“How do I know when to sell?”

It’s one of our most frequent reader questions over the past decade. And in this age of HODL-ers, it’s even more important. You don’t want to get stuck clutching a bad investment.

We want to maximize our opportunity for gain but balance that with minimizing our risk. That’s why we don’t “go with our gut.” And we sure don’t HODL to the bottom.

We use simple math.

It’s called a trailing stop. And it works like a safety line for rock climbing.

It gives us rope as we climb higher. But if we fall, the stop kicks in and keeps us from losing everything.

Rock climbers use a rope. We use a simple formula that tracks our position and lets us know when to sell.

All we do is figure out how much risk we want to take on – how far we’re willing to fall. For large stocks, 25% is generally good, although the more volatile stocks will get a 35% stop.

That means if we buy a stock for $100 per share and use a 25% stop, we’ll sell if it falls to $75. We would leave the position with 75% of our capital still intact.

That’s important because if we lose 25% of our capital, we only need a 33% gain to recover it. If we lose 50% of our capital, we need a 100% gain to recover it.

That’s why we always use stops.

It takes the emotions out and protects us when we need it most.

And it gets even better – as an investment rises, we raise our stop too.

If your investment goes all the way up to, say, $1,000, you’re probably a happy camper. But if it starts to fall again, your 25% stop kicks in.

Of course, you aren’t going to wait for it to fall all the way back down to $75. You’re going to set that stop at the new high: $1,000. So you’ll sell if it falls to $750.

That means you get to hold on to all your gains and avoid losing anything in the event of a crash.

And crashes happen. Regardless of the amount of work and research we do, there are always risks that can cause stocks to fall.

For example, on March 11, 2011, a tsunami hit the Fukushima Daiichi nuclear reactor in Japan.

The catastrophic wall of water caused the nuclear reactor to fail. The resulting meltdown was the worst nuclear disaster in modern history.

It also affected the stock market – specifically uranium miners.

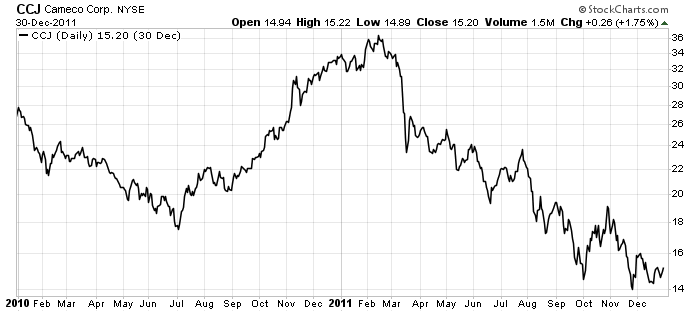

One producer, Cameco (NYSE: CCJ), had been on a 100%run in 2010 and early 2011. Shares rose from $17.50 to $36.25 by February 2011.

Then the Fukushima disaster occurred, and shares collapsed.

Cameco’s share price was $37.46 on March 10, 2011. It fell to $28.10 by March 17.

By Nov. 2011, the price had fallen below $14 per share. Investors who held on lost over 60% from the top.

More importantly, they didn’t just lose their profits. Even if they bought shares at the bottom in 2010, they lost 20% of their capital in just over a year.

Cameco’s 2010 Boom Turned Into a Massive Decline

Those investors turned a 100% profit into a loss because of a natural disaster – through no fault of their own.

Shares of Cameco continued to fall. In Nov. 2016, the stock bottomed at $7 per share. Today, shares have only recovered to around $25 – well below their 2011 highs.

In summary, holding Cameco shares since 2011 is an 11-year investment that lost 30% of its value. That’s a terrible result.

A trailing stop would’ve limited that loss and gotten you out of the position years ago. That’s why we use them. They protect us from making stupid, emotional mistakes.

Selling CCJ at Its Trailing Stop Would’ve Netted You a 60% Win

Let me show you a more recent example.

If you had the guts to buy precious metal explorer Coeur Mining (NYSE: CDE) in early 2020, just as the pandemic hit, you would’ve made out well.

From spring 2020 to early 2021, the company’s shares soared from $2.56 to $10.73. Bottom to top, that’s a 319% gain.

Investors could’ve quadrupled their money in Coeur. But if you didn’t know when to sell, you were on a round-trip.

This is what HODL got you:

Couer’s Pandemic Rebound Didn’t Last Long

Shares of Coeur Mining went from hated to loved to hated again in just one year.

A 319% gain turned into a 27% gain. The stock went from around $11 at the top to around $3 today.

But if you’d had a trailing stop, you’d have sold when it fell 25% from the top – at around $8. You see how this preserved your gains?

Our goals, as investors, are simple:

Preserve our capital, avoid big losses, and take outsized profits when the opportunities arise.

If you know when to sell, you can meet all those goals.

I recommend using a simple system to know when to sell. If you want to learn more about trailing stops, that’s a must read.

Good Investing,

Matt Badiali