The Energy Story No One Knows…Yet

In 2022, giant mining company Anglo American unveiled something new.

The world’s largest hydrogen powered mine haul truck.

That’s the second largest mining dump truck available. It has six wheels and is the size of a modest two-story house.

And it runs on hydrogen.

It’s a two-megawatt hydrogen battery hybrid. And it outperforms its diesel counterpart. It’s part of Anglo American’s nuGenTM Zero Emissions Haulage Solution. This is a fully integrated green hydrogen system. The green hydrogen can be produced at the mine site.

This new truck is critical, because the company produces as much as 15% of its emissions from its fleet of diesel mining trucks.

It’s part of Anglo American’s FutureSmart MiningTM. Anglo American committed to sustainable mining by bringing together technology and digitalization to drive sustainability outcomes. That includes carbon neutrality across its operations by 2040.

To put that in perspective, Anglo American is the world’s largest platinum producer. It mines copper, diamonds, polyhalite, nickel, iron ore, manganese, and platinum. Anglo American also owns 85% of the De Beers diamond company.

In 2022, Anglo American produced 2% of the world’s copper – tying it for 8th largest. In other words, this isn’t some small, do-gooder mining company.

Duncan Wanblad, CEO of Anglo American said,

“Over the next several years, we envisage converting or replacing our current fleet of diesel-powered trucks with this zero-emission haulage system, fueled with green hydrogen. If this pilot is successful, we could remove up to 80% of diesel emissions at our open pit mines by rolling this technology across our global fleet.”

The company teamed up with some of the world’s leading creative engineering companies, like ENGIE, First Mode, Ballard, and NPROXX to:

- Design, build, and evaluate a 1.2MWh battery pack, as the haul truck system uses multiple fuel cells that deliver up to 800kW of power, combining to deliver a total of 2MW of power.

- Design and implement a software solution to safely manage power and energy between the fuel cells, batteries, and vehicle drivetrain.

- Develop the power management and battery systems from the ground up, enabling us to tailor the system to each mine and improve overall efficiency by designing in energy recovery as the haul trucks travel downhill through regenerative braking.

- Build a hydrogen production, storage, and refueling complex at Mogalakwena that incorporates the largest electrolyser in Africa and a solar plant to support the operation of the haul truck.

This is a model that will be studied and emulated by major mining companies all over the world. It’s a testament to the mining industry that such a massive undertaking is going on already.

But the most interesting part is the energy source they chose: hydrogen.

Back in June 2022, I wrote this about hydrogen:

In fact, hydrogen is the fuel that will probably dominate the future.

Like oil, coal, and natural gas, hydrogen is an efficient battery to store solar energy. Where fossil fuels store that energy in carbon (which converts to CO2 when we combust it), hydrogen converts to water.

It’s a natural replacement for methane (natural gas). When we combust natural gas in a power plant or stove, we produce both carbon and water – and that carbon gets pumped into the atmosphere. When we combust hydrogen, we just produce water. There is minimal waste.

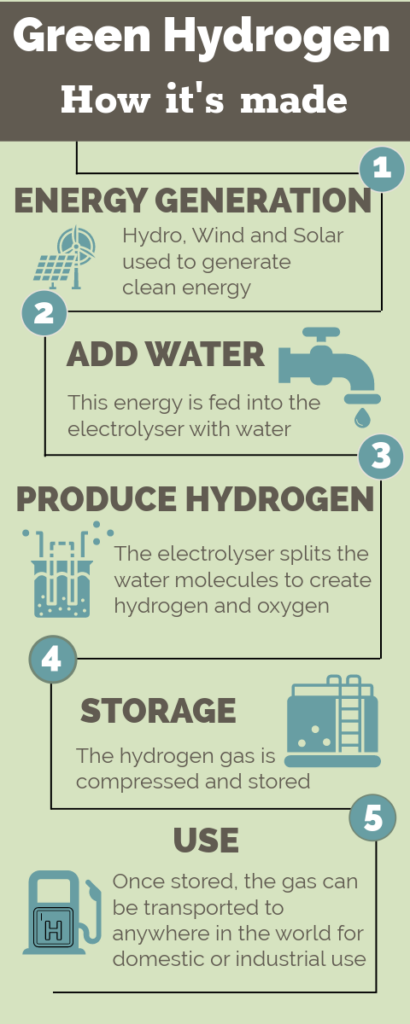

Even better, to generate hydrogen fuel, we simply use electricity to split water molecules into oxygen and hydrogen. The electricity and water can come from almost anywhere. And if that power is coming from solar panels, it’s a virtually zero-emission process.

