Standing on the sidelines and trying to figure out the best time to enter the game can cost you.

For the risk adverse time is your best friend. Time in the market is an important factor that investors must appreciate. If you want to mitigate risk, you need to take your time. Short term market volatility can cause the faint hearted to run for the sidelines. As plays plummet investors may try to cut their losses or on the other hand try to time the market when it is best to play.

The good news is you really do not need to time the market to be successful. History has shown that staying in the game for the long term will pay off. Time is on your side!

Here are some reasons why entering the market sooner and staying in the market longer will benefit your overall position.

Don’t be on the sideline during the market’s best days

A big danger of trying to time the market is missing the big upsides. History shows that when the market has big drops, it tends to rebound very quickly. This cycle often takes just a few days. If you try to time these odds are you’re going to be on the wrong side of that cycle.

If the market is good at something, it is letting investors know that stock prices don’t simply go up forever. Downturns are a part of investing. How you respond matters. Or, in some cases, how you don’t respond.

Staying true to your investing plan, your time horizon and risk tolerance when markets are calm should be the same when the market hits some bumps.

This is not to say you should never respond to market moves. Rather, it’s more of a reminder that good planning mitigates some risk. Part of your plan needs to include an investing discipline around diversification and regular rebalancing.

Can you say dividends?

Don’t underestimate the power of a dividend. This is another reason trying to time the market may not help your long-term goals.

Let’s say for example you buy 500 shares of a company, a stock that currently pays a $2 annual dividend. In other words, 500 shares of stock that would pay you over $1000 per year in dividends alone.

By just hanging out for 3 years that’s $3,000 in dividends! That’s money lost if you ran for the sideline. Even if the stock cycled during those 3 years, you still have $3K.

Attention to the details!

So, you’re going to get rich in the market. You’re going to sniff out all the best stocks and always buy low and sell high. And you’re going to work a full-time job, raise a family, spend weekends and evenings at kids’ events all while learning 8th grade math with your daughter. But sure, you still have time to put in the effort to do research like Warren Buffett to decide when to buy or sell.

Playing the market long does not take away all the need for attention, but with a long approach, you can automate your investing. This passive approach to investing can help reduce anxiety and keep you from panic selling during times of volatility

This passive approach does not mean that your personal goals need be ignored. Rather, there are ways to limit your risk or shift your investments over time without resorting to full-on market timing.

Earnings on top of earnings

It takes money to make money. In this case the concept of compound interest or earning interest on money that was previously earned as interest.

Like that snowball, it starts out small but as it rolls it begins to collect more and more snow. After time that snowball begins to get even bigger faster. Same is for an original investment, interest, and the benefit of time.

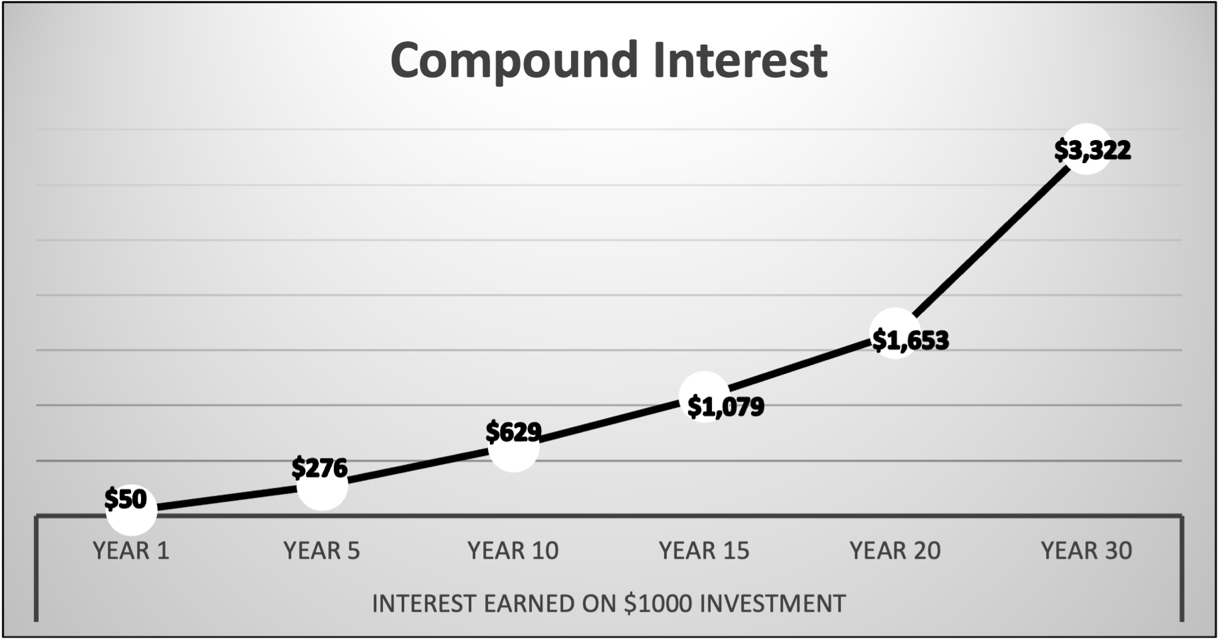

In its simplest form for example, you have an initial investment of $1000 that earns an annual interest of 5%. At the end of one year, you would have $1050. That is $50 for just having money. But that is not the secret sauce of compound interest. It is what follows, if you stay steady the following years you earn not only on your initial investment of $1000 but also on the interest payouts along the way. So, in year two that $50 of free money gains you an additional $2.50. This may seem small to you but over time it adds up. You’ll earn interest on your initial deposit, and you’ll earn interest on the interest you just earned. The following chart is a very simple chart that reflects how just sitting on an initial investment of $1000 can grow over time.

As you see that over a 30-year period your initial investment of $1000 can grow to $4,322 which is $3,322 of just interest income. And this is compounded annually, it would be even greater if compounded monthly.

Figure 1 – Annually compounded 5% interest on initial investment of $1000

The above example is on a simple $1000 investment at 5% but the S&P 500 has historically returned around 10 percent including dividends. Your portfolio gains could be very substantial if to stay in and not on the sidelines.

Time is your best friend

When growing your savings, time is your friend. The longer you can leave your money the more it can grow. Trying to target only the good days will not work. You’re riding out volatility, and you’re benefitting from compounding and dividends.

So, the best time to invest is the long time.

For the Good,

Michael Nichols