The Best Way to Play the Global Demand for Batteries

The daily news just keeps underpinning our metal outlook.

The dollars invested by major companies just gets larger and more compelling.

Just this week, we heard that China’s Yadea Group, one of the world’s largest E-bike makers, planned to invest $1 billion in an E-bike factory in the Philippines. The electric motor-cycle market is huge and getting bigger.

Batteries now go into everything – yard machines, lawn mowers, bicycles, cars, and even communities. The advances in energy storage (batteries) will change the world for the better.

In the past, we had single, monolithic power plants. They consumed massive amounts of coal, natural gas, or uranium to power an entire region. And if the plant went down, it was a struggle to reroute power to the right places.

The Texas power crisis of 2021 is a fitting example of how this system can fail. The locals called it “snovid” because it shut everything down. Three severe winter storms hit in February 2021. Between 246 and 700 people died as a result of the grid failure.

While that prevented demand from overwhelming the grid, it also cut power to natural gas supply chain. That reduced natural gas supply to the power plants, which increased the problem.

And while Texas does get about 24% of its power from wind power, it doesn’t store that power. A network of grid-scale batteries would have taken up a part of the extra load from the heaters that blasted across the Lone Star state.

Batteries aren’t a panacea. There’s no guarantee that they would have prevented the deaths in Texas. But they would have helped reduce the spike in demand. Batteries possess flexibility in the system, like shock absorbers. They can accept extra production on the one hand and supply immediate power when demand spikes.

They can help manage the balance and flatten the spikes in demand and supply.

The reason is simple, they cost much less today than ever before. BloombergNEF cites the decrease in cost from $1,200 per kilowatt-hour of storage in 2010 to $151 per kilowatt hour in 2022.

Around the world, grid scale battery storage more than doubled in just three years.

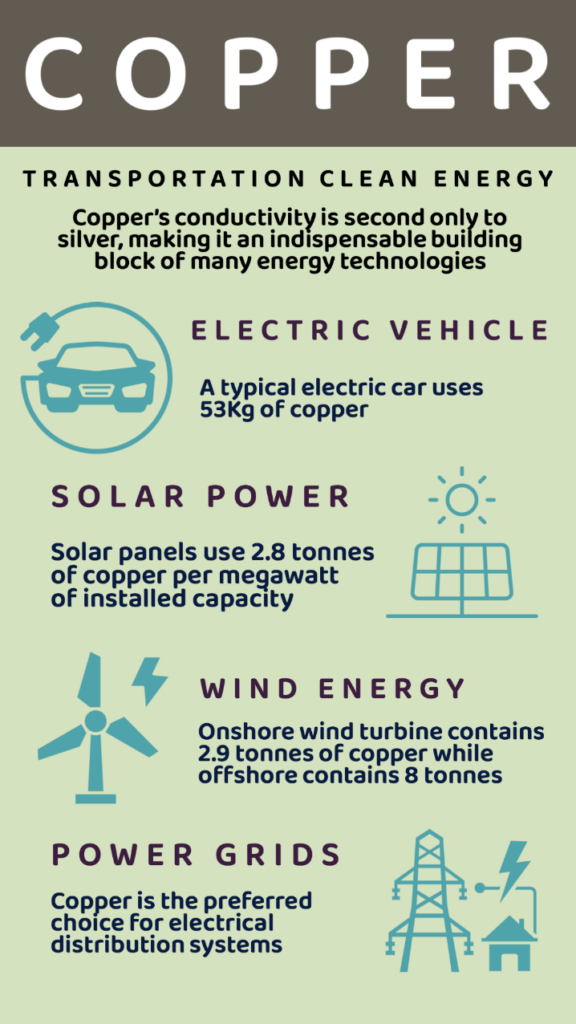

The question then becomes…where is all this metal going to come from?

All these batteries, from the one you plug into your drill, to the ones that power your car all require a lot of metal.

The rising tide of batteries should drive a demand for these basic materials. And that’s what leads us to this month’s idea.

We want a big, integrated metal company. A company that can create value at all levels of demand, but also is a good neighbor.

And we found it.