If we move to hydrogen power, it will change the world. Imagine being able to produce fuel anywhere we have access to sunlight and water. It will cause a massive shift in global economics. Countries that once had to buy energy – usually in the form of oil and gas, regardless of the price – could now produce their own.

That last bit is what Anglo American sees too. They can produce the fuel for their trucks right at the mine. All they need is a solar panel, a water tank, and a compressor. They can make hydrogen, compress it, and store it on site.

No fuel trucks, no diesel bunker, no pipelines. And the sunlight is free. You can make hydrogen where it’s cheap and clean, then take it to where you need it…OR…you can make it where you need it.

But green hydrogen isn’t just about fuel. It will decarbonize industries like ammonia (fertilizer), methanol, refining, steel making, shipping, etc.

Make no mistake, hydrogen will play an important role in the world’s energy mix in the future. It’s the ultimate battery. And it fits with our existing technology. We don’t need to come up with something new and unique. Hydrogen works today.

There are gale force tailwinds for hydrogen, between the U.S. Inflation Reduction Act and support packages proposed by the European Union Commission. In addition, hydrogen projects jumped from bench scale to large-scale, recently.

And that’s why this month’s research target is Anglo American’s partner in its nuGenTM Zero Emissions Haulage truck. This company isn’t just working with Anglo American. It just announced plans to build a new automated gigafactory in Michigan. It will invest $400 million and create more than 500 new jobs.

And produce the equipment the world needs to produce hydrogen.

The Hydrogen Solution: Nel ASA.

The company is Nel ASA (OTC: NLLSF), the parent company of Nel Hydrogen.

Nel ASA (OTC: NLLSF) is a $1.9 billion hydrogen technology company, based in Norway. The company manufactures electrolysers. These are the equipment that produce low emission hydrogen.

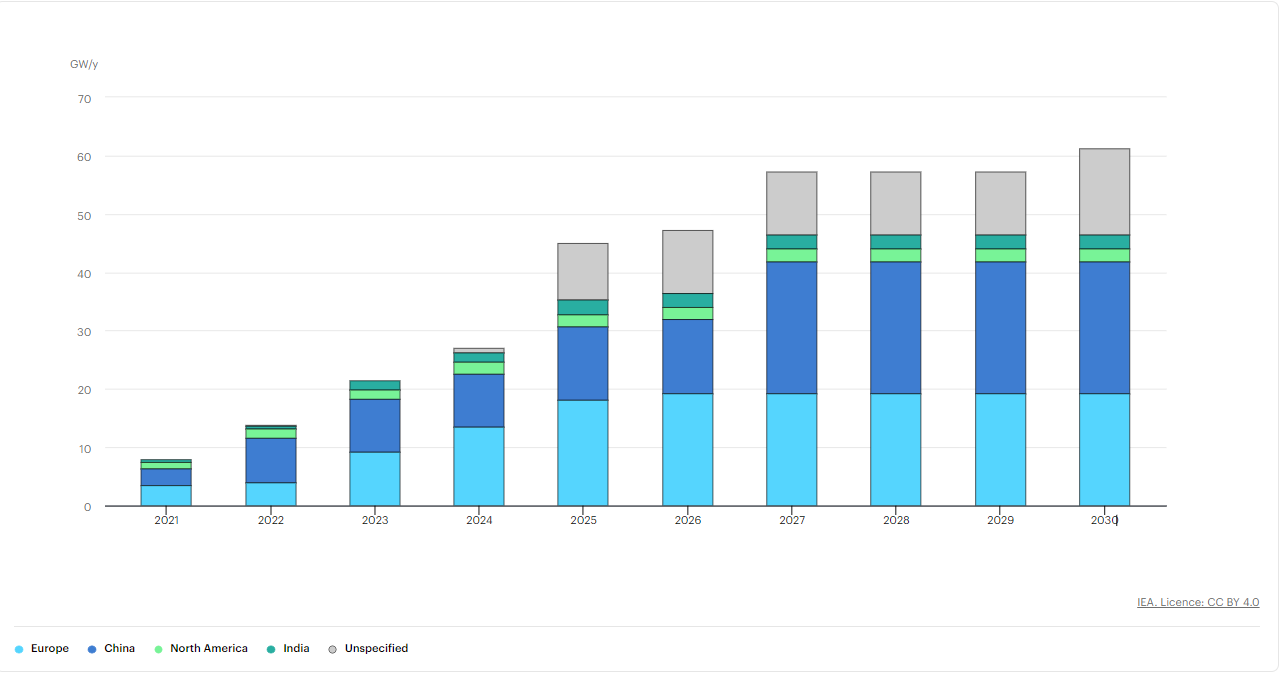

In 2021, investments in electrolyser deployment hit $1.5 billion. And it’s a growing market as you can see in this projection from the International Energy Agency:

The main period of growth in hydrogen will be from now through 2027. That’s why we should have companies like Nel in our portfolio.

