OK you are investing for the good and want to make sure your investment dollars are making a difference. But like the great old western, “The Good, The Bad and The Ugly” asked, how do you know?

The widely used tool for selecting the good and not the ugly is an ESG (Environment, Social, Governance) rating. Just like how your personal credit score looks at a bunch of things to come up with your ability to pay back a loan, ESG ratings look at a bunch of different things to decide how good, bad, or ugly a company might be.

The ESG rating provides an understanding of a company’s performance on ESG issues. A good ESG rating means the company manages its environment, social, and governance risks better relative to its peers. A poor ESG rating, then not so good as related to its peers.

To fully understand ESG scores, it’s essential to be aware of what factors they measure and how ESG rating agencies calculate them.

Before we get to the how it’s good to know the who.

Many third-party services evaluate companies and provide ESG ratings.

Most are paid services, but a couple will provide basic evaluation information for free.

Here are a few of the more popular ESG rating services

These are just a few of services that center their business around providing analysis and evaluation services. There are many more and the growth of these types of evaluation services almost seems exponential as money moves into these for the good markets. This may seem good but on the negative side is this is a complex business and there are no standards set when evaluating a company’s ESG worth.

Even the ESG Raters don’t get the same ranking

The complexities and evaluation differences can result in mixed signals when looking at the exact same company. Plus, it is simply not easy to evaluate a company on values of which many are subjective. How do you get down to a single score?

For more on the issues around ESG ratings issues check out this paper published to SSRN. The paper presents lots of findings, but the following is important, “Results that have been obtained on the basis of one ESG rating might not replicate with the ESG ratings of another rating agency.”

How does it happen

Now that we understand how two ESG rating agencies are not alike, let us look at how they arrive at a particular score.

Let us pick on MCSI for this exercise.

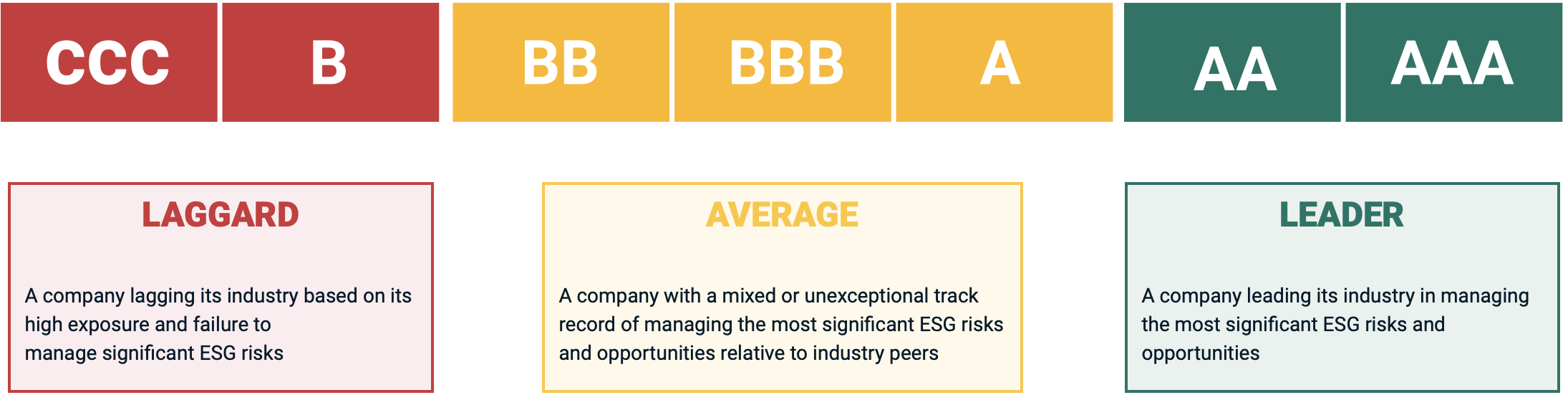

Per MSCI, “We use a rules-based methodology to identify industry leaders and laggards according to their exposure to ESG risks and how well they manage those risks relative to peers. Our ESG Ratings range from leader (AAA, AA), average (A, BBB, BB) to laggard (B, CCC)“

