The Best New Nickel Project in America Today

In 2017, I flew to Anchorage Alaska to tour a “lost gold mine”

According to the U.S. Geologic Survey, prospectors found gold in the area near the Lucky Shot mine in 1918.

The mine itself went into production in 1922. The mine operated for twenty years.

However, in 1942, the government closed down all non-essential mining for the war effort.

It never reopened, even though the vein was super rich, running as high as two ounces of gold per ton in places.

The mine opening (portal) sat well up on a steep cliff. Our helipad was a Jenga stack of timbers.

I wasn’t thrilled about that part.

Especially when the prop wash flattened me to the side of the hill.

I loved going underground in the old Lucky Shot mine. We had to slither by the sheet steel welded over the opening.

Once inside, the tunnel still had the pine log supports from ninety years ago.

The visit to Lucky Shot didn’t result in an investment opportunity, unfortunately.

But as often happens when you travel, it was a chance meeting that created our opportunity today.

And we caught a lot of fish.

The owner of the boat also ran a small exploration company called Millrock Resources.

A Canadian expatriate, Greg Beischer spent forty years working in the mining exploration industry.

He had over a decade working for majors before he opened his own company.

Fast forward to last weekend.

Greg was in Orlando Florida with his new company at the Money Show. A giant investor showcase that features everything from real estate to day trading ideas.

Greg and I sat on an energy metals panel.

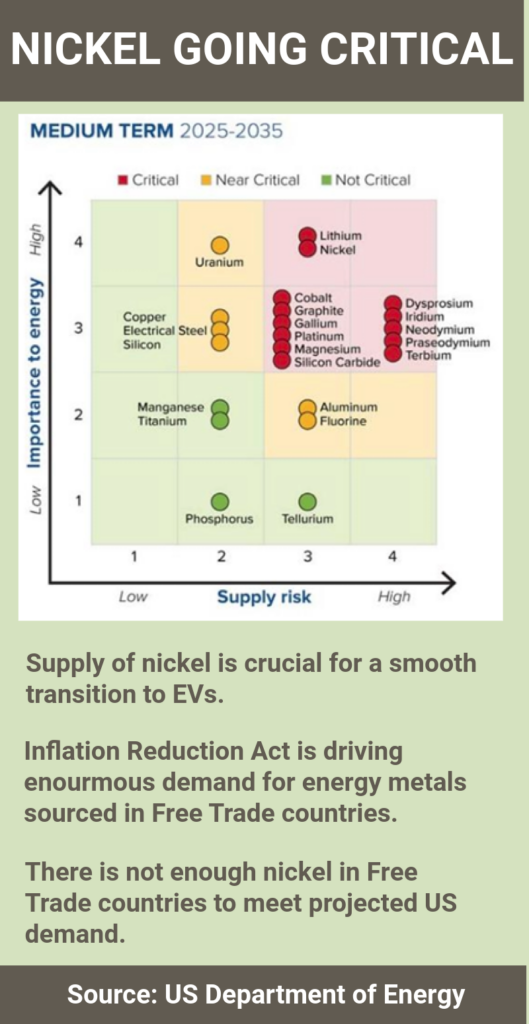

We discussed electric vehicle demand and the lack of new battery metal projects. There just aren’t that many new projects in the U.S.

However, Greg’s company has one. He touched on a few aspects of his new project, and I was intrigued.

Afterward, I attended his company talk and realized that we needed to own it in our portfolio.

It owns a giant nickel and platinum group deposit in Alaska called Nikolai.

This deposit meets all the criteria for the EV battery industry. And Greg knows the Nikolai deposit well. It was this project that brought him to Alaska in the 1990’s.

And when the company wanted to move him somewhere else, he opened his own company and stayed.

This month, we’re going to “dig” into America’s next giant nickel deposit with Alaska Energy Minerals.

