This Tiny Power Company Is Raking In the Cash

Happy New Year!

I spent the holidays in Pennsylvania with my family. We had a great visit, but we experienced a weather phenomenon that I’ve never seen before.

We left Florida early to avoid a late December storm. The severe weather put 200 million Americans under some sort of weather advisory.

We drove through the night in pouring rain. The temperature hovered around 33 degrees from Virginia all the way up to Pennsylvania. Road signs warned us to get where we were going and stay there. So that’s what we did.

It was a long, rainy, dark drive – one I’m not in a hurry to repeat. But we made it.

The next morning, we woke up to negative-degree temperatures and snow. The rain from the night before had become a solid glaze of ice. Every surface was treacherous.

Our car became a block of ice. We couldn’t open any of the doors (and my kids’ snow boots were trapped). We didn’t lose power at our house, but we were lucky.

Many families had power outages during this storm.

In our area, the power company had to enact rolling black outs to keep the power going to critical infrastructure.

I was shocked. It was the first time I experienced rolling blackouts. And it exposed a problem that I knew existed but hadn’t experienced.

I first heard about the issue back in 2013 at a Discover Unconventional Gas conference in San Antonio, Texas. This was a conference dedicated to the shale revolution gripping the oil industry.

I was in the audience, listening to a pipeline company CEO discuss the challenges of moving natural gas from fields to consumers. He told us that it was easier to build 30 miles of undersea pipeline in the Gulf of Mexico than a mile of pipeline in the Northeast.

The problem, he said, was red tape.

In the Gulf of Mexico, all he had to deal with was technical issues. There was only one governing body, so once the permit was in-hand, you could roll. But in the Northeast, there are dozens of agencies, municipalities, and governments that must be consulted.

His conclusion was that growing natural gas distribution up there was nearly impossible. That’s a huge problem because natural gas is the dominant fuel for power generation today. If we can’t increase the volumes to the Northeast, then we need a different way to bring electricity to the region.

That’s why I’m excited about this month’s recommendation.

Because it can supply power to that region without the hassle of building new pipelines. It is a small but growing power company. That’s critical, because there is a huge need for power in that populous corner of the U.S.

We think it can be a stock we own for the long term.

What Are Rolling Blackouts and Why Do We Have Them?

According to the industry news site, Just Energy, rolling blackouts are emergency procedures used “to balance the power supply in a specific region.”

I didn’t understand what that meant, either… so I did some more digging.

I always thought power grids were just pipelines for electricity.

But there is a lot more to them. And they are much more delicate than pipes. We use alternating current (AC) as our power supply. And that current has a frequency (called hertz). We maintain that frequency at a specific rate.

If we add demand or cut supply, that frequency falls. And power grids are incredibly sensitive to those changes. Dropping frequency can physically damage the equipment used to move power around the grid. That can lead to total failure of the grid.

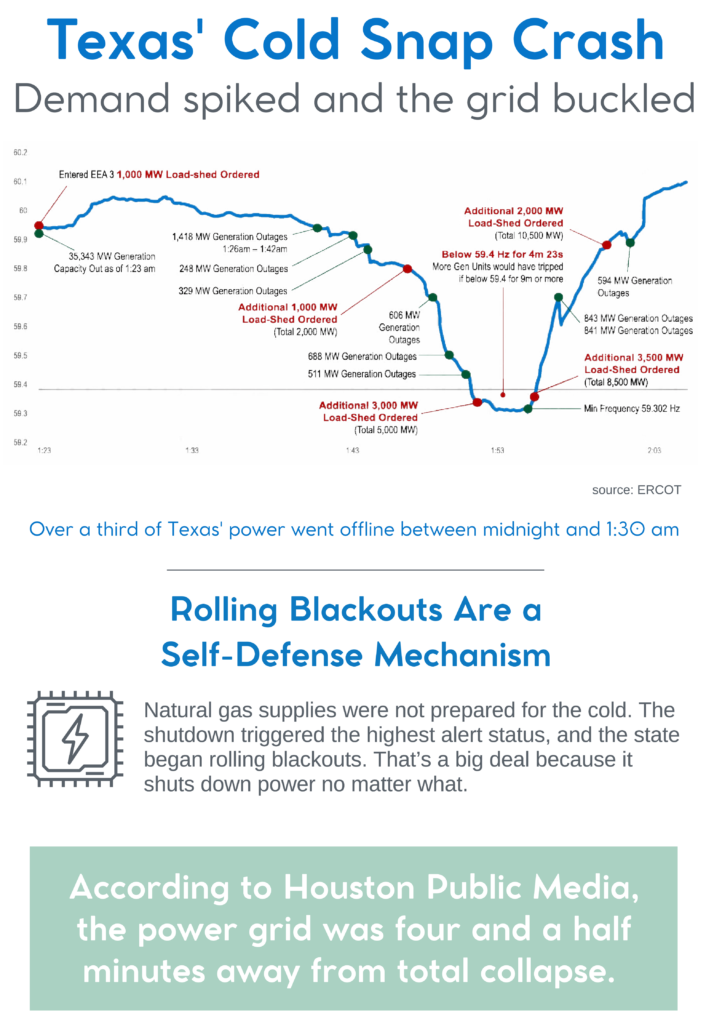

The most publicized event related to falling frequency was in February 2021 in Texas.