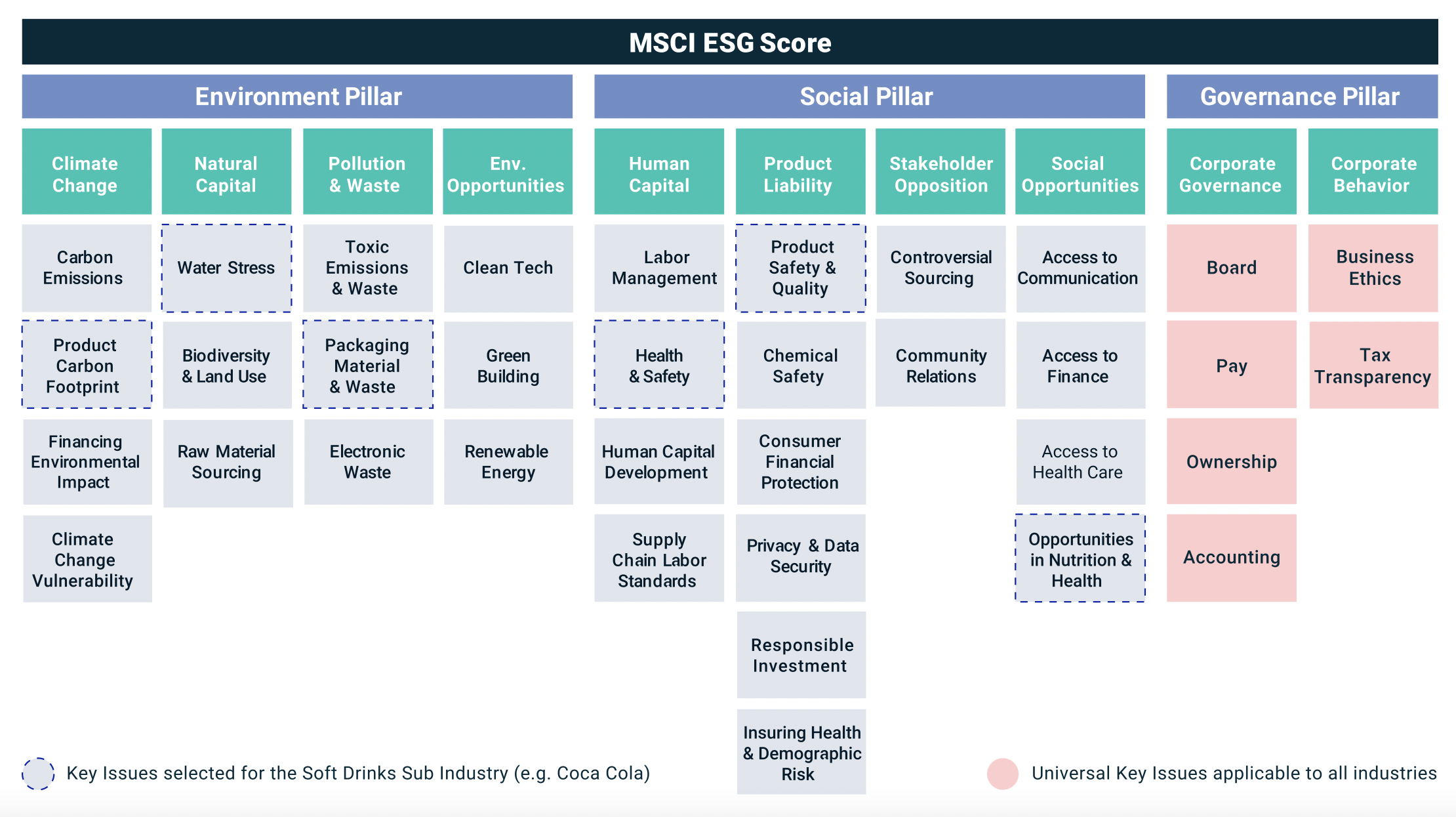

The foundation of the MSCI ESG score is a framework that measures 35 key issues across 10 categories within the pillars of environment, social, and governance.

Companies are scored on each key issue. MSCI analyzes 80 different exposure metrics and 270 governance metrics to score companies from 0 to 10 on each key issue. A low score means the company is heavily exposed to the issue and is not managing that risk effectively. A high score indicates an aggressive effort to mitigate the risk. An example of risk mitigation for carbon emissions would be a company goal to become carbon-negative by 2030.

Issues are weighted. MSCI weights key issues according to their timeline and potential impact. Issues that could have a major environmental or social impact within two years have the highest weights. Issues with lesser potential for impact and a timeline of five years or more have the lowest weights. Worker safety in a manufacturing environment, for example, presents an immediate risk with severe financial and legal consequences. That would justify a heavier weighting.

