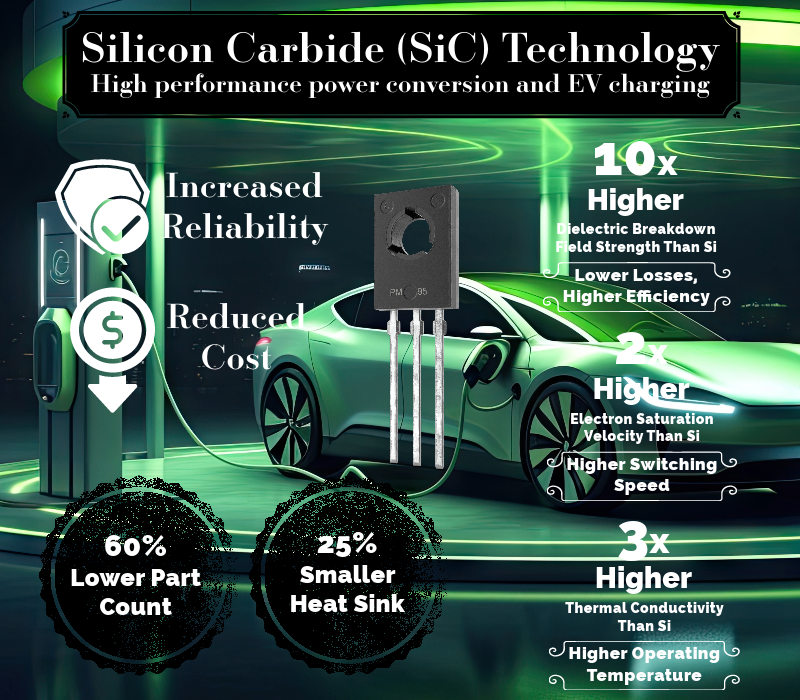

Silicon Carbide (SiC) will facilitate the next generation of EVs

The electrical backbone of an electric vehicle (EV) includes the electrical components like battery, motor, controls, and auxiliary equipment.

The current state of EVs uses a 400-volt system for its backbone. The next generation will use 800 volts. That creates some significant benefits.

An 800-volt system recharges faster than a 400-volt system. And it consumes less energy. That means the 800-volt system can go farther on a single charge, without increasing battery size.

Hyundai has two 800-volt models in production, the IONIQ and the Kia EV6. They can go from 10% to 80% charge in 18 minutes.

However, those improvements come at a price. The entire system needs to be redesigned.

The highest profile change will be in the chips. Silicon gets too hot to use with an 800-volt system.

That’s where Silicon Carbide (SiC) comes in.

While more expensive than silicon, SiC is more efficient. Energy loss is only 2% compared to 5% to 6% for silicon. SiC chips increase range by 6% and allow faster charging. That may not seem like much, but increased range is the holy grail of EV engineers. And that puts SiC chips in high demand

Dr. Masayoshi Takemi, Executive Officer, Group President, Semiconductor & Device of Mitsubishi Electric, said:

“Demand for SiC power semiconductors is expected to grow exponentially as the global market for electric vehicles increases in line with the transition to a decarbonized world.”

Automotive suppliers like Bosch, Infineon, and Onsemi are all increasing their positions in SiC manufacturing. Bosch sees SiC chip demand growing 30% per year. The company plans to invest $1.5 billion to convert TSI Semiconductors from silicon wafers to SiC wafers.

Analysts believe the SiC market will grow 28% per year compounded. They estimate that the SiC total addressable market will grow from $3 billion in 2022 to $21 billion in 2030.

This month, we are going to focus on a company that is spinning out a subsidiary that will be a major supplier of SiC semiconductors for the EV market. That’s why we like Coherent Technologies.

That’s why we like Coherent Technologies.

The Levi’s of Silicon Carbide – Coherent Technologies

Coherent Technologies (NYSE: COHR) is a $4.95 billion technology company.

The company develops diversified applications for the industrial, communications, electronics, and instrumentation markets.

It was founded in 1971 and employs about 26,000 people in twenty-four countries. It holds over 3,000 patents. Coherent is an excellent corporate citizen. The company also receives high marks for corporate responsibility. It sources half of its electricity from renewable sources.