As we discussed, hydrogen will be part of the energy mix in the near future. It’s too easy to make, it fits our existing energy demand technology, and it’s the most abundant element in the universe.

The company operates globally and has a long history. Founded in 1927, it built the first small electrolyser at Norsk Hydro in Norway. The company evaluated ways to create fertilizer from pure hydrogen.

Since then, the company continued to refine and develop its hydrogen manufacturing processes. In 2023, the company announced plans to build an automated gigawatt electrolyser plant in Michigan. As we discussed earlier, this will bring jobs and $400 million in investment to the area.

When it’s built, the plant will be one of the largest electrolyser manufacturing plants in the world. Michigan beat out several other locations for the facility. The proximity to General Motors’ (GM) headquarters in Detroit played a big role.

GM is the leading designer of “Hydrotech Fuel Cell Technology”. They call it The Affordable Hydrogen Fuel Cell Power Solution for Land, Air, and Sea Applications. The technology is impressive. The first application for the fuel cells is in generators. The truck maker will use HYDROTECH fuel cell power cubes. The cubes will generate electricity to power the trucks. GM believes that the cubes will have applications far beyond long-haul semi-trucks. GM plans to include earth-moving, mining, ships, and rail.

This push into advanced hydrogen fuel cell technology puts Nel’s plan to construct its facility nearby into context. We want to see Nel, and GM collaborate more in the future. The joint development in Michigan will improve Nel’s efficiency and costs, which will materially improve its profitability going forward.

Nel plans is to focus on the large-scale electrolyser business. They project that this segment will account for 90% of demand through 2025. Demand will come from fueling heavy duty vehicles like semis and mining equipment.

The two companies agree on one thing, hydrogen will play a role in the future of transportation.

Nel believes hydrogen will be the Number 1 fuel of the future for the following reasons:

- The world needs a new energy source to replace oil & gas

- Hydrogen is the element with the highest energy density

- Hydrogen can be produced from water and renewable energy

- Access to renewable energy (think solar) is practically infinite

- The electric grids don’t have the capacity to manage the entire future energy demand alone

- The demand for stable energy supplies can not be supplies by the fluctuating nature of renewable energy production in general

- Large scale introduction of renewable energy depends on energy storage solutions

The takeaway from Nel’s list is that hydrogen can function as a “battery” for renewable energy like wind and solar power. By splitting water molecules with solar, you can then use that energy anytime (even at night).

And unlike lithium batteries, you can make hydrogen anywhere you have a solar panel and a water source. And when you release the energy from hydrogen (through combustion) you create pure water.

It’s far too elegant a solution to not become a major part of the energy landscape in the future.

Finance

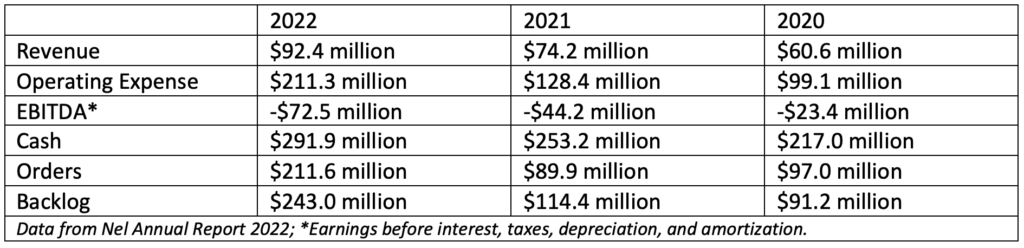

The table below shows Nel’s performance (converted from Norwegian Kroner to U.S. dollars):

The most important takeaway from these data is the growth from 2021 to 2022.

- Revenue rose 25%

- Cash grew 15%

- Orders grew 135%

- Order backlog grew 112%

The bad news is that the operating expense grew as well, from $128 million to $211 million. And that sent Nel’s earnings down by $28.4 million.