The Best New Nickel Project in America Today

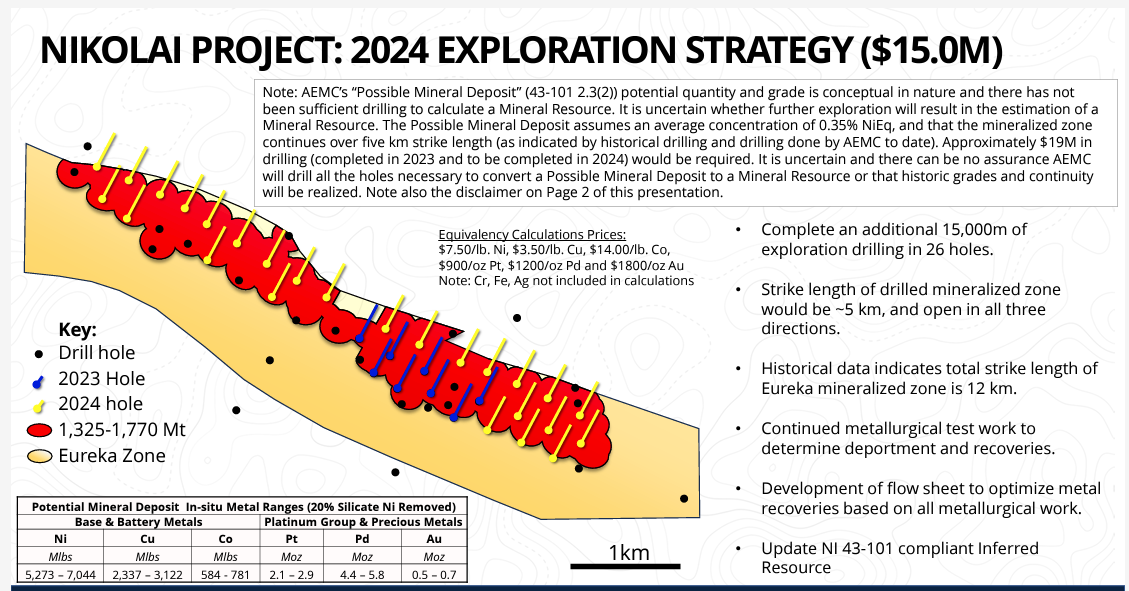

The Nikolai project is a gigantic area of anomalous nickel mineralization. The Eureka Zone is 35 square miles. The company holds another 18 square miles in the Canwell Zone.

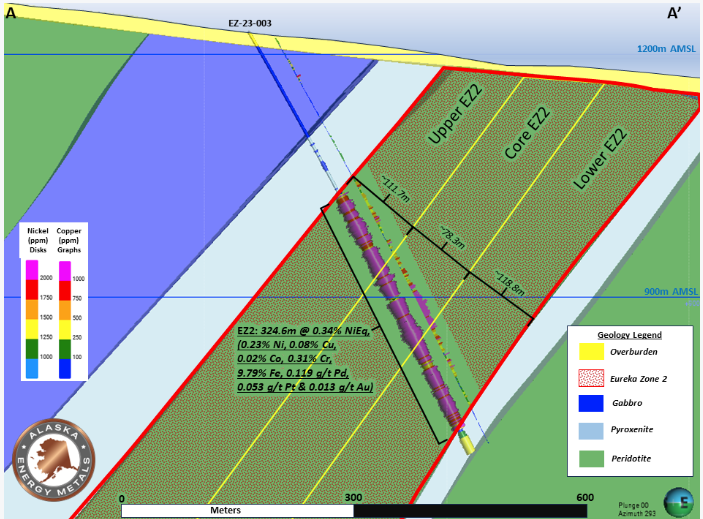

Drilling in the Eureka Zone identified three steeply dipping layers of mineralization. The upper, the core, and the lower zones.

All three zones contain metal, but the core zone has the highest grades.

The three zones together are around 300 meters thick (nearly 1,000 feet), on average.

Greg told me that the Nikolai Project brought him to Alaska in the 1990’s. He worked for a major mining company at the time.

They made the discovery and sent him to evaluate the project. However, the price of nickel collapsed in 1997, bottoming around $1.65 per pound.

And while the drilling indicated that the Nikolai deposit was huge, it didn’t have the grade.

It takes a lot of metal per ton to make an economic mine at $1.67 per pound.

However, since then, the price of nickel rose substantially. Today, a pound of nickel is worth around $8.90. And it spiked to more than $23.50 per pound in 2006.

At the current price, Nikolai looks much more interesting. And our outlook is that the nickel price should rise due to EV demand.

This project looks even better down the road.