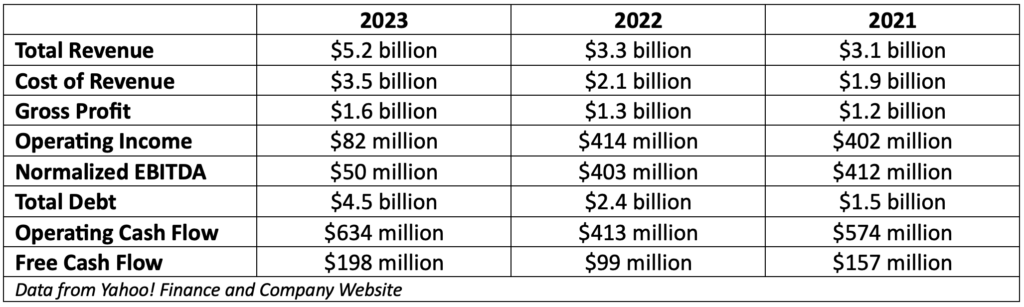

The company generated $5.2 billion in revenue in 2023. The breakdown by segment:

- 29% Lasers

- 26% Materials

- 45% Networking

The company operates in North America, Europe, China, Korea, and Japan. The company makes:

- Fiber lasers for specialty welding

- UV laser for OLED manufacturing

- Laser systems and processing heads

- Laser components like optics and crystals

- Ceramics, metal matrix composites and diamond

The company has several applications that are in demand by carmakers.

But the big news came out recently.

On October 10, 2023, the company announced that Denso Corporation and Mitsubishi Electric Corporation agreed to invest $1 billion into its SiC business.

Each company would invest $500 million for 12.5% of the company. As part of the arrangement, Denso and Mitsubishi Electric will enter into long-term supply contracts.

Shinnosuke Hayashi, President & COO, Representative Member of the Board at DENSO said,

“We are very pleased to establish a strategic relationship with Coherent, which has a world-class track record in SiC wafer manufacturing. Through this investment, we will secure a stable procurement of SiC wafers, which are critical for BEVs, and contribute to the realization of a carbon-neutral society by promoting the widespread adoption of BEVs.”

It’s impressive that Coherent invested in its SiC division beginning in 2021. It was part of a ten-year, $1 billion commitment to new products to enhance its position in the market. Spinning out the SiC division with partners will grow its cash flow. And the combined $1 billion investment will fund the expansion of the SiC division.

The deal values the SiC portion of Coherent at $4 billion ($3 billion attributable to Coherent). That’s a 300% increase in value from Coherent initial investment. And it means we can buy the rest of the company’s business for less than $2 billion.

Coherent invests half a billion dollars in research and development each year. That’s the highest in the industry.

The rest of Coherent’s business is increasingly valuable and diverse.

We believe they are worth far more than $2 billion, which means we get them at a discount.

Nuclear Fusion

It is a leader in the lasers used in high-temperature superconducting (HTS) tape. HTS tape is the key to mass deployment of tokamak nuclear fusion reactors. Global demand for HTS tape could grow by an order of magnitude through 2027.

Coherent signed an agreement with Faraday 1867 Holdings LLC that outlines a partnership in HTS tape manufacturing.

The goal of the partnership is to supply the mass deployment of tokamak nuclear fusion reactors.

According to the company’s press release:

The prospect of carbon-free energy has accelerated the development of tokamaks over the last decade, driving the demand for HTS tape, the technology at the heart of the extremely strong electromagnets used to confine plasma in magnetic-confinement fusion reactors. Coherent LEAP excimer lasers are the industry standard in pulsed laser deposition that enable the manufacturing of HTS tape. Faraday 1867 Holdings LLC is the world’s leading producer of HTS tape through its subsidiary, Faraday Factory Japan LLC. The LOI outlines a strategy to increase manufacturing capacity at Faraday’s factory in Japan with excimer lasers from Coherent, to meet the global demand for HTS tape that is expected to grow by a factor of ten by 2027.

Coherent and Faraday 1867 Holdings worked together for a decade on the development of the HTS tape. The new agreement will increase the manufacturing capacity at Faraday’s factory in Japan.

