The New “Supermajor” Energy Company

It Should Be the Cornerstone of Every Investor’s Portfolio

In December 2019, I spent a week in Abilene, Texas.

It’s one of my favorite towns in Texas. The little downtown is great – it has excellent restaurants and bars. I look forward to driving out to Buffalo Gap for steak at Perini Ranch.

Normally, I stay in Abilene when I visit the industry in the Permian Basin – the large oil and gas field in West Texas and New Mexico. On this trip, the oil bust was in full stride.

Instead, I ended up learning about a totally different form of energy production that Texas leads the nation in: wind.

One of the things I admire about Texans is that they understand boom and bust economies. Many families, particularly in Abilene, have history all the way back to the cattle booms and busts of the 1800s. That represents a uniquely American cultural memory.

The first big boom coincided with the California Gold Rush. Thousands of hungry miners flocked to the gold fields of California and drove up the price of beef. The boom ended when the gold market went bust in 1857.

In 1868, a boom in population and wealth in the eastern states spurred demand for beef yet again. Cattle that sold for $4 each in Texas could go for $40 in New York. This was the heyday of the great cattle drives. Cowboys drove herds up the Chisholm Trail from Texas through Kansas to the stockyards in Kansas City. There, the animals went on trains to the big cities on the East Coast.

However, an economic panic in 1873 ushered in another big bust. The fall crushed the price of cattle and many ranchers went bankrupt.

Then the oil industry exploded onto the scene. In 1901, the iconic Spindletop well was discovered. It produced an enormous 100,000 barrels per day and over 17 million barrels per year. That single well exceeded the entire state of Texas’ oil production in 1900. It kicked off a boom that brought about $235 million ($7.2 billion in today’s dollars) in exploration and investment into the state.

For a decade, oil prices soared on scarcity, only to plummet when drillers found the next gusher. In 1930, the discovery of the super-giant East Texas Oil Field sent oil prices into a tailspin. There was so much extra oil around that the government had to step in and shut down wells to prop up the price.

Texas’ economy has relied on commodities other than just oil and cattle. Over the years, it has been a big cotton and lumber producer, too.

That illustrates just how adaptive the state economy is. And while most folks outside of Texas think of it in terms of oil and cattle, there’s a new energy revolution going on, particularly in West Texas.

On my trip in 2019, the latest bust in oil was underway. Texas’ oil prices had fallen nearly 20% in the past few months. And it would get much worse in 2020 (it has recovered since then). I saw just one drilling rig on a three-hour drive through this decade’s most prolific oil fields.

But I saw hundreds of wind turbines.

I went to a ranchers’ dinner one evening. It was a serious affair. I ate some of the best steaks in my life, both elk and beef. Discussions ran the gamut of old stories, jokes, and eventually the business of ranching. The men in the room owned thousands of acres in West Texas. As we sat outside around a fire pit, I could hear the rhythmic whoosh of a giant wind turbine.

The host told me that the wind turbine leases were a godsend. They smoothed out the income from his cattle operation and flattened the typical highs and lows of agricultural prices. That got me thinking, so I did some more digging in the final days of my visit.

As I talked to folks around the area, I discovered a new boom in energy had arrived in Texas.