More importantly, Nikolai holds more than just nickel.

In its recent press release, the company reported 324.6 meters of rock that contained 0.23% nickel, 0.08% copper, 0.02% cobalt, 0.119 g/t palladium, 0.053 g/t platinum, and 0.013 g/t gold.

That works out to 4.6 pounds of nickel, 1.6 pounds of copper, 0.4 pounds of cobalt per ton of rock. Cobalt is worth $15 per pound. Copper is $3.67 per pound. The platinum and palladium values actually add over $5 per ton as well.

That means the metal value of this rock is over $50 per ton at current prices. That will come down, once the company figures out how much of the metal they can recover.

The more important aspect of Nikolai, for economics, is its scale and consistency. This deposit is massive.

The company believes that, in the small area it drilled so far, could hold:

- 1.3 to 1.8 billion pounds of nickel

- 433 to 580 million pounds of copper

- 117 to 157 million pounds of cobalt

- 512 to 686 thousand ounces of platinum

- 1.1 to 1.5 million ounces of palladium

- 152 to 203 thousand ounces of gold

And that’s just a fraction of the overall deposit.

The investment thesis for us is that this project will get much (much!) larger. Here’s what I mean:

Next year, the company plans to invest $15 million in drilling and exploration.

The goal is to dramatically expand the underground map of the Nikolai deposit. Once the company has this information, they can create a much better volume calculation on the metals. But they believe it could expand by nearly five times!

That’s because, so far, the deposit shows exceptional uniformity. In other words, the metal looks the same in each drill hole. That’s particularly attractive to mining companies because it makes things easy.

If every ton of rock looks like the last one, they don’t have to change any processes.

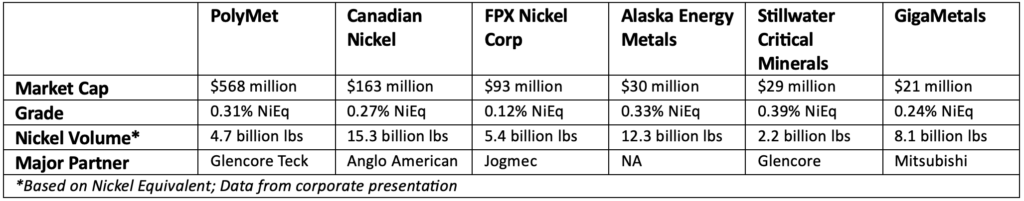

The other exciting opportunity for us is that Alaska Energy Metals is well undervalued compared to its peers.

Most of the other junior nickel companies have major mining partners like Anglo American, Mitsubishi, Jogmec, Glencore, and Teck Resources.

Here’s a breakdown of the valuations:

As you can see, the grade compares well between Nikolai and its peers. The size of the project dwarfs many of its peers. And the company trades for a fraction of the value of its closest peers.

All it’s missing is a major partner.

And with Greg’s contacts, that could be something that comes in the next 18 to 24 months.

Our risk in this company is that the metal demand doesn’t materialize the way we expect. Low nickel/copper prices will prevent development. That’s what happened in the 1990’s and it is a risk today as well.

However, EV demand continues to ramp up, battery manufacturers invested billions into new plants in the U.S. and the U.S. government put a premium on domestic battery metal supplies.

Those factors reduce our risk of falling metal prices over the next two years.

Alaska Energy Metals is a new junior explorer, so its share structure looks good:

As we discussed earlier, this is an experienced and successful management team. Greg guided Millrock Resources for 15 years, through some lean times. Now he has a strong project with the right mix of metals.

We believe Alaska Energy Metals’ shares could easily double on next year’s drill program.

Action to Take: Buy Alaska Energy Metals (TSX V: AEMC; OTC: AKEMF) below C$0.60 per share.

We believe there will be opportunities to buy this stock around C$0.50 to C$0.55 per share over the next few weeks. Be patient.

If you are buying the OTC shares, buy below $0.42 per share.

The recent spike in Alaska Energy Metals’ share price came on the October 30th press release. We believe that the price will come down off that high as early investors take some profits. As that happens, it will create a buying opportunity for us.

Take your time building your position in the company. We should be able to get shares at lower prices.

Good Investing,

The Mangrove Investor Team