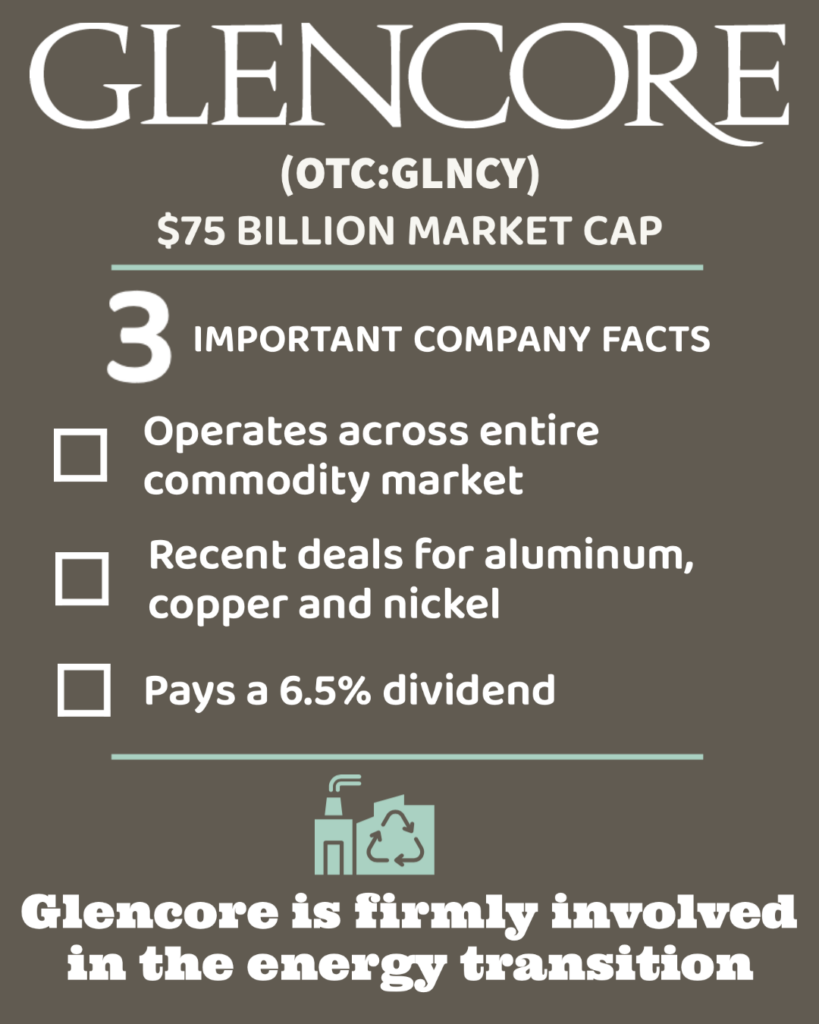

The company is Glencore Plc. (LSE: GLEN; OTC: GLNCY). It’s a giant international metal company.

They aren’t listed in the U.S., but we can gain access to shares through the over-the-counter market.

Our risk with Glencore is that the world goes into recession. That would stifle infrastructure investments around the world. It would certainly delay the bull market in metals.

However, that’s a risk for any investment right now. If we go forward with the outlook that the world’s economy isn’t going into recession, then we want to have Glencore in our portfolio.

The World’s Largest Integrated Metal Company

Glencore Plc (OTC: GLNCY) is a giant, $71.9 billion integrated commodity company.

They produce, refine, process, store, transport, and market everything from grains to metals, to energy. The company also invests in all types of commodity businesses.

For example, it owns a lead smelter that is the largest customer of recycled lead acid batteries from European battery recycler Recylex.

I see Glencore as the Amazon.com for the energy revolution.

The company operates in several distinct stages of the commodity supply chain. They partner in everything from mines, like the Mara copper project in Argentina to tugboat operations in Australia to grain farms in Canada. They operate shipping terminals, smelters, and recyclers.

That makes Glencore one of the best companies for exposure to the whole gamut of commodities, without taking on much risk. And the company currently pays us 6.5% dividend yield to hold its shares.

