Spotlight Weekly – The Stock Market IS NOT the Economy

On January 3, 2022, the S&P 500 closed at 4,796.56. It was an all time high

It marked an incredible rally from its 2,237.40 low in March 2020. Every dollar you put into the S&P back then, more than doubled in just two years.

However, as the market peaked, so did the cost of everything. Fuel prices, food prices, and shipping costs all soared. The inflated costs hit consumers hard, and the Federal Government took notice.

Rising inflation sparked a strong response from the Federal Reserve bank. They began to raise interest rates, which shook the market. A strong fear of recession took hold of the stock market. Investors sold in droves and the S&P 500 retreated.

As we discussed in the past, the market spent the last two years waiting for the recession. Everyone knew it was coming. It wasn’t an “if,” it was a “when.” So, we waited. And waited.

And in the meanwhile, the S&P 500 bottomed and began to climb again. As you can see in the chart below, it’s now at 4,516.22. That’s just 6% below its all-time high…

And yet there are still fund managers who are convinced that we will have a recession. I hear it all the time from stockbrokers and money managers. They don’t want to speculate right now, because this is all going to come crashing back down.

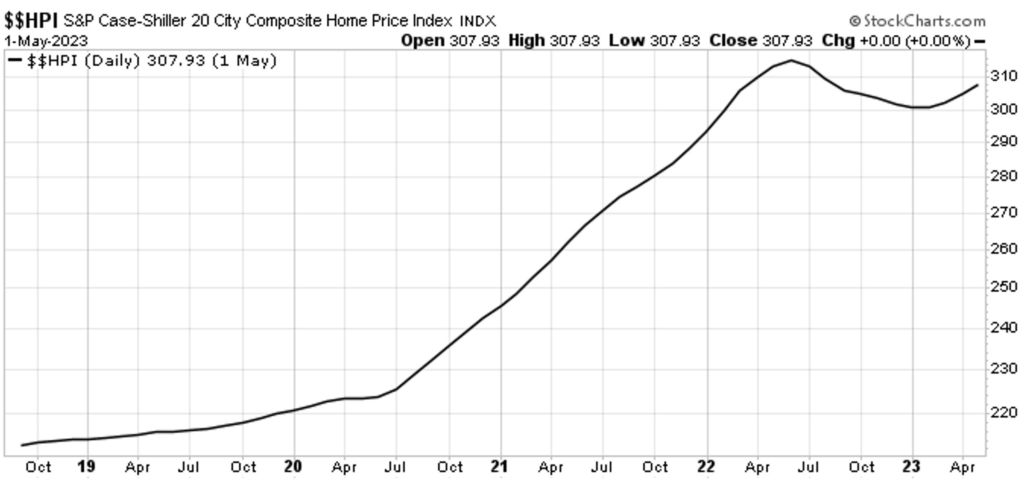

And it could. I honestly expected high interest rates to hit the housing market much harder. And that could’ve created a recession. But according to the Case Shiller 20 City Home Price Index, real estate has recovered as well.

However, sentiment is recovering and that’s great news for the economy.

For the Good,

The Mangrove Investor Team