The CEO, Håkon Volldal, is aware of the company’s lack of profitability and addressed it in the annual report:

…At the same time, the transition from small to large-scale projects implies significant investments. The costs related to the scale-up are real and evident in our bottom-line for the year. Clearly, continuing along this trajectory for many years is not sustainable. We need a path to industry leadership that also allows Nel to become profitable, and this is outlined in our business strategy coined “bigger better focused”.

… Consequently, Nel will continue to invest in research and development to improve the efficiency (OPEX) and cost (CAPEX) of its equipment. The joint development agreement with General Motors is an example of such an investment. Besides enabling more green hydrogen projects to become viable without subsidies over time, continuous efficiency and cost improvements are key to keeping healthy margins over time.

We want the company to invest and grow. And we want it to improve its profitability. And so does everyone else. As long as we are getting that message from the CEO, we can be satisfied that management is working to make that happen.

Growth is shown in the company’s milestones:

- In March 2022, the company inaugurated the world’s first fully automated electrolyser manufacturing plant in HerØya, Norway.

- In July 2022, the company contracted to supply 200 MW of electrolyser equipment to a U.S. customer.

- In November 2022 Nel signed a joint development agreement with GM to develop Nel’s proton exchange membrane electrolyser technology. The goal is to reduce the cost at the pump for GM vehicles.

- In December 2022, a customer ordered sixteen hydrogen refueling stations for a U.S. customer. It’s the single largest order of refueling stations in Nel’s history.

- In January 2023, HH2E ordered two 60-megawatt (MW) electrolyser plants in Germany. These will be among the largest green hydrogen production plants in Europe.

- In February 2023, green hydrogen maker HyCC ordered a 40 MW plant for its Netherlands project. SkyNRG, a sustainable aviation fuel manufacturer, will use the hydrogen to produce sustainable aviation fuel called H2eron.

Demand for Nel’s products is increasing as hydrogen continues to make inroads as a fuel and as a source of electricity. And the value of Nel’s stock will continue to rise as it becomes more profitable in the future.

We have two risks with Nel, as we see it today. The first comes from the company itself. They must execute their plans and grow profitability. Without profit, Nel is just another science project. The second is that the stock continues to sell off in the short term.

That’s as much an opportunity as a risk.

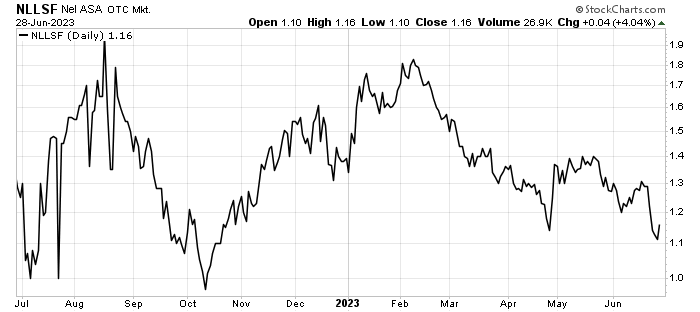

Here’s the latest chart of Nel:

Nel’s low price is just under $1.00 per share. It’s currently $1.16 per share. That means, if it retests it previous low, we risk losing 16%.

That doesn’t seem likely, but an easy way to hedge that risk would be to use a Good till Cancelled Limit Order at $1.10 per share.

That way, if the stock does pull back again, you pick save some money on the entry. And it would only be a 10% fall from $1.10 to $1.00 if the stock does retest lows. The risk is that the stock doesn’t look back from here and we miss it.

And we don’t want to miss it if it moves higher. The tailwind of hydrogen is strong and growing. The reward from Nel is that the company should grow both from its business and as the hydrogen market expands over the next few years.

Action to Take: Buy Nel ASA (OTC: NLLSF) either at the market or with a Good till Cancelled Limit Order at $1.10 per share. A 25% trailing stop is appropriate here, because if the stock falls 25%, it will be making new 52-week lows. That would be a sign of trouble.

Needless to say, we are bullish on hydrogen. Seeing so many big names involved, like GM, Anglo American, and Woodside Energy tells us that hydrogen is mainstream and growing. Nel’s involvement with important milestones like the world’s first fully automated electrolyser manufacturing plant and hydrogen aviation fuel show us that the company is an industry leader.

That’s why we want Nel in our portfolio.

Good Investing,

The Mangrove Investor Team