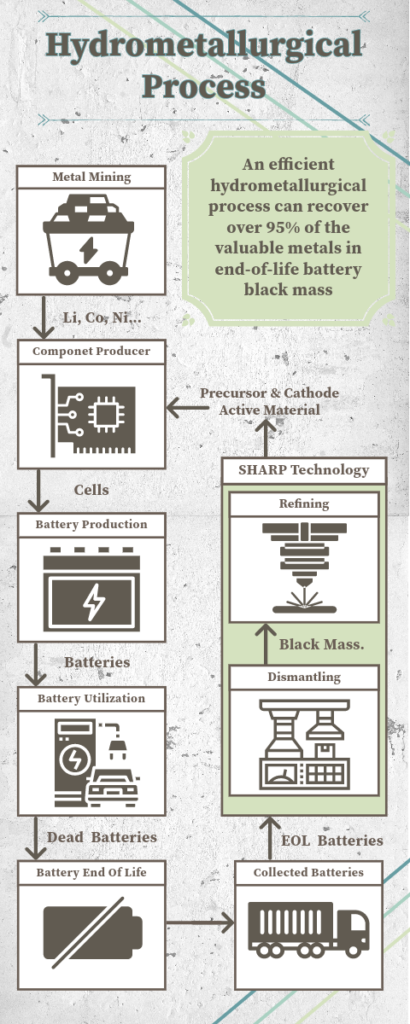

Lithium-Ion Battery Recycling

Coherent created its streamlined hydrometallurgical advanced recycling process (SHARP). The process recovers 95% of the lithium, nickel, cobalt, and manganese from dead lithium-ion batteries.

According to the company, the SHARP process has a 60% lower capital cost, uses 30% less reagents, and less utility costs compared to the industry standard hydrometallurgical processes.

In addition, the process creates zero liquid discharge. It has no solid, gas or liquid toxic waste. And it uses less energy and water than other methods.

Automotive Manufacturing

Coherent’s laser technology has applications in several vehicle manufacturing processes. The company makes lasers for welding many unconventional materials:

- Thin or heat sensitive materials

- Metals like aluminum, copper, and high-strength steel

- Joining dissimilar materials

The company’s lasers are also integral for welding EV batteries. They generate minimal heat to avoid damaging delicate parts. They save money with higher productivity. And they have flexible welding parameters, so are useful when conditions change.

The company’s lasers get used EV construction.

They are used to strip and weld “busbars.” Busbars are the central nervous systems of the EV. They are the main power conduits, ribbons of insulated copper.

Coherent’s lasers strip off insulation without damaging the busbars. Other lasers precisely weld the busbars. EV manufacturing is a new process. And innovation is key to improving the systems.

Coherent’s lasers are at the heart of these innovative technologies.

The company’s financials are solid.

In 2023, the company’s revenue was above the high-end of its estimate. It paid down $121 million of its debt. The company’s revenue forecast is for $4.5 billion to $4.7 billion in 2024.

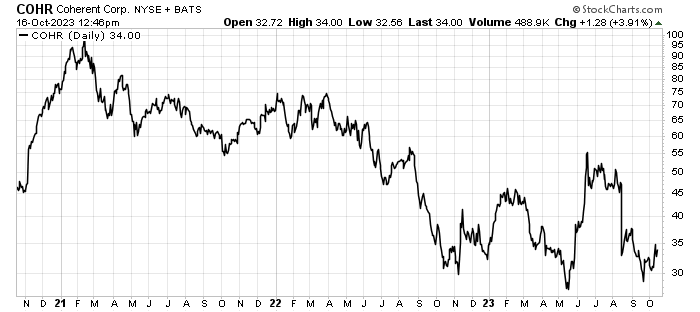

That reflects a decline from this year. That contributed to the recent decline in the company’s share price, which you can see here:

However, the company’s technology contributes directly to improvement in EV performance. That’s an area where we see significant growth.

That leads us to believe that the current decline in the share price is a short-term response.

Action to Take: Buy shares of Coherent Corp (NYSE: COHR) up to $40 per share. Use a 25% trailing stop to track your position. That means, if you buy shares Coherent at $34 per share, you will sell your position if it fell below $25.50 per share.

By doing that, we only risk 25% of our capital on our position in Coherent. And if the shares fall precipitously from here, we need to sell our position.

We really like Coherent Corporation. It’s a company that is both innovative in technology and in its social responsibility.

We see the growth potential in the areas of focus of Coherent – EV manufacture, communications, and energy technology.

That’s why we believe the current decline in share price is an opportunity for us to take a position in this emerging company.

For the Good,

The Mangrove Investor Team