Spotlight Weekly – Economic News

The Good Economic News Continues

It marked an incredible rally from its 2,237.40 low in March 2020. Every dollar you put into the S&P back then, more than doubled in just two years.

However, as the market peaked, so did the cost of everything. Fuel prices, food prices, and shipping costs all soared. The inflated costs hit consumers hard, and the Federal Government took notice.

Rising inflation sparked a strong response from the Federal Reserve bank. They began to raise interest rates, which shook the market. A strong fear of recession took hold of the stock market. Investors sold in droves and the S&P 500 retreated.

As we discussed in the past, the market spent the last two years waiting for the recession. Everyone knew it was coming. It wasn’t an “if,” it was a “when.” So, we waited. And waited.

And in the meanwhile, the S&P 500 bottomed and began to climb again. As you can see in the chart below, it’s now at 4,516.22. That’s just 6% below its all-time high…

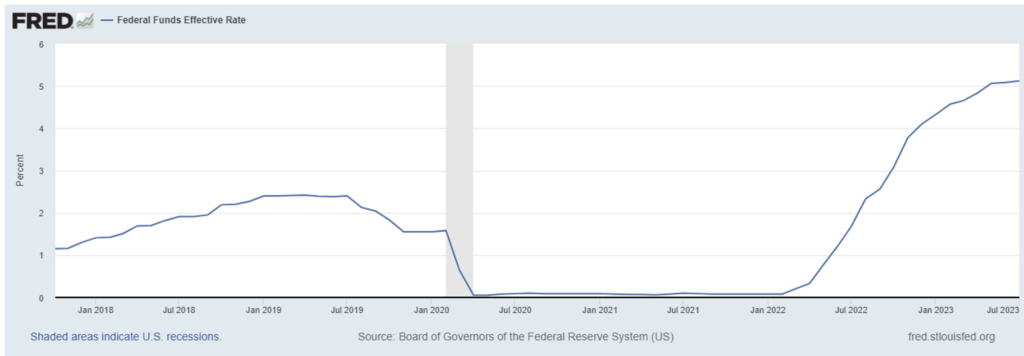

They did that because inflation took off. You can see the change in the chart below:

As you can see, the line was relatively flat from until mid-2020. And then it skyrocketed. That was the impact of inflation on consumer prices. The Fed reacted, by raising interest rates…two years later.

There are lots (and lots) of side effects to raising interest rates. Just turn on Bloomberg for fifteen minutes anytime during the week and you’ll get a dose of it. And the Fed didn’t just raise rates, they threw on the emergency brake. But in general, we can expect these changes to impact stocks, bonds, and commodity prices.

High interest rates impact stocks and commodity prices. If they can earn 5%+ in Treasury bonds, fewer will take a risk on stocks. And as more investors buy those bonds, the stronger the dollar becomes. By saying “stronger”, it means the dollar becomes more valuable in terms of other currencies. Effectively, you get more pounds, euros, lira, etc. per dollar.

And that has some downstream impacts. It makes our European vacations cheaper. But it hurts companies that export goods to other countries. Goods priced in dollars become more expensive. It has the opposite affect on imports. Imported commodities become less expensive in dollar terms.

In summary, the current economic situation looks good. The interest rate hikes cooled off inflation. It hasn’t hit the ideal target yet. But the economy appears healthy. We have high employment and rising wages.

That would imply that the Fed would take a break from raising rates. That would be great for the stock market. Because once the Fed quits messing around and sits on its hands, the market will really take off.

For the Good,

The Mangrove Investor Team