A cold snap there shut down the power supply and ramped up demand. That combination caused the frequency to fall dramatically. You can see the timeline in the chart.

The cold snap froze equipment and pipelines.

The issue in Texas wasn’t an isolated incident.

It was highlighted by Groton Electric Light Department, a municipally owned power company in Massachusetts. In November 2022, the general manager Kevin Kelly said:

“For the last few years, the reliability of the electric grid has been deteriorating, especially in the winter in New England. This year is even worse. If there is an extended cold snap, there is a high probability of rolling blackouts.”

Kelly’s letter highlighted concerns around “base-load” power.

Base-load power is the backbone of our power grid. It’s what’s always available. In the past, this came from coal and nuclear power. However, as we’ve discussed before, coal power is on the way out. Kelly’s concern is that we have not replaced the closing plants.

And he’s not wrong. If natural gas companies can’t build new pipes, the best way to replace base-load power is from a new nuclear plant… and that’s a long shot. Short of that, the grids need all the other forms of power – things like wind and solar.

And as we said earlier, this is a problem across the U.S. Old power plants are closing. According to the Energy Information Administration (EIA), almost a quarter of the remaining coal plants will be shut down by 2030.

This is a massive change in the sources of electric power at a time when everything we use is going electric. Cars, trucks, leaf blowers, lawn mowers, and even boats all need electricity.

We would be crazy not to invest in the companies fixing this problem.

That’s why we recommend Genie Energy (NYSE: GNE) as our first company in 2023.

Growing a Green Power Company

Genie Energy (NYSE: GNE) currently has no debt and pays us $0.30 per share in quarterly dividends.

At the current price, that’s a 2.9% yield.

The investment thesis is simple. The company generates excellent cash flows from its retail business. And it’s actively growing through its renewables business and customer acquisitions.

We like its plan to develop a portfolio of solar projects, as you’ll see below. The regulatory environment means that the company can recover up to 30% to 40% of its investment within two years.

The recent pop in Genie’s shares coincides with the announcement that the company got the green light to build its first company-owned solar farm in upstate New York.

This 4-megawatt plant will be the first of two new projects. The company completed a review for a second, 6-megawatt plant in the same area.

It’s also scheduled to begin construction in 2023.

This isn’t a perfect solution to the problems in the Northeast. It won’t prevent rolling blackouts in the case of a weather event. But it’s going to help.

The answer is more power infrastructure. The more electrical generation we have, the less severe the drawdown will be.

Compound annual growth rate, or CAGR, is a useful tool to measure the direction a company is growing.

It works best on companies that have revenue and earnings, like Genie. But we can use it to examine share prices for every public company.

The formula is simply:

Where:

- EV is the most recent value

- BV is the starting value.

- N is the number of years involved.

So, to calculate the CAGR for Genie’s Free Cash Flow, it would look like this:

- EV = $119 million

- BV = $15.3 million

- N = 4 years

If we do the math, that works out to a whopping 67% CAGR!

That’s fantastic, especially compared to Genie’s revenue, which only grew at 2% over that same period.

Michael Stein, CEO of Genie Energy said in a statement:

Community solar plays to Genie’s strengths as an integrated solar provider. In our first two projects, we not only obtained control of the sites and are overseeing permitting, but we are also financing and managing the construction of the projects.

We’ll utilize our own designed and manufactured solar panels and our retail arm will identify, enroll, and manage the projects’ customers. This vertically integrated approach enables us to capture significantly more of each project’s realizable economics while delivering a superior value to our customers.

In Texas, the power outages affected 29.5 million people. The Northeast is home to 50 million people. The power supply in that region needs support. And that’s what Genie Energy’s solar farm will do.

Genie also continues to grow through acquisition. In November 2022, the company announced that it had bought a portfolio of 11,000 residential and small commercial customers in the Northeast and Midwest.

Our risk is that Genie’s shares slide back to their January 2022 levels. And that could happen if the company has an issue with the solar farm construction. We will address that if it happens. But our risk-to-reward ratio here looks good.

The company’s revenue and profit margins are stable and growing. This stock should do well in our portfolio.