Financials:

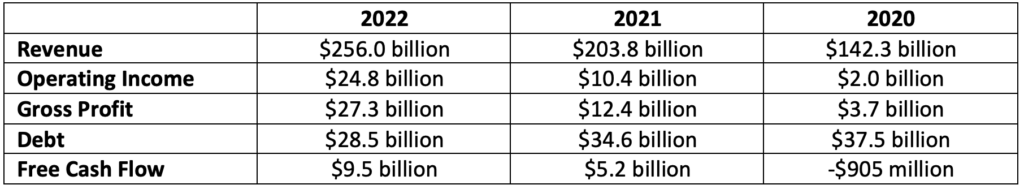

As you can see in the table below, the company suffered in 2020. Like most global businesses, the Covid-19 lockdowns hammered the company. It recovered. The resilience of Glencore’s business is testament to its utility. And it will become more important as the energy transition deepens.

Some important takeaways from the table are the 24% decline in debt and the massive jump in Free Cash Flow. The company paid down $9 billion in debt, from $37.5 billion to $28.5 billion. And it saw a $10.4 billion increase in annual free cash flows.

Those are signs of a healthy and growing business.

Business Overview:

In April 2023, the company announced a deal with Norsk Hydro ASA, one of the world’s leading low-carbon aluminum makers. Glencore acquired 30% of the Alunorte project and a 45% stake in Mineracao Rio do Norte SA. Both projects are in Brazil. The ownership gives Glencore the right to the aluminum produced by those mines.

Glencore’s head of Alumina and Aluminium said:

“The growing decarbonization trend is driving demand not only for the mass production of batteries that require the raw materials which Glencore produces, but also for primary aluminum as a strong, lightweight manufacturing metal.

“The acquisition of the equity stakes in Alunorte and MRN provide Glencore with exposure to lower-quartile carbon alumina and bauxite, enhancing our capability to supply such critical material for the ongoing energy transition to our customers.”

The giant company also moved into nickel and copper. On June 12, 2023, the company participated in a deal to buy two additional mines in Brazil. Along with Stellantis (which owns Chrysler) and Volkswagen’s battery unit PowerCo, the group acquired the Santa Rita nickel sulphide mine and the Serrote copper mine. This will bring the nickel concentrate to Glencore’s refining facilities in North America and Western Europe. The final material will go into EV batteries for Volkswagen, Stellantis and others.

As you can see, Glencore is firmly involved in the energy transition, from all parts of the supply chain. It’s size, diversity, and global presence makes it an excellent investment for the next few years.

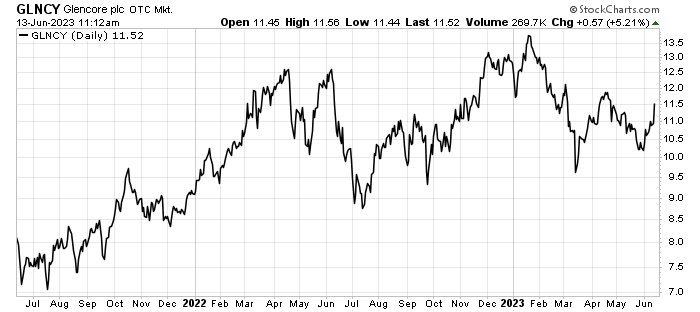

Recommendation: Buy Glencore PLC (OTC: GLNCY) up to $12.50 per share. At $12.50, our dividend yield would be 5.6% (they pay $0.70 per share per year). We recommend using a 25% trailing stop on the position.

That means we’ll risk 25% of our capital on this position.

So, if you invest $500, you risk losing $150 in our worst-case scenario. Barring that outcome, we’ll collect our dividends and wait to see if Glencore keeps growing.

Wrap Up:

Glencore is another terrific way to play the energy transition.

It’s a big, diverse, integrated commodity company. The business model lends itself to profiting from every part of the commodity chain. That’s good in a bad market, because when one part is down, another is usually up. But in a good market, it’s outstanding.

Our outlook is bullish on commodities, energy metals in particular. And Glencore is the perfect company to own if you agree.

Sincerely,

The Mangrove Investor Team