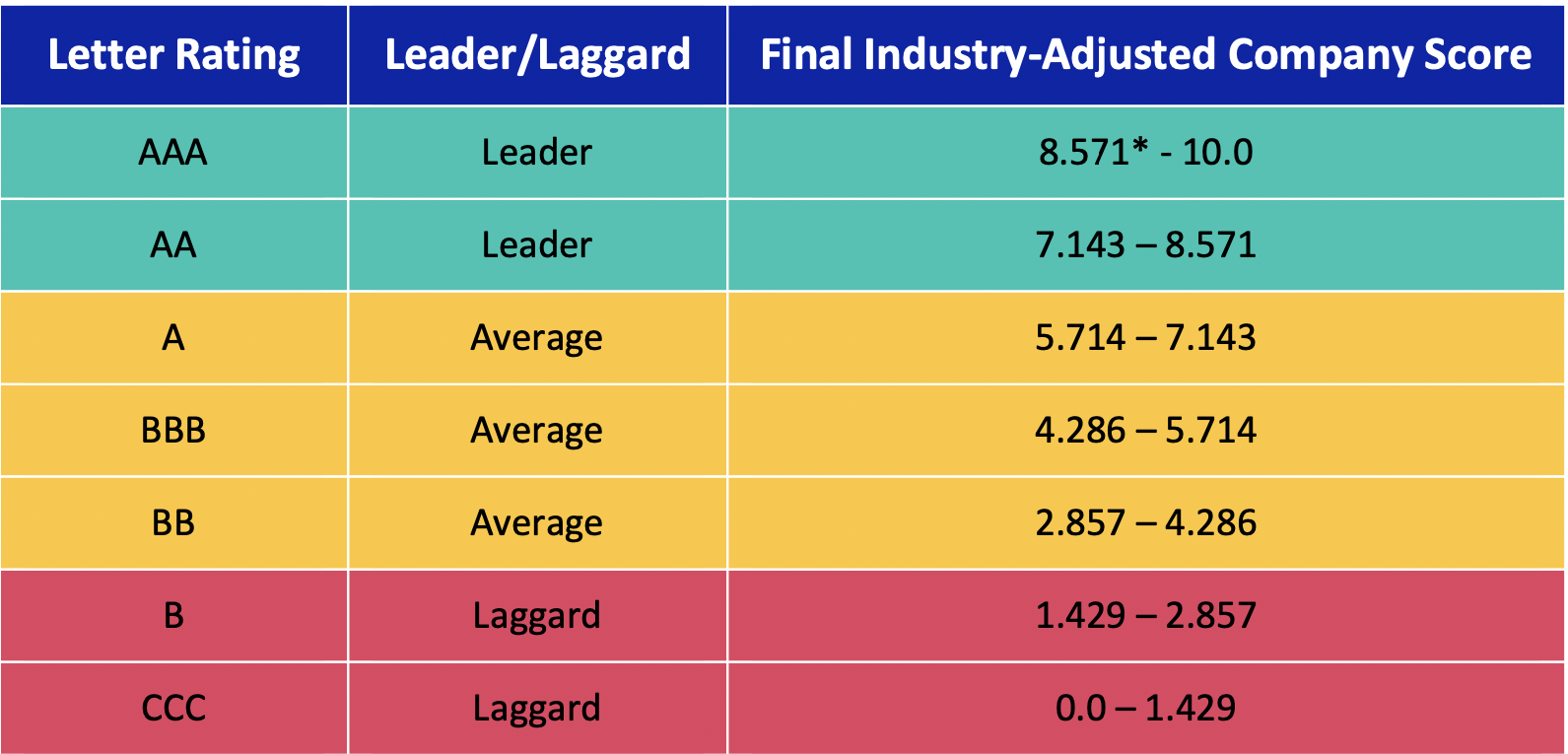

Issue scores and weights are combined. Issue scores and weights are combined to produce an adjusted numerical score from 0 to 10 for the rated company.

MSCI translates the numerical score into an ESG Rating. ESG Ratings range from CCC at the low end to AAA at the high end. As shown in the table below, the ratings are also grouped into three segments: laggard, average, and leader.

Leaders are proactively managing ESG risk as compared to their peers. Average ESG performers may be managing some key ESG issues well and others poorly, or just be average across the board. Laggards are more unmanaged and are exposed to ESG risk.

Score data source

MSCI uses public data sources to evaluate for ESG ratings. Sources include company reporting such as sustainability reports and proxy reports. Plus, they use other media sources from regulatory organizations as well as government and non-government organizations. MSCI may also work directly with companies to validate information.

What ESG rating is not and best way to use that

First and foremost, ESG ratings do not include a typical company financial investment analysis. Although you would expect a company that scores highly on an ESG rating would have less risk that does not guarantee a return on your investment.

Investing for the good should not involve picking stocks based on ESG ratings alone. Rather, use the ESG ranking to help augment your decision process.

You can use ESG ratings to supplement financial analysis. An ESG review gives you more insight into company risk.

In the end ESG ratings need to be viewed as another tool in your tool belt when building your investment portfolio.

For the Good,

Michael Nichols