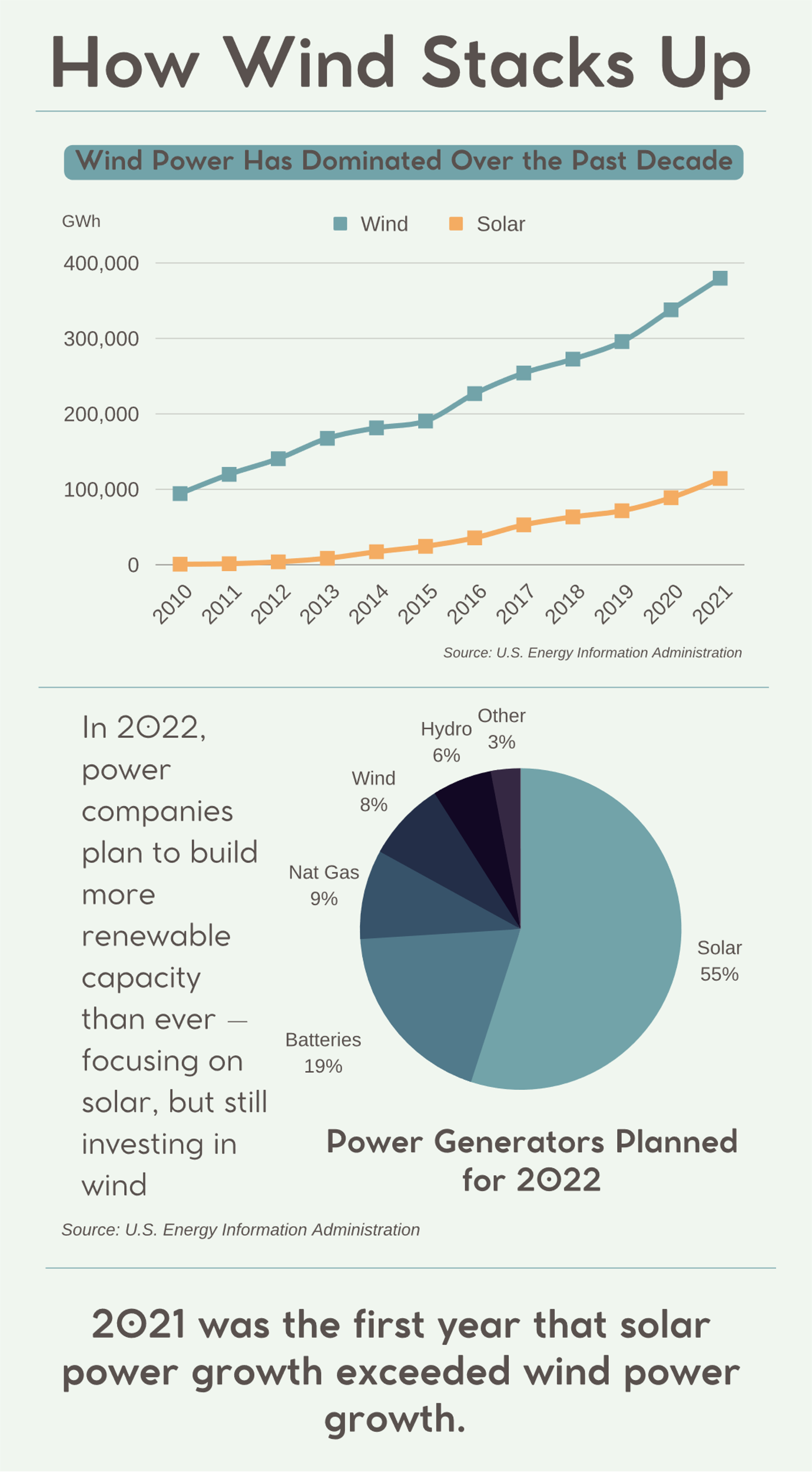

Wind Power Has Grown Rapidly Since 2010

This is the great thing about investing in alternative energy: Decarbonization is happening quickly now. Companies that started moving in this direction five or 10 years ago have a huge competitive advantage today. And they are the ones that we want to own as part of our portfolio. Thankfully, we are in luck. There is a whole new class of giant sustainable energy companies in the world today.

And one of the major contributors to this trend in renewable power growth is today’s investment recommendation. It’s one of the new “supermajor” energy companies. And it is one of the largest builders of U.S. electric power infrastructure. It has invested over $90 billion in new renewable power generation over the past decade.

The New Supermajors Are Into Wind and Solar

There is a clean-energy supermajor in our midst.

The name “supermajor” originally comes from the oil industry. Someone coined it to describe companies like ExxonMobil and Chevron – global giants in the petroleum industry. Today, analysts at Bloomberg have coopted that label to describe a handful of clean energy companies.

Three of the four – Enel, Iberdrola, and Orsted – operate outside the U.S. However, there is one company that has quietly built a huge renewable power capacity in the U.S.: NextEra Energy (NYSE: NEE).

In the 2020 Letter to Stakeholders, Chairman and CEO Jim Robo committed to the kind of business practices we love to see here at Mangrove. Here’s what he said:

…In the midst of these extraordinary times, we remain as committed as ever to our long-term strategy.

This strategy starts with a vision: We want to be the largest, most profitable clean energy provider in the world with the best skills and capabilities across the industry. This vision is informed by our values: We are committed to excellence; we do the right thing; we treat people with respect. This vision and these values inspire us every day.

We are passionate about generating clean, renewable energy, while protecting the environment and giving back to the community. Florida Power & Light Company (FPL) and Gulf Power aim to be the most reliable and best operating utility companies in the country, while rapidly growing clean energy. NextEra Energy Resources is focused on building a diversified clean energy company with an emphasis on growing the world’s leading wind, solar and storage portfolio. Across the enterprise, we are delivering outstanding value for our customers, supporting our communities, and empowering our teams, all while generating significant shareholder value and doing good for the environment.

That’s the talk, but NextEra’s actions bear out its commitment to doing good.

It has invested over $90 billion in clean energy infrastructure over the last decade. That makes it the largest investor in U.S. energy infrastructure and one of the largest capital investors in the U.S., period. That’s the kind of commitment to community that we believe in as well.

As we mentioned earlier, NextEra is the world’s largest producer of wind and solar energy. It owns many of the windmills I saw in Texas. It was a first mover in the decarbonization of electrical power. And it will do well in the next few years as the Biden administration continues to reward renewable energy. But even without the political boost, this American supermajor is a great investment.

Some things to know about NextEra right off the bat:

- The company has reduced its dependency on foreign oil by 98% since 2001.

- It plans to invest $50 billion–$55 billion in U.S. infrastructure through 2022.

- It employs thousands of Americans through its investments in electrical infrastructure.

- It won S&P Global’s Platts Global Energy 2020 Energy Transition Award for leadership in environmental, social, and governance.

Over the past 10 years, the company delivered a compound annual earnings growth of 8%. That’s fantastic. That means $1,000 invested turned into $2,159. For buy-and-hold investors, that’s excellent. More than doubling our money every decade? Fantastic!

And that trend should continue, as the U.S. economy embraces decarbonization over the next decade. NextEra is way ahead of the trend. And it continues to lead the way. For example, its subsidiary FPL brought on 1,100 MW of solar power in 2020 alone. And NextEra Energy Resources is a leading developer and operator of wind, solar, and battery storage. In 2020, it commissioned 5,750 MW of renewable energy. That’s double the amount in 2019. It will construct 23 GW-30 GW of renewable energy production by 2024.

NextEra should become a foundational part of everyone’s portfolio. It’s the kind of company we want to buy and hold. And then give the shares to our grandchildren in 20 or 30 years.

Recommendation: Buy shares of NextEra Energy (NYSE: NEE).

We will use a 25% trailing stop on our position in NextEra. We’ll collect $0.42 per share every quarter.

NextEra Energy is exactly the kind of company we want to own for the next decade. It’s a major utility that embraced the future. It invested heavily in the kinds of energy production we want for the future. And its locations have rising populations.

We see NextEra Energy as the best investment in the energy space today.

Good Investing,

Matt Badiali